2012 Downtown Revitalization Phase II

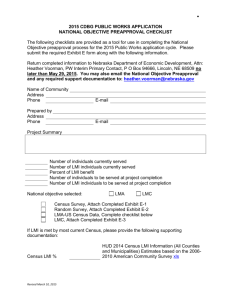

advertisement