White Paper and Supplements by Mr. George Farias

advertisement

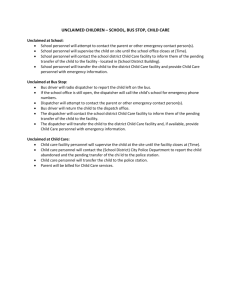

A WHITE PAPER TO GUIDE THE HB724 UNCLAIMED MINERAL PROCEEDS COMMISSION IN ITS HISTORICAL MISSION March 21, 2014 The work and mission of the HB724 Unclaimed Mineral Proceeds Commission appear to be complex, but in reality they are simple and attainable. Some general comments are provided first and then a specific approach is outlined to comply with the mandates contained in House Bill 724 to study unclaimed land grant mineral proceeds. The descendants of Spanish and Mexican land grants in South Texas maintain that Common Law, i.e. Texas Property Law, enacted in 1840, authorizes and gives them the right to file claims against mineral proceeds from unclaimed oil and gas wells whose owners have never been found, which are located in the respective land grants awarded their ancestors. The most important conclusion for the commission to reach is a major legal one, confirming and validating that these descendants do have a claim to those minerals under present law as written, that is, that it is intrinsic in the law. For the commission to reach this consensus may require an independent interpretation of the law because the law neither specifically authorizes this right, referring to “unknown heirs,” who now have become “known” by virtue of a declaratory judgment in state district court, nor does it specifically deny it. In a simplistic viewpoint, if the law does not prohibit something then it must be legal. To be realistic, the validation of the law might require an official interpretation. It is interesting to note the following statement in the state comptroller’s website, Window on State Government, “Unclaimed Property and Mineral Proceeds,” Item (6) states, “If the owner is deceased, you can provide the Unclaimed Property Division with documentation proving you are an heir of the reported owner. Such documentation includes copies of wills, or, if there is no will, a notarized Affidavit of Heirship is required for claims of less than $10,000 or less. Claims that exceed $10,000 require a court’s Determination of Heirship or a Small Estates Affidavit of Heirship, both of which require a judge’s signature.” (see Attachment A). No doubt, the declaratory judgment meets this requirement. This statement by the state comptroller indicates that her office has accepted formal legal heirship documents to pay claims for unclaimed mineral proceeds. If so, a precedent has been established. A review of payments by the comptroller for claims using legal heirship documents should confirm the claims of descendants of Spanish and Mexican land grants. Payment of such claims by the comptroller need not necessarily have been made to these descendants but might have been paid to other Texas citizens. For example, a person in the Permian Basin might have found out his great grandfather sold the land but not the minerals, left no will, and never formally passed title to his descendants. With heirship court documents, the person could claim his or her rights. It also seems very possible that a review of case law would discover legal challenges ruled in favor of the heirs. Since this is a state matter the Texas Attorney General is the person to provide an opinion, which normally takes six months to promulgate. I recommend that one or two lawyers from the attorney general’s office be assigned to the commission to obtain this opinion and as liaison personnel to assist in expediting the legal opinion process. This assignment of staff is in keeping -2-White Paper March 21, 2014 with Section 2(h) of HB724 that states, “On the commission’s request, the comptroller, or any other state agency, department, or office shall provide any assistance this commission needs to perform the commission’s duties.” These lawyers can also help scrutinize the related points of law for an opinion. The other legal points to be clarified include laws about transference of mineral rights when the contract is silent, current statutes of limitations, if any, the transference of minerals to owners under the Texas Constitution of 1866, the fiduciary responsibility of the state for unclaimed funds and its rights to interest on those funds (but not the principal), etc. It is not the job of the commission to do homework. That is the responsibility of staff. The idea of a subcommittee to do limited study is a sound one, which I refer to as an executive committee if it includes the chairman. One of the other legal points bears clarification. It has been stated that prior to 1866 Texas landowners did not own the mineral interests on the land, but many of the families of the original grantee were living on the land. However, Appendix III of the New Guide to Spanish and Mexican Land Grants in South Texas, Texas General land Office, 2009, “Sal del Rey” and Mineral Rights in Texas, pages 167-168, states, “This prompted a substitute ordinance with a broad and contrary effect. The substitute did not refer specifically to “Sal del Rey.’ Instead it proposed giving away the state’s mineral interest to existing surface owners. The effect was retrospective. Owners of land granted by the successive sovereigns (Spain, Mexico, Republic of Texas, and the state of Texas) before adoption of this amendment, would be given complete ownership of the minerals on their land. “ (see Attachment B) There seems to be confusion about what constitutes unclaimed mineral proceeds. I divide them into two categories. The first I call Type One and are abandoned royalties of title holders who have disappeared. These proceeds come back to the oil and gas companies, and every three years they come back to the state with an amount and name or best description. This is the fund maintained by the Texas Comptroller’s Unclaimed Property Division mixed in with traveler’s checks, bank accounts, and other property. The analysis of these funds indicate that most of the persons named will never be able to recover their property. The other unclaimed mineral proceeds are those I categorize as Type Two, those produced from unclaimed wells whose owners have never been found without a name attached. These funds come to the state after three years such as the Type One proceeds to be kept in trust by the state. If, as previously mentioned, the unclaimed wells have the initials of the original land grantee that practice enforces descendants’ claims. Oil and gas companies make extensive efforts to find rightful owners for obviously they need to legally drill for all the benefits of current revenues