Minerals Council of Australia

advertisement

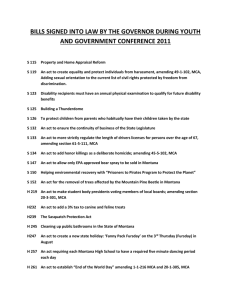

MINERALS COUNCIL OF AUSTRALIAN SUBMISSION REVIEW OF THE ROLES AND FUNCTIONS OF NATIVE TITLE ORGANISATIONS DISCUSSION PAPER 1 1. Introduction The Minerals Council of Australia (MCA) is the peak industry association representing exploration, mining and minerals processing companies in Australia. MCA members account for more than 85% of annual minerals production in Australia and a slightly higher proportion of mineral exports. Members of the MCA recognise that industry’s engagement with Indigenous peoples needs to be founded in mutual respect and in the recognition of Indigenous Australian’s rights in law, interests and special connections to land and waters. This point is made even more acute by the fact that more than 60% of minerals operations in Australia have neighbouring Indigenous communities. The minerals industry is committed to working with Indigenous communities within a framework of mutual benefit, which respects Indigenous rights and interest. The MCA welcomes changes that improve the efficiency and operability of the Native Title system without diminishing the rights of Indigenous Australians. We support approaches that encourage negotiation and mediation in determining agreed outcomes with traditional custodians, in addition to promoting fair, transparent and timely decisions that do not impose unnecessary costs on those involved. In recent years, the MCA has advocated collaboratively with the National Native Title Council (NNTC) for a review of the functions of native title organisations given: the need for adequate resourcing of those bodies to be able to undertake their native title responsibilities; lack of clarity of roles particularly in a post determination native title context; increasing numbers of bodies providing native title expert advice; and, concerns that the standards of practice required of Government funded native title organisations are not applicable to all bodies providing expert advice in the sector. MCA welcomes the Review which will examine whether the statutory roles and functions of Native Title Representative Bodies (NTRBs)/Native Title Service Providers (NTSPs) continue to meet the evolving needs of the system, particularly the needs of native title holders after claims have been determined and agreement beneficiaries . However the MCA is also very aware that some of these issues, particularly those relating to rogue operators are being addressed in other reviews being conducted by other Government Departments. The Minerals Council strongly recommends that the relevant recommended strategies are aligned across the reviews in order to minimise the potential for conflict or duplication. The following comments are provided in response to a discussion paper prepared by Deloitte Access Economics in June 2013. 2.0 Native title representative bodies and native title service providers 2.1 Roles and functions of native title representative bodies and native title service providers The paper identifies that currently each NTRB/NTSP is funded by FaHCSIA to deliver native title services to a specific region. The original role of NTRBs/NTSPs was on assisting native title holders to achieve recognition of their native title through the claims process. However over the past few years there has been an increasing focus of activity on: assisting to negotiate future act agreements and ILUAs; and, assisting, entities, including PBCs, to implement the opportunities that flow from future act agreements and ILUAs. 2 It also identifies that there remains a considerable volume of claims to process for some years, and that in addition there is likely to be future demand for assistance with compensation claims once judicial precedents have been established. The MCA is of the view that NTRBs/NTSPs are currently undertaking a range of core and noncore activities of which some should be provided on an exclusive basis and others are provided in an increasingly competitive context. This typology is described in Table A below. Table A: Roles of NTRBs/NTSPs in current environment (combination of pre and post determination environment) Exclusive Nonexclusive Core facilitate the resolution of native title claims in accordance with s203BB(1)(a) assist in establishing PBCs and provide support for first 12 months ensuring that people with a possible native title interest are informed of other claims and of future acts and the time limits for responding other functions conferred by relevant Acts or by and other law e.g. cooperation between NTRBs, consulting with Indigenous communities, and providing education to Indigenous communities on native title matters representation of applicants in native title determination proceedings agreement making (Future Act, ILUAs and heritage etc.) (except in NT where these roles are exclusively provided by Land Councils under ALRA) Noncore provision of ongoing governance support to PBCs where the capacity of PBCs are minimal to generate benefits. (currently not funded) provision of governance training assist in implementing agreements on behalf of PBCs where there is significant capacity to generate benefits to implement agreements; provide agreement implementation monitoring and evaluation services The strengths of NTRB’s/NTSPs are that they provide a valuable regional coordination focus, have strong relationships with the majority of native title holders and claimants, and they are able to achieve efficiencies across the native title claim and agreement making processes. These attributes can provide them with a strong competitive advantage in providing nonexclusive services in an increasingly competitive market. However the operational capacity of NTRBs/NTSPs can be constrained by their ability to recruit and retain relevant expertise required to provide its core services. To be able to offset the costs of purchasing expertise, NTRBs/NTSPs are increasingly focusing on agreement making, which is largely funded by mining companies. Unfortunately there appear to be unintended impacts of this trend: the focus on claim work is being diluted; and, the potential for conflict of interest emerges as the NTRB/NTSP acts as both a representative/advocacy body as well as an advisor, and possibly an implementation service provider. 