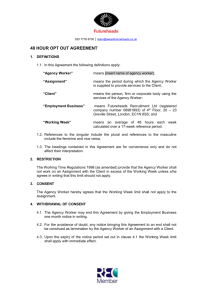

EMPLOYMENT RIGHTS ACT 2008 - Harvard School of Public Health

advertisement