Annex B & C (Microsoft Word file - 314kb)

advertisement

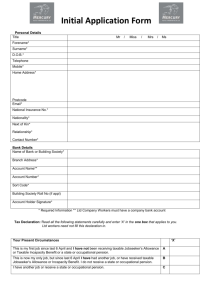

Annex B to Home Office Circular New Police Pension Scheme 2006: pensions for partners – a guide This guidance and declaration form are for use by members of the New Police Pension Scheme, but can also be used by members of the current Police Pension Scheme on a provisional basis as explained below. If you joined the police service on or after 6 April 2006, you are a member of the New Police Pension Scheme (unless you opted out) and you can ignore the rest of this page. Important points for members of the current scheme In the New Police Pension Scheme (NPPS) a pension can be paid for life to a police officer’s partner, even if they are not married to each other or in a civil partnership with each other, in the event of the officer’s death. This benefit is not payable in the current Police Pension Scheme (PPS). Members of the current scheme currently have an opportunity to transfer to the new scheme in a three-month ‘options exercise’ which began on 1 November 2006 and will end on 31 January 2007. If you are a member of PPS, and you are living with a partner who is not married to you or in a civil partnership with you, then you are strongly advised to consider completing a declaration form (at the end of this leaflet) without waiting to decide whether or not to join NPPS, as this will help to protect your partner’s position in the interim. If you were to die between 6 April 2006 and the end of the options exercise, then – unless you had opted in writing to remain the current scheme – your partner would be able to submit a claim for a pension. But you must jointly have completed a declaration form. Completing a declaration form does not commit you to joining NPPS. If you do not opt to transfer to NPPS, your declaration will simply lapse at the end of the options exercise or on the date you opt to remain in the current scheme, if that is earlier. Any pension and lump sum death grant payable to a surviving unmarried partner of a member of PPS, under this transitional arrangement, could be affected by benefits payable under PPS to any surviving children. Introduction The New Police Pension Scheme 2006 (NPPS) provides pensions for four types of survivors of scheme members: Widows and widowers Surviving civil partners Surviving partners in the case of couples who are in long-term relationships but who are neither married nor civil partners Children (generally payable to age 19, unless the child is in full-time education in which case payable to age 23) NPPS has not been designed to pay pensions to adults such as: Dependent family members (for example, parents, grandparents, brothers or sisters) Friends People in a purely financial relationship (such as a flatshare or a joint purchase of property) People in casual relationships. This leaflet deals only with pensions for unmarried partners – that is, people of the same or opposite sex who are living together in a long-term relationship but neither married nor registered as civil partners. If you need information on pensions for other survivors, or on NPPS generally, you should refer to the NPPS Members’ Guide or contact your pensions administrator. In this leaflet, the term ‘unmarried partner’ is used as shorthand for a partner who is neither married to nor in a civil partnership with a member of NPPS. The term ‘nominated partner’ is used to refer to such a partner who has been nominated in a declaration form to receive a pension on an NPPS member’s death. If you have an unmarried partner, you will want to know whether the NPPS will pay a pension to your partner after you die. This leaflet provides guidance on the qualifying conditions for an unmarried partner’s pension and how the pension is worked out. The qualifying conditions The NPPS rules provide for an unmarried partner’s pension if: you and your partner have together completed and sent to the appropriate police authority a joint declaration of partnership; and at the time of your death, you and your partner were living together as partners in an exclusive, committed and long-term relationship, which would have lasted for the foreseeable future; and either your partner was financially dependent on you or the two of you were financially interdependent; and you and your partner were either free to marry each other (if you are of the opposite sex) or free to form a civil partnership with each other (if you are of the same sex). You can make the declaration while you are serving or after you have left the service, providing you retired with a pension provided under NPPS or left with entitlement to a deferred pension payable under NPPS. Is there any minimum service period? You must have at least two years’ qualifying service in the NPPS in order for a surviving partner to receive a pension. ‘Qualifying service’ is not the same as pensionable service. Qualifying service is normally the calendar length of police service, plus any previous service or employment which you transferred into NPPS. Half time service for a year in a police force, for example, would count as one year towards qualifying service (but could only count as a maximum of half a year’s pensionable service). What is meant by an ‘exclusive, committed long-term’ relationship? The NPPS can provide a pension for your unmarried partner only if you are living together in a long-term relationship with just one person, which you both intend to continue indefinitely. If you have a similar relationship with more than one person, none of them would be entitled to a pension under NPPS. As a general rule, you should interpret ‘long-term relationship’ to mean ‘one that had lasted at least two years and would continue to last for the foreseeable future’. However, the police authority may exercise discretion to pay a pension to a nominated partner in a cohabiting relationship that had lasted for less than two years, provided they are satisfied that you and your partner would have continued to live together for the foreseeable future and cohabitation would therefore have lasted for at least two years and that the requirements are otherwise met Following your death, the police authority will consider your case individually and take account of anything that supports the claim that you and your partner had a permanent relationship which would otherwise have continued. As long as you consider that your relationship is permanent, you should not let the fact that you and your partner have been together for less than two years stop you from filling in a declaration form. After your death, the police authority will not want to pry unnecessarily into your or your partner’s personal life or to try to ‘disprove’ your partner’s eligibility for a pension, but they will need to be satisfied that your relationship satisfies the legal requirements. What is meant by financial dependence and interdependence? Under HM Revenue and Custom’s rules governing occupational pension schemes, your partner must be financially dependent on you or you must be financially interdependent. Your partner is ‘financially dependent’ on you if you provide all or most of the income on which you both live. ‘Financially interdependent’ means that you rely on your joint finances to support your standard of living. It doesn’t necessarily mean that you need to be contributing equally. For example, if your partner’s income is a lot more than yours, he or she might pay the mortgage and most of the bills, and you might pay for the weekly shopping. What is meant by ‘free to marry’ and ‘free to form a civil partnership’? There must be nothing which would prevent you from marrying your partner (if you are of the opposite sex) or forming a civil partnership with your partner (if you are of the same sex). Neither of you can be married to or have a civil partnership with anyone else. You must not bear a relationship to each other which would prevent marriage or civil partnership. Annex A to this leaflet includes a list of relationships which are too close to allow a marriage and Annex B includes a similar list for civil partnership. [Note: Annexes A and B are omitted from the version reproduced in this Circular.] I’m waiting for my divorce (or dissolution of a civil partnership) to come through – will my partner get a pension if I die in the meantime? No. If you are married or have a civil partner, NPPS will pay a pension to your surviving wife, husband or civil partner, even if you no longer live with them. If you want your partner to receive a pension, you must both be legally free to marry or form a civil partnership with each other when you make your declaration. How do I nominate my