52.13Kb - G

advertisement

Parametrical regulation of multi-criteria economic policy based on nonautonomous computable general equilibrium models

Abdykappar A. Ashimov, Yuriy V. Borovskiy, Bahyt T. Sultanov, Rakhman A. Alshanov,

Nikolay Yu. Borovskiy, Bakytzhan A. Aisakova

Kazakh National Technical University, Almaty, Republic of Kazakhstan

Abstract. In paper the problem of a choice of the effective concerted state policy in the

sphere of economic growth with the help of multi-criteria optimization on the basis of two nonautonomous computable general equilibrium models (CGE models) with the common economic

optimization tools is considered. Conditions of consistent optimization on the base of pair of

models and development of the parametrical regulation theory elements on a class of discrete

non-autonomous controllable dynamic systems are given.

Efficiency of application of one method of joint parametrical identification of two

investigated non-autonomous models (CGE model of sectors of economy and CGE model with

knowledge sector) is shown. The parametrical identification of the considered pair of investigated

macroeconomic mathematical models consists in finding estimations of unknown parameters

(values of exogenous functions) in the given limited areas for which the minimum value of some

target function (criterion) is reached.

The estimation of Pareto set for considered two-criteria problem and the solution (on the

base of Pareto set) of an optimization problem with one utility function are found.

Key words: Computable general equilibrium model, Parametrical identification, Multicriteria optimization.

1. Elements of the parametrical regulation theory on the basis of discrete nonautonomous dynamical systems

We consider the following discrete controllable system:

𝑥(𝑡 + 1) = 𝑓(𝑥(𝑡), 𝑢(𝑡), 𝑎(𝑡)), 𝑡 = 0, 1, … 𝑛 − 1; 𝑥(0) = 𝑥0 .

(1)

Here t – time, taking non-negative integer values; 𝑥 = 𝑥(𝑡) – vector-function of the systems’

state; 𝑢 = 𝑢(𝑡) – control; vector-function of a discrete argument; 𝑎 = 𝑎(𝑡) – known

uncontrollable vector-function of a discrete argument (element of the Euclidian space of the

corresponding dimension); 𝑥0 – known initial state of the system; 𝑓 – known vector-function of

its arguments.

The method of choosing optimal values of economic tools is associated with the model of

maximization of the optimality criterion

max ∑𝑛𝑡=1 𝐹[𝑡, 𝑥(𝑡)],

𝑢

1

(2)

where 𝐹 – known function and with the following constraints. Phase constraints imposed on the

solution of the system (1) are of the following type:

𝑥(𝑡) ∈ 𝑋(𝑡), (𝑥(𝑡)) ∈ 𝑋𝜑 (𝑡), 𝑡 = 1, … , 𝑛,

(3)

where 𝜑 – given vector-function; 𝑋(𝑡), 𝑋𝜑 (𝑡) – given sets. Constrains imposed on control are as

follows:

𝑢(𝑡) ∈ 𝑈(𝑡), 𝜓(𝑢(𝑡)) ∈ 𝑈𝜓 (𝑡), 𝜒(𝑢(0), 𝑢(1), … , 𝑢(𝑛 − 1)) ∈ 𝑈𝜒 , 𝑡 = 0, … , 𝑛 − 1,

(4)

where 𝜓, 𝜒 – given vector-functions; 𝑈(𝑡), 𝑈𝜓 (𝑡), 𝑈𝜒 – given sets.

On the basis of the relations (1) – (4) we obtain the following variational problem, so called

the variational calculus problem on the synthesis of optimal laws of parametrical regulation. The

analogous problem and theorems, corresponding to the described below theorems 1 and 2, for the

case of autonomous dynamical systems were considered in (Ashimov et al, 2012).

Problem 1. Given the known function 𝑎 find control 𝑢, satisfying the condition (4), so that

corresponding to it solution of the dynamical system (1) satisfies the condition (3) and provides

the maximum for the functional (2).

