General and Special Conditions

General Conditions

OCCUPANTS

VEHICLES

PRELIMINARY ARTICLE

This insurance contract is hereby established between NOSSA – NOVA

SOCIEDADE DE SEGUROS DE

ANGOLA, S.A., hereinafter referred to as the Insurer, and the Policyholder identified in the Specific Conditions.

This insurance contract for Occupants of Vehicles conforms to what is laid down in the General, Special and

Specific Conditions of this Policy, in agreement with the statements made in the proposal that served as the basis and of which it is an integral part.

CHAPTER I

DEFINITIONS AND OBJECT OF

CONTRACT

ARTICLE 1 – DEFINITIONS

For the purpose of this contract the following are taken to mean:

Insurer: The agent legally authorised to sell the Occupants of Vehicles insurance, and who, with the

Policyholder, underwrites this contract.

Policyholder: The person or entity that signs the insurance contract with the

Insurer, and who is responsible for paying the premiums;

The Insured Person: The person in whose interest this contract is signed with the Insurer of the person (Insured

Person) whose life, health or physical integrity is insured. According to the type of insurance selected, Insured

Persons are considered to be: a) Family members without driver: i) The spouse, children, parents or persons adopted of the Insured Person or the driver of the vehicle; ii) Other relatives or kin, up to

3 rd

. degree, of the Insured

Person or the driver of the vehicle, provided they live with the same in shared economic circumstances; iii) The legal representatives of companies and the

Managing-Partners of

Policyholder companies, when performing their iv) duties;

Employees, salaried workers or representatives of the Policyholder, when performing their duties; v) The Policyholder, when a passenger; b) Family members with driver:

The persons referred to in a) and the driver of the vehicle; c) All occupants.

Beneficiary: The individual or company benefiting from anything paid by the Insurer that arises from the contract;

Policy: The document that authorises the contract signed between the

Policyholder and the Insurer, bearing the General and Special Conditions, if there are any, and the Specific

Conditions agreed;

Additional Amendment: A document that authorises a change made to a

Policy;

Total Premium: Price paid by the

Policyholder to the Insurer for contracting the policy;

Return: Part of the insurance premium already paid returned to the

Policyholder;

Road Accident: An accident occurring exclusively as a result of driving on roads, whether the vehicle, described in the Specific Conditions, is mobile or not, during vehicle transport, the entry or exit for the same vehicle and the active participation, in the course of travel, of small or performance-related repair jobs to the same vehicle;

Accident: An event or series of events resulting from the same cause likely to bring the guarantees of the contract into action.

ARTICLE 2

– OBJECT OF

CONTRACT

1.

The contract guarantees, should a road accident occur on Angolan territory, the payment of capital or indemnities due to: a) Death or Permanent Disability; b) Treatment costs.

2.

Capital due to Death is only due if death occurs within one year counting from the date of the accident.

3.

Capital due to Permanent

Disability is only due if this is clinically diagnosed within one year counting from the date of the accident.

4.

Capital insured in cover against the risk of Death or Permanent

Disability, is not cumulative, so that if the Insured Person dies as a result of the road accident, the sum of the capital due for Permanent

Disability, that would have been attributed or paid for the same accident, is deducted from the capital due for Death.

CHAPTER II

EXCLUSIONS, DECLARATION

OF RISK

AND INCONTESTABILITY

ARTICLE 3 - EXCLUSIONS

1.

Excluded from the insurance cover are accidents caused as a result of: a) Use of motorcycles or similar

(motorised cycles), fourwheeled motor cycles and velocipedes with an auxiliary engine; b) Natural disasters, such as cyclones, earthquakes, tsunamis, and other disasters with similar effects as well as lightning; c) Strikes, labour unrest, uprisings and/or a change in public order, acts of terrorism and sabotage, insurrection, revolution, civil war, invasion and war against a foreign country (declared or not) and hostilities between foreign nations (whether a declaration of war has been made or not) or warlike acts caused directly or indirectly by these hostilities; d) Explosion or any other phenomenon directly or indirectly related to nuclear fission or fusion, as well as the effects of contamination; radioactive e) Sports trials, races, rallies, or during the respective training for the same; f) Action or omission on the part of the Insured Person influenced by the use of alcohol or alcoholic beverage leading to a blood alcohol level of over

0.5 grams per litre and/or the use of drugs other than those prescribed medically, or when the Insured Person is unable to control his/her acts; g) Practice of facts that result in intentional, guilty acts or omissions or serious negligence on the part of the Insured

Person, such as suicide or attempted suicide, including risky practices, dares or challenges; h) Practice of facts that result in intentional, guilty acts or omissions or serious negligence by the Beneficiary against the

Insured Person, in that part of the benefit relative to the same. i) Any action or intervention carried out by the Insured

Person on him/herself.

