Duress, Bargaining Power, and Unconscionability

advertisement

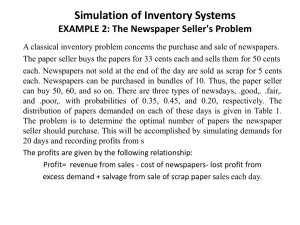

Duress, Bargaining Power, and Unconscionability §4.8 Duress, Unconscionability Bargaining Power, 11 5 and Duress is a defense to an action for breach of contract. In its original sense duress implies a threat of violence. A points a gun at B saying, "Your money or your life"; B accepts the first branch of this offer by tendering his money. But a court will not enforce the resulting contract. The reason is not that B was not acting of his own free will. On the contrary, he was no doubt extremely eager to accept A's offer. The reason is that the enforcement of such offers would lower the net social product by channeling resources into the making of threats and into efforts to protect against them. We know this class of "contracts" is nonoptimal because ex ante-that is, before the threat is made--if you asked the B's of this world whether they would consider themselves better off if extortion flourished, they would say no. By a modest extension of meaning, duress can also be used to describe the use of a threat of nonperformance to induce a modification of contract terms in cases such as Alaska Packers'Assn. v. Domenico, discussed in §4.2 supra, where the promisee lacks adequate legal remedies. In addition, the word is frequently used as a synonym for fraud, as where an illiterate is induced to sign a contract that contains unfavorable terms not explained to him. Most cases involving the abuse of a confidential or fiduciary relationship, although often grouped with duress cases, are at bottom (as should be clear from the previous section) cases of fraud. Duress is also used as a synonym for monopoly. A finds B wandering lost in a snowstorm and refuses to help him until B promises to give A all his wealth. Perhaps here too B should be excused from having to make good on the promise; if we permit monopoly profits in rescue operations, an excessive amount of resources may be attracted to the rescue business. (Remember the discussion of salvage in Chapter 3.) We shall come back to this example. Is there any difference between it and Domenico? Isn't the latter, too, a case of temporary, "situational" monopoly? When a transaction is between a large corporation and an ordinary individual, it is tempting to invoke the analogy of duress and compare the individual to the helpless fellow forced to sign a promissory note with a knife at his throat--espe-cially if his contract with the corporation is a standard contract or the consumer is a poor person--and conclude that the terms of the deal are coercive. Many contracts (insurance contracts are a good example) are offered on a take-it-or-leave-it basis. The seller hands the purchaser a standard printed contract that sets forth, sometimes in numbing detail, the respective obligations of the parties. The purchaser can sign it or not as he pleases but there is no negotiation over terms. It is an easy step from the observation that there is no negotiation to the conclusion that the purchaser lacked a free choice and therefore should not be bound by onerous terms. But there is an innocent explanation for these so-called "contracts of adhesion": that the seller is trying to avoid the costs of negotiating and drafting a separate agreement with each purchaser. These costs, of which probably the largest is the cost of supervising the employees and agents who engage in the actual contract negotiations on the company's behalf, are likely to be high for a large company that has many contracts. Consistent with the innocent explanation, large and sophisticated buyers, as well as individual consumers, often make purchases pursuant to printed form contracts. Use of printed forms leads to the problem that contract lawyers call "the battle of the forms." A may sign, and send to B, a printed form contract, constituting an offer, and B, instead of signing A's form, may sign, and send to A, B's own printed 116 Contract Rights and Remedies form contract. Under the common law's "mirror image" rule, unless B's form was identical to A's, it would fhil as an acceptance of A's offer and would instead be treated as a counteroffer. Tile Uniform Commercial (;ode takes a more liberal approach. If A upon receipt of B's form begins to perform, this is taken to mean that B's acceptance is effective even if it contains materially discrepant terms, since A upon receipt of B's fbrm could have informed B that it was unacceptable, rather than beginning to perform. Which approach--that of the common law or that of the UCC--makes better economic sense? The sinister explanation for the form contract is that the seller refuses to dicker separately with each purchaser because the buyer has no choice but to accept his terms. This assumes an absence of competition. If one seller offers unattractive terms, a competing seller, wanting sales for himself, will offer more attractive terms. The process will continue until the terms are optimal. All the firms in the industry may find it economical to use standard contracts and refuse to negotiate with purchasers. But what is important is not whether there is haggling in every transaction but whether competition forces sellers to incorporate in their standard contracts terms that protect the purchasers. Under monopoly, by definition, the buyer has no good alternatives to dealing with the seller, who is therefore in a position, within limits, to compel the buyer to agree to ternts that in a competitive market would be bettered by another seller. It does not follow that the buyer will be indifferent to the terms of the contract ottered by the seller. On the contrary, since a monopolized product will be priced higher than it would be under competition, prospective buyers will invest more, rather than less, in search; and one form of consumer search is carefitl reading of the terms of a contract. It is also false to conclude that it will not pay the consumer to read the contract if he knows the monopoly seller will not bargain (haggle) with him. The consumer must still decide whether to buy the product or do without. The fact that a product is monopolized does not make it a necessity of liti~. The effect of monopoly, as we shall see in Chapter 9, is to reduce the demand for a product, implying that some customers prefer to do without it rather than pay the monopoly price. So a consumer facing a monopolized market has a real choice, and he will want it to be an informed choice. Contracts are sometimes said to involve duress if the terms seem disadvantageous to buyers, and the buyers are poor. An example is a sale on credit where the buyer agrees that the seller may discount the buyer's promissory note to a finance company. At