colorado lottery*fy-10 strategic marketing planning outline

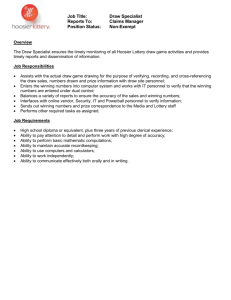

advertisement