partner? You and your partner must fill in and sign a declaration form and send it to your force’s pensions administrator, who acts on behalf of the police authority. You will find a declaration form, including the address where to send it, at the end of this leaflet. The police authority cannot pay a pension to your partner unless they have received a valid declaration form which you and your partner have completed. You are encouraged to complete a declaration form to nominate your partner as soon as you consider that your cohabiting relationship is exclusive, committed and longterm – you do not have to wait for two years before doing this. It is your responsibility to ensure that the information in the form is kept up to date. What does my partner need to do after my death? Your partner will need to be aware that, after your death, he or she will need to provide information to the police authority in writing to support his or her claim to a partner’s pension. Your partner must satisfy the police authority that, at the time of your death, you and your partner were living together in an exclusive, committed and long-term relationship and that the other conditions described in this leaflet are met. There is more information in the section ‘How your partner submits a claim after your death’ further on in this leaflet. I don’t really want my force to know about my relationship You send your declaration to your force’s pensions administrator, who acts on behalf of the police authority. All pensions documentation and casework is handled in the strictest confidence and in line with data protection legislation. Your declaration will be handled with appropriate confidentiality. What if we split up? If your relationship comes to an end, it is essential that you tell your pensions administrator in writing as soon as possible so that they can cancel your declaration. Once the declaration is cancelled, your partner would not be able to submit a claim for a survivor’s pension in the event of your death. If you enter into a new permanent relationship, you may want to make a new declaration at some time in the future. Should I make a will? If you want to leave anything to your partner, quite apart from your pension, you should consider making a will. If you die without a will (“intestate”), your property will not automatically go to your partner. You can draw up a will without using a solicitor but you should consider getting legal advice, particularly if your financial affairs are complicated. It is important to bear in mind that mentioning your partner in your will does not amount to making a declaration of partnership for the purposes of NPPS. The only valid declaration is one in the appropriate form. Where a form has been completed, however, naming your partner as a beneficiary in a will is one of the factors that may be taken into account by the police authority in considering whether the relevant conditions are met. How your partner makes a claim after your death How does the process work? Your partner will only be able to make a claim after you die if you had both jointly completed a declaration form before your death. When the police authority becomes aware of your death, they will contact your partner as recorded on your declaration. They will invite your partner to fill in a claim form and to provide information to support his or her claim to a partner’s pension. Most people die several years into their retirement and your partner will be asked to supply information that is appropriate at the time of your death rather than at the date of your declaration. While it is possible to outline the sort of supporting information that the police authority might be looking for now, this is likely to change over the years to reflect changes in society. It is not possible to be definite about the sort of information your partner might be asked to provide at some time in the future after your death. This leaflet will be updated from time to time, in consultation with the staff associations, to reflect changes in guidance on supporting information. If you have made a declaration, you should keep yourself up to date. What sort of information might support my partner’s claim? The police authority will need to be satisfied that you, your partner and your relationship meet the conditions that are set out in the NPPS regulations and described in this leaflet. The police authority will ask your partner to confirm his or her identity. They will also ask your partner to confirm that neither of you were married or in a civil partnership and that there was nothing to prevent you from marrying each other or forming a civil partnership. There must be nothing to suggest that your relationship was likely to end. The police authority will ask your partner to provide information about your relationship and to confirm that you were financially dependent or interdependent. Where appropriate, your partner will have to provide documents to confirm the information given in his or her claim. The information will enable the police authority to decide whether your relationship meets the conditions. There are various possible forms of supporting information and, because everyone is different, it is not possible to provide a definitive list. However, examples of supporting information include: confirmation that you lived in a shared household; confirmation of shared household spending; information about children you brought up together; a mutual power of attorney; a joint mortgage or tenancy; a joint bank account; joint savings accounts or investments; a joint credit arrangement; wills naming each other as the main beneficiary; your partner being nominated as the main beneficiary of life assurance; your death leading to extra living expenses for your partner. These are just examples and each case will be considered individually. The police authority may be able to help your partner if he or she is stuck for information or evidence to put forward. You and your partner may wish to consider now what sort of information he or she would be able to provide in support of a claim. Do I have to own a house or flat with my partner? Not necessarily, but you must have been living together. Most people in a permanent relationship will have either owned or rented property together. If you both maintain separate households and do not share each other’s living expenses your partner would not qualify. If your circumstances force you to spend your final years away from home, in residential nursing care, for example, the police authority will take account of your situation when you were living at home as well as at the time of your death. Why don’t married couples or civil partners have to go through the same process? Marriage and civil partnership give people rights and responsibilities, including certain rights over each other’s property. If people decide not to marry or form a civil partnership, the police authority needs to be satisfied that the relationship meets the statutory requirements in order for a pension to be paid to an unmarried partner. Can my partner appeal if they are turned down for a pension? If your partner thinks they have been turned down without a good reason, he or she may try to resolve the issue using the police authority’s internal resolution procedures. Alternatively, he or she may pursue the matter through the Crown Court. More information about appeals in general is given in the NPPS Members’ Guide. Benefits payable on death How much is my partner’s pension? If you die in service, your partner is entitled to a pension of 50% of the ill-health pension that you would have received if you had been permanently disabled for regular employment at the time of your death. You should refer to the NPPS Members’ Guide for more information on how ill-health pensions are calculated. Example 1 Alec is a full-time officer earning £42,000 per year and he and his partner, Bianca, have completed a declaration form. If Alec dies in service (and has not opted out of NPPS) at age 35 having 5 years’ pensionable service, Bianca will be entitled to receive a pension of half of 15/70 of his pay, or £4,500 per year, if she submits a valid claim. If you die while you are receiving a NPPS pension, or if you die after you have left the police service with an entitlement to receive a deferred NPPS pension at 65, or if you have opted out of NPPS and are entitled to a deferred pension but die in service, your partner is entitled to a pension of 50% of your pension entitlement at the date of your death. Example 2 Chris transferred his service from the current Police Pension Scheme to NPPS and retires at the end of 2007 with a NPPS pension of £20,000 