3 To avoid the potential for confusing stakeholders and conflict of interest, NTRBs/NTSPs should be required to separate their activities into three separate business streams: native title claim work; agreement making; and agreement implementation and manage their resources accordingly. The income generated from the agreement making and implementation streams could still be used to subsidise the native title claim work stream. Keeping these functions as separate business streams will also help to facilitate more transparency for funding entities. As the resolution of native title claims provides certainty for all stakeholders, and helps to minimise the risk of contestability and fractured communities, the MCA strongly promotes the need for claim work being undertaken expeditiously and that NTRBs are both: appropriately funded to perform this function and are held accountable for achieving timely outcomes. There is a risk that managing the future act process results in a diminished focus by NTRBs on resolving native title claims. This risk is supplementary to the disincentive inherent in the Native Title Act which accords traditional owners with the full suite of native title rights in future act negotiations conducted prior to determination. The risk for registered native title claim groups is that there determined native title rights may be less than the rights afforded to them prior to determination of native title. The MCA acknowledges that in some cases, NTRBs will not be able to undertake their core exclusive and nonexclusive responsibilities to effectively represent the interests of all groups in their constituency due to geographical alignments, and/or conflicts of interest. In these unique circumstances these groups should be able to apply to Government for support to fund representation from other reputable expert groups where they are able to establish sufficient cause (including income testing process) and where there is a commitment to establishing a solution that will resolve rather than exacerbate tensions between the parties. In a post determination environment it is the view of the MCA that NTRBs will continue to have a core role in representing the interests of native title holders to facilitate better policy and governance mechanisms that deliver enhanced and sustainable benefit sharing outcomes across their respective regions. They also have a critical role in supporting and educating PBCs, particularly the more vulnerable ones which are unable to purchase expertise to assist them to implement agreements. However where PBCs have the capacity to purchase expertise for negotiating and implementing expertise, NTRBs/NTSPs will be operating in an increasingly competitive environment. 2.2 Agreements 2.21 Agreement making Where PBC’s have significant potential to generate economic and community benefits from their native title holdings it is the view of the MCA that they should be able to purchase the services required from reputable providers in an open market. If NTRBs/NTSPs are competitive in this space, then they may well be the preferred service providers, however it would not be appropriate for NTRBs/NTSPs to hold a monopoly on services as it would restrict access to the expertise required. In these instances it would be preferable for private service providers to work in a collaborative manner with the NTRBs so as not to generate divisiveness. It is highly likely that NTRBs/NTSPs will be the preferred service provider for PBCs that do not have significant potential to generate economic and community benefits from their native title holdings. However NTRBs/NTSPs are currently not funded to provide ongoing governance support to these PBCs to comply with their statutory obligations. The review will need to consider the most effective means of either covering these costs (e.g. potentially transferring funds currently provided to IBA) or consider reducing the statutory reporting requirements for PBCs that have limited activities. 4 The reliance on mining companies to subsidise the funding of agreement negotiation services provided by NTRBs, particularly where native title claims have not yet been decided is deserving of some attention. Some critics suggest that this income flow compromises the integrity of agreement negotiations. Matters worth considering could include: increasing funding provided by government for NTRBs/NTSPs to undertake core responsibilities (including servicing PBCs with little prospect of generating significant social and economic benefits); amending the Native Title Act to allow NTRBs/NTSPs to cost recover for these services; establishing a minimum statutory charge that is payable to NTRBs/NTSPs; and/or requiring transparent revenue reporting of funds received. Such an approach would assist to standardise costs (and revenues) in the system and would also provide additional protection for companies such that payments could not be considered to be in any way influencing the outcomes of the negotiations but instead are simply transactional fees. Any change would need to be subject a mechanism to ensure the costs are reasonable and transparent. Some MCA members have also advocated that the Government should give consideration to establishing the level of compensation payable for impairment or extinguishment of native title rights and interests. Such an approach would provide clarity to all stakeholders about the cost of doing business and would minimise the negotiation requirements and costs substantially. 2.22 Benefits The Indigenous Community Development Corporation (ICDC) entity (See Attachment One) was developed jointly by the MCA and the NNTC and recommended for adoption by a Government Working Party in July 2013. It will address many of the concerns identified in the discussion paper with regard to managing agreement funds. It will enable community and economic development to occur for current and future generations, and the pooling of smaller agreement funds to be more meaningfully invested. Integral to the ICDC is the implementation of a governance structure which requires the appointment of a reputable independent fund manager for agreement monies over a specified threshold. 