Why alliances - London Business School

advertisement

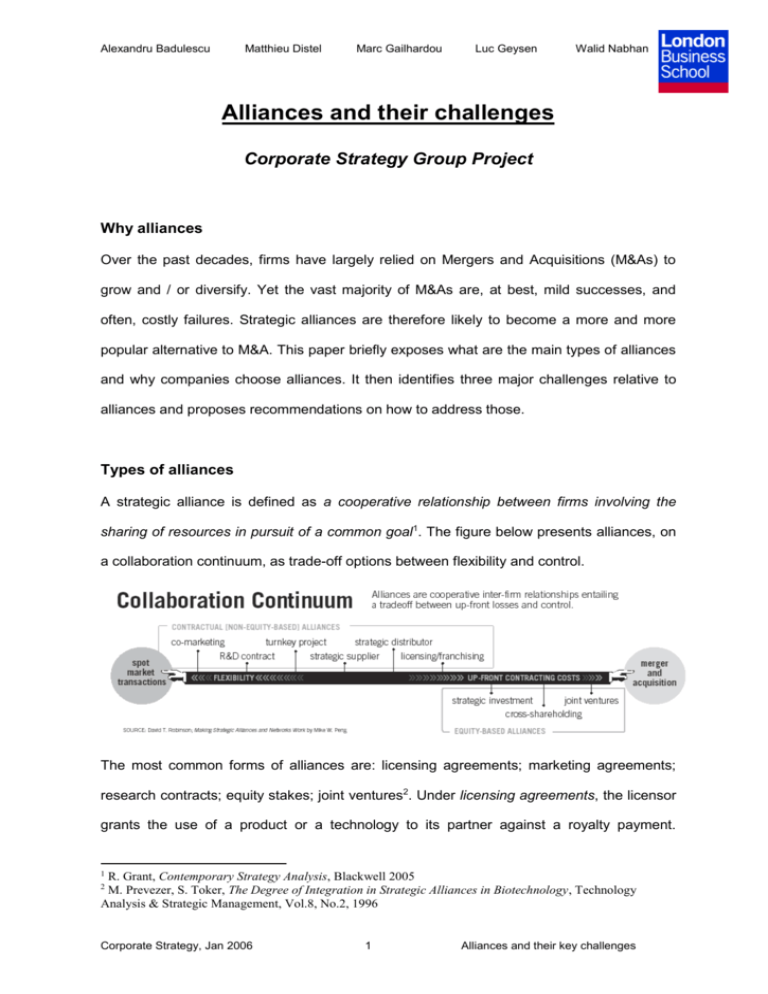

Alexandru Badulescu Matthieu Distel Marc Gailhardou Luc Geysen Walid Nabhan Alliances and their challenges Corporate Strategy Group Project Why alliances Over the past decades, firms have largely relied on Mergers and Acquisitions (M&As) to grow and / or diversify. Yet the vast majority of M&As are, at best, mild successes, and often, costly failures. Strategic alliances are therefore likely to become a more and more popular alternative to M&A. This paper briefly exposes what are the main types of alliances and why companies choose alliances. It then identifies three major challenges relative to alliances and proposes recommendations on how to address those. Types of alliances A strategic alliance is defined as a cooperative relationship between firms involving the sharing of resources in pursuit of a common goal1. The figure below presents alliances, on a collaboration continuum, as trade-off options between flexibility and control. The most common forms of alliances are: licensing agreements; marketing agreements; research contracts; equity stakes; joint ventures2. Under licensing agreements, the licensor grants the use of a product or a technology to its partner against a royalty payment. 1 R. Grant, Contemporary Strategy Analysis, Blackwell 2005 M. Prevezer, S. Toker, The Degree of Integration in Strategic Alliances in Biotechnology, Technology Analysis & Strategic Management, Vol.8, No.2, 1996 2 Corporate Strategy, Jan 2006 1 Alliances and their key challenges Alexandru Badulescu Matthieu Distel Marc Gailhardou Luc Geysen Walid Nabhan Integration between the activities of the firms is minimal. Licensing agreements are widely used in the biotech industry, where biotech firms license large pharmaceutical companies. Marketing agreements are essentially a mirror image of the licensing agreements: large pharmaceutical companies provide the marketing and distribution of products manufactured by smaller research companies. In research contracts, a firm receives funding for a research activity in an identified area of application. The contract usually specifies how the outcome of the research will be managed (patent rights, responsibilities for commercialisation). Alliance by Equity stakes is often used between a large established firm and an emerging firm. It implies a certain degree of control (e.g. a seat on the board) over the latter. Joint Ventures are a more advanced form of alliance involving the creation of a new separate company jointly owned by the partners and operated by one of them or by shared resources. Purpose of alliances Alliances have mainly two types of purpose: (1) sharing risks and (2) gaining access to “something” that the firm does not have. Risk sharing is a driver for alliances typically in the oil industry (e.g. exploration joint-ventures as an example from the experience of our team), but is also observed in other industries such as car manufacturing (development of a common vehicle platform). Alliances for “access” apply to various situations. A firm may have to enter an alliance to gain access to a foreign market where regulations require partnering with a local company. A firm may seek access to a specific technology or skill; or a particular capability along the value chain (marketing, distribution). Whether they are established between competitors (oil industry, car manufacturing) or companies in different positions on the value chain (e.g. large pharmaceutical-biotech), alliances always imply a degree of cooperation and some reciprocal benefits. Corporate Strategy, Jan 2006 2 Alliances and their key challenges Alexandru Badulescu Matthieu Distel Marc Gailhardou Luc Geysen Walid Nabhan Challenges and failure of alliances Unlike M&A, alliances are always meant to seek a win-win outcome. This is an intrinsic merit of alliances, however it is also their key weakness –the “win-win” may not always materialise, or at least not be felt as such by one or both parties, leading to a break-up. What is success for an alliance? Is it the achievement of sales goals or development according to scientific or technical specifications? Or is it meeting the expectations of parties? –and do they have a common understanding of those expectations? However one defines success, reality is that between 50-70% of alliances fail. For example, the rate of failure in pharmaceutical and biotech alliances is estimated at 67%3, mainly in the form of not meeting scientific goals (71% of respondents4) and missing sales targets. Other general and common forms of failure in alliances are: (i) disagreements on sharing of contributions to and / or returns