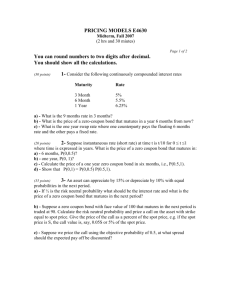

CHAPTER 8

advertisement

CHAPTER 8 1. A one-period strip has a price of $86 and par value of $100. A two-period strip has a price of $88 and par value of $100. Show the arbitrage opportunity. Long Short Net Cum Net 2. 1 | +100 +2 +2 +100 +102 2 | -100 -100 +2 A two-period bond has an annual coupon of $7, par value of $100, and price of $98. Another two-period bond has an annual coupon of $8, par value of $100, and price of $98. Are there any arbitrage opportunities? Short Long Net Cum Net 3. 0 | -86 +88 0 | +98 -98 1 | -7 +8 2 | -107 +108 0 0 +1 +1 +1 +2 In problem 2, is there an arbitrage opportunity if the $8-coupon bond has a price of $98.25? 0 | 1 | 2 | Short x +98x -7x -107x Long -98.25 +8 +108 0 0 +0.98 +0.98 +0.73 +1.71 Net Cum Net x 98.25 1.0026 98 4. In problem 2, suppose the $8-coupon bond has a price of $101, are there arbitrage opportunities? Long Short Net Cum Net 0 | -98 +101 1 | +7 -8 2 | +107 -108 +3 +3 -1 +2 -1 +1 5. The coupon on a two-period par bond is $9. A one-period strip has a price of $93.46 and a two-period strip has a price of $87.34. Are there arbitrage opportunities? Explain. 0 1 2 |____________|____________| Long -100 +9 +109 Short .09 +8.41 -9 Short 1.09 +95.20 -109 ___________________________ Net +3.61 0 0 Cum Net +3.61 +3.61 +3.61 6. Suppose that R0,1 is 3 percent and R0,2 is 6 percent. For one-period and two-period strips with $100 par values, show the operations to create: (a) a long forward position; (b) a short forward position. R0,1 = 3% R0,2 = 6% S1 = 100 = $97.09 1.03 x= 89 = 0.9167 97.09 S2 = 100 = $89.00 (1.06 )2 a. 0 1 2 |________________________|________________________| Long -89.00 +100 Short .9167 +97.09(.9167) -100(.9167) _________________________________________________ Long Forward 0 -91.67 +100 b. 0 1 2 |________________________|________________________| Short +89.00 -100 Long .9167 -97.09(.9167) +100(.9167) _________________________________________________ Short Forward 0 +91.67 -100 7. Assuming the term structure in the preceding problem, show the arbitrage operations if the actual forward interest rate is: (a) 15 percent, (b) 5 percent. (1.06)2 = (1.03)(1 + f0,2) f0,2 = 9.09% a. Implied f0,2 = 9.09% Actual f0,2 = 15% Borrow at 9.09% and lend at 15% a) |____________|____________| Short +89.00 -100 Long .9167 -89.00 +91.67 Lend at 15% 0 -86.96 +100 ___________________________ Net 0 +4.71 0 Cum Net 0 +4.71 +4.71 b. Implied f0,2 = 9.09% Actual f0,2 = 5% Borrow at 5% and lend at 9.09% 0 1 2 |____________|____________| Long -89.00 +100 Short .9167 +89.00 -91.67 Borrow at 5% 0 +95.25 -100 ___________________________ Net 0 +3.57 0 Cum Net 0 +3.57 +3.57 8. Suppose that you buy a three-year bond with annual coupons of $7 and par value of $100 for a price of $102. One-year, two-year, and three-year strips with $100 par values sell for $95, $90, and $85 respectively. Suppose that you shortsell 7% of the one-period strip, shortsell 100% of the 3-period strip, and shortsell 11.50% of the two-period strip. Is this an arbitrage position? What would describe this position? Long Short 7% Short 11.5% Short 100% Net 0 1 2 | | | -102 +7 +7 +(95)(0.07) -(100)(0.07) +6.65 -7.00 +(90)(0.115) -(100)(0.115) +10.35 -11.5 +85 0 This is the long forward position. 0 -4.50 3 | +107 -100 +7 9. A five-year bond has a price of $100, annual coupon of $10, and par value of $100. An eight-year bond has a price of $100, annual coupon of $6, and par value of $100. Are there any arbitrage opportunities? 0 1 | | Long -100 +10 Short +100 -6 Net 0 +4 Cum Net 0 +4 2 | +10 -6 +4 +8 3 | +10 -6 +4 +12 4 5 6 7 8 Total Inflows | | | | | | +10 +110 150 -6 -6 -6 -6 -106 148 +4 +104 -6 -6 -106 +16 +120 +114 +108 +2 The $10 coupon bond has more total inflows ($150) and receives them sooner than the $6 coupon bond ($148). 