2.3 Recognition of NTRBs The MCA does not have a strong view on the value of recognition provisions, particularly when NTRBs/NTSPs operate in almost identical regulatory environments and are empowered to undertake identical roles and functions. It is important however that any change to the recognition provisions does not erode existing governance standards and core function requirements. 2.4 Rationalisation of NTRBs/NTSPs The MCA does not have a strong view as to whether NTRBs/NTSPs should be rationalised. However it is essential that adequate provision is given to resourcing their core and exclusive roles, and to ensure the remaining land claims applications are resolved in a timely manner. The review should give also give consideration to whether revenue generating activities are assisting to subsidise the costs of providing core activities or creating unintended impacts of taking the focus away from core activities that don’t generate income. In a post determination environment it may not be possible for all NTRBs/NTSPs to remain viable due to the lack of regional revenue generating activities and because of the complexity of services that will need to be provided and the increasingly diverse skill set required to address them. The determinants of rationalisation should include: maintenance of stability and certainty for all stakeholders, respect for local decision making, service requirements, capacity to purchase required expertise, capacity to meet statutory obligations as well as cost of providing the services. (e.g. it is highly likely that the more marginal NTRBs will be working in regions where 5 PBCs will need extra support due to less potential for revenue generating activity. The cost of providing these services will need to be factored into a rationalisation process.) Most importantly the needs and expectations of the Traditional Owners of the region will need to be managed very respectfully and sensitively in a rationalisation process so as not to create divisiveness or conflict which may impact negatively on future agreement making and implementation outcomes. 3. PBCs/RNTBCs The creation of PBCs prior to, or as soon as practicable after, a determination to represent the interests of native title claimants and manage their native title rights and interests. The MCA has attempted to classify the roles and responsibilities of PBCs/RNTBCs below in Table B. MCA members have identified the need for PBCs to maintain the register of native title holders and make it accessible to native title interest groups. This is essential to facilitate agreement making in the future and to ensure benefits are shared appropriately. This function does not appear to be a regulatory requirement or a function described in the review paper. MCA would recommend it be included and resourced appropriately as a core and exclusive activity in the future. TABLE B: Roles of PBCs/RNTBCs Core Exclusive Nonexclusive Noncore protect and manage determined native title in accordance with the wishes of the broader native title holding group; ensure certainty for governments and other parties with an interest in accessing or regulating native title lands and waters by providing a legal entity through which to conduct business with the native title holders maintaining the register of native title holders and making it accessible to interest groups consulting with NTRBs/NTSPs negotiating future act agreements agreement implementation review and evaluation holding, investing or otherwise applying moneys in trust as directed by the native title holders bringing revised or further native title determination application cases in the FCA 6 consulting with NTRBs/NTSPs on native title related matters establishing separate entities to manage economic/community development outcomes management of community/economic development outcomes. 3.1 PBC/RNTBC capacity There are an increasing number of PBCs/RNTBCs that are utilising opportunities derived from their native title to facilitate community and economic development outcomes. These activities are often associated with higher risk. To protect the core interests PBCs should be required to establish separate entities for commercial activities. In the future the separate entity could include an ICDC (See Attachment 1). The MCA has for a long time been concerned that PBCs have not been funded adequately to undertake their statutory and practical responsibilities (as described in Table B) and NTRBs are not funded sufficiently to provide them with adequate support. To address perceptions about whether the additional funding is necessary, PBCs should be required to disclose the means/resources of the native title holders and their related entities from all sources as part of a means test. Where it is unlikely that PBCs will generate sufficient commercial opportunities to defray administration costs of the PBC, the MCA is of the view that their statutory reporting and compliance requirements should be less onerous. The NTRB in the transitional period could provide advice to PBC/RNTBC members of this option and advise government accordingly. Alternatively another option to consider is an already existing entity could provide the PBC administrative support for traditional owners to undertake their statutory responsibilities. 