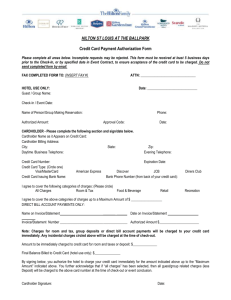

VISA CORPORATE CREDIT CARD

advertisement

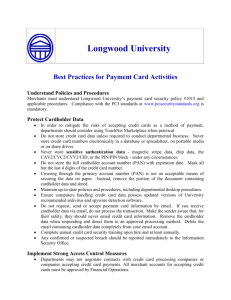

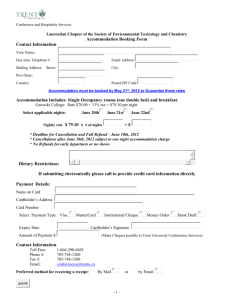

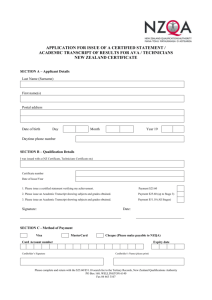

I, _________________________, hereby agree to comply with the terms and conditions of the U.S. Bank Corporate Credit Card and Carroll’s Corporate Credit Card Policy (as it currently exists and as it may be subsequently revised). I acknowledge receipt of the Policy and confirm that I have read and understand its terms and conditions. As the holder of the Corporate Credit Card, I agree to accept responsibility for the protection and proper use of the card and to keep and submit proper documentation for all purchases as outlined in the Policy. I understand that the College will audit the use of the Corporate Credit Card. I understand that the Corporate Credit Card is to be used for business use only. I further understand that improper use of the Corporate Credit Card may result in disciplinary action, up to and including termination of employment. Should I fail to use the Corporate Credit Card in accordance with the Policy, I understand that I will be personally responsible for payment of any charges on the Corporate Credit Card. I agree to take any steps necessary to permit Carroll College to collect any amounts owed by me even if I am no longer employed by the College. If Carroll College initiates legal proceedings to recover amounts owed by me under this Agreement, I agree to pay legal fees incurred by Carroll College in such proceedings. I understand that Carroll College may terminate my right to use the Corporate Credit Card at any time for any reason. I agree to return the Corporate Credit Card to Carroll College immediately upon request or upon termination of employment. I understand and agree that this Agreement supersedes and replaces any prior agreements between me and Carroll College regarding the Corporate Credit Card. Cardholder’s Name (Print Name) ____________________________________________ Cardholder’s Signature ______________________________________ Date _________ Supervisor’s Name (Print Name) ____________________________________________ Supervisor’s Signature ____________________________________ Date ___________ Please return the signed copy to the Business Office. VISA CORPORATE CREDIT CARD The Carroll College Visa Corporate Credit Card Program has been established to provide Departments with a convenient and efficient means to purchase low dollar items and, at the same time, reduce the costs associated with initiating and paying for purchases. The Carroll College VISA Corporate Credit Card is administered by U.S. Bank VISA Corporate Card Services, Inc. The corporate credit card will be issued in the name of the employee, for the purpose of making authorized purchases on the College’s behalf. No one other than the cardholder whose name is on the card is authorized to use the card. Payment will be issued for these authorized charges. Cardholders are responsible for the integrity and accuracy of their credit card purchases. It is the responsibility of the Business Office to oversee all aspects of the Corporate Credit Card program. These responsibilities include authorization of new cards, the monitoring of current cardholder accounts, review of charges prior to posting to the general ledger, and performing monthly cardholder audits to verify that the Credit Card Policy and Procedures are being followed. The Business Office reserves the right to terminate/rescind a Corporate Credit Card at any time. Fraud or misuse of the Corporate Credit Card, including use of the Corporate Credit Card for personal charges, may result in disciplinary action, up to and including termination. Application, Eligibility and Program Terms 1) Full-time Faculty and Staff are eligible to participate in the Cardholder program. It is not necessary for every eligible departmental employee to receive a Corporate Credit Card typically it should be the individual(s) who make the majority of the departmental purchases. 2) A completed Credit Card Application must be submitted for each prospective cardholder. These applications can be obtained from the Controller or Assistant Controller. 3) The application must be approved by the applicant’s supervisor and/or budget administrator . 4) A Cardholder Agreement Form must be signed by the prospective cardholder. 5) Only the Cardholder whose name is embossed on the Credit Card is authorized to use the Card and is responsible for ensuring that all charges made with the Card are in compliance with these Policies and Procedures. Card sharing is prohibited. 6) Cards and card numbers must be safeguarded against use by unauthorized individuals within or outside the College. 7) The Corporate Credit Card is to be used for business use only. Personal use is strictly prohibited. Use of the Corporate Credit Card 1) The purpose of the credit card is to facilitate business conducted on behalf of the College. 2) All expenses need to be substantiated by supporting documentation. Any charges unsubstantiated by supporting documentation will be considered personal expenses and must be reimbursed by the cardholder. 3) Cash advances are prohibited. 4) Use of the Corporate Credit Card for personal expenses is strictly prohibited. Unauthorized and/or Inappropriate Credit Card Use The VISA Corporate Credit Card must never be used to purchase items for personal use or for non-College purposes even if the Cardholder intends to reimburse the College. A Cardholder who makes unauthorized purchases with the Credit Card, as defined under non-allowable charges, or uses the Credit Card in a manner that violates the terms of this policy, will be subject to disciplinary action, including possible card cancellation, personal payment for unauthorized charges, termination of employment with Carroll College, and criminal prosecution. Non-Allowable Charges Your Corporate Credit Card cannot be used for the following items: Personal charges, even with the intent of reimbursing the College Cash Advances/Withdrawals from ATM’s Gift Certificates and/or Gift Cards. Note: Prior approval must be obtained from the Business Office for the purchase of gift certificates or gift cards. If approved by the Business Office, a list of who received the gift certificate/gift card must be provided. Inter-Departmental Charges Computer Software and/or Hardware over $1,000, unless specifically approved by the Business Office and CCIT Payment for special services that require 1099 reporting. Note: these payments