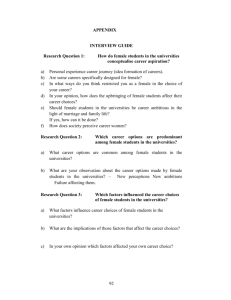

Research and Regions Main Report

advertisement