Answers

advertisement

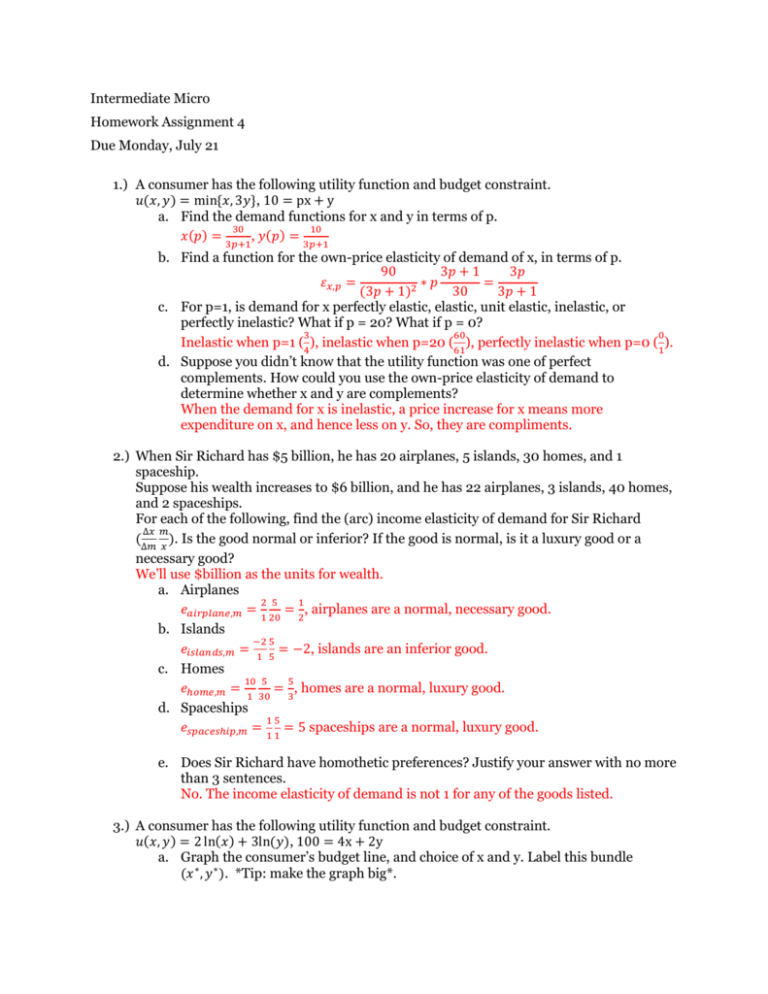

Intermediate Micro

Homework Assignment 4

Due Monday, July 21

1.) A consumer has the following utility function and budget constraint.

𝑢(𝑥, 𝑦) = min{𝑥, 3𝑦}, 10 = px + y

a. Find the demand functions for x and y in terms of p.

30

10

𝑥(𝑝) = 3𝑝+1, 𝑦(𝑝) = 3𝑝+1

b. Find a function for the own-price elasticity of demand of x, in terms of p.

90

3𝑝 + 1

3𝑝

𝜀𝑥,𝑝 =

∗𝑝

=

2

(3𝑝 + 1)

30

3𝑝 + 1

c. For p=1, is demand for x perfectly elastic, elastic, unit elastic, inelastic, or

perfectly inelastic? What if p = 20? What if p = 0?

3

60

0

Inelastic when p=1 ( ), inelastic when p=20 ( ), perfectly inelastic when p=0 ( ).

4

61

1

d. Suppose you didn’t know that the utility function was one of perfect

complements. How could you use the own-price elasticity of demand to

determine whether x and y are complements?

When the demand for x is inelastic, a price increase for x means more

expenditure on x, and hence less on y. So, they are compliments.

2.) When Sir Richard has $5 billion, he has 20 airplanes, 5 islands, 30 homes, and 1

spaceship.

Suppose his wealth increases to $6 billion, and he has 22 airplanes, 3 islands, 40 homes,

and 2 spaceships.

For each of the following, find the (arc) income elasticity of demand for Sir Richard

∆𝑥 𝑚

(∆𝑚 𝑥 ). Is the good normal or inferior? If the good is normal, is it a luxury good or a

necessary good?

We’ll use $billion as the units for wealth.

a. Airplanes

2 5

1

𝑒𝑎𝑖𝑟𝑝𝑙𝑎𝑛𝑒,𝑚 = 1 20 = 2, airplanes are a normal, necessary good.

b. Islands

−2 5

𝑒𝑖𝑠𝑙𝑎𝑛𝑑𝑠,𝑚 = 1 5 = −2, islands are an inferior good.

c. Homes

10 5

5

𝑒ℎ𝑜𝑚𝑒,𝑚 =

= , homes are a normal, luxury good.

1 30

3

d. Spaceships

15

𝑒𝑠𝑝𝑎𝑐𝑒𝑠ℎ𝑖𝑝,𝑚 =

= 5 spaceships are a normal, luxury good.

11

e. Does Sir Richard have homothetic preferences? Justify your answer with no more

than 3 sentences.

No. The income elasticity of demand is not 1 for any of the goods listed.

3.) A consumer has the following utility function and budget constraint.

𝑢(𝑥, 𝑦) = 2 ln(𝑥) + 3ln(𝑦), 100 = 4x + 2y

a. Graph the consumer’s budget line, and choice of x and y. Label this bundle

(𝑥 ∗ , 𝑦 ∗ ). *Tip: make the graph big*.

b. The price of x increases to 5. Draw the new budget line, and find and label the

consumer’s choice of x and y under the new budget. Label this bundle (𝑥 ∗∗ , 𝑦 ∗∗ ).

c. Graph a budget line through (𝑥 ∗ , 𝑦 ∗ ) with the slope of the new budget line. What

is m’ for this budget line?

𝑚′ = 110

d. On your budget line from part c, circle the bundles that you know will not be

chosen, according to WARP.

e. Solve for the compensated demand, and label it on the graph as (𝑥 𝐶 , 𝑦 𝐶 ).

f. What is the substitution effect, and income effect, on x?

Substitution effect= -1.2, income effect = -0.8.