memorandum team 12

advertisement

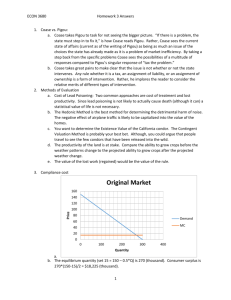

MEMORANDUM DATE: May 24, 2013 TO: Prof. Rajiv Krishnan Kozhikode FROM: Team 12 Class BUS 374 D100 Colton Dow 301124297 Pierre Levesque 301210629 Gurneet Takhar 301064886 Tiffany Sun 301158475 Shuying (Lavina) Tan 301157828 SUBJECT: Adding Value to Coase’s Essay: The Nature of the Firm? In the 1930’s Ronald Coase (1937) released an article regarding “The Nature of the Firm”. In his article Coase (1937) explains the components, benefits, and changing factors relating to firms. In completing his research Coase (1937) concludes some viable reasons as to why organizations such as firms exist in a capitalistic society. Coase (1937) identifies a discrepancy between economic resource allocation and business leaders’ role on these allocations. More precisely, Coase (1937) identifies the purpose of his paper “to bridge what appears to be a gap in economic theory between the assumption that resources are allocated by means of the price mechanism and the assumption that this allocation is dependent on the entrepreneur co-ordinator” (Coase, 1937). The task of this memo is to answer the question of “why do organizations exist?” using the principle benefits of a firm in Coase’s article. Our group will accomplish this by examining an article that challenges a select few of Coase’s arguments. One specific argument Coase (1937) makes that is to be challenged is how technology affects transaction costs. This argument will be investigated in further detail later on. Prior to these investigations,it necessary to lay out Coase’s main arguments and assumptions. To demonstrate the reasons for the existence of a firm, Coase (1937) starts with the question “why it is profitable to establish a firm”? The answer is the existence of marketing costs of allocating resources through the price mechanism while a firm can direct resources more efficiently depending on entrepreneur-co-ordinator, and reduce these costs including transaction costs, costs of negotiating and contracts for each exchange transaction in an open market (Coase, 1937). When a firm comes into being, some authority such as an entrepreneur can direct resources within the organizations, enabling production costs to be lower than costs of obtaining a good or service from the outside market (Coase, 1937). Also, with short-term contracts, costs are generated when every new contract is created. Accumulated costs can be large and so longterm contracts are desired, which can reduce costs and risk at the same time. This so called longterm contract leads to the establishment of a firm (Coase, 1937). Another reason why firms emerge goes to the existence of uncertainty in market (Coase, 1937). Coase (1937) starts with the assumption without uncertainty, in which case every worker is doing exactly the right thing at the right time and hence managers are performing purely routine function. However, in reality, with the introduction of uncertainty, the primary problem of operation is to forecast future wants, and to determine what to do and how to do it (Coase, 1937).. Production then requires and is based on the producer’s forecasting on customers’ wants. Consequently, firms emerge to provide central direction for the process of production with the knowledge, skills and judgement of an entrepreneur (Coase, 1937). Last but not least, the division of labour contributes to the forming of a firm. Although this rational is not as popular as the ones mentioned above, it does provide some insight for our thinking. The growth of economy arouses differentiation and complexity, which is likely to collapse into chaos (Coase, 1937). Integrating force is therefore of chief significance (Coase, 1937). Coase’s argument is that organization provides better integrating force than price mechanism. It is human nature that A would guarantee B some benefits such as wages to get B under control, only if the man is given that power to do so (Coase, 1937). And B is willing to be under direction only with the guaranteed benefits. Hence enterprise and wage system come into being and that prompts the establishment of a firm (Coase, 1937). Coase (1937) argues that as the transaction costs of a firm decrease they have a tendency to limit its expansion. The limit of a firm size is limited by its transaction costs until its value is zero there is no need to increase the size of the firm because it would not give value to the transaction. In Geoffrey Samson essay “The Myth of Diminishing Firms” (Sampson, 2003), he explains that with today’s technology; the Coase’s argument does not stand. He explains that firms who uses ERP (Enterprise resource planning), even though they lower their transaction costs, it does not come as a variable on the sizes of the firms. Coase argues that as the transaction costs of a firm decrease it also decrease its tendency to limit its expansion. We see examples of companies that are still lowering their transaction costs but still increase in size. We can notice that when Coase made ihs essay in 1937, computing companies did not exist. Companies were starting using telephone or telegraph to do B2B transactions. These technologies help decrease transaction but not as significantly as the arrival of computer and the different software that are implemented in large sections of the manufacturing process and in B2B transactions. We believe that with this new technology, and the facility to access any component of manufacturing transactions. The threats of losing or sharing valuable information to undesirable outsiders or competition could also demonstrate a reason to create firms or increasing their sizes. Trust is another reason to create or increase the size of a firm because a firm would not have a leak of information or knowledge travelling around between firms’ communication exchanges. The two latter reasons were not expressed in Coase’s essay, but with the advance communication technologies already in used, which were not invented in 1937; it should be taken into consideration. Even though Coase’s (1937) theory has been around for many decades, we didn’t worship it as if it was a holy bible. It can be challenged in terms of how well his theory answered the question: why do firms exist. From Coase’s (1937) point of view, firms arise when they can arrange to produce internally without the cost of the market such as information cost, negotiating cost,etc. This can be very true by itself, but not quite complete when we look at it from a big picture. Coase’s focus was on the imperfection of the market, rather than the strength of firms, which should not be overlooked. It is also true that firms exist because they have functions that individuals would not have. Apple Inc. exists as a firm not to avoid transaction costs, but because they have the talents and resources to invent and produce what’s not yet in the market. They do not exist to meet the demand of the market, but to create demand for the market. Apple is only one example of thousands of innovative companies existing in the current business world. As a matter of fact, individuals can be inventors but don’t necessarily have the resources to make their inventions available for the market. It is not uncommon to see patents from individuals sold to companies to be further developed and commercialized to the market. At the same time, firms have the power to invest in long-term bets on innovations that might not succeed. But once they are successful, they are likely to disruptively redefine the market. Firms also come into existence because they have the power to bring different talents together to create value for the society, achieving the ideology of 1 plus 1 being larger than 2. Firms facilitates education and culture where people compete and learn from each other, eventually accomplish goals that are impossible for individuals to reach. Although aspects of Coase’s theory are applicable to the nature of a firm ,and their existence, the growth of technology and advancement of the business world has created instances that could not have been foreseen by Coase. The expansion of the internet has connected the market to become globally more accessible and has allowed firms to lower costs and connect with consumers with much more easily. The new level of complexity in the market has diversified the existence of firms to focus on innovation and creating products and services not already in the market. Coase ‘s idea of transaction costs effecting a firms ability to produce unless they are lowered by producing internally is seen as narrow and challenged by current day trends of lowering costs through virtual firms. From a big picture, Coase has ignored firm's strength also give rise to firms existence and innovative firms exist to redefine the market rather than simply meet the market's needs. References Coase, R. 1937. The nature of the firm. Economica, 4(16): 386–405. Sampson, G. 2003. The myth of diminishing firms. Communications of the ACM, 46 (11): 25-28.

![New Institutional Economics [NIE]](http://s2.studylib.net/store/data/005438886_1-ae096202c0642c437b8d589e7fef75a9-300x300.png)