per year. Chris and his partner, David, completed a declaration form. If Chris dies before David, David will be entitled to receive a pension of half of Chris’s pension at the date he died, i.e. half of £20,000 per year uprated for inflation to the date of Chris’s death, if he submits a valid claim. Will my partner’s pension stop if he or she forms a new relationship? No. Your partner will receive their pension for the rest of their life, even if they marry, form a civil partnership or otherwise enter into a new relationship after you die. Will you increase my partner’s pension every year? Yes. Their pension will be paid every month and it will be increased every April to reflect increases in the cost of living. My partner is a lot younger than me. Will this affect their pension? If your partner is more than 12 years younger than you, your partner’s pension will be reduced to reflect the age difference. This reduction will be 2.5% for every year or part of a year over 12 years, up to a maximum reduction of 50%. This rule also applies to spouses and civil partners. Example 3 Emma is a full-time officer aged 42 earning £70,000 per year. She and her partner, Frank, aged 28, have completed a declaration form. Emma dies in service (and has not opted out of NPPS) at age 43 having 20 years’ pensionable service. If Emma and Frank had been aged within 12 years or less of each other, Frank (on submission of a valid claim) would have been entitled to receive a pension of half of 26/70 of Emma’s pay, or £13,000 per year. Since Frank is 14 years younger than Emma, however, this is reduced by 5%, or £650, to give £12,350. Will my partner receive any other benefits when I die? NPPS has provision to pay a lump sum if you die while in service. The amount of the lump sum death grant is three times your annual pensionable pay at the time of death. This will be paid to your nominated unmarried partner at the discretion of the police authority, providing he or she has submitted a valid claim. If you wish to nominate someone else to receive your lump sum death grant, you should complete a lump sum death grant nomination form (which you can obtain from your force’s pensions administrator). A lump sum death grant nomination does not override the provision that the grant will go to a surviving partner, at the police authority’s discretion, but it would take effect if both you and your partner were to die at the same time. Declaration form By completing this declaration form you nominate your partner to receive an adult partner’s pension payable under the Police Pensions Regulations 2006, subject to the submission of a valid claim in the event of your death. This declaration alone does not give your partner entitlement to a pension. If you were to die, the police authority would need to be satisfied that your relationship with your partner met the qualifying conditions for the payment of a pension at the time of your death. Please read this leaflet for more information. If you are a member of the Police Pension Scheme 1987, then if you do not opt to join the New Police Pension Scheme 2006 this declaration will lapse on 31 January 2007 or on the date you opt to remain in the current scheme, if that is earlier. Please fill in this form in black ink and in BLOCK CAPITALS, and send it to your force’s pensions administrator, acting on behalf of the police authority, at the address shown below. They will acknowledge that they have received the form by returning a copy of it to you. Please return the completed form to: PART 1. ABOUT YOU (THE SCHEME MEMBER) Your name Pay reference Address (it is your responsibility to tell your pensions administrator if you subsequently change address) Postcode Daytime telephone number PART 2. ABOUT YOUR PARTNER Partner’s full name including title Partner’s date of birth Partner’s address (this should normally be the same as the address of the NPPS member) Postcode Now turn over PART 3. DECLARATION We confirm the following. We have lived together for ….. years, during which time our financial affairs have been interdependent (or the partner has been financially dependent on the NPPS member). We have an exclusive, committed and long-term relationship with each other and we intend to continue this indefinitely. We are not married to each other and we have not formed a civil partnership with each other We are not related in a way that will prevent marriage or civil partnership Neither of us is married to anyone else. Neither of us has formed a civil partnership with anyone else Neither of us is currently nominated as the unmarried partner of anyone else. We will tell the scheme administrator in writing if our relationship comes to an end. We understand that benefits will not be paid unless the partner provides satisfactory evidence that the declaration above is valid when the NPPS member dies. Scheme member’s signature (signed in the presence of the witness named below) Date Partner’s signature(signed in the presence of the witness named below) Date PART 4. WITNESS (NOTE: THE WITNESS IS SIMPLY REQUIRED TO WITNESS THE SIGNING OF THE FORM BY THE SCHEME MEMBER AND PARTNER IN PART 3 ABOVE) Name of witness Address of witness Postcode Signature of witness Date FOR POLICE AUTHORITY USE The declaration has been recorded. Your name Telephone Official address Signature Date Annex C to Home Office Circular New Police Pension Scheme 2006: unmarried partners - guidance for pensions administrators 1. Introduction 1.1 The New Police Pension Scheme (NPPS) can provide pensions for surviving partners of people who are in long-term relationships but who are neither married nor civil partners. These notes provide guidance for NPPS administrators on qualification for an unmarried partner’s pension, the procedures involved in nominating a partner and the criteria to be used in deciding whether someone qualifies for a partner’s pension when a member dies. 1.2 In this guidance, the term ‘unmarried partner’ is used as shorthand for a partner who is neither married to nor in a civil partnership with a member of NPPS. The term ‘nominated partner’ is used to refer to such a partner who has been nominated in a declaration form to receive a pension on the NPPS member’s death. The terms ‘officer’ and ‘member’ are used interchangeably to denote the member of NPPS, whether in service or retired. 1.3 The provisions described in this guidance apply to the partner of an officer who has joined NPPS, either on joining the service or after transferring from the current Police Pension Scheme (PPS). Officers who have remained members of PPS, or who are not members of either scheme, cannot nominate an unmarried partner to receive a survivor’s pension. This is subject to the transitional arrangements described below. 1.4 Any enquiries about this guidance or unmarried partners in general may be addressed to the police pensions section at the Home Office on 020 7035 1883 or 1882. Transitional arrangements 1.5 NPPS came into effect on 6 April 2006 for all new entrants to the service. Officers who were already in service at that date currently have an opportunity to transfer to the new scheme during the 3-month ‘options exercise’ which began on 1 November 2006 and will end on 31 January 2007. Between 6 April and 31 January 2007, the last date of the options exercise, an officer who is a member of PPS may submit an unmarried partner declaration form, provided he or she has not opted in writing to remain in the current scheme. This would have the following effect: if the officer opts to join NPPS, the declaration will continue to have effect and his or her partner will be able to submit a claim for an adult partner’s pension in the event of his or her death; if the officer opts to remain in PPS, the declaration ceases to have effect when the option is made and should be destroyed. You should inform the officer that this has been done. An unmarried partner would not be able to submit a claim for an adult partner’s pension (if the officer were subsequently to decide to join NPPS after the options exercise, he or she would have to submit a fresh declaration); if the officer has neither opted to join NPPS nor to remain in PPS by the last date of the options exercise, he or she remains in the current scheme by default and the declaration ceases to have effect at 31 December and should be destroyed. You should inform the officer that this has been done. An unmarried partner would not be able to submit a claim for an adult partner’s pension (if the officer were to decide subsequently to join NPPS after the options exercise, he or she would have to submit a fresh declaration); if the officer were to die in the period between completing the declaration and the last date of the options exercise then, providing he or she had not opted to remain in the current scheme, his or her partner would be able to submit a claim as if, for these purposes only, the officer had been a member of NPPS. 1.6 These transitional arrangements have effect solely for the purposes of an unmarried partner’s pension in the event of an officer’s death before he or she has made an option as part of the options exercise. A member of PPS who completes an unmarried partner declaration is not thereby deemed to have opted to join NPPS. Any children’s benefits under PPS are unaffected. 