10. Suppose there are three 2-year bonds with par values of $100 and with coupons of $3, $4, $5 and that the prices of one-year and two-year strips are $94 and $89. In a perfect market, what should be the prices of bonds with coupons of $3, $4, and $5? If the bond with the $4 coupon sells for $97, describe the arbitrage opportunities. If the bond with the $4 coupon sells for $96, describe the arbitrage opportunities. $3 coupon: P = (3)(0.94) + (103)(0.89) = 94.49 PVA = 1.83 P = (3)(1.83) + (100)(0.89) = 94.49 $4 coupon: P = (4)(1.83) + (100)(0.89) = 96.32 $5 coupon: P = (5)(1.83) + (100)(0.89) = 98.15 If Pc=4 = $97, short this bond and buy 0.50 of $3 coupon and 0.50 of $5 coupon. Profit = 97 – 96.32. If Pc=4 = $96, buy this bond, short 0.50 of $3 coupon and 0.50 of $5 coupon for a profit of 0.32. 11. Suppose that there is a spot market for Treasury strips and a forward market. A oneperiod strip with $100 par value sells for $95.50 and a two-period strip sells for $92.25 per $100 of par in the spot market. In the forward market for strips for delivery in one year, strips have quotes of $97.00 per $100 of par. Please describe any arbitrage opportunities available? Long Short x 12. 0 | 92.25 1 | x(95.50) (100)x x Long Forward Short Forward 0 0 -96.60 +97.00 +100 -100 Net 0 +0.40 0 92.25 0.9660 95.50 A one-period strip has a spot interest rate of 8% and par value of $100. A two-period strip has a spot interest rate of 3.80% and par value of $100. Are there any arbitrage opportunities? 0 | 13. 2 | +100 1 | Short +92.81 Long -92.59 +100 Net Cum Net +0.22 +0.22 +100 +100.22 2 | -100 100 (1.038) 2 100 92.59 1.08 92.81 -100 +0.22 Arbitrage Bond G is a two-period bond with annual coupon of $5.25, par value of $100, and price of $101. Bond H is a two-period bond with annual coupon of $5.50, par value of $100, and price of $101. Are there any arbitrage opportunities? Short G Long H Net Cum Net 0 | +101 -101 1 | -5.25 +5.50 2 | -105.25 +105.50 0 0 +0.25 +0.25 +0.25 +0.50 14. Bond G is a two-period bond with annual coupon of $5.25, par value of $100, and price of $97.50. Bond H is a two-period bond with annual coupon of $6.50, par value of $100, and price of $101.00. Are there any arbitrage opportunities? Long G Short H Net Cum Net 15. 1 | +5.25 -6.50 2 | +105.25 +106.50 +3.50 +3.50 -1.25 +2.25 -1.25 +1.00 Suppose that one-period strips sell at $95 and two-period strips sell at $91 per $100 of par. A two-period bond has an annual coupon of $8, $100 par value, and price of $106. Are there any arbitrage opportunities? Short Long (1.08) Long (0.08) Net 16. 0 | -97.50 +101.00 0 | +106 -91(1.08) -(98.28) 95(0.08) (7.6) 0.12 1 | -8 2 | -108 +100(1.08) 100(0.08) 0 0 Suppose that one-period strips sell at $97.50 and two-period strips sell at $94.00 per $100 of par. A two-period bond has an annual coupon of $6, $100 par value, and price of $106. Are there are any arbitrage opportunities? Short Long (1.06) Long (0.06) Net 0 | +106 -94 -(99.64) -97.50 -5.85 0.51 1 | -6 2 | -106 +100(1.06) 100(0.06) 0 0 17. Suppose that a 1-period Treasury strip with $100 par value has a price of $91, a 2-period strip with $100 par value has a price of $88, and a 3-year bond with annual coupon of $8 has a price of $100. Suppose an investor decides to buy the 3 period bond and short 8% of a 1-period strip. What is the correct way to describe this position? (a) (b) (c) (d) (e) Long forward position. Short forward position. An arbitrage position. An extremely risky position. None of the above. The correct answer is e. This is a long spot position. Long Short (0.08) Net 0 | -100 +91(0.08) +7.28 1 | +8 -100(0.08) 2 | +8 3 | +108 -92.72 0 +8 +108