VML`s top budget priorities

advertisement

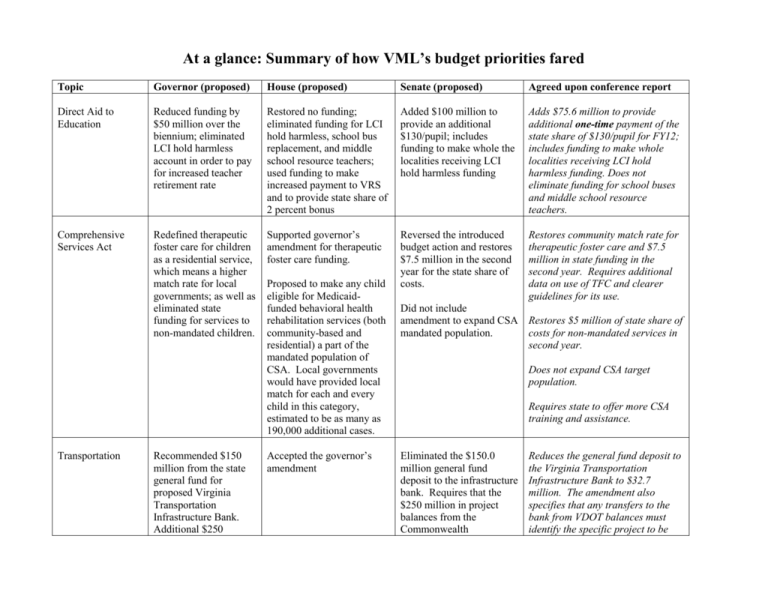

At a glance: Summary of how VML’s budget priorities fared Topic Governor (proposed) House (proposed) Senate (proposed) Agreed upon conference report Direct Aid to Education Reduced funding by $50 million over the biennium; eliminated LCI hold harmless account in order to pay for increased teacher retirement rate Restored no funding; eliminated funding for LCI hold harmless, school bus replacement, and middle school resource teachers; used funding to make increased payment to VRS and to provide state share of 2 percent bonus Added $100 million to provide an additional $130/pupil; includes funding to make whole the localities receiving LCI hold harmless funding Adds $75.6 million to provide additional one-time payment of the state share of $130/pupil for FY12; includes funding to make whole localities receiving LCI hold harmless funding. Does not eliminate funding for school buses and middle school resource teachers. Comprehensive Services Act Redefined therapeutic foster care for children as a residential service, which means a higher match rate for local governments; as well as eliminated state funding for services to non-mandated children. Supported governor’s amendment for therapeutic foster care funding. Reversed the introduced budget action and restores $7.5 million in the second year for the state share of costs. Restores community match rate for therapeutic foster care and $7.5 million in state funding in the second year. Requires additional data on use of TFC and clearer guidelines for its use. Transportation Recommended $150 million from the state general fund for proposed Virginia Transportation Infrastructure Bank. Additional $250 Proposed to make any child eligible for Medicaidfunded behavioral health rehabilitation services (both community-based and residential) a part of the mandated population of CSA. Local governments would have provided local match for each and every child in this category, estimated to be as many as 190,000 additional cases. Accepted the governor’s amendment Did not include amendment to expand CSA Restores $5 million of state share of mandated population. costs for non-mandated services in second year. Does not expand CSA target population. Requires state to offer more CSA training and assistance. Eliminated the $150.0 million general fund deposit to the infrastructure bank. Requires that the $250 million in project balances from the Commonwealth Reduces the general fund deposit to the Virginia Transportation Infrastructure Bank to $32.7 million. The amendment also specifies that any transfers to the bank from VDOT balances must identify the specific project to be million from VDOT balances used to supplement GF, bringing the total for the bank to $400 million. Transportation Fund be certified before deposit to the infrastructure bank. funded as well as the corresponding fund source. VRS Required Contribution for Local Employees New local employees required to pay; option for localities to require Plan 1 employees to pay 5% member contribution (3% salary increase) Accepted governor’s amendment except requiring 5 percent salary increase Rejected governor’s amendment Rejects governor’s amendment. VRS Teacher Contribution Rate 7.16 percent 5.16 percent 6.33 percent 6.33 percent State assistance to local law enforcement (HB 599) No reductions or restorations of earlier cuts for HB 599 funding; at the same time, made partial restoration of earlier reductions in state assistance to sheriffs’ offices in FY12. No amendment. Provided $18.7 million in FY12 to bring HB 599 to the same total level of funding as for FY11. Budget language provided the same allocation in FY12 as it receives this fiscal year. Provides $12.4 million in FY12. Budget language requires that all HB 599 localities receive the same percentage reduction in their FY12 allocations when compared to their FY11 allocations. Water Quality Improvement Fund agricultural and urban runoff (nonpoint) in FY11 Added $32.8 million to WQIF for non-point pollution source reduction. $14 million to be used specifically for agricultural runoff. $18.8 million would have been used for the same purpose, although $5 million was expected to be directed toward urban runoff. Reallocated the $32.8 million surplus revenue by depositing $4.9 million in the WQIF reserve and $22.9 million for agricultural runoff. A portion of the remaining $5 million was expected to be available for reducing urban runoff pollutants. Reallocated the $32.8 million with $27.8 million for reducing agricultural runoff and a portion of the remaining $5 million available for reducing urban runoff pollutants. Reallocates the $32.8 million with $27.8 million for reducing agricultural runoff. The remaining portion is deposited in the WQIF reserve and no money is made available for reducing urban runoff pollutants. Water Quality Improvement Fund sewage treatment (point source) Added $3.644 million Deposited $547,645 of the in FY11 to the WQIF to $3.644 million into the reimburse localities for WQIF reserve. sewage treatment plant upgrades. Authorized up to $3 million of the $3.644 million to fund a study of the James River on water quality standards. Authorized an additional $107.8 million in bonds for FY12 to reimburse localities for sewage treatment plant upgrades. Authorizes up to $3 million from the WQIF to fund a study of the James River on water quality standards. Also deposits $546,645 of the $3.644 million into the WQIF reserve. This means that less than $100,000 in additional funds will be available to reimburse localities for sewage treatment plant upgrades. Line of Duty Act No amendment Allowed localities to establish alternative programs to fund LODA benefits; required localities to pay only for benefits given as of 7/1/2010, allowed local governing body to determine eligibility. Delayed optout to 2013. Delays the deadline for localities to opt out of the statewide Line of Duty program from 7/1/2011 to 7/1/2012 Delayed the deadline for localities to opt out of the statewide Line of Duty program from 7/1/2011 to 7/1/2012