and payment of royalties to lease holders. They make exhaustive searches of county and other records. Failing there the oil and gas companies desire to stake a claim by drilling an unclaimed well at great expense. It is an investment in the future as they hope and pray that rightful owners will someday come forth. Drilling an unclaimed well requires a permit from a district judge representing the state, called a receivership hearing. In granting the request, the judge may require the oil and gas company to reserve 100% of the funds and pass them on to the state after three years or the -3- White Paper March 21, 2014 judge may require that the funds be deposited in a county bank account called a registry. If the rightful owners show up in the future, the oil and gas company can recoup its investment. In one case I reviewed, the petroleum company could keep 75% and grant the owners a 25% royalty. This ratio may not be uniform. This process raises several questions. First, does all the money kept initially by the drilling company or held by the county find its way ultimately to the state? Second, does the state monitor these wells, their units and dollars of production, to insure all funds are paid in? Third, what controls does the state have to insure that all the monies find their way to state coffers? As a former auditor, a major part of my study was to determine if a company had what are called good internal controls. The Texas Railroad Commission has all the records and an analysis of their data should show the number of unclaimed wells and their units and dollars of production. From this data the state could set up an accounts receivable for each oil company. Fourth, are the oil and gas companies sending in reports as required to corroborate the Texas Railroad Commission figures? If the state is accepting the money on faith, human nature will take the path of least resistance and retain the funds. Fifth, do state agencies have adequate staff to perform their duties, especially now with the increased production from the Eagle Ford Shale and forthcoming new mineral discoveries? Sixth, is the state enforcing the 1985 law and are the oil and gas companies meeting their agreements to abide by the law? The next important question to be raised here is to determine the amount of money that has been submitted to the state since 1985. The oil and gas companies and the state absolved themselves of all liabilities before then. The law mandates that these proceeds be deposited into the General Revenue Fund. What we do not know is what happens after that. Does the comptroller’s unclaimed property division handle these funds or do they go directly to another department? Is there a large escrow account holding the fifty million dollars in trust pledged by Getty Oil and it’s forty-nine fellow plaintiffs to start a new fund, in addition to thirty-three years of production (since September 1, 1980 as per Compromise Settlement Agreement) or has the state appropriated and budgeted the funds for other state needs? If so, it questions the fiduciary responsibility of the state, which can be corrected currently by starting to deposit Type Two mineral proceeds in a trust account that is visible to all. The question then must arise as to why there are so many wells with no owner and no name attached. The answer is simple. The land grantee and his or her family never sold or otherwise conveyed these mineral interests. The possibility that someone will show up with title in hand registered in a county that he or she is the owner of a certain unclaimed well is remote. In most cases, therefore, the descendant heirs maintain that the ownership is still in the estate of the land grantee, that the rights are still in the family, and the descendants are “de facto” owners. Webster defines de facto as ” in reality or fact, serving a function without being legally or officially established, or in practice not necessarily ordained by law.” On July 8, 2008, my first declaratory judgment was approved by the late 229 th District Judge Ricardo H. Garcia for the Jacinto de la Peña land grant in Zapata County. During the proceedings Mrs. Eileen McKenzie Fowler, my attorney, asked Judge Garcia if, in his opinion, -4- White Paper March 21, 2014 the heirs had a right to these unclaimed minerals. He said, “There is no doubt about it.” It is in the record. This was one judge’s opinion but from a distinguished jurist with a long résumé. This was encouraging to me and confirmed what we had been told by Mrs. Fowler. As she mentioned in her prior report, this was also the opinion of Houston 157 th Civil District Court Judge Felix Salazar and her former law partner, described posthumously as a “trailblazer.” He had a major role in kicking off our campaign. Mrs. Fowler and Judge Salazar consulted with other Houston lawyers for assistance in designing a workable plan to bring justice long-delayed and long-denied to South Texas families. There are some misconceptions that need clarification about our cause: 1. That our claim will infringe on the rights of title holders. That is incorrect as they have full legal rights and contracts with oil and gas companies, many of them generating lucrative royalties. Our HEIRS brochure on the front page states this very emphatically so that there is no misunderstanding. As previously stated, we have no claim on land as the state laws of adverse possession are clear about this. 2. That our descendants will become wealthy by filing claims. Except for a lucky few that will not be the case. The basic formula will be based upon the amount of production and the personal percentage interest each claimant has to the whole base of descendants of that grant. If I am one of a hundred living descendants (called primaries), my declaratory judgment would show that I can only get 1%. If there are thousands of descendants on my grant, my percentage goes down. I can only claim my share and no more. However, we are claiming thirty-three years of back production and for future production, so the sums received may be slightly more than modest. These funds would be important, nonetheless, as many descendants are on retirement incomes or are unemployed. 3. That the state escrow funds will be compromised or depleted. That will never happen. Oil and gas revenues are increasing and the funds will be stimulated. More importantly, the majority of claimants , here also, will never come forward. Even though thousands have joined our cause, there are hundreds of thousands and perhaps millions who will never come forward. The monies are there in perpetuity, if and when any descendant comes forward. Our experience is that most descendants do not know their ancestry, they have other personal priorities, and many are simply not interested. 