2.

Also excluded are accidents that occur when the vehicle is driven by a person without the correct driving licence or during the possession or abusive use of the vehicle.

3.

Also excluded are: a) Hernias of any nature, varicose veins and their complications and lumbago; b) Accidents or events that produce only psychic effects; c) Illness of any nature, unless proved by unequivocal, undeniable medical diagnosis, that is a direct result of an accident covered. But never, in any case whatsoever, will the following disorders be covered:

- Acquired Immune

Deficiency Syndrome

(AIDS) and any form of hepatitis;

- Sickle cell disease anaemia;

- Heart attack not caused by external physical trauma;

ARTICLE 4 – DECLARATION OF

RISK

1.

The Policyholder and/or the

Insured Person may, even temporarily, replace the vehicle described in the Specific

Conditions, provided the

Insurer is notified prior to doing this, indicating the registration number, and other features of the vehicle.

2.

Should such an alteration increase the risk, the Insurer reserves the right to suggest to the Policyholder, new conditions for maintaining the contract, or to terminate the contract by registered letter, or by any other means with written proof, 15 days in advance counting from the date on which it is sent.

3.

In being notified of the new conditions, the Policyholder may, in the following 30 days, terminate the contract, by registered letter, or by any other means with written proof.

4.

In the case the vehicle indicated in the Specific Conditions is sold, the Policyholder and/or the Insured Person should immediately notify the Insurer of the fact, and the Insurance

Contract ceases to have effect at 24 hours on the day of sale, unless the Policyholder and/or the Insured Person have expressly decided to use the facility granted to them in number 1 of this article.

5.

The Policyholder and/or the

Insured Person should notify the Insurance in advance of all changes, namely those that may affect risk assessment. Should an accident occur that is in some way caused by a change in risk that has not been declared, or has added to the risk, the Insured Person will be compensated only in that

proportion of the premium paid for the premium due in relation to the new risk and the first two premiums are calculated based on the Rate in force when the accident occurs. However, the

Insurer is not obliged to pay the indemnity, if it can prove that it would never have accepted the contract had it been aware of the actual risk on the date of signing the contract.

ARTICLE 5

–

INCONTESTABILITY

1.

This contract is based on declarations made in the respective proposal, made by the Policyholder and/or the

Person Insured, in which all objective and subjective facts and circumstances must be mentioned truthfully, of which they are or should be aware and that are likely to be considered in the risk assessment, or that may influence acceptance of the same insurance contract or in the correct determination of the applicable premium.

2.

Should the Policyholder and/or the Insured Person fail to mention, by omitting or incorrectly declaring to the

Insurer any facts or circumstances referred to in n°

1 of this article, the latter may, within the 15 days after becoming aware of such an omission or incorrect declaration, decide to terminate the contract or to amend it, establishing new conditions.

3.

Should the Insurer decide to modify the contract, the

Policyholder has 15 days, counting from the date of receiving this notification, to decide whether to terminate the contract. In not exercising this right, it is assumed that the Policyholder agrees with the modification of the contract, with new conditions established by the Insurer.

4.

Should the Policyholder or the

Insurer decide to terminate the contract, the former has the right to be reimbursed for the premium already paid, in the terms laid down in number 2 of Art.7.

5.

If, between the time of signing the contract and that of terminating or modifying it, an accident covered by an indemnity occurs, the amount paid by the Insurer is reduced in proportion to the difference between the premium covered and that which effectively would be covered if the omission or incorrect statement had not occurred.

6.

Should the Policyholder and/or the Insured Person intentionally omit or incorrectly declare to the

Insurer any of the facts or circumstances referred to in n°

1 of this article, the latter may terminate the contract, with effect from the date of its start or from the time the risk increased, by sending notification to the

Policyholder within the 30 days following the date on which the Insurer became aware of such omission or incorrect statement.