include services such as stipends, honoraria, consulting, and contracted services. These payments must be made by check for tax reporting purposes. Construction, Renovations and installation services Capital Equipment. Note: Equipment with a cost exceeding $1,000 requires special tracking by the Business Office. Rents and leases Annual Contract Maintenance The Business Office must approve any exceptions Supporting Documentation A merchant-produced original document that records the relevant details for each item purchased, including quantities, amounts, a description of what was purchased, the total charge amount and the merchant’s name and address (e.g. itemized sales receipts, original invoices, signed and dated packing slips, credit receipts, etc.) is required for any charge on the Corporate Credit Card. The Cardholder is responsible for obtaining purchase documentation from the merchant to support all purchases made with the Credit Card and verifying that the documentation complies with the requirements for supporting documentation. Supporting Documentation Is Required For All Credit Card Transactions Do Not send Copies of Receipts The College Must Retain Original Receipts for Audit Purposes Procedures for Substantiating Purchases The monthly billing statement will be sent directly to the employee holding the corporate credit card. The statement must be reviewed by the employee for verification of charges. The employee must attach all supporting documentation. When the monthly statement is received, the employee must match the individual charges listed with the customer copy of charges. On the back of the customer copy, the employee must indicate the business purpose, the name of the individuals involved, and the business relationship of the individuals involved. Receipts must include itemized detailed information. The total charge is insufficient. (i.e. a restaurant receipt with the total and tip is not sufficient. The employee must turn in the detailed descriptive receipt.) The employee must indicate the appropriate account number to charge the transaction. The employee must also attach the original statement and the annotated original receipts together with a notation as to which account in the employee’s budget to charge the expenditures. The employee must document the business purpose of the transaction. In the case of entertainment/hospitality expenses, the names and titles of those being entertained must be included. The employee must sign the statement authorizing and acknowledging the purchases made on the credit card. The immediate supervisor and/or individual having budget authority must then review the statement with accompanying receipts and sign indicating approval. The statement should be forwarded to the Assistant Controller on or before the due date indicated on the monthly billing statement. If a statement with supporting documentation is not submitted to the Assistant Controller within 20 days after the employee received the statement, charging privileges may be suspended. If supporting documentation is 45 days past due, the card will be automatically canceled and will not be renewed. Statements submitted without supporting documentation will not be processed by the Business Office and will be returned to the employee. The employee will become personally liable for all charges not accompanied by supporting documentation. What Information Should I Focus on When Submitting my Credit Card Monthly Statement? The Business Office must make sure that each Cardholder’s report includes the documentation that the IRS is known to look for in its audits. The general rule is that the IRS requires documentation of the “5 Ws” Who, What, When, Where, and Why. Who – Names/Titles of those entertained including an explanation of the relationship if applicable. What – Nature of the expense incurred and substantiation of the expense incurred (usually on receipt) When – When was expense incurred (usually on receipt) Where – Where was expense incurred (usually on receipt) Why – Business Purpose of meal/entertainment/lodging/expense Approval/Authorization Employee/Cardholder: Employee/Cardholder’s signature is required to certify that credit card transactions are true, correct and in compliance with the policies of the College. Employees/Cardholders must sign the form and approve all transactions made on the Corporate Credit Card Use of a signature stamp or signing another person’s name is not allowed. Approver: Approvers have primary responsibility for insuring that Credit Card charges are submitted in accordance with College policies. This includes reviewing supporting documentation for completeness in support of all credit card transactions. Missing, incomplete or inadequate documentation should be resolved with employee/cardholder’s submission of credit card statement transactions in accordance with this policy. The Approver must have authorization to sign for the account(s) being charged The Approver cannot be the employee/cardholder Whenever possible, the Approver should be the employee/cardholder’s direct supervisor The Approver should not report to the employee/cardholder Corporate Credit Card Security It is the Cardholder’s responsibility to safeguard the Corporate Credit Card and Corporate Credit Card account number at all times. Cardholders must keep their Corporate Credit Cards in a secure location at all times. Cardholders must not allow anyone else to use their Corporate Credit Card or account number. Card sharing is prohibited. Cardholders must not write their Corporate Credit Card account numbers where others can easily see them. Cardholder Separation/Termination from the College Prior to separation or termination from the College, Cardholders must surrender their Corporate Credit Card and corresponding supporting documentation to the Business Office. This will be included on the Human Resource’s exit checklist. The Controller must be notified immediately when a Credit Card is to be canceled. The card must be destroyed by cutting it in half. Both card halves must be forwarded to the Controller in the Business Office. Lost, Stolen, or Damaged Corporate Credit Cards As soon as you discover your card lost, stolen, or that you have fraudulent charges, you must notify U.S. Bank Visa, 1-800-344-5696 and the Controller in the Business Office (447-5432) immediately to limit the College’s liability and exposure for unauthorized charges. Current Policy This Corporate Credit Card Policy supersedes and replaces any other College policy regarding use of corporate credit cards.