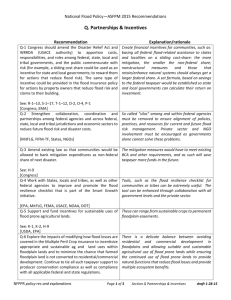

Partnerships & Incentives - The Association of State Floodplain

advertisement

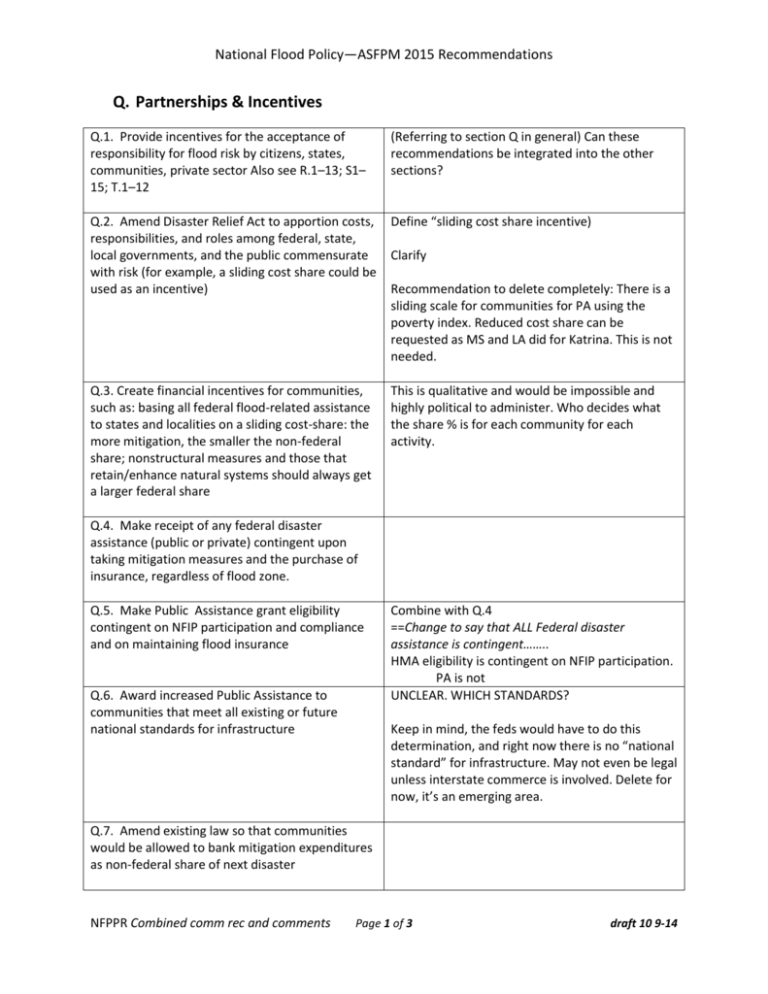

National Flood Policy—ASFPM 2015 Recommendations Q. Partnerships & Incentives Q.1. Provide incentives for the acceptance of responsibility for flood risk by citizens, states, communities, private sector Also see R.1–13; S1– 15; T.1–12 (Referring to section Q in general) Can these recommendations be integrated into the other sections? Q.2. Amend Disaster Relief Act to apportion costs, responsibilities, and roles among federal, state, local governments, and the public commensurate with risk (for example, a sliding cost share could be used as an incentive) Define “sliding cost share incentive) Q.3. Create financial incentives for communities, such as: basing all federal flood-related assistance to states and localities on a sliding cost-share: the more mitigation, the smaller the non-federal share; nonstructural measures and those that retain/enhance natural systems should always get a larger federal share This is qualitative and would be impossible and highly political to administer. Who decides what the share % is for each community for each activity. Clarify Recommendation to delete completely: There is a sliding scale for communities for PA using the poverty index. Reduced cost share can be requested as MS and LA did for Katrina. This is not needed. Q.4. Make receipt of any federal disaster assistance (public or private) contingent upon taking mitigation measures and the purchase of insurance, regardless of flood zone. Q.5. Make Public Assistance grant eligibility contingent on NFIP participation and compliance and on maintaining flood insurance Q.6. Award increased Public Assistance to communities that meet all existing or future national standards for infrastructure Combine with Q.4 ==Change to say that ALL Federal disaster assistance is contingent…….. HMA eligibility is contingent on NFIP participation. PA is not UNCLEAR. WHICH STANDARDS? Keep in mind, the feds would have to do this determination, and right now there is no “national standard” for infrastructure. May not even be legal unless interstate commerce is involved. Delete for now, it’s an emerging area. Q.7. Amend existing law so that communities would be allowed to bank mitigation expenditures as non-federal share of next disaster NFPPR Combined comm rec and comments Page 1 of 3 draft 10 9-14 National Flood Policy—ASFPM 2015 Recommendations Q.8. Make all flood related mitigation funding (including levee and dam funds) contingent on having a comprehensive, mitigation plan that will support community resilience/sustainability. Q.9. Support and fund incentives for sustainable uses of floodprone agricultural lands Q.10. Reduce subsidized crop insurance and crop disaster assistance (disincentives to wise use of floodprone lands) and tie all such taxpayer support to producer conservation compliance. This could further encourage conversion of agricultural lands to developed land if the farmers lose these programs. Better crops than houses in these areas. Alternatively, explore the impacts of decoupling flood losses from the Multiple Peril Crop insurances to develop appropriate and sustainable land uses within floodplain lands and to minimize the chance that farmed floodplain land is not converted to residential/commercial development. Will we see a massive