3.2 Other sources of support As identified earlier the MCA is of the view that NTRBs/NTSPs should exclusively undertake the following roles in supporting PBCs: transitional role in helping recognised native claim holders to establish PBCs which involves provision of legal and governance capacity building assistance (already paid for by government); and, advisory role for PBCs with few opportunities to engage in agreement making of any significance. This role would include keeping them informed of native title act changes, negotiation opportunities and provision of support to maintain governance requirements. This role is currently not funded by government, however funding is currently provided to IBA for this purpose which might be diverted to NTRBs for this purpose. However as argued previously, provision should also be available in extenuating circumstances where the PBC would prefer another service provider to provide these services. The MCA has also identified other nonexclusive support roles the NTRBs/NSTPs could provide (See Table A) including assistance with agreement making and monitoring and evaluations services. However the MCA is more cautious of NTRBs/NTSPs assisting PBC’s/RNTBC’s in post-agreement implementation particularly where they have also provided agreement negotiation assistance due to potential for confusion and perception of conflict of interest, unless these functions are managed as separate business streams. The use of the proposed ICDC entity could keep these functions separate. The skill set required for implementing agreements is arguably different to negotiating agreements and would require NTRBs/NTSPs to diversify substantially. Alternatively NTRBs/NTSPs may be able to engage in joint venture/partnership arrangements with reputable private agents to provide these services as a means of increasing capacity, reducing confusion and conflict of interest risks, and reducing the risk of PBCs being exposed to rogue operator elements (discussed below). Nonexclusive functions can also be provided by private agents, ORIC and Trusts. However the MCA recommends that PBCs require all agents and service providers consult with and work collaboratively with NTRBs/NTSPs (discussed further below). 7 4. Private Agents While NTRBs/NTSPs are currently the main providers of services to native title holders, they are operating in an increasingly contested market in which native title holders are also able to purchase services from nonNTRB/NTSP based professionals and services (private agents). The types of services that may be provided by private agents are described in Table C below. TABLE C: Roles of Private Agents Core Exclusive Noncore no authorised role (except when contracted by NTRBs/PBCs) negotiating future act agreements agreement implementation review and evaluation holding, investing or otherwise applying moneys in trust as directed by the native title holders bringing revised or further native title determination application cases in the FCA Nonexclusive no authorised role (except when contracted by NTRB/PBCs) provision of governance training assist in implementing agreements on behalf of PBCs where there is significant capacity to generate benefits to support future implementation of theseagreements; provide agreement implementation monitoring and evaluation services management of community/economic development outcomes. It is necessary that all potential and recognised claim holders have the capacity to make informed decisions and are aware of their responsibilities to the broader community. However in practice, it can be difficult for a single NTRB to represent the interests of all claim groups in its geographical jurisdiction due to: the NTRB Board membership precluding some claim groups so is not seen as being representative of all relevant interests; a claim group crossing the jurisdictions of a number of NTRBs; incidences of bad previous experience which has eroded trust of some claim groups in working with their NTRBs; and/or the NTRB not having the competencies to provide the required service. In these cases it can be both necessary and beneficial for PBCs and claim groups to pay for the services of private agents to assist in agreement negotiation and implementation processes. Whilst there are a range of private agents that behave with integrity and deliver good outcomes, it is concerning that some agents are reportedly behaving in an exploitative manner with little accountability and there is no clear mechanisms for recourse, despite this being mitigated to some extent where the agent is a member of a regulated profession such as lawyers and accountants through their professional association. As mentioned previously: funding should be set aside by Government for PBCs to access private agent services on an application basis particularly when they are not generating revenue from their native title rights; these private agents should be required to engage with NTRBs/NTSPs; and, be required to have the same accountability and transparency reporting requirements back to the funder. There have been a range of consumer protection issues identified by NNTC and MCA members. The MCA considers there is merit in the establishment of a register of Future Act (and other relevant acts) service providers 8 which could be held by the Federal Law Court or the National Native Titles Tribunal that will provide native title parties and PBCs with a source of information for selecting suitable providers. To be eligible to be on the register the service providers must comply with a set of standards which include a fiduciary duty to act in the best interests of their clients. It would be the role of the FCA or the NNTT to undertake review of service provider’s compliance with the code of conduct and respond to complaints. Resourcing will be required to undertake these roles which could draw upon agent registration fees. There should also be a commitment to increasing stakeholder awareness of leading practice agreement making, possibly through a publication which focuses on what constitutes good agreement making and the appropriate role and behaviour of agents. MCA is of the strong view that after twenty years of implementing the Native Title Act there is a substantial body of knowledge that can be jointly documented by the MCA, the NNTC and the Attorney General’s Office. This information can be made available to registered native title claimants, and to industry representatives and agents that are practicing in the native title sector. The value of NTRB/NTSP network is that it provides an advocacy role that informs how the native title system could operate more effectively. However given the growing number of service providers that are servicing the native title sector it may also be timely and appropriate for a body to be established that focuses on developing sector standards and provides a capacity building service to its membership similar to other industry groups. 