Firstly, the tax review must consider axing the Contributions Tax that

advertisement

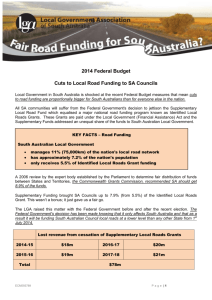

MAYOR’S COLUMN The Federal Government’s planned Taxation Review provides an ideal opportunity to address two issues impacting on Council’s capacity to deliver services and infrastructure for the community. Firstly, the tax review must consider axing the Contributions Tax that local government is forced to pay on superannuation shortfalls. The 15 per cent Contributions Tax is nothing but a windfall gain for the Commonwealth, costing the City of Greater Bendigo $1.546M in 2013. Local authorities in Victoria were required to pay a massive $79.94M. Imagine how great it would be if Councils were instead able to invest this money in capital works and services. Secondly, the review must revisit the decision to freeze indexation on Financial Assistance Grants to local government. Councils such as ours are recipients of Financial Assistance Grants from the Federal Government, which have historically been increased by CPI annually. These are significant untied grants which councils rely upon for their day-to-day operations. At the last Federal Budget, the Government announced that the grants would not be indexed for the next three years, which effectively reduces their real value. In our case, this amounts to approximately $1.8M less funding. Councils are responsible for $73B worth of infrastructure and Financial Assistance Grants have boosted their capabilities to fund this vital infrastructure, maintain 85 per cent of the State’s road network and pay for crucial community services like libraries, swimming pools and parks. These cuts, together with the Contributions Tax, are forcing councils to reassess their budget options and are leaving communities vulnerable to scaled back services and potentially deteriorating infrastructure. The Municipal Association of Victoria (MAV) State Council on October 24 provides an important vehicle to raise the issues and seek sector wide support for the MAV to make a comprehensive submission to the review. Council will move the following resolution at the meeting: That the MAV prepare a comprehensive submission to the upcoming Federal Government review of taxation, advocating for change on a range of issues impacting on local government including, but not limited to: 1. Removal of the contributions tax on Defined Benefits Superannuation shortfalls 2. Increased access to the Financial Assistance Grants to local government