7.

Terminating the contract means for the Policyholder the loss of premiums due up to the date the notification

referred to in the previous number was received and the

Policyholder must also reimburse the Insurer for the amount of indemnities paid in the meantime.

CHAPTER III

START, DURATION,

REDUCTION

TERMINATION OF

AND

THE

CONTRACT, SALE OF VEHICLE

AND CANCELLATION OF

CONTRACT

ARTICLE 6

– START AND

DURATION OF THE CONTRACT

1.

This contract is considered to be signed for the period of time established in the Specific

Conditions and takes effect from zero hours on the day immediately following that on which the Insurer accepts the proposal, unless, with the agreement of both parties, a date different to that for the start of cover is chosen, which, however, may not be prior to reception of the proposal.

2.

The proposal is considered to be approved once 15 days have elapsed from the date on which it is received by the Insurer, although the latter may not have informed the Applicant of non-acceptance or of the need to get information essential for risk assessment.

3.

The insurance can be contracted for a specific period or for one year and following.

In the second case, it will remain in force for exact periods of one year and will be tacitly renewed at the end of each annual period, unless determined otherwise by either of the parties, by registered letter, or by any other means with written registration, within a minimum of 30 days before the date of expiry.

ARTICLE 7 – REDUCTION AND

TERMINATION OF CONTRACT

1.

Both the Policyholder and the

Insurer may at any time reduce or terminate the contract, by registered letter, or by any other means with written registration, to the other party, at least 30 days from the date on which the reduction or resolution takes effect.

2.

Should the contract be reduced or terminated the amount of the premium paid to be returned for the period initially contracted but unused is 75% or 50% depending on whether it was the Insurer or the Policyholder that decided to reduce or terminate, respectively.

3.

Reduction or termination of the contract takes effect at 24 hours on the actual day on which these occur.

4.

The stipulation in n° 6 of Art.

10 applies to termination of the contract due to the failure to pay the premium.

5.

Whenever the Policyholder is not the same as the Insured

Person identified in the

Specific Conditions, the latter should be notified a minimum of 15 days in advance of the termination or renewal of the contract.

ARTICLE 8 – SALE OF VEHICLE

1.

The insurance contract is not transferred should the vehicle be sold, and its effects cease at

24 hours on the actual day of

sale, unless it is used by the actual Policyholder to insure another vehicle.

2.

The Policyholder should notify the Insurer of the sale of the vehicle within 24 hours.

3.

Failure to comply with the obligation provided in the previous number, means that the Insurer has the right to an indemnity for a sum equal to the amount of the premium corresponding to the period of time elapsing from the time of selling the vehicle and the end of the annual insurance period in which this takes place, notwithstanding the fact that the contract has ceased to have effect in the terms of ruling n°

1.

4.

In notifying the Insurer of the sale of the vehicle, the

Policyholder may ask for the effects of the contract to be suspended and the respective extension of the validity period of the policy, up to the time the vehicle has been replaced.

Should the vehicle not be replaced within 90 days counting from the date on which suspension is requested, the validity period will not be extended, and the policy is considered null and void from the date on which suspension begins, the premium to be returned by the Insurer corresponding to that period of unused cover.

ARTICLE 9 – NULLITY OF

CONTRACT

1.

This contract is considered null and void and, consequently, has no effect in the case of accident, when either the

Policyholder or the Insured

Person have made incorrect declarations as well as not revealing facts or circumstances known to them and which could have an effect on the existence or conditions of the contract, namely accepting the contract, maintaining it or renewing the contract by the insurer.

2.

If such declarations or failure to reveal information has been done in bad faith, the Insurer has the right to the premium, notwithstanding the contract becoming null and void in the terms of the previous number, as well as to reimbursement of amounts paid in indemnities paid in the meantime.

CHAPTER IV

LIABILITY, PAYMENT AND

CHANGE OF PREMIUM

ARTICLE 10 – LIABILITY AND

PAYMENT

1.

The premium is due on the date on which the contract is signed, and for the insurance to come into effect the respective payment must be made within the deadline stipulated for the purpose.