1.7 The payment of a pension to a surviving unmarried partner of a member of PPS who dies before 31 January 2007, without having opted to join NPPS, is accordingly subject to the following proviso: no benefits paid to an unmarried partner of a deceased member of PPS can be to the detriment of a benefit which any surviving child of the PPS member would expect to receive under PPS. This includes the increased allowance payable to a child survivor during the first 13 weeks. Where there are children to whom pension benefits are payable under PPS, the surviving unmarried partner would receive only the remainder of the lump sum death grant payable under NPPS after the allowance payable to the children in the first 13 weeks has been deducted. Where a child’s allowance is greater under the current scheme than it would have been under NPPS, the unmarried partner’s pension would be abated to ensure that the total paid out did not exceed the total due under NPPS. 1.8 You are advised to seek the advice of the Home Office police pensions section (at the contact number given in paragraph 1.4) if you encounter a case in which a surviving unmarried partner of a former PPS member claims a pension under these transitional arrangements and a pension is payable under PPS to one or more children of the former PPS member. 1.9 The rest of this guidance should be interpreted in the light of the transitional arrangements described above. 2. Who qualifies for an unmarried partner’s pension? 2.1 The relevant provision is regulation 40 (Survivors) of the Police Pensions Regulations 2006. Under regulation 40(2), a partner who is neither a spouse nor a civil partner may qualify for an adult survivor’s pension if the following conditions are met: the NPPS member has made and sent to the relevant police authority a declaration, signed by the NPPS member and the partner, that: the member and his or her partner were cohabiting as partners in an exclusive, committed and long-term relationship; and either the partner was financially dependent on the member, or the two of them were financially interdependent; and the member and partner were either free to marry each other or free to form a civil partnership with each other; and the member has acknowledged an obligation to send to the police authority a notice of revocation should the relationship end; the declaration had not been revoked by the NPPS member before his or her death; the surviving partner has submitted a claim in writing to the relevant police authority and has satisfied the authority that: at the time of the officer’s death, the first three conditions in the set of bullet points above continued to apply; and the period of cohabitation mentioned in the first condition had been at least two years at the time of the officer’s death, unless the police authority exercise discretion to pay a pension to a nominated partner in a shorter relationship. 2.2 For these purposes, the ‘relevant police authority’ means the authority for the force in which the member is serving at the time of his or her declaration, or the authority which pays his or her pension if he or she has retired (or would pay a deferred pension). 3. Nomination of a partner on a declaration form 3.1 A declaration form is at Annex A to this guidance. The form is also provided at the end of the leaflet for members on unmarried partner pensions (Pensions for partners - a guide). There must be a valid declaration signed by both the member and the nominated partner. If no valid declaration has been made, a pension will not be paid – regardless of any subsequent claim. 3.2 The declaration may be made while the officer is serving or after he or she has retired, providing the officer retired with a pension (including a deferred pension) provided under NPPS. A serving officer must have at least two years’ qualifying service in NPPS in order for a surviving partner to receive a pension, but there is nothing to prevent an officer from making a declaration if he or she has less service. Note that ‘qualifying service’ is not the same as pensionable service. Qualifying service is normally the calendar length of police service, plus any previous service or employment which the officer transferred into NPPS. Half time service for a year in a police force, for example, would count as one year towards qualifying service (but could only count as a maximum of half a year’s pensionable service). 3.3 On receipt of a declaration form, or a revocation, you must acknowledge it in writing to the NPPS member. 3.4 A declaration nominating a partner should normally be accepted as it stands, subject to the comments in paragraphs 3.6 and 3.7 below. The member and the partner are required to confirm that their relationship meets the conditions at the time the declaration is made, but as explained above any surviving partner is not entitled to a pension unless and until they have made a valid claim after the death of the member. There is little point in making detailed checks or further enquiries at the declaration stage - the relationship could change or end. At this stage, you should only need to check that: the officer is a member of NPPS (subject to the transitional arrangements described in Section 1); the nomination is properly completed and signed by the member, the nominated partner and the witness; there is no apparent reason to suggest that the nomination is invalid. 3.5 Note that the witness to the declaration is asked only to declare that he or she has witnessed the signatures by the member and the partner; the witness is not asked to confirm that what is said in the declaration is true. Note also that the requirement on the form for a signature by a witness is not a requirement of the Regulations and that the absence of such a signature does not render it invalid. If you receive a declaration which has not been signed by a witness, you should retain it and send a fresh declaration to the member and ask him or her to resubmit it with the witness section completed (it will have to be re-submitted since the witness is asked to witness the actual signatures). However, if a member were to die before re-submitting a witnessed declaration then the surviving partner would still be able to submit a claim providing the original declaration is otherwise in order. 3.6 There may be cases where a nomination needs to be questioned at the time it is made: for example, where you have information to suggest that the member is married or in a civil partnership (and there is no evidence of divorce or dissolution of the partnership), or you aware of some other reason why the officer and the nominated partner would not be free to marry or form a civil partnership with each other, or where the officer has made a previous nomination which has not been cancelled. 3.7 One other point in respect of the declaration form that may need to be questioned relates to cohabitation. As explained in Section 4 which follows, the NPPS member and the nominated partner must be cohabiting. If the member and the partner have given different addresses on the declaration form then this is, on the face of it, in contradiction to the declaration given elsewhere on the form that the member and the partner have been living together. In these circumstances you should raise the point with the member. The fact of different addresses need not necessarily mean that the declaration should not be accepted – one or other of the addresses may be temporary, for example. Members are encouraged to complete a declaration form to nominate their partner as soon as they consider that their relationship is exclusive, committed and long-term and they might be temporarily living apart or still be looking for accommodation together. 