Keywords: Gulf of Guinea region, management, natural resources

advertisement

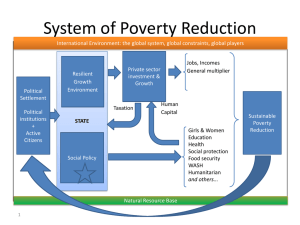

NATURAL RESOURCES MANAGEMENT AS A FACTOR OF UNDERDEVELOPMENT AND SOCIAL INEQUALITY IN THE GULF OF GUINEA REGION Petar Kurečić University North, Varaždin, 104. brigade 3, Croatia petar.kurecic@unin.hr Goran Kozina University North, Varaždin, 104. brigade 3, Croatia goran.kozina@unin.hr ABSTRACT The paper studies natural resources management as a factor of underdevelopment and the high levels of social inequality in the countries of the Gulf of Guinea region. It is a well-known fact that the Gulf of Guinea region comprises several states that are very significant producers of oil, a primary natural resource of the region, but also of the contemporary world. Therefore, the oil extraction and exports represent a lifeline for many of the world’s oil exporting countries. The main thesis of the paper is: long-term lagging behind in the development of most sectors of the economy i.e. non-diversification of economy in the countries of the Gulf of Guinea region is a product of overreliance on rents that are earned from the exports of natural resources, mainly oil. The afore-mentioned features of the Gulf of Guinea region countries are the result of political decisions made by the regimes that keep themselves in power through the usage of rents obtained from the oil exports. These rents are mostly used for financing of the state security apparatus loyal only to the regime, keeping the “internal peace” and the status quo in the society through social care benefits. The data about the GDP and GDP per capita of the studied states, that provide us information about the economic growth, show a significant economic growth of the Gulf of Guinea region states in the last couple of decades. However, we conclude that oil does not benefit the economies and societies of the Gulf of Guinea region countries. In the Gulf of Guinea region, reliance on oil exports represents the main factor that prevents the diversification of economy in the oil exporting countries, therefore hindering economic development and consequently the rise of living standard of the overwhelming majority of the population. Keywords: Gulf of Guinea region, management, natural resources, social inequality, underdevelopment. 1 INTRODUCTION “Oil, more than any other commodity, illustrates both the importance and the mystification of natural resources in the modern world (Coronil, 1997: 49). The quote stated above, represents a claim that points to the real, and the other, imaginary, perceived importance and the value of control over exploitation, transport and export (causal actions that strongly depend on each other) of oil, as one of the very important, or probably the most important natural resource of the modern world. This paper represents a study in the natural resources management as a factor of underdevelopment in the countries of the Gulf of Guinea region, which represents a region of Sub-Saharan Africa, the most underdeveloped part of the contemporary world. Contrary to the quantitative studies of the connections between dependence on natural resources and economic growth of resource exports dependent states studies (Alexeev, Conrad, 2009; Birdsall, Subramanian, 2004; Karl, Gary, 2003; Leite, Weidmann, 1999; McMillan, Rodrik, 2011; Sachs, Warner, 2001), the connections between natural resource dependence (primarily oil) and the indicators of underdevelopment1 in one particular region were studied. Why does dependence on oil exports, which clearly generates short and mid-term economic growth2, at the same time causes underdevelopment? It is a well-known fact that the possibility always exists for the oil producing countries to export oil on the foreign markets. Natural resources, and especially oil, generate immense revenues in the foreign currency (usually US dollars), which are not a product of economic development and labour. The Gulf of Guinea region, as a case study region in this paper, is a region that comprises several states, which produce oil in very significant quantities. Oil is the primary natural resource of the region, but also of the contemporary world. Therefore, the oil extraction and exports represent a lifeline for many of the world’s oil exporting countries, and especially for the countries whose exports and GDP mostly rely on oil exports. This dependence causes so-called “oil curse”, a dependence on oil exports