2012 Downtown Revitalization Phase II

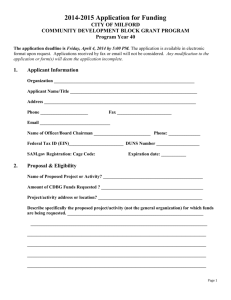

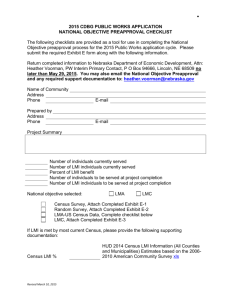

advertisement