2.

Following premiums are due on the dates stipulated in the policy, the scheme laid down in the following numbers being applicable in this case.

3.

The Insurer is bound, up to 30 days prior to the date on which the premium is due, to notify the Policyholder in writing, indicating this date, the amount to be paid and the form of payment.

4.

Failure to pay the premium on the date indicated in the notification leaves the

Policyholder in arrears and

once 30 days have elapsed from that date, the contract is automatically terminated, with no possibility of recovering it.

5.

During the period referred to in n° 4, the contract remains fully in force.

6.

Termination does not release the Policyholder from the obligation to pay premiums or instalments outstanding for the period in which the contract was in force, plus a fine of 50% of the difference between the premium due for the period of time initially contracted and the instalments already paid, adding the respective interest on arrears calculated according to legislation in force.

7.

The insurance is considered to be in force whenever the premium has been paid by the

Policyholder to the broker during the period indicated in n° 4 and the receipt has been given to the Policyholder by the broker with the authority to take payment.

ARTICLE 11 - ALTERATION TO

PREMIUM

If there is no change to the object or guarantee of the contact, any change to the premium may only be made when the next annual payment is due, the

Policyholder being notified of this a minimum of 30 days before it is due.

CHAPTER V

RIGHTS AND OBLIGATIONS OF

THE INSURER, THE

POLICYHOLDER AND/OR THE

INSURED PERSON

ARTICLE 12

– INSURER’S

RIGHTS

1.

Receive insurance premiums and excess premiums that, in the terms of the contract, are owed to it by the Policyholder.

2.

Demand that the Policyholder and the Insured Person comply with the formalities that in the terms agreed are necessary to complete the Insurance contract and for correct compliance with the contract, namely: a) The signature of the

Policyholder and the

Insured Person on the proposal submitted, as well as on all documents that alter or explain the contractual conditions established; b) The name of the

Beneficiary given expressly by the Insured

Person and notified by the

Policyholder.

3.

Be informed by the

Policyholder and by the Insured

Person of all facts and circumstances that may influence the capacity to analyse and decide on the risk acceptance conditions being proposed.

4.

Refuse acceptance of an

Insurance in which it has no interest.

5.

Exercise the rights assigned to it in the terms of the contract.

6.

Demand that the Policyholder, the Insured Person or the

Beneficiaries, comply with the formalities that, in the terms of the contract, are required for the correct assessment, contractual framework and settlement of payments to which it is bound by the respective guarantees coming into force.

7.

Be informed, throughout the time the contract is in force, of any changes to the professional and occupational activities of the Insured Person that may have an effect on contractual guarantees.

ARTICLE 13 – RIGHTS OF THE

POLICY HOLDER AND/OR THE

INSURED PERSON AND THE

BENEFICIARY

1.

The Policyholder has the right, prior to signing the contract, to be informed of the formalities required to sign the contract, of his contractual rights and obligations as well as of any facts and circumstances that may have an effect on his decision to finalise the insurance contract.

2.

The Policyholder has the right, throughout the period in which the contract is in force, to be informed of any changes to the insurance contract and to the implementation of the Insurer’s obligations that may have an effect on his decision to keep the insurance contract in force.

3.

The Policyholder has the right to receive an answer to all requests for clarification, required to understand the conditions and management of the insurance contract.

4.

The Policyholder has the right, in the terms of these General

Conditions, to be informed of situations where there has been a failure to comply with the contract and the respective obligations of the Insured

Person and the consequences of this failure to comply.

5.

The Insured Person and the

Beneficiary have the right to be informed of their rights in situations where the

Policyholder has failed to comply with the contract in the terms of the General

Conditions.

6.

The Policyholder has the right to name or change the

Beneficiaries of the contract, providing that this is done with the express, written consent of the Insured Person.

CHAPTER VI

CLAIMS, PRE-EXISTING

ILLNESS OR INFIRMITY

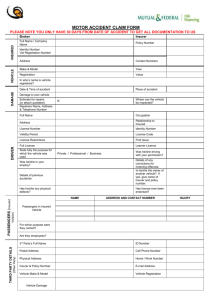

ARTICLE 14 – INFORMATION

AND NOTIFICATION OF CLAIM

1.