4. That the oil and gas companies are obligated to the heirs certified in court as legitimate descendants by a declaratory judgment. Not so. The oil and gas companies, under the law, are obligated to the state for deposits of unclaimed funds. Their direct obligations are to title holders who have leases. Any noted problems are between them. The state, in turn, under property law, is obligated to the descendants for payment of unclaimed minerals. Descendants look to the State of Texas for justice. I believe with the help of the commission a win-win situation can be achieved. Descendants should have no adversaries in claiming their rights. The work of the commission will guide the state to make improvements. It was correctly stated previously that it is not the commission’s -5- White Paper March 21, 2014 responsibility to audit or correct noted deficiencies in the state system. That is the work of state agencies and the legislature. However, in the process of its work and hearing testimony from different parties, the commission can make recommendations that will have substantial weight. The commission’s ultimate work will benefit the state, the oil and gas companies, always in need of good public relations, the title holders, and ultimately descendants who have been disenfranchised. All citizen of Texas will benefit from the commissions deliberations and conscientious conclusions. The HEIRS Committee under Mrs. Eileen McKenzie Fowler tried to amend the law in 2013 similar to the HB2611 bill in 2011 spearheaded by Mr. Al Cisneros that did not pass. Representative Ryan Guillen would not sponsor it again because he said he did not have the votes, and it would not pass. At the time we found out that he and his staff had filed HB724. The HEIRS Committee had no input in writing the bill. Representative Guillen said that if he sponsored a bill recommending a commission to independently review the matter, it had a better chance of passing. At that point Mrs. Fowler’s clients mobilized to support the bill and wrote their state representatives and senators in support. Her group of client descendants (twenty thousand of whom perhaps twelve thousand are registered voters) is the largest, and their letters, calls, and emails were a deciding factor in its passage. I am certain other descendants perceived its value and advocated as well. Mr. Al Cisneros and his colleague and friend, former Senator Hector Uribe, also had a significant impact with their work and expert testimony getting it out of the state house of representatives committee. There was a concerted effort in the Senate to kill the bill but was saved by District 21 Senator Judith Zaffirini from Laredo. It was her skill, perseverance and long service to Texas which outmaneuvered those bent on its destruction. Our group also had the help of the HEIRS committee of clients headed by Mrs. Fowler, Mrs. Rita Lopez Tice, business owner from Laredo, Mr. Miguel Alonso “Al’ Martinez, business owner from Corpus Christi, Ms. Cecilia Gallardo Vallejo from San Antonio now a case manager for Mrs. Fowler in La Porte, and our lobbyist Mr. Jimmy Willborn, all descendants. Mr. Willborn was very instrumental in our success in his visits to Austin. He is a former police officer, past president of the San Antonio Police Officers Association, and a former Bexar County constable. He and his wife have worked tirelessly over the years in support of legislation to benefit peace officers in their critical and dangerous work. He also has the added distinction of having been Director of the Texas Narcotics Control Program under former Governor Ann Richards. We are indebted also to the other sponsors of the bill, Texas House of Representative members, Abel Herrero District 34, J.M. Lozano District 43, Roberto D. Alonso District 104, Philip Cortez District 117 and in the Senate 20th District Senator Juan “ Chuy” Hinojosa. The bill passed with one nay vote in the House of Representatives and three nay votes in the Senate. Representative Guillen called this a “landmark” bill. It is, in my estimation, the most significant law regarding property law and oil and gas legislation since 1985. It was a minor miracle. It is an old truism that if you want to pass a bill In Austin, you need money and power. We had virtually no money, but we did have power in the thousands who wrote their representatives and senators. For certain there is some conflict and discord among the -6- White Paper March 21, 2014 descendants regarding the progress and the avenues being followed, but all are united in seeking the same remedy. HB724 seems to have passed, I believe, because the legislature saw this commission as coming into being at a very critical time. The commission’s work has higher implications due to the revenues that are at stake with burgeoning oil and gas explorations. No doubt the legislature felt it would be a great opportunity for a responsible and diverse professional group to help move Texas forward into the 21st century. To review this matter and to have a broader picture, I recommend invited testimony from the Texas Railroad Commission, The Texas Oil and Gas Association, a district judge who issues unclaimed well permits, or, in the alternative, a lawyer who works full-time finding rightful owners. Carroll Lake and Associates in Kenedy, Texas, employ fifty lawyers for this purpose, mostly doing work for Marathon Oil Company. Perhaps one of their lawyers could testify. To get to the heart of the matter I am listing the individual mandates of HB 724 and the resource necessary to comply: (A) Section 3(1) the amount of unclaimed original land grant proceeds delivered to the comptroller that remain unclaimed on December 1, 2014. Source: The state comptroller’s office can verify the Type One unclaimed mineral proceeds from their data base by breaking down how much are unclaimed mineral proceeds from title holders separate from bank accounts, travelers checks and other property. This is for information and has no significant bearing for most descendants. Type Two Unclaimed mineral proceeds will be more difficult to determine since the law apparently only requires the state comptroller to keep records for ten years. An analysis by the comptroller can be done on unclaimed mineral proceeds that have been received from oil and gas sources from all property in Texas for the