3.8 The declaration form should become part of the member’s pension record and should follow him or her (either in the original paper form or in an electronically scanned version of the original form) on transfer to another force. It is the responsibility of the pensions administrator to ensure that the declaration is maintained as part of the officer’s record throughout his or her service. It is the member’s responsibility to ensure that the information in the declaration (e.g. addresses) is kept up to date. If the relationship comes to an end, the member must tell the police authority in writing. On receipt of such notification you should cancel the declaration and inform the member that this has been done. 3.9 Where an officer rejoins after an interval, you should check whether there is an extant declaration and whether the officer wishes for it to remain in effect. 4. Claim by surviving partner 4.1 When a member dies, and there is a nominated partner, you should contact the partner to invite him or her to submit a claim. This is not a requirement of the Regulations, which simply require the surviving partner to submit a claim, but it is good practice. The surviving partner is unlikely to have a claim form (these are not included in the leaflet for members) and may not know where to submit a claim. A suggested covering letter is attached at Annex B to this guidance. This is a suggested form of words only and you may wish to adapt it to comply with your own force’s house style. A model claim form is attached at Annex C. You should also enclose a copy of the leaflet Pensions for partners: a guide. This is aimed primarily at members, at the time they complete the declaration, but the information which it contains will be helpful for surviving partners as well. 4.2 If and when the partner makes a claim, you will first need to confirm that there is a valid declaration, which had not been revoked by the member by the date of his or her death, naming the partner who has submitted the claim. You will need to be satisfied that the person submitting the claim is the person named in the declaration. You will then need to check that the member satisfied the relevant conditions at the date of his or her death – i.e. that: if the member was a serving officer at the date of death, he or she had at least two years’ qualifying service in NPPS; if the member had left the service, he or she had retired with a pension provided under NPPS or left with entitlement to a deferred pension payable under NPPS. 4.3 If the conditions described in paragraph 4.2 are not met, then the claim fails at this stage. The person submitting the claim should be informed that the claim has not been successful and the reason why. 4.4 If the conditions described in paragraph 4.2 are met, then you will need to be satisfied that the relationship between the member and the partner satisfied the qualifying conditions at the time of the member’s death. You should not pry unnecessarily into the partner’s personal life with the deceased member, or try to ‘disprove’ the partner’s eligibility for a pension. You must, however, be satisfied that the relationship satisfies the conditions specified in the Regulations. 4.5 The various conditions are considered in the paragraphs which follow. They are, to a large extent, interdependent and should not be considered in isolation. If the partner can demonstrate, for example, that he or she was financially dependent upon the member and had lived with him or her for several years then it would follow that their relationship is likely to have been committed and long-term. Similarly, evidence of financial interdependence – such as a joint mortgage or tenancy – is evidence that the relationship is likely to have been committed and long-term. As a general rule, you should look at the relationship between the member and the partner as a whole, with the various factors contributing to give an overall picture. Cohabitating 4.6 Regulation 40(2) of the 2006 Regulations specifically requires that the NPPS member and the nominated partner must be cohabiting and that the period of cohabitation must have been of at least of two years’ duration at the time of the officer’s death. Under regulation 40(3), the police authority has discretion to accept a shorter period of cohabitation, provided they are satisfied, in the particular circumstances of the case, that it is likely that the officer and his or her partner would have cohabited as partners for at least two years had the officer not died. 4.7 It follows that, in order to allow the claim, you must have evidence that the NPPS member and the nominated partner were living together. The addresses given on the claim form for the member and the partner should normally be the same as each other (as should the addresses given in the original declaration, subject to the comment in paragraph 3.7). However, the fact that the member and the partner may have been living apart at the time of the member’s death does not necessarily mean that they were no longer in a long-term relationship. It may be, for example, that one or other was obliged by circumstances to live away from home, e.g. in residential nursing care. 4.8 4.9 The circumstances in which you might accept a period of cohabitation of less than two years could include the following: where the partner is able to demonstrate the relationship was exclusive, long-term and committed, but where practical circumstances prevented the member and the partner from living together at the time of the member’s death (e.g. the member and the partner had been cohabiting, had to leave their joint home and had been looking to buy a new property together but the member had died before they were able to do so); where either the member or the partner had been in residential care or in a long-term stay hospital for some or all of the two years leading up to the date of the member’s death; where the relationship is of less than two-years’ standing, but otherwise meets the requirements. Even if a couple had been cohabiting for at least two years, you should still consider separately whether the relationship was, or was likely to have been, a long-term one (as well as meeting all the other requirements): see paragraphs 4.14 – 4.17. In practice the presumption would probably be that a relationship that met the requirement for cohabitation of at least two years was likely to be long-term one unless there was clear evidence to the contrary. Exclusive 4.10 The NPPS can provide a pension for an unmarried partner only if the relationship was exclusive. That is, the partner did not have a similar relationship with anyone else. This is difficult for the partner to establish in any direct way. It is recommended that you rely on the declaration by the partner in the claim that his or her relationship with the member was exclusive unless you have specific information to suggest otherwise (for example if you are aware that the partner was living with someone else at the time of the member’s death), in which case further enquiries might be appropriate. 4.11 The requirement for the relationship to have been exclusive is not necessarily invalidated by a separate, short-term relationship with someone else. The requirement is not intended to impose upon the police authority an obligation to investigate the fidelity of the partners in the relationship. An example of where the requirement of exclusivity would not be met would be where a person lived part of the week with one partner and the remainder of the week with another partner. In such a case neither relationship would have the necessary exclusivity. However, where a partner engaged in what in the context of a marriage would be regarded as an ‘affair’, this should not, in itself, be regarded as sufficient to mean that the requirement of exclusivity was not satisfied. 