opt to tax

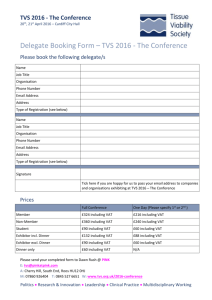

advertisement

DECISION MAKING PROCESS WHEN DECIDING WHETHER TO “OPT TO TAX” THE SALE OF NHS ESTATE What is the VAT position? the sale of land, including buildings and structures on that land, is exempt from VAT unless – it is the first sale ( leasehold exceeding 21 years or freehold) of a ‘qualifying’ building that the NHS has constructed (this is zero rated for VAT). By a qualifying building, Customs mean: (i) a dwelling (ii) a home or institution that is the permanent residence of people while staying there (eg a care home or institution for the permanently disabled). These are listed in VAT legislation (if you have any doubt about this, please consult the Customs and Excise NHS Admin Team) (iii) a building used by a charity either for a non-business purpose, or as a village community hall In the case of (ii) and (iii) the purchaser must provide you with a certificate of intended use. – it is the freehold sale of a non-qualifying building less than three years after the date of practical completion (this is liable to VAT at 17.5 per cent). A nonqualifying building is any building not referred to above. If you think this may be the case, you are advised to contact the Customs NHS Admin Team for advice. it is, however, possible to “waive exemption” and tax the sale at 17.5 per cent VAT (the “option to tax”). Why “opt to tax”? the NHS cannot recover the VAT incurred, for instance on agents and solicitors fees, in relation to a sale of land that it is exempt from VAT, but it can recover this if the land has been subject to an “option to tax”. So why not “opt to tax” everything? in certain circumstances taxing the sale of land can make it less attractive to a prospective purchaser:– the purchaser may not be able to recover the VAT charged; – Stamp Duty is payable on the VAT-inclusive value of the sale, so the purchaser pays more Stamp Duty if the land has been taxed. opting to tax can be a complicated process which may not be cost effective if there are only small amounts of VAT you wish to recover. It is better to follow these five tests when considering “opting to tax” the sale of land Test 1 - is it worthwhile opting to tax? you should only consider opting to tax if the amount of VAT the NHS can recover as input tax exceeds [ £ 1,000 ]. Otherwise opting to tax ceases to be a cost-effective exercise. in many cases the NHS will have been able to recover the VAT incurred on services contracted out to private sector providers, and in the case of vacant property the NHS will continue to benefit from this recovery of VAT until a decision is reached to dispose of the property. This includes, for example, the provision of site security. You need to be careful not to “opt to tax” solely in order to recover VAT that is already recoverable under Treasury rules. If you are in any doubt about this, please contact the Customs and Excise NHS Admin Team. Test 2 - is it commercially viable to “opt to tax” or will this discourage would be purchasers? many bodies that might otherwise be interested in purchasing surplus NHS land may be discouraged if you “opt to tax” because they cannot recover all the VAT they pay (and some cannot recover any of it). For example: – other Government Departments – medical practitioners – the private medical sector (e.g. BUPA) – most charities – housing associations providing rented accommodation – universities and fee-paying schools – the finance sector (banks, building societies, insurance companies etc) the following are examples of the types of organisation that can generally recover the VAT they pay: – house developers involved in “new build” (Waites, Bovis etc). – retailers, wholesalers and manufacturers – the leisure and entertainment sector (theme parks, multiplex cinemas, hotel and conference centres etc). – local authorities (these bodies can under special arrangements recover the VAT incurred in relation to their statutory, non-business activities). – media and advertising – transport undertakings property developers involved in non-residential developments will have to make much the same judgement as you are making, so they may not always want to pay VAT on the acquisition of land. It might be best to wait until a purchaser has been selected. Test 3 - is it legally possible to “opt to tax” the land in question? although the “option to tax” is widely available, it has no legal effect (so cannot be used) in the following circumstances. – a building intended for use as a dwelling. There is, however, one exception to this. Where a business purchaser of a non-residential building intends to convert this into a dwelling for sale, the ‘option to tax’ can apply with the written consent of the purchaser. This may sound strange, but it is because the purchaser will make a zero-rated supply when selling the dwelling and can recover the VAT charged. – a building intended either for use as a permanent residential establishment such as a care home, or for use by a charity for a non-business purpose or as a community/village hall (ie the buildings referred to in the paragraph ‘What is the VAT position?’, but without the need for a certificate by the purchaser); – land intended for use by a housing association for residential development, where the housing association certifies this in writing; – land sold to an individual who will construct his/her own place of abode on the land; [Note that in the above situations the