sale of crop lands – making them prime for development? Farm community relies heavily on crop insurance as a risk management tool so that when a disaster comes, the political support is not there provide disaster aid. Reducing the subsidy will not support this concept. Also phrased “Use incentives to encourage alternative, sustainable crops in floodprone areas” Revise to be clear about the relevance to flood risks USDA – esp. NRCS and FSA have lots of programs that do this. EPA and states do as well. Delete. Q.12. Deny subsidized crop insurance and disaster payments to agricultural producers with repetitive losses who do not accept offers of permanent easements or switch to alternative crops Q.13. States should Join together in existing or form new mutual aid (emergency management assistance) compacts This would create an incredible outcry in the agricultural and business community. Not advised. Reword as incentive ==Either drop this alternative crop concept or define what it is? Then evaluate whether those alternative crops are really sustainable This exists, its NEMA’s Emergency Management Assistance Compact (EMAC.). Well proven and not necessary to create another system. Q.14. Delegate (with monitoring) to qualified states the administration of flood mapping, HMGP, FMA, CAP, and environmental reviews for mitigation projects This is the CTP. Others addressed in H. Mitigation. Q.15. Explore use of true delegation model to move responsibility for NFIP activities to states (mapping, monitoring communities for compliance, technical assistance, training, etc.) If this is an expansion of CTP, leave, otherwise delete. NFPPR Combined comm rec and comments Page 2 of 3 draft 10 9-14 National Flood Policy—ASFPM 2015 Recommendations Q.16. Make CAP funding contingent upon the state’s provision of one fully funded professional full-time position—a CFM in floodplain management Some states may not have issues funding NFIP support staff but need CAP funds for other activities. Not our place to get in-between FEMA and states on CAP. Q. 17. Encourage market-driven private-sector incentives for mitigation Q. 18. Federal agencies should encourage integration of certification programs for the International Codes and for floodplain management (CFM) Q. 19. Deny subsidized assistance for public infrastructure that would encourage development in flood risk areas This would be very difficult as FEMA reservists cannot predict future land uses and the local political will. They follow the local floodplain management ordinance, that’s about the best we can expect. Q.20. Prohibit the use of federal funds to build any infrastructure to serve currently undeveloped SFHA. Combine 19-20 Q. 21.Reform the casualty loss deduction to better target the deduction as well as incentivize those that have mitigated. For example, limits could be set as to the number of times a person could claim the deduction without first mitigating as well as a means tested system to limit incomes of claimants. Q. 22. Develop a hazard mitigation tax credit much like energy efficiency tax credits that are given to property owners. Q. 23. Allow for tax advantaged disaster savings accounts Q. 24. Provide specific IRS guidance more broadly exempting cost effective mitigation assistance from federal taxes. Currently only FEMA mitigation programs have a specific exemption. NFPPR Combined comm rec and comments Page 3 of 3 draft 10 9-14