4.12 You should accordingly guard against giving too much weight to any suggestion of such a separate short-term relationship which you might receive, e.g. in the form of a letter from an aggrieved person alleging that the relationship with the nominated partner was not exclusive. The main consideration is that the relationship with the nominated partner was exclusive for the majority of the period between the date of the declaration and the member’s death and that there is no evidence of a new long-term committed relationship involving financial dependency or inter-dependence. You should rely primarily on the declaration and the claim to establish that this was so. Committed 4.13 Being ‘committed’, so far as a relationship is concerned, is not necessarily the same as being exclusive and long-term, but as mentioned above the factors cannot be considered in isolation. A relationship that is both exclusive and long-term, for example, is more likely to be committed than one which is either not exclusive or short term. Conversely, a committed relationship is likely to be both exclusive and long-term. Commitment can be demonstrated by such factors as children brought up together, long-term cohabitation, a joint mortgage or wills naming each other as the main beneficiary. Long-term 4.14 As mentioned previously, regulation 40(2) requires that the surviving partner must satisfy the police authority that the period during which the member and partner were cohabiting as partners in an exclusive, committed and long-term relationship had been of at least two years’ duration at the time of the member’s death. You may exercise discretion to pay a pension to a nominated partner in a shorter cohabiting relationship, provided you are satisfied that it is likely that the officer and his or her partner would have cohabited as partners for at least two years had the officer not died and that the requirements for the relationship to have been exclusive, committed and long-term are otherwise met. 4.15 The guidance for members on pensions for partners advises that, as long as they consider that their relationship is permanent, members should not let the fact that they and their partner had been together for less than two years stop them from filling in a declaration form. It follows that there will be some cases where the member dies after such a declaration has been made but before the relationship has lasted for two years. The essential point is that the relationship must have been committed and intended to be long-term at the time the member died. For a relationship to qualify as long-term, it should have the quality of one that seemed likely to have lasted for the foreseeable future. 4.16 In these circumstances, you must make a judgement as to whether the relationship would have continued indefinitely had it not been for the member’s death. Factors to take into account will be the information given in the partner’s claim form and whether the death was sudden and unexpected or likely to have been foreseen. There must be no clear evidence that the relationship was likely to have ended soon. 4.17 Note that, for unmarried partners, there is no equivalent of regulation 41(6) of the 2006 Regulations. This provides that the police authority may withhold a pension from a surviving spouse or civil partner if the marriage took place or the civil partnership was formed within the six months preceding the member’s death. Such a provision is not necessary in the case of unmarried partners, in that the authority in effect has discretion to withhold a pension from a surviving unmarried partner if the period of cohabitation was of less than two years or if the relationship was not long-term. Financially dependent or financially interdependent 4.18 The requirement for the partner to be financially dependent on the member, or for them to be financially interdependent, derives from HM Revenue and Custom’s rules governing occupational pension schemes. A partner is financially dependent on the member if the member provided most or all of the income on which the two lived and the partner’s own income, if any, is insufficient for him or her to maintain the same or a similar standard of living as when the partner and the member lived together. ‘Financially interdependent’ means that the member and the partner both contributed to their joint living expenses and relied on their joint finances to support their standard of living. It is not necessary that they both were contributing equally. The member, for example, might have had a higher income and might have paid the mortgage and most of the bills whereas the partner paid for the weekly shopping (or viceversa). 4.19 Evidence of financial dependence or interdependence can include confirmation of shared household spending, the member’s death leading to extra living expenses for the partner or any of the factors listed in paragraph 5.2. ‘Free to marry’ and ‘free to form a civil partnership’ 4.20 At the time of the member’s death, the member and partner must have been either free to marry each other (if they are of the opposite sex) or free to form a civil partnership with each other (if they are of the same sex). This is a matter of fact. Neither the member nor the partner can have been married to or have formed a civil partnership with anyone else at the time of the member’s death. They must not have been related to each other in a way that prevents marriage or civil partnership. Annex D to this guidance sets out a list of relationships which prevent marriage in England and Wales. Annex E sets out a similar list for civil partnership. The member and the partner must not have been in any of these relationships to each other at the time of the member’s death. 4.21 If the member was married or had a civil partner at the time he or she died, NPPS will pay a pension to his or her surviving wife, husband or civil partner, regardless of whether they were still living together. An unmarried partner cannot claim a pension if a marriage or civil partnership was still in effect at the time of the member’s death, regardless of separation or the fact of no longer living together. Divorce or dissolution of a civil partnership must have taken place in order for the member to enter into an unmarried partnership for the purpose of a survivor’s pension. New information 4.22 If new information comes to light, following the award of a pension to a surviving unmarried partner, that demonstrates conclusively that the conditions set out in paragraph 2.1 were not met (e.g. if it is shown conclusively that the member or partner was married at the time of the member’s death or had a committed long-term relationship with another partner), then the pension should be withdrawn. 5. Documentation 5.1 Where the answer to a question on the claim form can be demonstrated or supported by documentary evidence, then the partner should be asked to provide the documentation in question. Certified photocopies are acceptable1. To establish his or her identity, for example, the partner is asked to provide a copy of either his or her birth certificate or some other document (such as a passport or driving licence) which shows date of birth. Similarly, if the partner states in the claim form that he or she and the member brought up children together, then the partner would be expected to provide copies of the children’s birth certificates. 5.2 The claim form invites the partner to state whether he or she and the partner had any of the following, in order to demonstrate financial dependency or interdependency: a joint mortgage or tenancy a joint bank account joint savings accounts or investments a joint credit arrangement being the beneficiary of a will being the beneficiary of life assurance. 5.3 Where the partner indicates that any of these apply, then he or she must provide a document as evidence. Certified photocopies are acceptable. Any of these factors will provide strong supporting evidence not only of financial dependency or interdependency, but also by implication of an exclusive, committed and long-term relationship. But a claim would not necessarily fail if the partner was unable to demonstrate by documentary evidence that any of the above listed factors apply. There is no single document, or set of documents, which will demonstrate conclusively that the conditions are met. Conversely, there is no single document or set of documents which will mean that the claim fails if the partner is unable to provide them. You must be flexible in considering a claim and consider the information and evidence provided by the partner as a whole. 6. Follow-up enquiries and deciding the claim 1 ‘Certified’ in this context means that the copy has written on it or with it a statement by someone other than the partner that it is a true copy of the original. This can be done by the witness who completes Part 5 of the claim form or by some other person. 6.1 When you receive the partner’s claim and the supporting documentation, you will decide whether the evidence presented demonstrates that the conditions specified in the Regulations and described in Sections 3 and 4 are met. There will be one of three outcomes: the conditions are met and the claim is allowed; the conditions are not met and the claim is disallowed; the partner has not fully demonstrated that the conditions are met and more information is required. 