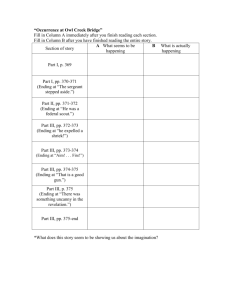

Chapter_04[1] - WordPress.com

advertisement

![Chapter_04[1] - WordPress.com](http://s3.studylib.net/store/data/007394558_1-453f92da0256d19553ef90d5f1d751c4-768x994.png)