from the alliance; (ii) the loose border between gaining access to and acquiring (skills or technology); (iii) the ambiguity around cooperation versus competition5. The causes of failures can be broadly grouped into external –no direct control by the parties- and internal –within control of the parties. Examples of external factors are technology changes and reduction of market potential. Examples of internal factors are: different expectations about time; lack of commitment; culture clashes (e.g. “not invented here” syndrome); lack of communication between parties (57% respondents in pharmaceutical-biotech alliances); undefined partner roles (43% of respondents); insufficient management attention and lack of resources / leadership to implement the deal (40% of respondents); strategic motives misfit. Most often alliances fail for internal reasons. Therefore, if management is aware, prepared and sufficiently skilled at running alliances, the rate of success can much higher. 3 Cutting Edge Information, 2004 ibid 5 G. Hamel, Competition for Competence and Inter-Partner Learning within International Alliances, Strategic 4 Corporate Strategy, Jan 2006 3 Alliances and their key challenges Alexandru Badulescu Matthieu Distel Marc Gailhardou Luc Geysen Walid Nabhan The figure below shows three key challenges of alliances (two internal and one external). Each challenge is illustrated by real life examples, and recommendations on how to address those challenges are proposed. M&A Market Changes Management changes Externalities Implementation Commitment Trust Deal structure Expectations Governance Long Term objectives Results Challenge # 1: How to secure alignment of expectations? Bird flu is increasingly considered as the biggest global health threat. Two Biotech/Pharma couples –Gilead/Roche and Biota/GlaxoSmithKline–have developed the only existing treatments for the disease –Tamiflu and Relenza. While the potential payoff from this drug development is huge, the situation is in reality much less rosy. Australian biotechnology company Biota Holdings Ltd (BTA.AU) is seeking damage compensations of up to US$326 million from GlaxoSmithkline PLC (GSK) for allegedly failing to market Relenza, the world's first influenza drug. At the same time the US biotechnology company Gilead Sciences Inc. (GILD) is seeking to end the licensing agreement with Roche Holdings AG (RHHBY) for influenza pill Tamiflu, on allegations that the Swiss drug maker poorly marketed the drug and miscalculated royalties. These examples highlight the importance of expectations alignment between the two partners. They illustrate some specific key challenges in the management of mutual Corporate Strategy, Jan 2006 4 Alliances and their key challenges Alexandru Badulescu Matthieu Distel Marc Gailhardou Luc Geysen Walid Nabhan expectations: commitment of the partners, expected results of the alliance and finally, long term objectives of the partners. It can be reasonably inferred that the level of commitment of GSK, whose objective was primarily to plug a short-term gap in its portfolio through a cheap bet, would not be the same as Biota’s commitment, a small biotech whose survival depended heavily on Relenza. A better assessment and understanding of the relative importance of the deal for the different partners would have helped avoiding the deadlock where the partners now are. In the case of the Gilead-Roche alliance, the commercial success of Tamiflu did not prevent the semi-divorce situation where the partners are. This highlights the importance of considering long-term objectives before going into an alliance, as expressed by M.Mc Cully (director of a consultancy): “The conditions of the deal were beneficial for the biotech when they were a small start up; but they never thought they’d grow up”. However, when facing high levels of uncertainty about the outcome of the deal and about the level of risk of the project, managers often fall into the trap of over-optimism, what the Nobel prize winner Daniel Kahneman calls “planning fallacy”: “the product of cognitive biases and organizational pressures which leads to make decisions based on delusional optimism rather than on a rational, weighting of gains, losses and probabilities” 6. This bias drives to over-confidence and over-estimation of the prospects, and under-estimation of potential problems, causing a lack of anticipation and preparedness. Successful companies understand that alliances are neither peripheral nor replications or extensions of the company. They are strategically vital and organizationally distinct. Such companies are prepared to commit resources to alliances, to measure, evaluate, learn, specialize, train, and strategize. Many