Deepwater Horizon Economic and Property Damages Settlement

advertisement

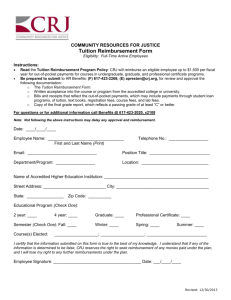

Deepwater Horizon Economic and Property Damages Settlement Agreement: Reimbursement of Accounting Fees This issue brief is designed to update state societies and state boards of accountancy on the Deepwater Horizon Economic and Property Damages Settlement Agreement (Settlement Agreement) and its possible effect on the reimbursement of accounting fees, so that state societies and state boards will be able to answer questions and share resources with members and licensees. Background The Deepwater Horizon (or BP – British Petroleum) oil spill started April 20, 2010 and over the next 3 months spilled nearly 5 million barrels across the Louisiana, Mississippi, Alabama and Florida coasts and in the Gulf of Mexico. The spill was caused by the explosion of the Deepwater Horizon oil rig off the coast of Louisiana. It damaged the Gulf of Mexico’s marine and wildlife habitats, and negatively impacted individuals and businesses. It is the largest accidental marine oil spill in the history of the petroleum industry. Current Status of the Deepwater Horizon Economic and Property Damages Settlement Agreement In August 2010, all of the lawsuits against BP and the other defendants concerning the Deepwater Horizon oil spill were consolidated before one Court. In March 2012, BP and plaintiffs agreed to a $7.8 billion Settlement Agreement that, if approved, would settle 100,000 claims filed by individuals and businesses. In May 2012, the Court granted preliminary approval of the Economic Class and the Settlement Agreement, and ordered that the Court-Supervised Settlement Program (Program) should begin accepting claims on June 4, 2012. The Court will consider final approval of the Settlement Agreement at a Fairness Hearing scheduled for November 8, 2012. NOTE: The Settlement Agreement is not yet final and is ultimately subject to the final approval of the Court. Possible Effect on the Reimbursement of Accounting Fees The Settlement Agreement (still awaiting final approval) provides draft terms and conditions necessary for the reimbursement of fees for accounting services. Under certain settlements, individuals and businesses may be eligible for reimbursement of accounting services. The terms and conditions described are segmented by the type of settlement payment, type of claimant, and the claim amount. The rates for reimbursement for preparation hours are also listed. The Program has directed that reimbursement requests must be itemized by date and person, and specify the work being performed on behalf of the Claimant. The Program indicates that it has the right to request and review any work papers (whether historical or specific to the Claim), time sheets or other supporting documentation related to the Claim or request for accounting support reimbursement and the reasonableness of the fees. These terms and conditions are more fully described in a proposed Frequently Asked Questions (FAQs) webpage and FAQs dealing specifically with Claimant Accounting Support Reimbursement. 1 Accounting Services Reimbursement Form The Accounting Services Reimbursement Form that accountants must sign and submit on behalf of claimants in order to get reimbursed was amended to require accountants to “ swear and affirm” (instead of having to “certify”) as to the accuracy of what is submitted. The statement also includes language that requires the accountant to acknowledge that if they have a contingency fee arrangement with the claimant, any payment will reduce the contingent fee and not be in addition to it. The Program indicates that the reimbursement will be limited to the accounting services necessary to complete the claim form or prepare documentation. Future Action The AICPA will continue to monitor the Settlement Agreement as it becomes final and will look to develop additional guidance for state societies and state boards regarding the final terms and conditions for reimbursement of accounting fees. Resources Deepwater Horizon Claims Center (DHCC) Alerts Deepwater Horizon Economic and Property Damages Settlement Agreement (as amended on May 2, 2012) Proposed FAQs for Claimant Accounting Support Reimbursement Settlement Agreement Sections Regarding Accounting Support Reimbursement (4.4.13.6 to 4.4.13.11) Sworn Written Statement for Claimant Accounting Support Form Contact Daniel Bond Communications Manager, AICPA 202.434.9226 dbond@aicpa.org 2