common law the finance company, as a holder in due course, could enforce the note flee from any detense that the buyer might have raised in a collection suit by the seller. So if you bought a chest of drawers from a furniture store and the citest turned out to be defective, but the store had discounted your note to a finance company, you would have to pay the full amount of the note and would be left with a right to sue the store for breach of warranty. But unfavorable though it is to consumers, the holder-indue-course provision reduces the cost of financing installment purchases by making collection suits cheaper and more certain. ~ In its absence, this cost (a cost borne, at least in major part, by the constimer; see §3.14 supra), would be higher. It is not obviously wiser for the consumer to decide to pay §4.8 1. Suppose that in the absence of such provisions finance companies would extract from sellers promises to indemnits' them for any losses suffered as a resuh of the finance company's being unable to collect its note because the purchaser has a good defense against the seller. Would this alter the conclusion that banning such provisions causes higher tinancing costs to consumers? Duress, Bargaining Power, and Unconscionability 117 more for a product than to decide to give up one of his legal remedies against the seller. Suppose that an installment contract provides that a default will entitle the seller to repossess the good no matter how small the remaining unpaid balance of the buyer's note and to keep the full proceeds from reselling the good to someone else. 2 If default occurs toward the end of the term of the note, repossession will confer a windfall gain on the seller since he has already received almost the full price for the good, including interest. But if it occurs early the seller sustains a windfall loss; he has received only a small part of the price, too little to cover both the depreciation of the good and the costs of repossession. (This assumes, but realistically, that the seller will not be able to collect the unpaid balance directly from the buyer, by suing him.) As long as competition among sellers of consumer goods is sufficiently vigorous to eliminate supracompetitive profits, 3 limiting the windfall gains of late defaults would lead sellers to require larger down payments or higher initial installment payments, or charge higher prices, in order to protect themselves against windfall losses from early defaults. Consumers unable to make large down payments or high initial installment payments'would be harmed by the change in the contractual form. This point shows that the case is totally unlike "Your money or your life." The latter represents a class of transactions that make the "buyers" worse off ex ante; but hard-up consumers may benefit both ex ante and ex post from "harsh" terms when the alternative would be to pay higher prices. Some courts have used the concept of "unconscionability" to invalidate contractual provisions that bear harshly on the poor debtor, as in the holder-in-due-course and repossession examples. Like usury laws and prodebtor provisions of bankruptcy law, the broad interpretation of unconscionability (narrowly interpreted it is just a voguish term for fraud, duress, and breach of fiduciary obligation) makes it more difficult for poor people to borrow, thus harming them ex ante though benefiting some of them ex post. It is arguable, however, that the law is merely redressing an imbalance created by the welfare laws, which encourage risky borrowing by truncating the downside of the risk. 4 But this is a different concern from unequal bargaining power, let alone duress. After this long excursus into dubious extensions of the concept of duress, let us return to a real case of duress (economically conceived). A ship becomes disabled, and the crew flees, leaving on board only the master, who let us assume is also the shipowner's authorized representative to deal with any salvors who may chance by. A tug operated by a salvage company comes alongside, and the captain of the tug offers the master a contract to save the ship for a price equal to 99 percent of the value of the ship and its cargo. If the master signs, should the owner of the ship be held to the contract? Admiralty law answers no, and this seems the correct economic result. The situation is one of bilateral monopoly, with the added complication that transaction costs are even higher than in other bilateral-monopoly contexts, since if the master of the ship tries to hold out for a better deal, the ship and all its cargo 2. Cf. Williams v. Walker-Thomas Furniture Co., 350 E2d 445 (D.C. Cir. 1965). The example is extreme; to deny the buyer any share of the proceeds of the resale of the repossessed merchandise would be considered a penalty and therefore forbidden. See §4.14 infra for further discussion of repossession. 3. A plausible assumption; most retail markets are highly competitive. Aald it might not make much difference if the market were monopolized. See §9.2 infra. 4. See Eric A. Posner, Contract Laws in the Welfare State: A Defense of the Unconscionability Doctrine, Usury l,aws, and Related Limitations on the Freedom to Contract, 24J. Leg. Stud. 283 (1995). 118 Contract Rights and Remedies may sink beneath him. These transaction costs can be avoided by a rule--the cornerstone of the admiralty rules of salvage rothat the salvor is entitled to a reasonable fee for saving the ship, but that a contract made after the ship gets into trouble will only be evidentiary of what that reasonable fee is. :' We are now prepared to give an economic meaning, or rather meanings, to the term "bargaining power," a term used frequently in legal argument. The most straightforward meaning, and the only one with clear implications for law or other public policy, is monopoly, unless it is bilateral monopoly; it is only when the monopolist is transacting with numerous parties that he can be said to have disproportionate bargaining power. But the term can also signify simply a refusal to bargain, as where a seller offers a contract on a take-it-or-leave-it basis; or can signify simply that one side of the transaction has better alternatives than the other side does, though not because of monopoly. For example, if there are many more men of marriageable age than women, women will on average be able to drive better marriage bargains than men can. In this sense of bargaining power, sellers have more bargaining power than buyers in a shortage, and buyers have more bargaining power than sellers in a glut. 5. See William M. I.andes & Richard A. Posner, Salvors, Finders, Good Samaritans, and Other Rescuers: An Economic Study of Law and Ahruism, 7J. Leg. Stud. 83, 100-105 (1978).