6.2 Where the claim is allowed, you should inform the partner in writing and make the necessary arrangements to pay the pension. Where the claim is not allowed, you should inform the partner in writing and give the reasons, explaining which of the conditions have not been met. 6.3 There may be cases where the partner has not been able to demonstrate fully that the conditions are met, but where the information provided suggests that the claim could be proved to be valid if more information or documentation could be provided (i.e. there is nothing in the claim or in the information already held about the member which suggests conclusively that any of the conditions are not met). In these circumstances you should write back to the partner asking for more information. You should specify precisely what information or documentation you require and why. Once the partner replies, you should decide the claim in the light of any additional information provided. A further round of enquiries with the partner should not normally be necessary. 7. Appeals 7.1 If the partner thinks he or she has been turned down without a good reason, he or she may try to resolve the issue using the police authority’s internal resolution procedures. He or she can also appeal to the Crown Court. 8. Benefits payable on death 8.1 The pension payable to a surviving nominated partner is payable for life and is the same as that payable under NPPS to any other adult survivor, namely: if the member dies in service while a member of NPPS, 50% of the ill-health pension that he or she would have received if he or she had been permanently disabled for regular employment at the time of his or her death; if the member dies while receiving a NPPS pension, or after having left the service with an entitlement to receive a deferred pension (or having opted out of NPPS with entitlement to a deferred pension but die in services), a pension of 50% of the member’s pension entitlement at the date of his or her death. 8.2 As with spouses and civil partners, if the nominated partner is more than 12 years younger than the member, the partner’s pension is reduced by 2.5% for every year or part of a year over 12 years, up to a maximum reduction of 50%. 8.3 For more detailed information about the calculation of adult survivors’ pensions, with examples, you may wish to refer to the NPPS Members’ Guide or the Commentary on the 2006 Regulations when it becomes available early in 2007. Lump sum death grant 8.4 In NPPS, the lump sum death grant (of three times the annual pensionable pay at the time of death) is payable as follows: to the member’s surviving spouse or civil partner, if there is one; if there is no surviving spouse or civil partner, and at the discretion of the police authority, to a surviving nominated partner (providing there is a valid declaration and the partner has submitted a claim for an unmarried partner’s pension which the police authority has accepted); if there is no spouse, surviving civil partner or surviving nominated partner, and again at the discretion of the police authority, to a person nominated by the member; otherwise, at the police authority’s discretion, to the member’s personal representative - usually the executor of their will. 8.5 The nomination of an unmarried partner to receive an adult survivor’s pension thus has the effect that the partner would receive a lump sum death grant, at the police authority’s discretion, if the member were to die while in service and the partner has submitted a claim for an unmarried partner’s pension which has been accepted. 8.6 The reason for the authority’s discretion, in the case of a lump sum paid to an unmarried partner, some other nominated person or the member’s personal representative (i.e. in the case of the last three bullet points in paragraph 8.4. above) relates solely to the question of inheritance tax, which would not be payable by a spouse. The expectation is that if an unmarried partner has submitted a claim, and the police authority has accepted it, then you would pay the lump sum death grant to that partner in addition to an adult survivor’s pension. 8.7 The payment of a lump sum death grant to a surviving unmarried partner extends to an unmarried partner of a deceased member of PPS who has been granted a pension under the transitional arrangements described in Section 1. This is subject to the proviso described in paragraph 1.5. Annex A to guidance for pensions administrators: declaration form By completing this declaration form you nominate your partner to receive an adult partner’s pension payable under the Police Pensions Regulations 2006, subject to the submission of a valid claim in the event of your death. This declaration alone does not give your partner entitlement to a pension. If you were to die, the police authority would need to be satisfied that your relationship with your partner met the qualifying conditions for the payment of a pension at the time of your death. Please read this leaflet for more information. If you are a member of the Police Pension Scheme 1987, then if you do not opt to join the New Police Pension Scheme 2006 this declaration will lapse on 31 January 2007 or on the date you opt to remain in the current scheme, if that is earlier. Please fill in this form in black ink and in BLOCK CAPITALS, and send it to your force’s pensions administrator, acting on behalf of the police authority, at the address shown below. They will acknowledge that they have received the form by returning a copy of it to you. Please return the completed form to: PART 1. ABOUT YOU (THE SCHEME MEMBER) Your name Pay reference Address (it is your responsibility to tell your pensions administrator if you subsequently change address) Postcode Daytime telephone number PART 2. ABOUT YOUR PARTNER Partner’s full name including title Partner’s date of birth Partner’s address (this should normally be the same as the address of the NPPS member) Postcode Now turn over PART 3. DECLARATION We confirm the following. We have lived together for ….. years, during which time our financial affairs have been interdependent (or the partner has been financially dependent on the NPPS member). We have an exclusive, committed and long-term relationship with each other and we intend to continue this indefinitely. We are not married to each other and we have not formed a civil partnership with each other We are not related in a way that will prevent marriage or civil partnership Neither of us is married to anyone else. Neither of us has formed a civil partnership with anyone else Neither of us is currently nominated as the unmarried partner of anyone else. We will tell the scheme administrator in writing if our relationship comes to an end. We understand that benefits will not be paid unless the partner provides satisfactory evidence that the declaration above is valid when the NPPS member dies. NPPS member’s signature (signed in the presence of the witness named below) Date Partner’s signature(signed in the presence of the witness named below) Date PART 4. WITNESS (NOTE: THE WITNESS IS SIMPLY REQUIRED TO WITNESS THE SIGNING OF THE FORM BY THE SCHEME MEMBER AND PARTNER IN PART 3 ABOVE) Name of witness Address of witness Postcode Signature of witness Date FOR POLICE AUTHORITY USE The nomination has been recorded. Your name Telephone Official address Signature Date Annex B to guidance for pensions administrators: suggested covering letter to send to surviving partner POLICE PENSION SCHEME: PARTNER’S PENSION We were sorry to hear of the death of [ sympathy. ] and I am writing to express our As you will know, [ ] nominated you to receive a partner’s pension. I enclose a copy of the declaration which you and [ ] made. As you will see, the declaration explains that, after the death of the scheme member, we ask the person nominated for information to enable us to decide if the qualifying conditions for the payment of a partner’s pension are met. The enclosed leaflet Pensions for partners: a guide explains what these qualifying conditions are. I do understand that official procedures are unwelcome at this time but we want to make sure that you receive the benefits to which you are entitled. To help us with this, I would be grateful if you would complete the enclosed claim form and return it to me with any appropriate supporting documents. All supporting documents will be treated in the strictest confidence and will be returned to you as soon as possible. Completion of the form will help us to build up a whole picture of your circumstances and it would be helpful if you could provide us with as much of the information requested as possible. Once we receive your completed claim form and have all the information we need, we will let you know our decision as quickly as possible. If you have any problems in completing the form, or if there is any further information that you require, please contact me as soon as you can. Annex C to guidance for pensions administrators: partner’s claim form This is a claim for a partner’s pension under the Police Pensions Regulations 2006. Please complete it in black ink and in BLOCK CAPITALS, and return it to the address given