2016 Clergy Compensation Forms Instructions ()

advertisement

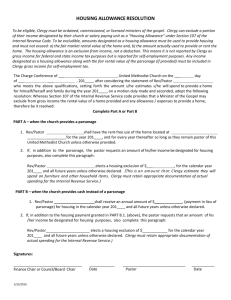

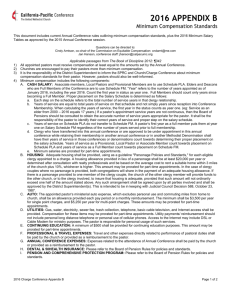

2016 Clergy Compensation and Expense Forms Instructions This packet of forms is used to report information related to the Clergyperson’s compensation and expenses for the coming year. The data on the worksheets flows to a Summary Resolution to be acted upon by the Charge Conference. The forms also calculate the cost of benefits that are provided in addition to salary and housing, and allow the pastor to make some elections that will benefit her/him tax-wise. Please note recent changes of significance to the Clergy Retirement Security Program (CRSP). 1. By action of the 2012 General Conference, clergy serving less than half-time are no longer eligible to participate in the CRSP. For those clergy who are no longer eligible to participate, the Oregon-Idaho Conference is encouraging local churches to make contributions to their pastor’s UMPIP account in an amount similar to what they have been contributing to CRSP. This contribution will be remitted directly to the General Board of Pension and Health Benefits (not the conference office). Lisa Pronovost in the conference office can assist local churches in completing the necessary paperwork. 2. Clergy who are still eligible for CRSP (i.e., appointed half-time or more) will need to contribute at least 1% of plan compensation to his/her UMPIP account in order to receive the maximum contribution from the church. There are five forms included as part of this packet: 1. 2016 Local Church Compensation & Benefits Worksheet This worksheet records the amount the church will pay for salary and housing (either a parsonage or housing allowance). Additionally it calculates the costs of benefits (pension, death & disability, and health insurance), as applicable. 2. 2016 Housing Allowance and Housing Related Allowances Worksheet The pastor can use this worksheet to estimate housing costs. 3. 2016 Clergy Compensation Allocation Worksheet This worksheet allows the pastor to have some of the cash compensation designated for utilities and furnishings, UMPIP contribution, Flexible Spending Account for medical and/or dependent care expense, and the dependent health insurance premium – all of which can be advantageous tax-wise. 4. 2016 Accountable Reimbursement Plan Worksheet This worksheet is used to establish an amount to be included in the church budget to pay the reasonable and necessary business and professional expenses of the pastor in carrying out the ministry of the church. 5. 2016 Summary Resolution This document summarizes the information from the worksheets, providing a resolution which includes the actions that must be taken by the Charge Conference. If you are completing these forms on your computer (either the Excel version or the PDF version) begin with the General Information page (Data tab in Excel) so you only have to enter information once. Here are more detailed instructions for completing the various worksheets. 2016 LOCAL CHURCH COMPENSATION & BENEFITS WORKSHEET: This form has been designed as both a compensation agreement between the Pastor and the Church and an information sheet for the Conference and Church regarding benefit amounts. The clergy person should use the Compensation Allocation Worksheet to allocate the total compensation between taxable and non-taxable compensation items. (See below) Page 1 of 4 For minimum Cash Salary amounts see the Equitable Compensation Schedule. The form also includes information regarding the Total Plan Compensation used to calculate some Benefit Amounts. Monthly and Annual benefit costs are included for CRSP – The Clergy Retirement Security Program (pension), Health Flex and the Comprehensive Protection Plan (CPP), which provides life and disability insurance. All clergy serving full or ¾ time total appointments are included in CPP. The premium is calculated at 3.2% of Total Plan Compensation. Clergy (other than part-time local pastors) serving less than ¾ time can be enrolled in CPP if their church chooses to elect coverage. The premium for optional coverage is 4.4% of the Denominational Average Compensation or $2,962.65 per year. Multi-church charges: A full Compensation Package must be completed for each church in a multichurch charge. Benefits are based on the appointment percentage of all churches the pastor is serving. Be sure to enter the names of any other churches in a multi-church charge and the total appointment percentage for the pastor to be sure benefits are calculated correctly. Pension (CRSP) and Life/Disability Insurance (CPP) are calculated based on the total plan compensation for each church and will be billed directly to each church. No other billing arrangement is available for these benefit costs. Health Insurance is calculated as a fixed premium. Please be sure to indicate the percentage of the total premium each church is responsible for paying. HOUSING & RELATED ALLOWANCES WORKSHEET – This form should be filled out by the pastor as a good faith estimate of the