period. Perhaps, they will be able to break down how much came from the land grants. However, while not comprehensive it will provide an idea of what has been received and what should have been deposited in an escrow account. (B) Section 3(2) recommendations for efficient and effective procedures under which the state may be required to (A) determine the owners of the proceeds; (B) notify the owners of the proceeds; and (C) distribute the proceeds to the owners. Source: Title holder owners of the proceeds cannot be found as oil and gas companies have been unable to do so. What the commission can do is validate that the descendants of the original grantee have a vested right and are “ de facto” owners. Notification can be done through their respective lawyers, but it will not be possible to notify all eligible. The proceeds can be distributed in the same fashion. Section 3(3) proposed legislation necessary to implement the recommendation made in the final report. Source: Mrs. Fowler in her report on February 28, 2014, included for the public record proposed amendments to the Texas Property Law, if needed, to make the law more inclusive but should not be necessary to validate claims. Section 3(4) any administrative recommendations proposed by the commission. -7-White paper March 21, 2014 Source: The testimony and facts gathered during its proceedings will result in natural recommendations to the state. Section 3(5) a complete explanation of each of the commission’s recommendations Source: A task of the writing of the report. It is worthy to note in closing that payment of claims will, to some degree, stimulate the Texas economy. The monies will come back to the government in federal Income taxes and state sales, gasoline, and other taxes. The money will find its way back to Austin in the end. Mr. Lance K. Bruun, commission chairman, stated correctly at the first meeting on January 31, 2014, that it is not the responsibility of the commission to hear past grievances. However his patience and that of the commission in allowing public testimony about past injuries to South Texas families was commendable because it revealed that our cause is not a perfunctory one but deeply rooted in tragic events experienced for over a century. Recognizing the past, the descendants look forward to the future and the great opportunity this forum represents for relief. In conclusion, the descendants seek accountability and justice by the equitable distribution of oil and gas revenues. It is hoped that these facts, opinions, and ideas will guide the commission in its very momentous task. I would be pleased to lend support as needed and appreciate the willingness of the commissioners to serve and to undertake this historical mission. ________________________ Signed _________________________ Date Biographical Note: George Farias is a retired executive director of a community mental health center in Bexar County. His hobby is ancestral study and U.S. Borderlands history and is an online retailer of books in these subject categories. He is a writer of family history books and genealogical and historical essays. His ancestors had twelve grants in South Texas containing 97,918 acres. Six of these grants have good gas and oil production, and he has been certified for three of those as a legitimate heir by declaratory judgment. He joined Mrs. Eileen McKenzie Fowler’s program in 2006 and is member of her HEIRS committee. He is also vice president of The Land Grant Justice Association, Inc. SUPPLEMENT #1 DATED MAY 19, 2014 TO A WHITE PAPER TO GUIDE THE HB724 UNCLAIMED MINERAL PROCEEDS COMMISSION IN ITS HISTORICAL MISSION March 21, 2014/April 25, 2014 TOPIC: DEPOSITS OF MINERALS FROM UNCLAIMED WELLS. My complaint on April 25, 2014 about deposits into the Texas General Revenue Fund of minerals from unclaimed wells, appropriated for state expenditures, was not to imply any malfeasance on the part of the state. I realized after my presentation that Mr. Jim Sheer confirmed that these monies were being appropriated for expenditures but a reserve is set aside for timely payment of claims. I am sure all descendants have no complains that the money is being used for education, infrastructure, for fighting crime etc. Our concern is the manner in which it is done and the lack of transparency. My recommendation is, initially, a simple accounting and fiduciary procedure. After deposit into the Texas General Revenue Fund the money can be transferred to a trust fund to be managed by the Comptroller’s Unclaimed Property Division separate and apart from the other property described. I understand the state is entitled to the interest earned from the trust. The interest can be used to hire additional staff to supervise the fund, and for other administrative costs, as it grows and as claims are processed and disbursed. This fund can be visible to the public in the same fashion as the other types of unclaimed property. I believe the fund will increase dramatically. Assume, for example that it reaches three billion dollars and the state is facing a budget shortfall of 2 billion. It does not make sense to ignore this resource. By legislative action the funds can be borrowed to balance the budget. The balance sheet of the fund will now show one billion dollars in cash and investments and a 2 billion dollar loan to the state. Of course, in directly appropriating the funds, the state loses the interest earnings but I understand this is a tradeoff. With a little patience the state can earn interest and utilize legally any available trust funds. The loan can be interest free. In this transparent method everyone benefits and the use of the funds are maximized. I hope the HB724 commission will consider this recommendation and include it in their final report. George Farias May 19, 2014 SUPPLEMENT #2 DATED MAY 25, 2014 TO A WHITE PAPER TO GUIDE THE HB724 UNCLAIMED MINERAL PROCEEDS COMMISSION IN ITS HISTORICAL MISSION March 21, 2014/April 25, 2014 TOPIC: RESPONSE TO MEMORANDUM FROM COMMISSIONERS TRACE BURTON, DONATO RAMOS JR. AND JAIME RANGEL DATED APRIL 25, 2014 ON LEGAL ISSUES RELATED TO THE OWNERSHIP OF MINERALS IN TEXAS Since I am not an attorney I cannot formally respond to this memorandum about mineral ownership in Texas. However, I can respond from a layman’s point of view and I will ask our legal advocates to respond later from a professional standpoint. After reviewing the memorandum and thinking about the impact on our claims from mineral production from unclaimed wells, I have concluded that these issues are irrelevant to our mission as follows: 1. Ownership of Minerals to Texas Citizens per Constitution of 1866. As stated previously in testimony, the children and grandchildren of the original land grantee were living on the lands and the rights were thus awarded to the family of the grantee. The first major oil discovery was in 1894 in Corsicana and later in the South Texas land grants. Our families have full rights to those minerals and some descendants still own parcels with title and are receiving royalties. Therefore it does not make any difference what happened before 1866 whether the state owned it or gave it retrospectively. 