Whenever any event brings the guarantees of this contract into action, the Policyholder and/or the Insured Person, at the risk of being held liable for loss and damages, undertake to: a) Take the necessary steps to avoid increasing the consequences of the accident: b) Inform the Insurer of the accident, in writing and within the 8 days immediately following the occurrence, indicating the date, time, location, causes, consequences, witnesses and any other information thought to be relevant. If there are several insurance contracts covering the same risk, notification must be made to the respective

Insurers, indicating the names of all of them; c) Up to 8 days after the Insured

Person has been treated clinically, send a medical statement showing the nature and location of injuries, the diagnosis as well as an indication of

Permanent Disability. possible

d) Submit the original documents and all documents justifying costs paid and covered by the policy.

2.

In case of accident, the Insured

Person undertakes to: a) Follow medical prescriptions, at the risk of the Insurer taking liability for only the consequences of the accident that presumably would have been verified had these prescriptions been observed; b) Undergo the medical examination designated by the

Insurer, whenever the latter requests this. Failure to do this relinquishes all liability on the part of the Insurer; c) Authorise physicians to provide the information requested, at the risk of the Insurer ceasing to be liable.

3.

Should the accident result in the death of the Insured Person, in addition to claiming for the accident, the Death Certificate must be sent to the Insurer (in which the cause of death is shown) and, when considered necessary, any documents explaining the accident and its consequences.

4.

Should it be impossible for the

Policyholder and/or the Insured

Person to comply with any of the obligations laid down in this contract, the obligation is transferred to whosoever – the

Policyholder, Insured Person or

Beneficiary - can comply with them.

5.

Unintentional incorrect or incomplete statements, as well as anything held back, or the omission of facts or circumstances that are also unintentional but that may influence assessment of the

Insurer’s liability, imply the duty to respond for resulting losses and damages.

6.

The Policyholder and/or the

Insured Person lose the right to indemnity if: a) Voluntarily and intentionally they cause or increase the consequences of the accident; b) They use fraud, collusion, false claim or any other wrongful means, as well as false documents to justify their claim; c) They use ill faith, omit or incorrectly state the increase in risk, in the terms laid down in n° 5 of Art. 4.

ARTICLE 15 – PRE-EXISTING

ILLNESS OR INFIRMITY

Unless expressed to the contrary in the

Specific Conditions, if the consequences of an accident are increased due to an illness or infirmity that dates from before the accident, the

Insurer’s liability may not exceed what it would have been had it occurred to a person not suffering this illness or infirmity.

CHAPTER VII

PAYMENT OF CAPITAL OR

INDEMNITIES

ARTICLE 16 – VALUES

The values guaranteed appear, expressly, in the Specific Conditions of the Policy, and are attributed by the

Insured Person, up to a maximum limit of the estimate shown in the vehicle’s papers designated in the Specific

Conditions of the Policy.

ARTICLE 17 – DEATH

1.

In the case of Death, occurring immediately or within one year counting from the date of the accident, the Insurer pays the corresponding insured capital to the Beneficiary, or

Beneficiaries, named in the

Policy.

2.

Should there be no named

Beneficiaries, the insured capital is attributed using the rules and order laid down for legitimate inheritance.

3.

For occupants under the age of

14, indemnity due to Death is limited to the sum paid in funeral expenses.

ARTICLE 18 – PERMANENT

DISABILITY

1.

In the case of Permanent

Disability, clinically diagnosed and setting in within one year from the date of the accident, the Insurer pays that part of the capital determined by the

Percentage Value Table, which is an integral part of this Policy.

2.

Payment of this indemnity, should nothing be expressed to the contrary in the Specific

Conditions, is made to the

Insured Person.

3.

The injuries not listed in the

Table attached to this Policy, even if less serious, are paid an indemnity in proportion to how serious they are compared to the listed cases, without taking account of the professional occupation.

4.

If the Insured Person is lefthanded, the disability percentages for the upper right limb apply to the upper left limb and vice-versa.

5.

For any other limb or organ, the physical defects already suffered by the Insured Person at the time of the accident will be taken into account in determining the level of the percentage value arising from this, which will be the difference between the already existing disability and that which has come to exist.

6.

The partial or total functional incapacity of a limb or organ is given the equivalent partial or total loss.

