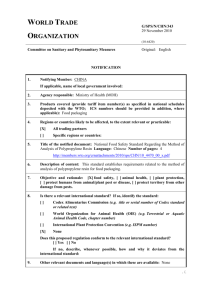

WT/ACC/SPEC/CHN/1/Rev.8

advertisement