rents, which hinders diversification of economies, therefore hindering economic development. It also hinders democracy and political freedoms in the societies, creating a paradox of curse instead of real wealth3. The challenges tied to “oil curse” are influencing the Sub-Saharan Africa profoundly. The economic growth of certain Sub-Saharan African countries is mainly a result of the increase in natural resources exploitation and subsequently exports, as well the increase in natural resources prices. The oil money rents are increasingly flowing into the oil exporting countries. In addition, there are some improvements in macroeconomic policies, education and management. These improvements have decreased the propensity towards slower economic growth. However, the rents are not used in the way they should be. (Page, 2009). Nevertheless, when discussing economic growth of African countries, we always have to remember that most of the world’s countries that have the highest population growth are located in Africa. The 1 Underdevelopment is usually characterized by a disarticulation mode of production, absence or low levels of proletarianization, over marginalization of the peasantry, low levels of productivity, high rates of unemployment and under-employment, chronic foreign debt and balance of trade problems, dependence on raw materials exports and industrial product imports, low levels of living, absolute poverty, inadequate food and poor nutrition, low income, dictatorial and corrupt leaders etc. See: Ajie, U. O. (2010). Politics of Development and Underdevelopment. Textbook, pp. 7-8. 2 Although the afore-mentioned authors of studies that study the influence of natural resource dependence do not agree about the long-term effects of dependence on natural resources and economic growth. 3 More in: Ross, M. (2012). The Oil Curse: How Petroleum Wealth Shapes the Development of Nations. Princeton, NJ: Princeton University Press. Kurečić, P., Hunjet, A., Perec, I. (2014). Effects of Dependence on Exports of Natural Resources: Common Features and Regional Differences between Highly Dependent States. M-Sphere Conference Proceedings. Retrieved 10.10.2014. from http://www.m-sphere.com.hr/book-of-proceedings-2014. continent will, by estimates, more than double its population by 2050, to 2.4 billion4. A large proportion of the economic growth of Africa in the last decade and a half is a result of recovery from the long period of economic stagnation, and not of the real economic growth. Changes in the determinants of economic growth, such as investments, diversification of industrial export products (and not only primary commodities) and productivity have not been the factors that were behind this economic growth. The main thesis of the paper is that (bad) natural resources management that maintains overreliance on natural resources rents, besides other factors, creates a long-term lagging behind in the development (and therefore sustaining underdevelopment) in most sectors of the economy i.e. non-diversification of economy in the countries of the Gulf of Guinea region. The afore-mentioned features of the Gulf of Guinea region countries are the result of political decisions made by the regimes that keep themselves in power through the usage of rents obtained from the oil exports. These rents are mostly used for financing of the state security apparatus loyal only to the regime, keeping the “internal peace” and the status quo in the society through sparse social care benefits. 2 METHODOLOGY The paper represents a case study of one particular region with the focus on certain common aspects of politics and political economy in one particular, defined geographical area, the Gulf of Guinea region5. The region comprises five important oil producers and exporters: Nigeria, Angola, Gabon, Republic of Congo, and Equatorial Guinea. The study included the following research: 1) Percentage of rents from the natural resources exports in the total GDP; 2) GDP per capita (PPP); 3) Daily oil production (in order to see the economic and strategic importance of each country from the region); 4) Various poverty indicators (percentage of national income shared by those with highest and lowest 10% incomes in the society, and poverty gap at $2 a day (PPP) (%); 5) GINI index. Main methods used were statistical analysis, content analysis, and the method of comparison. The biggest problem was insufficient available data about poverty indicators and GINI index for most of the countries of the region. Nevertheless, the data for two biggest and the most important countries, Nigeria and Angola was available (however, for only one year, and it was not the same year). 