Let 𝑉𝑎 – set of allowed "state-control" pairs of the considered system under the given

known function 𝑎, i.e. the set of such “vector-function” pairs (𝑥, 𝑢), which satisfy the relations

(1), (3), (4). We introduce notations: 𝑋 = ⋃𝑛𝑡=1 𝑋(𝑡), 𝑈 = ⋃𝑛−1

𝑡=0 𝑈(𝑡). The following two

theorems are true, their proofs are based on application of continuous functions’ features, and

particularly, on application the features of the functions continuous on the compact.

Theorem 1. Let for the known function 𝑎 the set 𝑉𝑎 be nonempty; sets 𝑋(𝑡) and 𝑈(𝑡 − 1)

be compact, and sets 𝑋𝜑 (𝑡), 𝑈𝜓 (𝑡 − 1) be closed for all 𝑡 = 1, … , 𝑛; the function 𝑓is continuous

in the first two arguments on the set 𝑋 × 𝑈, and the function 𝐹 is continuous in the second

argument on the set 𝑋. Let the mappings 𝜑, 𝜓, 𝜒 be continuous on the sets 𝑋, 𝑈, ∏𝑛−1

𝑡=0 𝑈(𝑡)

respectively; the set 𝑈𝜒 is closed. Then the problem 1 has a solution.

Theorem 2. Let the conditions of the theorem 1 be met for any functions 𝑎 ∈ 𝐴 (where 𝐴 –

a open set in the Euclidian space); the function 𝑓 is continuous in the third argument in A and

satisfies the Lipschitz condition in the first argument in X uniformly, in the second and third

arguments in 𝑈 × 𝐴. Then the optimal value of the criterion of the problem 1 continuously

depends on uncontrollable function 𝑎 from 𝐴.

2. Choice and the joint parametrical identification of the two CGE models

The following requirements are the basis for selecting two or more mathematical models

for solving the problems of consistent optimization.

1. Acceptable accuracy of the model description of a single subject area, in the framework

of which the problem of consistent optimization is solved with the criteria (𝐾1 , 𝐾2 , …),

corresponding to the selected targets of economic policy, as well as the possibility of obtaining

these criteria.

2

2. Compliance with the requirements of the formulation and solution of multi-criteria

optimization problem based on the considered models.

3. Effective realization of solutions to the consistent optimization problem.

Within the first requirement we consider the possibility of choosing two CGE models for

the consistent optimization in the sphere of economic growth. This possibility is evaluated by

solving the problem of joint parametrical identification of the following models (Makarov et al,

2007).

Model 1. CGE model of economic sectors is presented by 16 economic producing agents

(sectors), as well as by non-productive sectors: total consumer, government and banking sector.

This model contains 698 equations, with the help of which the values of its 698 endogenous

variables are calculated. It also contains 2045 estimated exogenous parameters (values of

exogenous functions).

Model 2. CGE model with knowledge sector is presented by the following six economic

agents (sectors): sector of science and education (knowledge), innovative sector, representing the

set of innovative-active enterprises and organizations; other sectors of economy; aggregate

consumer, uniting households; government; banking sector. Here the first three economic sectors

are producing agents. The model with knowledge sector contains 110 endogenous equations, with

the help of which the values of its 110 endogenous variables are calculated.

This model also contains 86 estimated exogenous functions. Out of them 9 exogenous

functions are common for the two considered models.

The problem of parametrical identification of the considered pair of researched

macroeconomic models comes to finding the estimates of unknown parameters (values of

exogenous functions) in the restricted areas specified for each model, under which we reach a

minimum value of the objective function 𝐾𝐼 , characterizing:

- deviations of the calculated values of endogenous variables of each model from the

corresponding observed values (known statistics);

- differences between the corresponding values of l = 18 endogenous variables of the

models 1 and 2, which have the same meaning;

and with the additional condition of coincidence of the corresponding values of estimated

parameters common to both models.

As the result of numerical solution of parameter identification based on the statistics of the

Republic of Kazakhstan for 2000 – 2008, applying two criteria (Ashimov et al, 2012) and the

Nelder-Mead algorithm (Nelder and Mead, 1965) the value 𝐾𝐼 = 0.026 was obtained. This

number is equal to the root-mean-square value of the relative deviations and discrepancies,

presented above.