2. Transfer of Minerals by Contract. In the Heirs brochure in the third panel under “Unclaimed Surface and Mineral Estates,” the opening paragraph says. “Normally under Texas property law when a person sells a piece of land and no mention is made of the mineral contained, the rights pass on to the purchaser. In the case of land grants, if no mention is made of the transference of minerals by sale or conveyance of the land, the minerals are retained by the seller and pass on to the heirs.” In the brochure I synthesized the research of others and this passage was taken from the website of the Lands Grant Justice Association from their history section as footnoted. I believe the author of this legal interpretation is Attorney Don Tomlinson and you may question him on this when he testifies June 27th. Since this statement relates to scrutiny of a contract it has no relevance to our claims because the reason unclaimed wells exist is that no contract can be found. There is no paperwork to determine ownership. These issues, then, have no bearing on our claims. George Farias May 25, 2014 SUPPLEMENT #3 DATED JUNE 9, 2014 TO A WHITE PAPER TO GUIDE THE HB724 UNCLAIMED MINERAL PROCEEDS COMMISSION IN ITS HISTORICAL MISSION March 21, 2014/April 25, 2014 TOPIC: ASSISTANCE TO THE UNCLAIMED LAND GRANT MINERALS COMMISSION BY THE COMPTROLLER OR ANY OTHER STATE AGENCY PER SECTION 2(h) OF HB724. Section 2(h) of HB724, A Bill to be Entitled an Act relating to the creation of a commission to study unclaimed land grant mineral proceeds, states “On the commission’s request the comptroller or any state agency, department or office shall provide any assistance the commission needs to perform the commission’s duties. “ It should be clear to every state agency that this is a mandate of law and it is unthinkable that any agency would refuse the commission’s request for data, special analyses, and reports. I recommend the following required data be obtained, at a minimum, from the following agencies for the commission to make sound recommendations to the legislature: A. THE TEXAS STATE ATTORNEY GENERAL 1. Opinions on all pertinent points of law. 2. The most important opinion is to corroborate that under present property law legally designated descendants of Spanish and Mexican land grantees have a right to file claims for mineral production from unclaimed wells. B. THE TEXAS STATE COMPTROLLER 1. The total amount of revenue deposits to the General Revenue Fund from unclaimed wells from September 1, 1980 to December 31, 2013. 2. A breakdown of the deposits by land grant or county. 3. A report on the deposit and disposition of the fifty-million dollar fund established by the Getty legal agreement. 4. An analysis of current claims paid on the basis on heirship establishing a precedent for claims by land grantees. C. THE TEXAS RAILROAD COMMISSION 1. Total unclaimed oil and gas wells in operation in the state. 2. Total unclaimed wells in operation by land grant. 3. Total production in units and dollars from unclaimed wells from September 1, 1980 to December 31, 2013. Should the state agencies resist these requests, assistance can be requested from State Representative Ryan Guillen and the other legislative sponsors of HB 724. In addition the Public Information Act, Texas Government Code Chapter 552, can be invoked. George Farias June 9, 2014 SUPPLEMENT # 4 DATED JULY 21, 2014 TO A WHITE PAPER TO GUIDE THE HB724 UNCLAIMED MINERAL PROCEEDS COMMISSION IN ITS HISTORICAL MISSION MARCH 21, 2014/APRIL 25, 2014 TOPIC: COMMISSION MEETING OF JUNE 27, 2014 AND PROPOSED DRAFT OF LEGISLATIVE REPORT. At the meeting of June 27, 2014, the commission formed a committee to write a draft of the final report, required by the HB724 legislation, to be presented at their next meeting on September 12, 2014. Apparently, the commission intends to make this their final meeting. It is inconceivable how any credible report can be issued when members have failed to conduct a single amount of independent research. The commission has been hostile and argumentative to the land grantee descendants and their representatives who have provided important information. It is the responsible role of the commission to investigate facts to corroborate testimony, or nullify it, with a conscientious review of information that can be easily obtained from state agencies as authorized by HB724. The commission has no excuse or sensible reason for a perfunctory function of such an important and substantive task. The commission has completely declined to utilize the tools made available by legislation. What is more disconcerting is that the commission left out Mr. Al Cisneros from the report writing committee, the only advocate we have on the commission. The descendants were allotted two other advocates on the commission but instead the process was subverted and two other members were chosen who have proven themselves to be inimical to the interests of the heirs. The whole purpose of the commission seems to deliberately make the claimants look ridiculous and to block their efforts. In fact, just the opposite has happened. By the sloppy and malicious work of the commission our base has been energized. We do not intend to fail to obtain the rights due every Texas citizen and we will ultimately prevail. We are at the point of no return and as one speaker said on June 27th, “we are here and we are not going away.” It is an unfortunate characteristic of Hispanics that they fail to unite on many issues to improve their lot and instead drag themselves down with petty bickering, internecine warfare, and jealousies. The public saw a classic example of this when the commission allowed a disgruntled client of Mrs. Eileen McKenzie Fowler to insult her repeatedly wasting everyone's valuable time. Any man who would consider himself a gentleman would never attack a woman, publicly or privately, especially in such a vicious manner. I was remorseful, embarrassed, and ashamed that I