4 http://www.telegraph.co.uk/news/worldnews/africaandindianocean/10305000/Africas-population-to-double-to2.4-billion-by-2050.html. 5 For the purpose of this paper, we have defined The Gulf of Guinea region and studied it here, as a region that comprises the following countries: Ivory Coast, Ghana, Togo, Benin, Nigeria, Cameroon, Equatorial Guinea, Gabon, Republic of Congo, Cabinda (Angola's exclave), Democratic Republic of Congo, and Angola. The coasts themselves, the parts of these countries that are in the proximity of the coast, as well as the Gulf of Guinea as a body of water, are strategically and economically the most important parts of the region. 3 NATURAL RESOURCES MANAGEMENT AS A FACTOR OF UNDERDEVELOPMENT IN THE GULF OF GUINEA REGION COUNTRIES Whether by bourgeois or Marxist standards, underdevelopment defines a relative condition in which a society lacks autonomous capacity to control and mobilize socio-economic formation for a sustainable economic growth and development necessary to effect physical, mental, material and technological fulfilment without dependence on external stimuli (Offiong, 1980: 15). Underdevelopment therefore refers to a socio-economic structure, which is subjugated and dominated by another social formation. (Ajie, 2010: 7-8). The concept of underdevelopment for the Gulf of Guinea region countries is clearly tied with the “dependence on raw materials exports” as Ajie (2010) states, other aspects of underdevelopment in the afore-mentioned region notwithstanding. Natural resources create a “curse” because they create a dependence on rents and suppress or eliminate a possibility for the other sectors of economy to develop. Natural resources hinder other, more valuable generators of economic growth, such as human capital and manufacturing (Basedau, 2005: 10). At the same time, natural resources stimulate irrational economic policies, such as imports substitution that prevents effective investing of natural resources rents and makes economy vulnerable to external shocks, caused by the decrease in prices of natural resources and in the volume of natural resources trading. This is especially accentuated during the periods of recession. Countries highly dependent on oil exports suffer from higher level of social inequality. Other difficulties that are more visible in the countries dependent on oil exports are: poor nutrition of the population (including even malnutrition), high mortality of children including infant mortality, shorter life expectancy, and lower degree of literacy among the population and lower level of population that attends even primary education6. For decades, the oil exporting countries of the region remained completely dependent on oil exports. In most of the countries, the population is rising rapidly. Oil money is used for food and industrial product imports. Exploitation of oil does not demand a lot of workforce, so the positive effects of oil exploitation on unemployment, once the infrastructure is built, are almost negligible. Oil exploitation is an economic activity that creates only a few well-paid jobs. Therefore, it widens the rich-poor gap in the societies even further (Karl, Gary, 2003). Specialization in only a couple of economic activities tied to the primary sector (especially mining) does not create a large number of jobs, although it increases the economic growth (McMillan, Rodrik, 2011). However, the duration and intensity of that kind increase depends solely on quantities and current prices of natural resources. 6 The Curse of Oil: The Paradox of Plenty, The Economist, December 20, 2005, http://www.economist.com/node/5323394. Figure 1: Percentage of rents from the natural resources exports in the total GDP, 2012 (http://data.worldbank.org/indicator/NY.GDP.TOTL.RT.ZS) From the Figure 1, it is clear that not all of the countries from the Gulf of Guinea region have the same percentage of natural resources exports in their total GDP. The percentage of dependence on natural resources exports as a generator of GDP varies among the countries of the region from less than 10 percent (Benin, Togo) to over 70 percent (Republic of the Congo). All of the countries from the region that depend heavily on exports of natural resources (over 40 percent of total GDP) are significant oil exporting countries (Angola, Republic of Congo, Equatorial Guinea, Gabon). Nigeria is a country with a population of over 170 million inhabitants, and therefore the percentage of natural resources exports in Nigerian GDP is less than 20%. Nevertheless, natural resources (primarily oil) represent about 95 percent of total exports of goods from Nigeria! Countries that depend heavily on natural resources exports tend to have a higher degree of social inequality. For instance, in Nigeria, the percentage of national income shared by the highest 10% in the society was 38.2% (2010), and in Angola, it was 32.4% (2009). Percentage of income shared by those 10% with the lowest income in Angola was 2.2% (2009), and in Nigeria, it was 1.8% (2010)7. 7 http://data.worldbank.org/indicator/SI.DST.10TH.10; http://data.worldbank.org/indicator/SI.DST.FRST.10. Figure 2: The Gulf of Guinea region countries: GDP per capita in US$ (PPP), 2013 (http://data.worldbank.org/indicator/NY.GDP.PCAP.PP.CD) The data in the Figure 2 give us a fake picture of reality. The overwhelming majority of the population in Equatorial Guinea and Gabon are not better off than the majority of the population in other Gulf of Guinea region countries. These countries have small populations (Equatorial Guinea 0.8 million, Gabon 1.6 million) and, in comparison to their small populations, still very abundant oil reserves8. Their oil reserves per inhabitant are much more abundant than in the other countries of the region. Therefore, their GDP per capita is very high. However, most of the oil money never reaches even these small populations because of high level of corruption. 8 Confirmed oil reserves of Equatorial Guinea in 2012 were about 1.1 billion barrels. Gabon's confirmed oil reserves were in the same year about two billion barrels. According to: http://www.eia.gov/countries/index.cfm?view=reserves. Since these countries have small populations, their oil reserves per inhabitant are much more abundant than in the other countries of the region. However, most of the oil money never reaches even these small populations because of high level of corruption. Figure 3: Daily production of oil in the Gulf of Guinea region countries, millions of barrels, 2012 (http://www.eia.gov/countries/index.cfm?view=production) The dependence on oil exports rents in the Gulf of Guinea region is tied to extreme poverty of the overwhelming majority of the population in the oil exporting countries. The Poverty headcount ratio at $2 a day (PPP) (percentage of population) in Angola was 67.4% (2009), in Nigeria 84.5% (2010), and in Togo (which does not have any significant oil reserves!), it was 52.7% (2011)9. Poverty gap at $2 a day (PPP) (%)10 in Angola in 2009 was 31.5%. In Nigeria it was 50.2 (2010), and in Togo 20.6% (2011). The data about GINI index11 for the countries from the region was available for Angola (42.7, 2009), Benin (43.5, 2012), Republic of Congo (40.2, 2011), Nigeria (43.0, 2010), and Togo (46.0, 2012). Available GINI index data show a high level of social inequality, on the African continent equalled or surpassed only by countries of Sub-Saharan Africa12, also highly dependent on natural resources exploitation and exports. For other states of the region, the mentioned data about poverty and social inequality were unavailable. Nevertheless, the available data points to high deficiencies in management of the natural resources (oil) that cause underdevelopment and the extreme poverty of the population. A very important factor that contributes to this situation is ever-present corruption13. The expectations of the population tied to the revenues from oil exports are in most of the cases quite different. Mostly they are tied to opening of the new jobs, higher level of health and social insurance, better and more available (geographically accessible and affordable) education, improvement of the infrastructure, such as construction of the roads and water wells etc., and food subsidies. The reality in the Gulf of Guinea region is mostly quite different since oil has brought to majority of their populations nothing but greater social inequality, higher levels of corruption and environmental degradation and devastation. Countries without the strong and 9 Population below $2 a day is the percentage of the population living on less than $2 a day at 2005 international prices. According to: http://data.worldbank.org/indicator/SI.POV.2DAY. 10 Poverty gap is the mean shortfall from the poverty line (counting the nonpoor as having zero shortfall), expressed as a percentage of the poverty line. This measure reflects the depth of poverty as well as its incidence. According to: http://data.worldbank.org/indicator/SI.POV.GAP2. 