7.

In relation to the same limb or organ, accrued percentage values may not exceed that which would correspond to the total loss of this limb or organ.

8.

Whenever an accident results in injury to more than one limb or organ, the total indemnity is obtained by adding the amount of the indemnities for each injury, without the total exceeding the capital insured.

ARTICLE 19 COSTS OF

MEDICAL TREATMENT

1.

The Insurer pays, up to the amount fixed for the purpose in the Specific Conditions, the costs required to treat injuries incurred, notwithstanding the exclusions defined in art. 3.

2.

Treatment costs are considered to be those relative to medical fees and hospitalisation, including medical treatment and nursing care required as a result of the accident.

3.

Should regular clinical treatment be required, and throughout the whole time it is required, the cost of travel to the physician, the hospital, clinical or nursing centre are also included, providing that the means of transport used is

adequate for the degree of the injury.

4.

Payment is made to whosoever can show they have paid the costs, against submission of documents proving this.

CHAPTER VIII

FINAL PROVISIONS

ARTICLE 20 – COEXISTING

CONTRACTS

1.

The Policyholder and/or the

Insured Person undertake to inform the Insurer, at the risk of being held liable for losses and damages, of the existence of other insurance contracts guaranteeing the same risk.

2.

Should another insurance contract exist on the date of the accident, guaranteeing the costs of Treatment, this Policy only covers the respective proportion of the values insured.

ARTICLE 21 – CHANGES TO

BENEFICIARY

1.

The Policyholder may, at any time, change the beneficiary clause, and should notify the

Insurer of this intention in a written document signed by the

Policyholder and by the Insured

Person.

2.

The change will only take effect from the date on which notification is received by the

Insurer and must be assigned to the contract in an amendment.

ARTICLE

COMMUNICATION

NOTIFICATION

22

–

AND

BETWEEN

PARTIES

1.

Communication or notification from the Policyholder laid down in this policy is only valid and fully effective when made by registered mail, or by any other means with written registration, addressed to the

Insurers head office.

2.

However, the Insurer should be notified of any change in the address or head office of the

Policyholder, within 30 days following the date in which these changes are made, by registered letter or by any other means with written registration, at the risk of any communication or notification from the Insurer being sent to the wrong address, but one which they hold as valid and in effect.

3.

Communication or notification from the Insurer provided for in this policy is considered valid and fully in effect if sent by registered mail, or by any other means with written registration, to the most recent address for the Policyholder that appears in the contract, or of which the

Insurer has been notified in the terms laid down in the previous number.

ARTICLE 29 – SUBROGATION

1.

Relative to the Costs of

Treatment, the Insurer is subrogated, up to the amount of the indemnity, to all the rights of the Policyholder and the

Insured Person, against third parties responsible for the accident, and they must undertake to do all that is necessary to implement these rights.

2.

The Policyholder and the

Insured Person are liable for the

losses and damages from any act that may impede or prejudice the right of the

Insurer to being subrogated to the rights of the policy.

ARTICLE 30 - ARBITRATION

1.

In any litigation arising from this policy there may be recourse to arbitration, in which case each of the parties appoints an expert-arbiter; these two experts, if necessary, appoint a third expert-arbiter, who will decide on points where there is a difference of opinion.

2.

Should there be disagreement regarding the appointment of a third expert-arbiter, Judge of the District in which the policy was issued will make the appointment.

3.

Arbitration will cover only a decision on values, and does not involve the Insurer recognising the obligation to pay an indemnity nor prejudice the allegation of legal or factual issues that are not merely value assessment matters.

4.

The expert-arbiters are dispensed from court formalities, and the final assessment may not be criticised by either of the parties.

5.

Each of the parties will pay the fees of the respective experts and half of the fees of the third expert-arbiter if there is one.

6.

Should differences of opinion involve clinical matters or the devaluation, the arbiters must be medical doctors.

ARTICLE 31 – APPLICABLE

LEGISLATION

1.

Any dispute involving the interpretation of this contract is resolved according to

Angolan law.

2.

Should this contract be lacking in any way, applicable legislation will be applied.

ARTICLE 32 – JURISDICTION

Jurisdiction to deal with any claim arising from this contract lies in the location in which the policy was issued.

