Rating (Empty Properties) Act 2007

advertisement

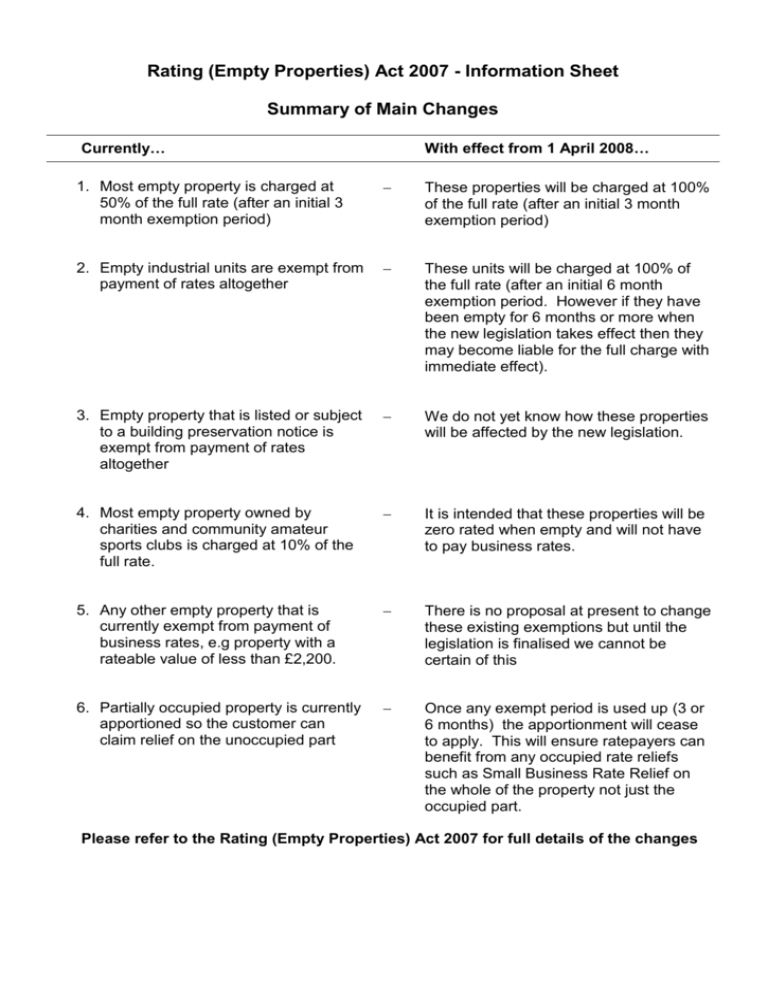

Rating (Empty Properties) Act 2007 - Information Sheet Summary of Main Changes Currently… With effect from 1 April 2008… 1. Most empty property is charged at 50% of the full rate (after an initial 3 month exemption period) These properties will be charged at 100% of the full rate (after an initial 3 month exemption period) 2. Empty industrial units are exempt from payment of rates altogether These units will be charged at 100% of the full rate (after an initial 6 month exemption period. However if they have been empty for 6 months or more when the new legislation takes effect then they may become liable for the full charge with immediate effect). 3. Empty property that is listed or subject to a building preservation notice is exempt from payment of rates altogether We do not yet know how these properties will be affected by the new legislation. 4. Most empty property owned by charities and community amateur sports clubs is charged at 10% of the full rate. It is intended that these properties will be zero rated when empty and will not have to pay business rates. 5. Any other empty property that is currently exempt from payment of business rates, e.g property with a rateable value of less than £2,200. There is no proposal at present to change these existing exemptions but until the legislation is finalised we cannot be certain of this 6. Partially occupied property is currently apportioned so the customer can claim relief on the unoccupied part Once any exempt period is used up (3 or 6 months) the apportionment will cease to apply. This will ensure ratepayers can benefit from any occupied rate reliefs such as Small Business Rate Relief on the whole of the property not just the occupied part. Please refer to the Rating (Empty Properties) Act 2007 for full details of the changes