Independence Rules Modernization Project

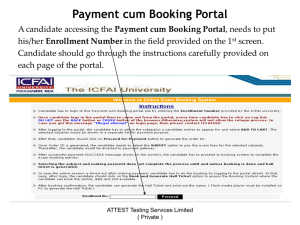

advertisement