11 Gini index measures the extent to which the distribution of income or consumption expenditure among individuals or households within an economy deviates from a equal distribution. The Gini index measures the area between the Lorenz curve and a hypothetical line of absolute equality, expressed as a percentage of the maximum area under the line. Thus, a Gini index of zero represents perfect equality, while an index of 100 implies perfect inequality. According to: http://data.worldbank.org/indicator/SI.POV.GINI. 12 Botswana 60.5 (2009), Chad 43.3 (2011), Lesotho 54.2 (2009), Madagascar 40.6 (2010), Malawi 46.2 (2010), Namibia 61.3 (2010), Rwanda 50.8 (2011), Senegal 40.3 (2011), South Africa 65.0 (2011), South Sudan 45.5 (2009), Swaziland 51.5 (2010), Uganda 44.6 (2013), Zambia 57.5 (2011). See: http://data.worldbank.org/indicator/SI.POV.GINI. The only other part of the World where GINI index shows such high degrees of social inequality is Latin America (especially Central America). 13 Corruption perception index, an indicator that measures perception of the public sector corruption, developed by Transparency International, in 2012 put Angola on the 157th place in the World (out of 174 examined countries). Nigeria was on the 139th place. Of the other significant oil exporting countries from the region, Equatorial Guinea was on the 163rd place, Republic of Congo on the 144th, and Gabon on the 102nd place. According to: http://www.transparency.org/cpi2012/results. independent institutions (all of the oil exporting countries from the region fall into that category) are destined to become the victims of the already explained “oil curse”. Reliance on oil exports rents also produces a slowdown of the economic growth, even when initial higher starting revenues per capita (because of oil rents) are taken into account. This negative effect of oil rents on economic growth “eats” between 0.6 (Leite, Weidmann, 1999) and 1 percent of annual economic growth rate (Sachs, Warner, 2001). This fact is mostly a product of two concurrent effects: increase in the corruption level (corruption takes away a significant portion of the oil rents into the private hands (mostly of the elite of an oil exporting country) and the inability to diversify the economy that usually remains up to a high degree dependent on the revenues from oil14. When discussing the oil curse, a question also needs to be raised: What about the long-term sustainability of oil export dependent economies? What if these economies do not diversify and become competitive on the international markets with products that are just commodities i.e. oil? What will happen when oil revenues become so low or when oil reserves completely peter? Countries that have abundant oil reserves and small population are in a better position, but in the long-term, they also need to diversify their economies. The biggest country of the region, with the most abundant oil reserves, Nigeria, was taken as an example of “resource curse” caused by poor resource management that keeps the dependence on oil exports high. The oil exports rents make for 80 percent of all revenues of Nigerian state and more than 95 percent of all export revenues of Nigeria15. Nigeria is more than just an oil exporting country. Considering the fact that oil rents make up for 95 percent of all export revenues, Nigeria is literally a “mono economy”, completely dependent on oil exports. The degree of dependency on oil exports is much higher than it was in the British colonial era (Watts, 2004: 58). Nigeria is therefore highly vulnerable to economic shocks that are a product of the oil price flows in the world market. Similar situation occurs in other highly oil export dependent countries of the region: Angola, Republic of Congo, Equatorial Guinea, and Gabon. In Nigeria, a slower economic growth is a not a product of ineffective natural resource exploitation. It is a product of policies practised by the ruling elites in the oil exporting countries from the region. Politicians make discretionary decisions how to distribute the money from the oil rents (Englebert, 2000; Ron, 2005: 447). If independent institutions that control politicians and at the same time promote their responsibility are non-existent (Robinson, 2005: 6), then the distribution of money from the oil rents is not effective and euphemistically said, nontransparent. If the oil export rents would be used for diversification of the economy and education of the population, than the economic growth would in the long-term be higher. 