housing and housing related expenses for the coming year. Only an amount equal to the fair rental value of the home plus other allowable costs can be used, even if the actual expense is greater. It is the pastor’s responsibility to document these expenses to the IRS. Note that any changes to these amounts must be made in advance of the pay period in which the changes will take effect. Retroactive adjustments are not allowed per IRS regulations. Enter the amount from line 1 or 2 on line II. of the Compensation Allocation Worksheet and in Section A of the Housing section of the Summary Resolution. Enter the amount from line 7 on line I.F. of the Compensation Allocation Worksheet and in the Salary section of the Summary Resolution. CLERGY COMPENSATION ALLOCATION WORKSHEET: This form has been designed as an information sheet for the Conference and the General Board of Pension & Health Benefits, as well as for use by the treasurer in preparing payroll, benefit payments and tax reports I. Cash Salary: The totals of lines A – F should equal the Total Cash Salary. A. Taxable Salary – the amount of the total salary not designated as non-taxable on lines B-F B. Salary Reduction Agreement for Pension – the amount the pastor has elected to contribute, on a Page 2 of 4 pre-tax basis. The treasurer will pay the monthly contribution directly to the institution holding the SRA. (Note, if the pastor elects to contribute on an after-tax basis, the amount would be included in line A.) Clergy in CRSP must contribute a minimum of 1% of plan compensation in order to receive the full matching contribution from the church. C. Flexible Spending Account (MRA/DCA) – the amount the pastor has elected directly with the General Board of Pension & Health Benefits for Medical or Dependent Care expenses. Maximum allowed for MRA: $2550; maximum allowed for DCA: $5000. D. Participant with Dependent/s Health Premium – the $75 monthly charge for pastors with dependents enrolled in the HealthFlex plan. This can be withheld on a pre-tax basis. E. Single Participant Health Premium – the $25 monthly charge for pastors without dependents who are enrolled in the Conference Health Insurance Plan. This can be withheld on a pre-tax basis. F. Utility & Furnishings Allowance: Enter the amount from line 7 of the Housing Allowance Worksheet. (This is a non-taxable part of Cash Salary.) Housing and utility/furnishing allowances are not available to lay supply pastors and Diaconal Ministers. II. Housing Allowance in lieu of parsonage: If the church provides a cash housing allowance, show the figure here (from Line 1 or 2 of the Housing Allowance Worksheet.) This does not include utilities, maintenance, or furnishings allowance(s) which are a non-taxable part of cash salary – see line F above. If the pastor lives in a church provided parsonage, the box next to “Parsonage” should be checked and no figure should be entered on this line. In the rare situation in which there is no parsonage and no housing allowance, the box next to “No Housing” should be checked and no figure should be entered on this line. ACCOUNTABLE REIMBURSEMENT PLAN WORKSHEET: Use the worksheet to calculate a budget amount for these expenses. The line items are provided as a guide for estimating expenses, they are not binding. Enter the total amount in the Accountable Reimbursement section of the Summary Resolution. Remember: These expenses are an administrative cost of the church and are not part of pastoral compensation. You may note that there is no specific instruction for Circuit Mileage. Because all circuits are uniquely configured, if you share a pastor with another congregation you will need to budget adequately to cover travel within the circuit. Be sure to adopt a reimbursement rate for use of a personal automobile. The 2015 IRS rate is 57.5 cents per mile. The 2016 rate will be published late in 2015 or early 2016. For planning purposes, you might want to use 57.5 cents per mile. Note: It is imperative that your church have in place an accountable reimbursement policy. Without a properly adopted policy in place, all expense reimbursements made to the pastor could be considered taxable income. A sample policy is available online or from your district office. Page 3 of 4 SUMMARY RESOLUTION: Fill in the Church & Clergy names and the amounts from the worksheets in each of the sections (the Housing Allowance amount should be the figure from line II of the Clergy Compensation Allocation Worksheet), be sure the resolution is signed by the appropriate officers of the charge conference, and keep on file with the Accountable Reimbursement Policy. Note that if you are filling this out for less than a full calendar year, you will still use annualized amounts. Be sure to note the number of months the resolution covers. The amounts are assumed to be approved on a pro-rata basis. REMEMBER: Pension, Health Insurance benefits, and Reimbursable Expenses are not part of pastoral compensation. While these items are an expense to the church, they are not to be considered in the compensation package. Page 4 of 4