3. Consistent optimization on the basis of the two CGE models

In the framework of the requirements 2 and 3 presented above (Section 2) the paper

considers multi-purpose choice of optimal economic policy in the sphere of economic growth and

in the sphere of innovation with the two-dimensional criterion 𝐾 = (𝐾1 , 𝐾2 ). The components of

the 𝐾 criterion respectively describe the mean value of real GDP (𝐾1 ) of the first model and the

mean value of real gross value added of the innovative sector (𝐾2 ) of the second model.

The considered problem of two-criterion optimization has the following form (5)-(7).

3

max 𝐾(𝑂).

𝑂

(5)

Here 𝑂 = {𝑂𝑗𝑘 (𝑡): 𝑗 = 1, … ,16; 𝑘 = 1, 2, 3; 𝑡 = 2011, … , 2015 } – the set of common regulated

parameters; 𝑂𝑗𝑘 (𝑡) – additional investments in year t to the j-th sector of the first model within the

framework of subsidizing the k-th sector of the second model (or the same, additional

investments to the k-th sector of the second model in year t within the framework of subsidizing

the the j-th sector of the first model). The constraints of the type (4) imposed on the controlled

parameters and the conditions of its realization on the basis of the two models are as follows:

𝑂𝑗𝑘 (𝑡) ≥ 0; ∑𝑡,𝑗,𝑘 𝑂𝑗𝑘 (𝑡) ≤ 11.5 × 1012 ; 𝑂𝑗 (𝑡) = ∑𝑘 𝑂𝑗𝑘 (𝑡); 𝑂𝑘 (𝑡) = ∑𝑗 𝑂𝑗𝑘 (𝑡).

(6)

Here 11.5 × 1012 – total volume of investments in tenge for the period 2011 – 2015 (tenge –

national currency of Kazakhstan); 𝑂𝑗 (𝑡) – additional investments in year t to j-th producing sector

of the first model; 𝑂𝑘 (𝑡) – additional investments in year t to k-th producing sector of the second

model.

Obviously, the stated additional investments satisfy equality ∑𝑘 𝑂𝑘 (𝑡) = ∑𝑗 𝑂𝑗 (𝑡) =

∑𝑗,𝑘 𝑂𝑗𝑘 (𝑡), which guarantees equal amounts of additional investment, consistently invested in the

economy for each t year of regulation in the framework of each of the two CGE models.

Constraints of the form (3) imposed on the vectors of endogenous variables 𝑦1 (𝑡) and 𝑦2 (𝑡)

of the first and the second model respectively, as well as imposed on l-th having the same

meaning the coordinates of these vectors, have the following form:

𝑦1 (𝑡) ∈ 𝑌1 (𝑡), 𝑦2 (𝑡) ∈ 𝑌2 (𝑡), |𝑦1𝑙 (𝑡) − 𝑦2𝑙 (𝑡)| ≤ 𝜀 𝑙 .

(7)

Here 𝑌1 (𝑡) и 𝑌2 (𝑡) – given sets; 𝜀 𝑙 – given small amounts, 𝑙 = 1, … , 18, 𝑡 = 2011, … , 2015.