14 Bornhorst, Gupta and Thornton 2008 cover 30 oil exporters over the period 1992-2005, a time when oil prices were mostly moderate or low in historical context. They estimate that revenues from hydrocarbons represented on average 16.2% of GDP or 49.1% of total fiscal revenue. For some regions the averages was higher: for 14 Middle East exporters, they were 20.0% and 57.2% respectively. But GDP includes both the hydrocarbon sector and a range of other production activities directly or indirectly dependent on the oil sector, and many “non-oil” taxes (including import duties or corporate taxes) are themselves dependent on activities and flows that depend on the domestic spending and export revenue made possible by the oil sector. The true dependence of these economies on oil is therefore far larger than it appears. “Sowing the oil” to diversify the economy has been a longstanding goal for many mineral exporters. However, few have managed to break free of dependence on their dominant resource. According to: Gelb, A. (2010), Economic Diversification in Resource Rich Countries, IMF paper, p. 2, www.imf.org/external/np/seminars/eng/.../gelb2.pdf. 15 http://www.africanoutlookonline.com/index.php?option=com_content&view=article&id=1916%3Anigerianoil-production-corruption-and-its-effects-on-post-colonial-economy-of-nigerian&Itemid=54. The system of fiscal relations inside the central governmental structures represents a relevant proof how voluntary political decisions determine the distribution and use of the oil rent money in Nigeria. This system also proves that the influence of political institutions on establishing the rational criteria for using the oil money is a precondition of responsible spending of that same money. This is a key factor that determines the outcome of natural resource (therefore oil as well) exploitation: responsible spending of rents and diversification of economy or “curse” (Olarinmoye, 2008: 21). In the case of Nigeria, oil is still a “curse”. Nigeria, a “mono economy” based on oil exports is, despite the fact that it has a large and growing internal market, unable to diversify its economy to a degree that enable it to decrease its dependence on oil exploitation and export. The oil reserves are far from inexhaustible. Estimates put Nigerian oil reserves’ duration to about 40 to 50 years from now16. Other estimates put Nigerian population in 2050 to 440.3 million17 (from 173.5 million in 201318). 4 CONCLUSION The key problem of the Gulf of Guinea region’s natural resource exports dependent countries, concurrent with corruption, is almost a complete lack of any visions and prospects of diversification of economies, which is also a product of poor resource management. Once the natural resources are exported and revenues earned, even the money that is left over after the corruption takes its part, is not used for the economic development. The inability to diversify economies leads to prolonging of these countries’ underdevelopment and the continuance of reliance of natural resources exports as main generators of exports (and in some countries even total GDP) of a particular country. So the circle of dependence and underdevelopment continues. In order to decrease the dependence on natural resources (primarily oil) exports and therefore make conditions for a long-term economic development and not just short- and midterm economic growth, the Gulf of Guinea region states to diversify their economies. First step should lowering the percentage of crude oil exports in the total exports of oil, and start refining the oil and exporting derivatives of oil. In the second phase, these countries should start to develop consumer goods industries. Nigeria has the advantage here over the other countries of the region, since it has a very large population. However, political stability and the containment of corruption are prerequisites for any development. We conclude that oil does not benefit the economies and societies of the Gulf of Guinea region countries. In the Gulf of Guinea region, reliance on oil exports represents the main factor that prevents the diversification of economy in the oil exporting countries, therefore hindering economic development and consequently the rise of living standard of the overwhelming majority of the population. 