did not interrupt the meeting to call out that this vengeful man, with his invectives, was out of order. However, every man in the room from the commission members to the participants was diminished in this humiliating process. The chairman of the commission stated at the first meeting in January that the grievances would not be permitted in testimony. Yet the attacker was given the floor for over an hour. It was a low point in the deliberations of this commission and it is a black eye to all the honorable people working on this very important and historical matter. It took a courageous non-Hispanic lady lawyer to bring our fractious group together with the added advantage of forming a voting bloc of 15,000-20,000 eligible voters. This is the American way to obtain results and we will vote public officials out of office in the future who fail to represent all the people instead of the privileged few who need no protection. If it is the intent of the commission to whitewash this matter, first of all, it will be held, for sure, in contempt of the legislature which voted almost unanimously for passage of HB724. Page -2- Supplement # 4 July 21, 2014 Secondly, it will be considered a profound blemish on the professional and personal reputations of the commission members. Such a disastrous situation should be avoided at all costs. No one should be hurt in the process of authorizing claims as those monies do not belong to anyone but the rightful owners of unclaimed mineral production from wells located in ancestral properties of the descendants. As previously stated in my testimony everyone gains by managing oil and gas revenues properly and in accordance with the law. The Commission also invoked, on June 27th, the case of Clark v. Strayhorn as justification for the state to spend unclaimed mineral funds. That is incorrect, as the case only confirms that the state has the right to keep all interest earnings on the unclaimed minerals principal dollars. Yet the state fails to set up a legal trust fund for unclaimed minerals and is losing millions of dollars in Interest earnings by indiscriminately spending the money outright. The millions could be used to fund more auditor positions for the comptroller and improve the oversight of oil and gas companies and county registries to insure that all monies owed the state find their way to Austin coffers. The direct spending of unclaimed minerals revenues is illegal and must stop. Supplement # 1 to my White Paper details the establishment of a trust fund that benefits all, allowing the state to borrow the principal by legislative approval to fund other state needs. I urge the commission to reconsider their perilous course. If all the previous testimony and documents are to be disregarded, the commission can examine carefully the legal basis for our claims as stated in excellent fashion by Mrs. Fowler in her “Response to Memorandum” presented to this body on June 27, 2014, dated June 25, 2014. The subject was “The (Fowler) Descendants’ Response to Memorandum on “Legal Issues related to the ownership of minerals in Texas” submitted to the Commission by Commissioners Trace Burton, Donato Ramos Jr. and Jaime Rangel.” In her memo is the complete justification for the state to accept our claims. The Commission’s work does not expire until June 1, 2015. There is much work to be done for a proper and legal outcome and I respectfully request that the commission reconsider their aimless course and work hand in glove with the legislature and the land grantee descendants for an honorable and forthright solution to the distribution of unclaimed mineral proceeds. George Farias July 21, 2014 SUPPLEMENT # 5 DATED JULY 28, 2014 TO A WHITE PAPER TO GUIDE THE HB724 UNCLAIMED MINERAL PROCEEDS COMMISSION IN ITS HISTORICAL MISSION MARCH 21, 2014/APRIL 25, 2014 TOPIC: PROPOSED LEGISLATIVE COMMITTEE TO REPRESENT THE INTERESTS OF THE DESCENDANTS OF LAND GRANTEES. Land issues have been a historic problem in New Mexico with the descendants of Spanish and Mexican land grantees accusing the state and the federal government of appropriating their ancestral lands illegally. Minerals seem to be a minor issue and may belong to the state. In 2003, The New Mexico Legislature formed The Interim Land Grant Committee to advocate for the descendants and to protect their interests. Since then various laws have been enacted to strengthen the legal rights of descendants. In addition, an administrative unit of the state was formed called The Land Grant Council with numerous functions but apparently to also serve as the support unit for the legislature. Information on the committee and council can be found on the Internet. To locate, Google Interim Land Grant Committee+New Mexico. It is proposed that the HB724 Commission recommend that the Texas Legislature form such a committee to similarly protect the interests of citizens whose ancestors were land grantees including descendants from Spanish and Mexican land grantees. Since the HB724 Unclaimed Mineral Proceeds Commission will be abolished June 1, 2015, the proposed legislative committee would assume the responsibilities of the commission, regardless of the outcome of the present study. Instead of an administrative unit to support the legislative committee, at an additional cost to the state, it is proposed that The Land Grant Justice Association Inc., a 501 (c) (4) non-profit organization, (TLGJA) assume the support role. This aspect of the legislative unit would be predicated on the inclination of TLGJA to participate and by approval of their board of directors. It is proposed, that if TLGJA assumes this responsibility, it will represent the interests of all land grant descendants regardless of their legal representation. A visit by a delegation of Texas legislators to their counterparts in New Mexico to study the Interim Land Grant Committee and its operations might be in order. George Farias July 28, 2014 SUPPLEMENT # 6 DATED OCTOBER 6, 2014 TO A WHITE PAPER TO GUIDE THE HB724 UNCLAIMED MINERAL PROCEEDS COMMISSION IN ITS HISTORICAL MISSION MARCH 21, 2014/APRIL 25, 2014 TOPIC: PROPOSED DRAFT OF THE UNCLAIMED MINERAL PROCEEDS COMMISSION PRESENTED AND REVIEWED AT THEIR COMMITTEE MEETING OF SEPTEMBER 12, 2014. The draft report of the HB724 Commission is welcome for the public to review its contents and provide feedback for an improved final product, and commendable as this is a very important step in the process. I have several concerns, comments, and recommendations after an initial personal review and the review by the commission of its