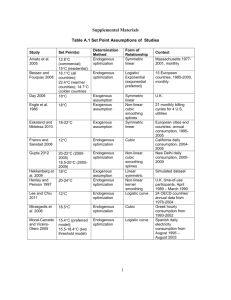

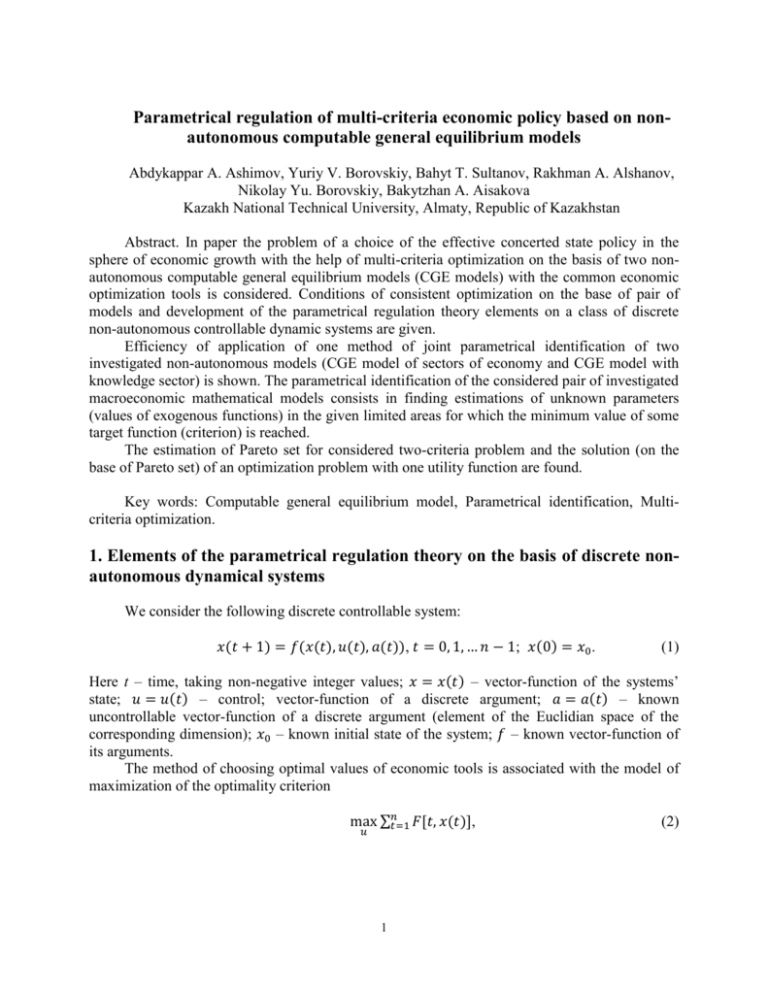

For the formulated two-criterion problem applying the Nelder-Mead algorithm the estimate

П of the Pareto set (see Figure 1) was obtained as the set of points sequentially connected by a

continuous line on the plane (𝐾1 , 𝐾2 ). Units of criteria measurements on the figure: 𝐾1 – 1012

tenge, 𝐾2 – 1010 tenge in prices of 2000. Existence of solutions to auxiliary (for estimating П)

single-criterion optimization problems (max 𝐾𝑖 (𝑂), 𝑖 = 1,2), relating to the type of problem 1

𝑂

with corresponding constraints imposed on endogenous variables and regulated parameters, as

well as continuous dependence of corresponding optimal criterion values on uncontrolled

functions are justified with the help of Theorem 1 and 2. Here the selected pair of consistently

controlled CGE models is used as discrete controlled system (1).

The solution to optimization problem of linear utility function of the form 𝑈(𝐾1 , 𝐾2 ) =

2

∑𝑖=1 𝑊𝑖 𝐾𝑖 /𝐾𝑖0 for the case 𝑊1 = 𝑊2 = 0.5 (equal importance of both criteria for the decision

maker) and for selected basic values of the criteria 𝐾𝑖0 is presented in Figure 1 with the help of

the point 𝐴(6.27, 4.30) ∈ Π. The sloping straight line passing the point 𝐴 is a equipotential line

of the utility function 𝑈 for the case corresponding to the maximum value of this function on the

set Π.

4

Figure 1. Estimation of the Pareto set

References

Ashimov, A.A., Sultanov, B.T., Adilov, Zh.M., Borovskiy, Yu.V., Novikov, D.A.,

Nizhegorodtsev, R.M. and As.A. Ashimov (2012); Macroeconomic analysis and economic policy

based on parametric control; New York: Springer (pp. 265).

Makarov, V.L., Bakhtizin, A.R. and S.S. Sulakshin (2007); The use of computable models

in public administration; Moscow: Scientific Expert, (pp. 304, in Russian).

Nelder, J.A. and R. Mead (1965); A simplex method for function minimization; The

Computer Journal, No. 7, (pp. 308–313).

5