5 BIBLIOGRAPHY Ajie, U. O. (2010). Politics of Development and Underdevelopment. Textbook. Retrieved 08.10.2014. from www.academia.edu. 16 http://www.thenigerianvoice.com/news/35801/22/nigeria-at-50when-oil-runs-out.html. http://www.photius.com/rankings/world2050_rank.html; http://populationpyramid.net/nigeria/2050/. 18 http://en.wikipedia.org/wiki/List_of_countries_by_population. 17 Alexeev, M., Conrad, R. (2009). The Elusive Curse of Oil. The Review of Economics and Statistics, 91(3) 586-598. Basedau, M. (2005). Context Matters-Rethinking the Resource Curse in Sub-Saharan Africa (Working Paper 1). Dakar: Institute of African Affairs. Birdsall, N., Subramanian, A. (2004). Saving Iraq from its oil. Foreign Affairs, 83 (4) 77-89. Coronil, F. (1997). The Magic of the State. Chicago, IL: University of Chicago Press. Englebert, P. (2000). State Legitimacy and Development in Africa. Boulder, CO: Lynne Renner Publishing. Gelb, A. (2010). Economic Diversification in Resource Rich Countries (IMF paper). Retrieved 22.07.2014. from: www.imf.org/external/np/seminars/eng/.../gelb2.pdf. Karl, T. L., Gary, I. (2003). The Global Record: Foreign Policy in Focus. Washington, D.C. & Silver City, N.M.: Interhemispheric Resource Center/Institute for Policy Studies, pp. 3542. Kurečić, P., Hunjet, A., Perec, I. (2014). Effects of Dependence on Exports of Natural Resources: Common Features and Regional Differences between Highly Dependent States. M-Sphere Conference Proceedings. Retrieved 10.10.2014. from http://www.msphere.com.hr/book-of-proceedings-2014. Leite, C., Weidmann, J. (1999). Does Mother Nature Corrupt? (IMF Working Paper). Washington, D.C.: International Monetary Fund. McMillan, M. S., Rodrik, D. (2011). Globalization, Structural Change and Productivity Growth (Working Paper 17143), Retrieved 18.07.2014. from: http://www.nber.org/papers/w17143. Offiong, D. (1980). Imperialism and Dependency. Enugu: Fourth Dimension Publishers. Olarinmoye, O. (2008). Politics Does Matter: The Nigerian State and Oil (Resource) Curse. Africa Development, 33 (3) 21-34. Page, J. (2009). Africa’s Growth Turnaround: From Fewer Mistakes to Sustained Growth (Working Paper 54). Washington, D.C.: Commission on Growth and Development. Robinson et al. (2005) Political Foundations of the Resource Curse (Manuscript). Cambridge, MA: Harvard University. Ron, J. (2005). Paradigm in Distress? Primary Commodities and Civil War. The Journal of Conflict Resolution, 49 (4) 443-450. Ross, M. (2012). The Oil Curse: How Petroleum Wealth Shapes the Development of Nations. Princeton, NJ: Princeton University Press. Sachs, J. D., Warner, A. (2001). The Curse of Natural Resources. European Economic Review, 45 (4-6) 827-838. Watts, M. (2004), Resource curse? Governmentality, oil and power in the Niger delta. Geopolitics, 9 (1) 50-80. http://www.africanoutlookonline.com/index.php?option=com_content&view=article&id=191 6%3Anigerian-oil-production-corruption-and-its-effects-on-post-colonial-economy-ofnigerian&Itemid=54. Retrieved 02.09.2014. http://www.telegraph.co.uk/news/worldnews/africaandindianocean/10305000/Africaspopulation-to-double-to-2.4-billion-by-2050.html. Retrieved 03.09.2014. http://www.thenigerianvoice.com/news/35801/22/nigeria-at-50when-oil-runs-out.html. Retrieved 02.09.2014. http://www.photius.com/rankings/world2050_rank.html. Retrieved 03.09.2014. http://populationpyramid.net/nigeria/2050/. Retrieved 03.09.2014. http://en.wikipedia.org/wiki/List_of_countries_by_population. Retrieved 03.09.2014. http://data.worldbank.org/indicator/AG.LND.TOTL.K2. Retrieved 04.09.2014. http://data.worldbank.org/indicator/NY.GDP.TOTL.RT.ZS. Retrieved 05.09.2014. http://data.worldbank.org/indicator/NY.GDP.PCAP.PP.CD. Retrieved 07.10.2014. http://data.worldbank.org/indicator/SI.DST.10TH.10. Retrieved 09.10.2014. http://data.worldbank.org/indicator/SI.DST.FRST.10. Retrieved 09.10.2014. http://www.eia.gov/countries/index.cfm?view=reserves. Retrieved 20.07.2014. http://www.eia.gov/countries/index.cfm?view=production. Retrieved 21.07.2014. http://data.worldbank.org/indicator/SI.POV.2DAY. Retrieved 07.10.2014. http://data.worldbank.org/indicator/SI.POV.GAP2. Retrieved 10.10.2014. http://data.worldbank.org/indicator/SI.POV.GINI. Retrieved 10.10.2014.