APPENDIX

Percentage Value Table (in the terms of n° 1 of Art. 18 of these General

Conditions

General Conditions.

PERCENTAGE VALUE TABLE

A –PERMANENT TOTAL DISABILITY

Total loss of both eyes, or vision in both eyes

Complete loss of use of the two lower or upper limbs

100%

100%

Incurable, total, mental disorder, as a direct, exclusive result of an accident

Complete loss of both hands or both feet

100%

100%

Complete loss of one arm and one foot, or of one hand and one foot 100%

Hemiplegia or complete paraplegia 100%

B –PERMANENT PARTIAL DISABILITY

1.

HEAD

Complete loss of an eye or reduction of sight in both eyes to half

Total deafness

Complete deafness in one ear

25%

60%

15%

5% Post-commotional syndrome in traumatic brain injury, with no objective signal

Generalised post-traumatic epilepsy, one or two convulsive attacks 50% per month, with treatment

Total anosmia 4%

Fracture of bones of nose or nasal septum with respiratory discomfort 3%

Total, unilateral nasal stenosis

Non-consolidated fracture of the lower jaw

4%

20%

Total or partial loss of teeth with possibility of prosthesis

Total or partial loss of teeth with no possibility of prosthesis

Complete ablation of lower jaw

Loss of brain substance involving the two lobes and with maximum diameter:

10%

35%

70%

- Over 4 cm

- Over 2 cm and equal to or less than 4 cm

- 2 cm

2. UPPER LIMBS AND SHOULDERS R

35%

25%

15%

L

Fracture of clavicle with clear effects

Frozen shoulder, slightly accentuated

5% 3%

5% 3%

Frozen shoulder, projection to front and abduction less than 90° 15% 11%

Total loss of movement in shoulder 30% 25%

Amputation of arm at upper third or complete loss of use of arm 70% 55%

Complete loss of use of one hand

Non-consolidated fracture of one arm

Pseudo-arthrosis of the two bones of the forearm

Complete loss of use of movement of elbow

Amputation of thumb:

- Loss of metacarpal

- Metacarpal maintained

Amputation of index finger

Amputation of middle finger

Amputation of ring finger

Amputation of little finger

Complete loss of movement in wrist

Pseudo-arthrosis of only one bone in forearm

Fracture of 1 st

. metacarpal with effects determining functional incapacity

Fracture of 5 th . metacarpal with effects determining functional incapacity

3. LOWER LIMBS

Disarticulation of a lower limb at the hip-femur joint or total loss of use of lower limb

Hip articulation by the mid-third

Complete loss of use of a leg below the knee joint

Complete loss of a foot

Non-consolidated fracture of hip

Non-consolidated fracture of a leg

Partial amputation of a foot, including all toes and part of the foot

Complete loss of movement in hip

Complete loss of movement in knee

Complete rigidity of ankle in favourable position

Moderate effects of transversal fracture of kneecap

Shortening of lower limb by:

5 cm or more

3 to 5 cm

2 to 3 cm

Amputation of big toe with its metatarsal

Complete loss of any toe, excluding the big toe

4. SPINE, THORAX

Fracture of cervical vertebral column with medullar lesion

Fracture of dorsal or lumbar vertebral column:

- Compression with sharp backbone rigidity, with no neurological signs

Neck pain, with clear backbone stiffness

Low back pain, with clear backbone stiffness

Incomplete paraplegia, walking possible, paralysis spasmodic

Deep-rooted pain with radiation (slight)

60% 50%

40% 30%

25% 20%

20% 15%

25% 20%

20% 15%

15% 10%

8% 6%

8% 6%

8% 6%

12% 9%

10% 8%

4% 3%

2% 1%

10%

10%

5%

5%

20%

2%

60%

50%

40%

40%

45%

40%

25%

35%

25%

12%

10%

20%

15%

10%

10%

3%

Isolated fracture of sternum with mild effects

Fracture to one rib with mild effects

Multiple fractures to major ribs

Spill from traumatic haemorrhage with radiological signs

5. ABDOMEN

3%

1%

8%

5%

Ablation of spleen, with haematological effects, without clinical signs 10%

Nephritic syndrome. 20%

Abdominal surgical scar with 10 cm eventration, not operable. 15%