5. CONCLUSION The MCA believes that in a post determination environment NTRBs/NTSPs and PBCs will continue to play critical roles in the native title system, but they will be operating in a more competitive market space. There is a need for government to provide safeguards to ensure that finalisation of remaining land claims is prioritised and resourced adequately; that private agents are complying with regulatory standards and accepted codes of behaviour; that Traditional Owner decisions are respected and complied with; and, that NTRBs/NTSPs and PBCs are adequately resourced to undertake their respective roles. The MCA appreciates the opportunity to respond to the review discussion paper and would welcome the opportunity to participate in further consultative fora where appropriate. If you have any queries regarding this paper please contact Therese Postma, Assistant Director Social Policy, on 02 6233 0600. 9 Attachment 1 – Overview of the Proposed Indigenous Community Development Corporation (ICDC) entity. The Indigenous Community Development Corporation The ICDC establishes a new category of entity for tax purposes as an opt-in structure for the management of payments and benefits negotiated by Indigenous communities and groups, whether these benefits come from the public or private sector including from land access related agreements or heritage related payments. Specifically, the ICDC provides a registered not-for-profit entity that is exempt from income tax and has DGR status. The development of the ICDC as a category of tax exempt entity would substantially enhance the effectiveness and efficiency of the existing system, including by: shifting the language away from concepts of charity to broader concepts of community and socio-economic development; creating greater flexibility within the taxation system for community specific approaches to managing funds for socio-economic development; providing for a structure that encourages intergenerational and sustainable benefits; creating capacity to maximise the delivery of economic and social dividends with minimal administrative burden and recognising the unique multifaceted challenge of Indigenous disadvantage, in line with Government’s commitment to ‘Closing the Gap’; and reducing welfare dependency, as private income streams from land-related payments and income from investing in business development are more effectively used and create real economies in remote locations. An advantage of the ICDC concept is its relative simplicity. Key features of the ICDC concept are: Authorised Purposes – ICDCs would be authorised to apply funds to purposes that are within the scope of the ordinary concepts of charity and broader community and economic development activities – this includes activities consistent with achieving the ‘Closing the Gap’ targets, business development, capital accumulation for future generations and the establishment of superannuation funds. Tax treatment - Money received (and earned) by ICDCs will be tax exempt to the extent it is applied for authorised purposes. Recipients of superannuation benefits will be taxed on ordinary concessional principles. Scope of Functions – The ICDC would be an optional vehicle for Indigenous communities to use to fund authorised purposes. An ICDC would not need to be the only vehicle used by those communities (other "for profit" entities can be used under the general law) but its flexibility and features are designed for it to be used as an "omnibus" structure to manage funds from multiple sources. The ICDC is a principally funding provider rather than entity service provider. Its functions would include identifying the most effective mechanism to implement the delivery of authorised purposes. Beneficiary communities – An ICDC can be for the benefit of any Indigenous community, and is not limited to native title or other land holding groups. However, while an ICDC may differentially apply benefits, as to amount, type and time, to different parts of an Indigenous community, the Indigenous community must be wide enough to pass the public benefit test. Decision-making control and governance compliance – Decisions about the use, investment and distribution of ICDC funds would be made by, or with the concurrence of, the relevant Indigenous community or the narrower group of traditional owners. Minimum governance structures for the ICDC would be prescribed and would include a model constitution, trust deed or rules depending on the relevant legal structure. Resourcing Prescribed Body Corporates - An ICDC would also be required to co-invest in the costs associated with the operations of any Prescribed Body Corporate when the monies received are over a specified threshold. Why is it required? Current legislation does not easily allow for the accumulation of funds derived from native title and other related agreements. Long term economic and social development activities and the accumulation of benefits are effectively disincentivised under current legislation which is working against the policy objective of ‘Closing the Gap’ and delivering positive intergenerational change for Indigenous people. While some agreements provide significant benefits over two decades or more, it is more often the experience of native title owners that they have a number of small payments from a number of mining agreements which singularly aren’t able to contribute to closing the gap or regional development outcomes. The ICDC will permit the accumulation of funds for use in delivering a substantive service or facility for Indigenous people rather than the collective value of these benefits from being lost through individual distributions. 10 11