The Petroleum and Natural Gas Regulations, 1969

advertisement

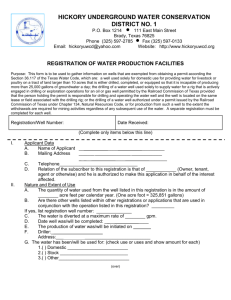

Saskatchewan Ministry of the Economy Expenditures Considered Under Exploration Permits as Defined in: The Petroleum and Natural Gas Regulations, 1969 The Helium and Associated Gases Regulations, 1964 The Oil Shale Regulations, 1964 A. GENERAL Only direct expenditures applicable to exploration will be allowed. Charges for administrative personnel or office expenses are not allowable as an exploration expenditure. Expenditures claimed for recoverable equipment (i.e. production casing) are not allowed. Where drilling operations are conducted in unsurveyed territory, Global Positioning System (GPS) co-ordinates of the well location must be submitted before expenditures will be considered. Please note that all core recovered from a well, including oil shale cores, must be submitted in accordance with provincial regulations before expenditures will be approved. B. DRILLING OPERATIONS 1. DRILLING (a) Footage – Contract To include the cost of drilling by a contractor on a footage basis. (b) Day Work – Contract Cost of drilling work by the contractor on a daily or hourly rate basis, including such costs as coring, deepening, fishing, plugging back and drill stem testing. (c) Cost Plus – Contract Cost of a well by a contractor on a cost plus basis. May include rental or depreciation on drilling rigs, crew labour, operating supplies and items normally furnished by a contractor on drilling footage or day labour basis. (d) Company Tools The cost of drilling a well may include charges for rental or depreciation on drilling rigs, crew labour, operating supplies and other items normally furnished by a contractor when drilling. (e) Bottom Hole Purchases The intangible drilling cost or amounts paid for a well drilled to a specific depth. 2. LABOUR (a) Company Labour Company labour incidental to drilling. To include labour incidental to installing temporary drilling equipment such as water lines, gas lines, substructures and blowout preventers (not to include labour charged under items 1 and 4). (b) Contract Labour Labour furnished by contractors for work incidental to drilling, including welding and machine work in connection with installing temporary equipment, water lines, gas lines, substructures, blowout preventers (not including labour under items 1 and 4). 3. AUTOMOBILES AND TRUCKS (a) Automobiles Reasonable amounts paid for automobile rental and charges for company owned automobiles based on costs and reasonable amounts paid to employees for use of personal cars where used in connection with drilling a well. (b) Truck and Service Equipment To include rental or company operating costs of trucks, bulldozers, drag lines, such as local hauling, freight, grading and ditching in connection with installation of temporary equipment; grading well locations; digging slush pits; cleaning up after completion and hauling drilling equipment, tools, mud and supplies for drilling purposes. 4. ROADS, BRIDGES AND DITCHES Costs in connection with the building of roads, bridges and ditches, including items such as company or contract labour, rental or operating costs of trucks, road grades, bulldozers and drag lines used for such road building and supplies of shale, gravel, oil and lumber, not recoverable, for the same purpose. 5. POWER, FUEL AND WATER (a) Fuel Includes the cost of fuel and power used in drilling operations, such as gas, gasoline, fuel, oil, etc. (b) Water Cost of water used in drilling operations, where applicable. 6. MATERIALS AND SUPPLIES (a) Bits and Equipment To include the cost of drilling bits, use and repair of core cutting equipment, rental of drill pipe, blowout preventers and other tools and equipment of an expendable nature not furnished by the drilling contractor. (b) Drilling Mud and Chemicals Cost of drilling and related material, such as bentonite, weighting material, lost circulation material, chemicals and crude oil used to condition the hole or to maintain circulation while drilling operations are being conducted. (c) Other Materials and Supplies To include the cost of cement, lumber and small tools and supplies used in drilling operations, such as forms, casing racks, runways, derrick floors, slush pits, derrick enclosures, casing shoes, collars, centralizers, scratchers and other similar noncontrollable materials and supplies, such costs not to include recoverable amounts for these items. (d) Surface Casing To include surface casing but not to include recoverable production casing. (e) Miscellaneous Not to include equipment required to put a well in production or salvageable equipment used in drilling the well (i.e. intermediate casing, liner, float equipment, endless tubing, casing bowl, wellhead, unsalvageable packers, plugs and down hole equipment). 7. SPECIAL SERVICES (a) Well Surveys and Test Services To include well surveys, electric, radiation and mechanical logs, sidewall cores, drill stem tests, directional surveys and velocity tests and any extra charges for service and expense to operator for the aforementioned and cost of rental equipment lost in the hole and repairs to such equipment furnished in connection with well surveys and tests. (b) Cementing Casing To include the cost of cement and cementing services for cementing casing in the well. (c) Shooting, Acidizing and Perforating Charges for shooting, acidizing and perforating necessary to break down the formation to obtain production. (d) Squeeze Jobs Charges for cementing services, cement retainers and perforating when squeeze operations are found necessary. 