major sections during the September 12th meeting. The draft report is lengthy and cumbersome. Sixty pages, even for a final report, is excessive. I doubt if any legislators, with their busy schedules, will take the time to read it in its entirety. Perhaps a summary report of 3-5 pages with conclusions and separate exhibits would be preferable. For example, Conclusion Number One would refer to HB724 Mandate #1, see Exhibit A for details, Conclusion Number Two, HB724 Mandate # 2, See Exhibit B, and, so on. What readers will seek is the bottom line of the report addressing HB724. Everything else is superfluous. The report should steer away from irrelevant content and especially continuing personal criticisms bordering on slander. The continued misinformation about attorney Eileen McKenzie Fowler and her program is deplorable and unprofessional and serves only to harm her, her clients, and the esteem of commission members. One criticism concerns her fees and the patently false notions that she has amassed millions and abused her clients. The facts will show exactly the opposite. Initially, ten years ago, Mrs. Fowler, was charging $ 100-$200 per person to obtain a declaratory judgment. When I joined her program in 2006 the fee was $ 250.00. Today I believe it is $ 375.00. I paid $ 250.00 for my first declaratory judgment. If I never collect a single mineral royalty the judgment itself is of immense value to me and my descendants and worth a lot more than what I paid for it. It takes hours of work to prepare for a court hearing. Some attorneys charge this much for one hour of consultation and may not even take the case. I read in the newspaper recently that an attorney in a high profile state case is charging $ 450 an hour perhaps being charged to taxpayers. I am not privy to Mrs. Fowler’s finances but as a former accountant, knowing what I paid, and since she noted a total of 11,000 clients adjudicated in our HEIRS brochure, I can estimate her annual budget. Assume that her average fee has been $300.00. Multiplying that rate by 11,000 produces a gross income of $ 3, 300,000. Divide that number by ten (10) years of operation and her average annual budget is $330,000. Divide that by 12 months and her monthly budget is $27,500. She has staff of four-five case managers who confirm genealogical data preparing and copying voluminous court Page -2White Paper Supplement # 6 October 6, 2014 documents. To that payroll with taxes, add rent, utilities, travel to various judicial districts, hotel, court costs, legal consultations, and administrative expenses. These details are private but one can readily see that what is left over for her as income Is significantly below what an average attorney of her experience would earn. Mrs. Fowler is in good standing with the Texas Bar Association, and in constant consultation with them. I would expect more respect and professional courtesy toward her, at least, by her legal colleagues. In addition, Mrs. Fowler has never promised her client millions, although statements can be misinterpreted. Perhaps the mention of the millions of dollars the State of Texas has misappropriated over 34 years gives some persons the impression that they will become wealthy. This is a personal misperception and not one that is promised or promoted. All HEIRS reports and other documents have informed clients that their recovery may be modest and that they have no claims if their land grants have no production. In my White Paper I noted the fact that our heirs would not become wealthy when we obtain the authorization to file claims. Another example of deficiency in the draft report is rehashing testimony that has no relevance. In particular I am speaking about the comment in the HEIRS brochure under “Unclaimed Surface and Mineral Rights,” about transfer of minerals title when the contract is silent on the matter. My White Paper Supplement # 2 explained that this clause is irrelevant because, in the minerals we claim, no contract has ever been found and that is why the wells are designated as “unknown”. This clause has not been proven right or wrong but to avoid further confusion we will reprint the brochure and eliminate this offending clause. One mandate that has been avoided by the commission is the total sum of unclaimed minerals deposited in the general fund and their disposition. The transparent fund (Type 1) of unclaimed royalties abandoned by their title holders is well recognized and does not need to be endlessly mentioned in deliberations and reports. What is lacking is the total sum of unclaimed minerals from wells with no name deposited by the state since 1980. (Type 2). While the monies have been spent, it is incumbent upon the commission to provide the legislature the total sums deposited during this period. The comptroller’s office is obliged to provide this data and I request it be presented to the commission at the October 24th meeting. The commission has requested numerous pieces of information from descendants to assist the process and now we, in turn, ask the commission to produce this important record of deposits from Texas as a whole. There are sections of the draft report indicating that there should be no valid claims in that this matter was settled 100 years ago. This is completely erroneous. This commission was created to recommend solutions to resolve this problem which remains an important and critical issue for land grant heirs. The commission should stop the obfuscation of issues by repeated references of how well Type I funds are managed by the comptroller’s office, and how much is paid out annually. In the main, this fund is meaningless for our cause and valuable time would be saved by mentioning this Page -3White Paper Supplement # 6 October 6, 2014 separate property only in passing. Mrs. Fowler has prepared information on the unclaimed wells by grant and the formula for distribution. She was denied to be put on the Invited testimony for the meeting of September 12th, but this information will be presented very soon to the commission. Mr. Bennie Bock was correct in stating that the formula for distribution of funds needs to be simple to be accepted. Mrs. Fowler’s formula, with some fine points, essentially takes the unclaimed mineral production since September 1, 1980 and divides it by the number of oldest living heirs , called primaries, for each land grant. This formula is also legally based on the laws of distribution and descent and is also mentioned in the Heirs brochure in the “Spanishlandgrants.com,” section. The legal basis for our claims