below, with any appropriate supporting documents. You must provide with this form a copy of either (a) your birth certificate or (b) your passport or (c) a current driving licence. The copy must be certified as a true copy: that is, you must ask someone to state on or with the form that is a true copy of the original and to sign and date this statement. You may ask witness who completes Part 5 of this form to do this if you wish, or ask someone else. You must also provide a copy of any document requested in the form, if appropriate. Any copy must be certified as a true copy (see note above). Please return the completed form to: PART 1. ABOUT YOU Name Any previous name by which you have been known Date of birth National Insurance Number Address Postcode Daytime telephone number Most recent previous address and date you lived there From Yes/No Have you or your partner ever been married? If yes, please provide a copy of the decree absolute, or death certificate, to show that the marriage had ended by the date of your partner’s death Have you or your partner ever been a civil Yes/No partner? If yes, please provide a copy of the final dissolution order or death certificate, to show that the partnership had ended by the date of your partner’s death To PART 2. ABOUT YOU AND YOUR PARTNER How long had you and your partner lived together? Were you living together at the time of your partner’s death? If no, please explain why you were living apart Where were you living at the time of your partner’s death? (if this was different from your current address given in Part 1) Yes/No Did you spend any long periods (over six months) apart (other than, for example, stays in hospital)? If yes, please give details of the circumstances and dates Yes/No Were you and your partner responsible for bringing up any children together? If yes, please give the names and dates of birth of the children and provide copies of their birth certificates Yes/No 1st child’s name 1st child’s date of birth 2nd child’s name 2nd child’s date of birth 3rd child’s name 3rd child’s date of birth Did you and your partner have the Power of Attorney in respect of each other? (if yes, please provide a copy of a document to support this) Please give any other information about your relationship with your partner which might be relevant to your claim (continue on a separate sheet if necessary) PART 3. ABOUT YOU AND YOUR PARTNER’S FINANCIAL CIRCUMSTANCES Please indicate whether you and your partner had any of the following joint financial arrangements. If you indicate ‘yes’, you must provide a copy of a document to confirm this Joint mortgage or tenancy Yes/No Joint bank account Yes/No Joint savings accounts or investments; Yes/No A joint credit arrangement Yes/No Being the beneficiary of your partner’s will, or your partner being the beneficiary of your will Being the beneficiary of your partner’s life assurance, or your partner being the beneficiary of your life assurance Yes/No Yes/No Did you and your partner share any other joint financial commitment not shown in the above list? If so, please say what it was and provide a copy of a document to confirm it Please give any other information about you and your partner’s financial arrangements that would support your claim. For example, whether you shared day-to-day living expenses and whether you are experiencing additional expense following your partner’s death (continue on a separate sheet if necessary) PART 4. DECLARATION I confirm that the following applied at the time of my partner’s death: My partner and I had lived together for the length of time stated in Part 2 of this form, during which time our financial affairs were interdependent (or I was financially dependent my partner). We had an exclusive, committed and long-term relationship with each other and we intended to continue this indefinitely. We were not married to each other and we had not formed a civil partnership with each other We were not related in a way that would have prevented marriage or civil partnership Neither of us was married to anyone else. Neither of us had formed a civil partnership with anyone else Neither of us was nominated as the unmarried partner of anyone else. Signature (signed in the presence of the witness named below) Date PART 5. WITNESS (NOTE: THE WITNESS IS SIMPLY REQUIRED TO WITNESS THE SIGNING OF THE FORM IN PART 4 ABOVE) Name of witness Address of witness Postcode Signature of witness Date Annex D to guidance for pensions administrators: guide to relationships that are not allowed to marry in England and Wales Note: This list is based on the statutory list in the Marriage Act 1949 (section 1, schedule 1) and applies to England and Wales. Slightly different restrictions apply in Scotland and Northern Ireland. The statutory list may change, so the following list is only a guide. PART 1 A man may not marry his: mother, adoptive mother or former adoptive mother; daughter, adoptive daughter or former adoptive daughter; grandmother; granddaughter; sister; aunt; or niece. PART 1 A woman may not marry her: father, adoptive father or former adoptive father; son, adoptive son or former adoptive son; grandfather; grandson; brother; uncle; or nephew. Part 2 A man may not marry any of the following female relations unless: both he and the woman have reached 21; and the younger person has never been treated as a child of the family of the older person before age 18. the daughter of an ex-wife the ex-wife of their father the ex-wife of a grandfather the granddaughter of an ex-wife Part 2 A woman may not marry any of the following male relations unless: both she and the man have reached 21; and the younger person has never been treated as a child of the family of the older person before age 18. the son of an ex-husband the ex-husband of their mother the ex-husband of a grandmother the grandson of an ex-husband Part 3 A man cannot marry: the mother of his ex-wife unless both the ex-wife and the ex-wife’s father are dead; or the ex-wife of his son unless both the son and the son’s mother are dead. Part 3 A woman cannot marry: the father of her ex-husband unless both the ex-husband and the ex-husband’s mother are dead; or the ex-husband of her daughter unless both the daughter and the daughter’s father are dead. In either case, both people must be 21 or over. In either case, both people must be 21 or over. Annex E to guidance for pensions administrators: guide to relationships that are not allowed to form civil partnerships in England and Wales Note: This list is based on the statutory list in Part 1 of Schedule 1 to the Civil Partnership Act 2004 and applies to England and Wales. Slightly different restrictions apply in Scotland and Northern Ireland. The statutory list may change, so the following list is only a guide. PART 1 PART 1 A man may not form a civil partnership A woman may not form a civil with: partnership with: father, adoptive father or former mother, adoptive mother or former adoptive father; adoptive mother; son, adoptive son or former daughter, adoptive daughter or adoptive son; former adoptive daughter; grandfather; grandmother; grandson; granddaughter; brother or half-brother; sister or half-sister; parent’s brother or half-brother; or parent’s sister or half-sister; or son of a brother, half-brother, sister daughter of a brother, half-brother, or half-sister. sister or half-sister . Part 2 A man may not form a civil partnership with any of the following relations unless: both have reached 21; and the younger has never been treated as a child of the family of the older person before age 18. the son or grandson of a former wife or civil partner the former husband or civil partner of a parent or grandparent Part 3 A man cannot form a civil partnership with: the former spouse or civil partner of a child unless both the child and the child’s other parent are dead; or the father of a former civil partner unless both the former civil partner and the former civil partner’s mother are dead. Part 2 A woman may not form a civil partnership with any of the following relations unless: both have reached 21; and the younger has never been treated as a child of the family of the older person before age 18. the daughter or granddaughter of a former husband or civil partner the former wife or civil partner of a parent or grandparent Part 3 A woman cannot form a civil partnership with: the former spouse or civil partner of a child unless both the child and the child’s other parent are dead; or the mother of a former civil partner unless both the former civil partner and the former civil partner’s father are dead. In either case, both people must be 21 or over. In either case, both people must be 21 or over.