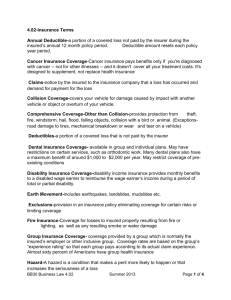

A. Overview Of Automobile Compensation System

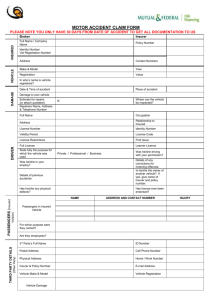

advertisement