firms institutionalize their alliance capability by establishing a dedicated alliance management function. Professors Jeffrey Dyer of Brigham Young University, Prashant Kale of the University of Michigan, and Harbir Singh of the University of Pennsylvania compared 203 firms, including a few large pharmaceuticals, 6 Harvard Business Review , July 2003 Corporate Strategy, Jan 2006 5 Alliances and their key challenges Alexandru Badulescu Matthieu Distel Marc Gailhardou Luc Geysen Walid Nabhan some with and some without alliance management functions. They found that those with alliance functions had a 25 percent higher long-term alliance success rate and generated almost four times the market wealth whenever they announced the formation of a new alliance. Our recommendations In order to maximize their chance of securing alignment of expectations, companies in alliances should: o Perform a transparent, objective analysis of their respective expectations and derive together a shared set of expectations; o Set up an “internal launch” that clarifies roles, responsibilities and operating protocols and ensures that internal boundaries are effectively managed; o As the next step, proceed to a “joint launch” of the alliance, bringing the right people from both sides to the table to have them talk about how they will handle problems; o Assure review and re-alignment of expectations during the life of the alliance, as divergence may appear. Challenge # 2: To what extent can we trust the partner? – The bitter story of the Sendo-Microsoft alliance. In December 2002, the British smart-phone manufacturer Sendo filed a suit in a Texas court against Microsoft, for “fraud, theft of intellectual property, and conspiracy to destroy Sendo”. The alliance between the two companies was started in 2000. At that time, Microsoft was looking for a smart-phone manufacturer that would host an adapted version of Windows Pocket PC. Sendo was a new British start-up willing to develop a smart-phone (the Z100), and looking for an operating system. The alliance was concluded with Microsoft taking a 5% stake in Sendo (for US$12 million) and a seat at Sendo’s board. Corporate Strategy, Jan 2006 6 Alliances and their key challenges Alexandru Badulescu Matthieu Distel Marc Gailhardou Luc Geysen Walid Nabhan The plan was to release an early prototype by August 2001. Sendo worked throughout 2001 to develop the Z100 and embed Microsoft’s OS on it. Soon, the testing phase with the mobile phone carriers started and testers complained about software bugs. Despite Sendo’s repeated requests, Microsoft was delaying the release of the bug fix, which in turn delayed the market release of the phone. The delays were slowly pushing Sendo towards bankruptcy. Situation was thus slowly worsening when, in October 2002, Microsoft announced the Orange SPV, a new smart-phone developed with HTC (Taiwanese company) and Orange. On Nov. 7, 2002, Sendo’s CEO Hugh Brogan announced he would cancel the Z100 development and develop a new smart-phone using Symbian. The alliance stipulated that if Sendo filed for bankruptcy, Microsoft would get royalty-free access to Sendo's smart-phone technology, as well as rights to sell that technology to other manufacturers. This, says Sendo, was the motive behind Microsoft’s delays in releasing the software bug fix. Microsoft’s behaviour in this case looks like an attempt to commoditize the handheld market in the same way it commoditized the PC market. This would push forward Microsoft’s operating system at the expense of the handheld manufacturers. It was thus clear that Microsoft’s and Sendo’s interest were incompatible in the medium term. From a game theory perspective (see figure below), Microsoft had much more to gain by not collaborating in this alliance. If Microsoft could acquire the core capability from Sendo, they would gain from free riding and Sendo would incur the cost of unilateral collaboration and be pushed towards bankruptcy. The issue at the heart of this situation is trust. Therefore, our recommendations are: o Be clear about the strategic motivations and interests of the partner firm. There must be compatibility of interests throughout the duration of the alliance, or in the medium term at least. This will involve some due diligence to understand the partner’s strategic and competitive situation. Corporate Strategy, Jan 2006 7 Alliances and their key challenges Alexandru Badulescu o Matthieu Distel Marc Gailhardou Luc Geysen Walid Nabhan Before engaging in an alliance, a company should question “why would the other firm want to ally with us and not with another company?” As soon as the partner learns these capabilities, it does not need an alliance anymore. In