is Common law. If the commission disputes this fact, we want to know, “ then who are the rightful owners?” We want this answered at the next meeting of October 24th. It was puzzling on September 12 th to hear statements that the heirs have no rights to unclaimed funds, yet there followed discussions about a formula for distribution. Much ado about nothing has been discussed about the exit of Judge David Peeples from hearing and approving declaratory judgments. His reasons are personal but he assigned ad-litem judges to hear Mrs. Fowler’s cases and hearings are being scheduled currently. The declaratory judgment is a valid legal process and one definitely required by the comptroller to pay claims. Statements were also made at the September 12th meeting that Mrs. Fowler has failed to obtain unclaimed royalties for her clients over the years. The blame lies with the Texas state bureaucracy, not with her. About five years ago she contacted the comptroller’s office and explained several initial claims she was about to file. A representative of the comptroller informed her that these claims could not be paid, that the law would have to be changed, and that the state had no money to pay these types of claims. First of all, the representative was incorrect in her first statement. Present law and the comptroller’s guidelines detail the steps to claim by heirship. The law does not need to be changed, but this led to the failed attempt in 2011 to amend the property law. The bill did not pass and apparently not necessary. Secondly, it was correct that the state had no money, because for over 34 years the state has balanced the budget on the backs of the land grant heirs, and in years past prior to 1985. However, as noted, the state has to stand behind its obligations and, if the money is gone, the state will have to find the necessary sums to pay our claims. Again, I explain this in the Heirs Brochure in the section “ The Claims Process and Current Barriers.” What the commission fails to grasp, or refuses to acknowledge, by not reading and understanding material presented, is that since our heirs group has no distinct title to unclaimed wells, it is impossible to match wells with Individual heirs. Our ancestors who obtained the grants had original titles. What is happening here is that a group of land grant heirs is laying claim to the oil and gas production in their ancestral lands of a group of unclaimed wells. This type of claim has never been considered or paid in the Page -4White Paper Supplement # 6 October 6, 2014 past. This is a new phenomenon (Heirs Brochure, “The Claims Process and Current Barriers”). What is required singularly to solve this problem is to obtain a formal legal opinion to confirm that the heirs are correct in their rightful claims under the law, an opinion this commission refuses to obtain. The solution is simple to clear this barrier. We do not have to engage in endless, immaterial, misleading and irrelevant points of view. Most of this commission’s work has been a waste of valuable time for the commissioners and the heirs who have also spent personal resources to travel to Austin. Truth is immutable. It never changes. and in time, in spite of artificial barriers, we expect to prevail in our claims. One advantage to this commission is that our claims are now in the public record. History will judge who is right and who is wrong here, but we cannot wait for the judgment of history. One other item merits a review and comment. Considerable time has been taken in testimony about the injustices to South Texas families in the past due to murders and theft of property. This is a separate legal issue and is not an issue the commission is charged with reviewing. Many families suffered injuries and those abusive acts, as my daughter, Diane, testified, created a pattern that has been passed down from one generation to the next permeating every aspect of our lives. If those persons can prove those illegal acts, that have no statute of limitation, they can seek restitution from the state. If ignored, lawsuits can be filed in federal court as the State of Texas has violated the Fourteenth Amendment of the U.S. Constitution numerous times. This constitutional amendment concerns the responsibilities of the state to protect the life and property of its citizens. Not only does the State of Texas have a miserable record of protecting the rights of South Texas families, the state condoned the illegal acts and agents of the state were complicit in many of these atrocities. Chairman Lance K. Bruun at the January meeting stated that the commission was not formed to hear grievances. I commended him for hearing these stories in spite of this rule but the rule should be enforced now rather than spending valuable time deflecting the unclaimed mineral issue. These historical crimes of murder and thievery are separate but related to the issue of minerals, the purview of this commission. In the instance of unclaimed minerals the state has been legally negligent as well. In spite of my disenchantment, I see a positive dawn in the state of Texas. Current generations, as has been noted, did not commit the aforementioned abuses. However, present day legislators and state officials have the power and the means to provide relief and ameliorate the excesses of the past. I am not naïve enough to think that bad habits and bad business practices can be easily changed in a governmental culture but I am encouraged that more persons of good will are coming into positions of leadership in our great state. The future bodes well for all Texas citizens as long as we stay informed, vigilant, and vote to demand our rights under the law. Finally, I repeat and emphasize my criticism of the commission disregarding the mandates of HB 724 by not employing staff members of state agencies to provide important data and not getting pertinent legal opinions from the Texas Attorney Page -5White Paper Supplement #5 October 6, 2014 General. ( White Paper Supplement # 3). It is not up to the HEIRS group to provide the commission all the information it needs to deliberate, although substantial material has been provided. The Commission must do its own independent research, and cannot finalize any credible report unless they do the work to support the claims of heirs or produce concrete and unassailable evidence to refute their claims. In the absence of not performing their specifically charged legal duty the commissioners run the risk of being in contempt of the legislature. Respectfully submitted, George Farías October 6, 2014