law is concerned with the intention of the purchaser, so you will need to establish this. Where the purchaser is legally required to certify the intended use in writing, this has been made clear in the narrative]. – pitches at residential caravan parks and certain moorings for houseboats. in addition to this there is a complex anti-avoidance provision aimed at people who lease property that they intend to occupy (or that they intend the person funding the property or a person connected with either to occupy) for a purpose that does not normally permit recovery of any VAT paid. This should not affect the simple disposal of surplus NHS estate. Test 4 – how does a person “opt to tax”? all options to tax have to be notified in writing to Customs and Excise NHS Admin Team within 30 days (this means writing in good time to the NHS Administration Team). however in addition to this, it is necessary first to seek authority from the Customs & Excise NHS Admin Team to opt to tax if there has been any prior leasing or letting of the land in question by the person wishing to opt to tax. Thus, for example, in the case of a former NHS hospital complex you will need to seek Customs’ prior agreement to opt to tax if, in the past, space has been let for trading concessions, Friends groups or private medical use. it is not possible to opt to tax part of your interest in a building. So for example, if the NHS owned an eight-floor building, it would not be possible to opt to tax floors 1 to 4 but not floors 5 to 8; but if the NHS only had a lease of floors 1 to 4, that is all its option to tax would cover until the NHS acquired an interest in any of the other floors. it is also necessary to remember that for the purposes of the option to tax, two buildings linked internally or by a covered walkway are deemed to be a single building governed by a single option to tax. This may be material if you are selling a hospital complex to more than one person. Test 5 - when does the “option to tax” take effect? an option to tax takes effect from the day you have chosen and notified (within 30 days) to Customs and Excise, or from the day Customs and Excise have consented to in writing. It is only from then that you can start to recover any VAT incurred in relation to the land that is not otherwise recoverable, for example under the Treasury contracting out rules. Taking two examples: Example 1 VAT incurred throughout 2000 on site security £100,000 Premises vacant, no intention at that stage to sell. The £100,000 VAT can be recovered under the Treasury’s contracting out rules. Example 2 VAT incurred throughout 2000 on site security £100,000 Premises vacant; plans in progress to dispose of these. Option to tax effective from 1 April 2001. The £100,000 VAT cannot be recovered until 1 April 2001. [Normally, it is not possible to recover input tax (VAT on business purchases) more than three years after it was incurred. However, the option to tax permits this in two circumstances: 1. The original intention was to let the building in question without opting to tax. The building has not been let, but the intention has changed now that you have opted to tax. This change of intention permits you now to recover the VAT previously not recovered. 2. You have agreed a partial recovery of this VAT as part of the process of obtaining prior permission to opt to tax (test 4 above). Over and above this, where the building is a capital item under the Capital Goods Scheme, the recovery of input tax is determined by that scheme. If you do wish to recover VAT incurred before the date of your option to tax, you are advised to seek the help of the Customs and Excise NHS Admin Team, if you have not already done so.]. you need to be very careful about the timing of any deposits received in relation to the building. If they are received before the “option to tax” takes effect, they are exempt from VAT and – if you have not already done so, you will need to seek Customs and Excise’ agreement to opt to tax; – you will not be able to recover all the VAT incurred in relation to the land being disposed of. Customs and Excise do not view payments held in stakeholder accounts as having been “received” for VAT purposes. Further help and guidance This document has been jointly produced by NHS Estates and HM Customs and Excise. VAT Notice 742 ‘Land and Property’ ~ November 1995 plus updates. [This notice includes a template for notifying an option to tax plus more extensive guidance on how the option to tax works.] Further Guidance can be obtained from: NHS Admin Team 2nd Floor St Christopher House Southwark Street London SE1 0TE 020 8929 2695 CONSIDERATION OF OPTION TO TAX Will the VAT recovered be more than £1000 (Test 1) YES NO Recover VAT following normal NHS contracted out rules NO Is it legally possible to opt to tax (Test 3) YES YES Is the sale to be to a body that cannot recover VAT on a purchase price (Test 2) NO NO Is the property to be sold 'linked' to another (Test 4) NO YES Consider effect on linked land. If effect acceptable (yes), if not (No) YES Will all expenses be incurred within a three year period. NO YES Is it still legally possible to opt to tax (Test 3) Consider when opt to tax should be made to ensure full recovery (the later the better), obtain approval through Head of Property NO YES Opt to tax at time of exchange of contracts, having obtained approval through Head of Property Recover VAT following normal NHS contracted out rules