other words, the firm should offer collaboration and should share knowledge up to the point of protecting its core capabilities. o If the company goes forward with the alliance, it should consider that the level of trust between parties in an alliance is a trade off between control and flexibility. Higher trust will mean more flexibility, whereas lower trust implies greater need for control and therefore greater transaction costs. The structure of deal itself will define how much formal control mechanisms are put in place and of course they will come with a cost: preparation of contract and enforcement of specific clauses. Microsoft and Sendo payoff matrix Collaborate ? No Sendo Yes Microsoft Yes No 10 -5 5 10 0 0 -2 0 • Assumption – Microsoft will acquire Sendo’s core capability • For Microsoft the strategy optimizing the payoff is No collaboration and they enjoy “free riding”. • For Sendo the strategy is Collaboration and they incur the costs of unilateral collaboration. Sendo Microsoft Challenge # 3: How to protect the alliance in the face of external changes? In 2001, an alliance was made between Celltech and Pharmacia. Pharmacia acquired the marketing rights for the product CDP 870 in return for payments of up to US$165 million and a 40% share of profits for Celltech. At the time, this was one of the most generous Corporate Strategy, Jan 2006 8 Alliances and their key challenges Alexandru Badulescu Matthieu Distel Marc Gailhardou Luc Geysen Walid Nabhan agreements ever made for a biotech company. However in 2003 the world’s largest pharmaceutical company Pfizer acquired Pharmacia. For Pfizer the potential of the CDP product was not very attractive and Pfizer therefore wanted to postpone phase III trials and renegotiate the financial terms of the contract, or simply walk away. After this information was made public, the stock price of Celltech fell by 20%. Celltech management encouraged investors not to think about the implications of Pfizer’s decision, promising them that they would sign a new deal as soon as possible at the same conditions. After five months of uncertainty, Belgian company UCB replaced Pfizer in a new alliance with Celltech. Luckily the terms of the alliance stayed the same for Celltech. The above example illustrates the challenge that a partner in an alliance faces when externalities impact the alliance implementation. These can be major events such as an M&A or one of the partners going bankrupt. This can end the alliance abruptly, with potentially serious effects on the other party. However, externalities can also have a minor change on an alliance partner, but a big impact on the alliance agreement itself. Examples are a change of senior management in one of the parties, or the discontinuation of a one-to-one personal relationship following a promotion or departure. Our recommendations o It is risky to put all your alliance relationship “eggs” in the basket of only one executive or manager. It is advisable to build relationships with several key contacts in the organization of the partner and create a process to document and manage the relationship. o Include an exit strategy in the alliance contract that copes with externalities. o Communicate with the partner upfront when a merger or acquisition is going to happen. The alliance agreement can be taken into account during the M&A process. Corporate Strategy, Jan 2006 9 Alliances and their key challenges Alexandru Badulescu Matthieu Distel Marc Gailhardou Luc Geysen Walid Nabhan o Review alliance performance periodically and make adjustments if necessary. o When senior management is changed, build on the personal relationships with the new key contacts. Summary of recommendations Alliances are about a necessary situation of sharing risk and/or gaining access to a resource, knowledge or capability. They seem to be doomed in more than 50% of the cases. By creating a common definition and understanding of expectations, by assuring commitment and trust between parties or by considering specific contingency actions, managers can influence in a significant way the success or failure of an alliance. Researching objectives and expectations of the other party before the deal, putting in place processes to manage the alliance, and building and maintaining appropriate levels of communication and relationship with the partner are essential to success. The most effective approach consists in developing systematic alliances capabilities that transcend particular partnerships. This includes training and the creation tools, templates, and processes, helping to promote an “alliance mindset” throughout the organization. Corporate Strategy, Jan 2006 10 Alliances and their key challenges