8. OTHER INTANGIBLE DRILLING COSTS (a) Geological and Engineering Fees, salaries and expenses of Geologists and Engineers for work in setting pipe, coring and surveying well locations, for geological and engineering services, such as core analysis, sample analysis and palaeontological services. (b) Other Technical Personnel Salaries, travel expenses, laboratory expenses, etc. for technical personnel directly applicable to the drilling work only. (Charges for administrative personnel or office expenses are not allowable as a drilling expenditure). (c) Employee Benefits Workers Compensation, Unemployment Insurance, etc. for payroll portions of labour attributable to drilling costs as already included. (d) Insurance Charges for the relative drilling period for premiums on insurance allocable to drilling wells. (e) Loss and Damage To include surface rights compensations (charges for capital damage and rental for one year) incidental to a drilling site, costs of plugging dry holes and equipment damaged, lost or abandoned in the hole. (f) Unclassified Drilling Costs To include only miscellaneous drilling costs, such as travel expenses and telephone expenses in connection with the procuring of equipment or direction of drilling operations, as well as the well location survey (costs allocated to the specific year of the permit term during which the well is spud) and surface rights costs, but not to include cost of drilling license or legal fees or the fees and expenses of procuring the surface lease (landman), administrative overhead, or the GST. C. EXPLORATORY WORK OTHER THAN DRILLING OPERATIONS 1. SURVEYS (a) Maximum credit, as governed by the regulations, may be approved for original surveys of the following types: (1) seismic (2) gravimetric (3) magnetic and aeromagnetic (4) radioactive and aeroradioactive (5) geochemical (6) structure drilling or core drilling (b) Maximum credit of 50% of the allowable expenditure as governed by the regulations, may be approved for re-interpretations of existing data with respect to the surveys listed under 1 (a) and does not include the purchase cost of existing seismic. Maximum credit of 50% of the allowable expenditure as governed by the regulations, may be approved for original surveys or re-interpretations of surveys of the following types: (1) electrical (2) photogeological (3) any other approved method of testing the sub-surface of the sedimentary basin not already listed (c) In principle, exploratory work should be carried out on the permit lands. However, since it is often necessary for a proper technical evaluation to extend a geophysical survey beyond permit lands, credit for certain geophysical expenditures outside the permit lands will be granted as follows: (1) Credit will be allowed for off-permit expenditures providing the work is performed within six miles from the permit lands; (2) The amount of off-permit geophysical expenditures may not exceed the amount of geophysical expenditures made on the permit; (3) Statements of expenditures showing a breakdown between on and off permit work and accompanied by a map or plan clearly indicating the lands covered by the geophysical surveys claimed shall be filed at the time of submitting the preliminary expenditure statement; (4) If credit is claimed and granted for off-permit work, all reports, maps and information for the off-permit area required under the regulations must be filed. (d) Geophysical data required on permit disposition submissions: NOTES: 1) If any of the following information is not being transmitted, the permit holder is required to provide reasons, in writing, for their omission. 2) All maps referred to below must be submitted in a reproducible format. If the maps are larger than 11”x17” they must be on a clear sepia print or submitted in Portable Document Format (PDF). If the maps are no larger than 11”x17” they may be submitted on bond paper stock. Seismic: (i) (ii) (iii) A shot point elevation map drawn to a scale of 1:50,000. If this is not available, the permit holder should be submitting the coordinates and ground elevation for ALL shot point locations in a tabular format. Shot hole lithology must be submitted for all new submissions (not required if vibroseis project). Three structure contour maps drawn to a scale of 1:50,000 on the best available horizons above, at and below the Paleozoic group. These maps should indicate the datum elevation and the correctional or replacement velocity. A copy of the complete report submitted by the contracting seismograph company. Gravity: (i) (ii) (iii) A station location map drawn to a scale of 1:50,000. This map must also indicate the ground elevations of key stations or the ground elevations of all stations must be submitted in a tabular format. A contour map drawn to a scale of 1:50,000 showing the corrected values of key stations. A copy of the complete report as prepared and signed by a Geophysicist, a Geologist or an Engineer. Approved Geophysical: NOTE: This section refers to those geophysical procedures performed in accordance with Section 2(h) of The Sedimentary Basin Geophysical Exploration Regulations. (i) (ii) 2. A contour map drawn to a scale of 1:50,000. This map should indicate the location of each station and its observed value. A copy of the complete report as prepared and signed by a Geophysicist, a Geologist or an Engineer. CONTRACT WORK Items normally furnished by the contractor for the type of survey being undertaken. If supervision is given by an employee of the permittee or any charge is made over and above the contract price this must be itemized in detail and fully explained. 3. COMPANY PROJECT Where exploratory work is performed by a company crew, expenditures are to be itemized in detail. Also the method of prorating these costs between permits or projects must be explained, i.e. actual time spent on the permit, acreage basis, number of miles run or number of shot holes. (a) Salaries and Wages May include salaries and wages for Field Crews, Party Managers, Party Chiefs, Field Supervisors, Geophysical Computing staff, Interpreters, Geologists and Geophysicists, including employee benefits. (b) Materials and Supplies Only costs of materials and supplies used on the project. (c) Contract Work Contracts to outsiders such as trucking, bulldozing, clearing brush, etc. (d) Capital Charges Not to exceed the maximum capital cost allowance as provided for in the Income Tax Act (Canada). (e) Rentals (I) Equipment–automotive, technical, etc. (if not company owned). (II) Real Estate-office space only when necessary to maintain field office for the carrying out of the particular project and may include automotive storage for field crew. (f) Travel and Sustenance For company personnel for period of actual work on the project. (g) Automotive Expense Reasonable amounts for automobile rental and charges for company-owned automobiles (based on cost) and reasonable amounts paid to employees for use of personal cars in connection with the project. (h) Legal Survey Costs When permit area is in unsurveyed territory the cost of a recognized legal survey of the area shall be accepted as an expenditure in the year in which any of the work in connection with such survey was done, but the total credit for such survey shall not exceed twenty percent of the expenditure required to be made during the second year of the term of the permit. (i) Miscellaneous May include such charges as telephone, freight and cartage, etc. which pertain directly to the project. Fred Ochieng, P. Eng. Manager, Resource Assessment