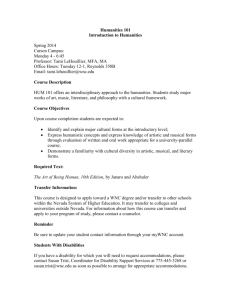

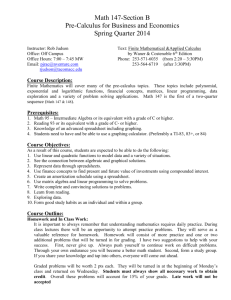

FIN 432 - Investment Analysis and Management

advertisement

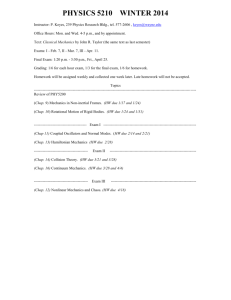

Syllabus - FIN 432 - Investment Analysis and Management Professor James Dow Fall 2009 (#18186) TR 11:00-12:15 JH 1228 Welcome to the Honors section of FIN 432. This syllabus is probably longer than what you are used to. In every class there is a problem of seeing the forest for the trees. This is a particular problem in an investments class, which at times can be very theoretical and detail oriented. To help you keep the big picture in sight, this syllabus will focus on why we are studying each topic and what I expect you to get out of it. One warning: the first half of the course will move very fast. The key to success is to complete the problem sets ahead of time and to develop a solid understanding of the material well before the midterms. For the problem sets, it’s OK to consult with other students in the class. However, be sure you can do the problems by yourself because that’s how you’ll be doing them on the exams. Catalog Description: Prerequisite: FIN 303. Passing score on the Upper Division Writing Proficiency Exam. BUS 302 and BUS 302/L are prerequisites for BSBA majors. Survey of investments including corporate and government securities, real property and financial intermediaries. A survey of investment theory emphasizing security analysis, valuation and portfolio management. Office Hours and Contact Information: Office hours: TR 9:00-9:30 and 1:30-2:30, or by appointment. Office: JH 4107 Phone: x4539 E-mail: james.dow@csun.edu Text: The textbook for this course is Investments by Jones. It is expected that all students can download information from the internet (including PDF files) and can use Excel for basic financial and mathematical calculations. You will also need a financial calculator. There is a webpage (http://www.csun.edu/~jpd45767/432/fin432bh.html) which will have the syllabus and other handouts. Grading: Your grade for this class is based on a weighted average of the letter grades of the individual assignments. 20% 20% 20% 20% 20% 6 Problem Sets Midterm I Midterm II Other Exercises Company Analysis Project +/- grading will be used. There is no final exam for this course. Problem sets and instructions for the exercises will be given out in class and also made available on the class webpage. Professional Certifications. For people considering careers in finance, there are three common certifications: CFA (Chartered Financial Analyst), CFP (Certified Financial Planner), and Series 7 (General Securities Representative Exam) and related exams. Each of these exams has a large section focused on investment analysis. If you are planning on taking one of these exams I would recommend that you get the topics list so that you can see how the material covered in this class ties in to the particular exam. Links to the topics lists are available on the class webpage. COURSE CONTENT The course is divided into four sections. 1. An Introduction to the Various Asset Types What are stocks and bonds? How do they work? How do you get information about them? How would you buy them? What other things can you invest in? Any investor has to know this kind of information before getting started and so this is where we begin. At the same time, we will also learn how to do a variety of basic financial calculations. We will be going through this section very quickly so it is important to do the reading ahead of time and especially important that you spend time on the problem sets to master the basic calculations. Outcome: By the end of this section you should be familiar with the basic investment options, where and how they are bought and sold, and their characteristics in terms of risk and return. 2. Modern Portfolio Theory and Asset Allocation Modern portfolio theory (MPT) refers to a collection of ideas that characterize much of the research in financial economics over the last 40 years. There are three basic building blocks of MPT: portfolio choice using the concept of an "efficient frontier", formal asset pricing models such as the Capital Asset Pricing Model (CAPM), and the idea of efficient markets. We will look at each of these ideas and see how it affects investor behavior. The efficient frontier is a way of determining the risk-return tradeoff an investor would face when constructing a portfolio from a variety of different assets. This is one of the techniques used by managers of large portfolios. Most of the calculations are beyond the scope of this course but we will look at the logic underlying this procedure and how the intuition behind it can be applied to individual investors. One of the central questions in finance is what determines the expected return to an asset. Why does one stock offer a higher average return than another? From FIN 303 you already know that the answer is risk. In this class we will take it one step farther and ask, what is the appropriate way to measure risk, or alternatively, what risks do investors need to be compensated for? The most common answer to this is given by the CAPM, although the usefulness of this theory is under debate. We will examine how the CAPM works along with some of the arguments in the debate. Perhaps the most controversial part of MPT is the idea of efficient markets. Basically, market efficiency is the notion that new information is quickly and accurately reflected in the price of financial assets such as stocks. In other words, you, as an investor, cannot do better than the market by spending time researching companies or responding to market trends. Clearly, this idea has strong implications for investors! While it is broadly agreed that markets are not perfectly efficient, there is much discussion and debate over how efficient they are. In this section we will do two things: we will look at how researchers test whether markets are efficient or not, and we will look at how investors should behave if markets are generally efficient. Project: Asset Allocation Report. Outcome: By the end of this section you should be able to explain the basic principles of modern portfolio theory and how they restrict investor behavior. Using these ideas, you should be able to construct a recommended investment portfolio for an individual investor. Some of the ideas developed here, such as how diversification and asset allocation can be applied to individual financial planning, are covered in more detail in FIN 422 - Theory and Practice of Financial Planning. 3. Some Strategies for Stock Selection A large number of investors do not believe that MPT completely describes the world (or describes the world at all!). They believe that markets are sufficiently inefficient that there are bargains out there to be had, and that they are smart enough to find them. In this section, we will look at some of the strategies they use. I want to be clear up front that I am not recommending any particular investing strategy. Indeed, I am fairly skeptical about some of the things I am having you read. However, over the course of your career you are going to see lots of different people telling you how you should invest. An important skill is to be able to evaluate their recommendations critically. By critically, I don’t necessarily mean criticize. Rather you should be able to determine the logic behind their recommendation, evaluate if the logic is correct, and then assess if the recommendation reasonable for your situation. Stock selection strategies are often divided into two types: fundamental analysis and technical analysis. Fundamental analysis depends on the idea that the long-run value of a company depends on economic factors such as profitability, in other words, “the fundamentals”. There are a variety of investment strategies using this approach ranging from the highly quantitative discounted cash flow analysis to ratio analysis and value investing to qualitative analysis of industry trends. We will examine a number of these approaches. Technical analysis is derived from the idea that there are short-run patterns in stock prices driven by investor psychology. A lot of these strategies are pretty questionable, but the general idea, that the investor’s state of mind can matter, is important. The area of finance that studies this is called “behavioral finance”. We will see how the findings of behavior finance can help you reduce errors you might make when investing and perhaps also how to take advantage of errors made by other investors. Projects: Company Analysis. Outcome: At the end of this section you should be able to use one or more of several stock selection techniques to choose companies to invest in. You are not going to be an expert in any of these techniques, and you should really spend more time studying before actually investing real money, but at least you will have some idea of what you are doing. This section will also provide a good background for students taking FIN 437BH - Advanced Topics. In that course, students manage and make investment recommendations for part of the University Foundation’s portfolio. 4. Alternate Assets: Bonds, Derivatives, Real Estate and Other Stuff. Up to now, most of the course has focused on equity investments; however, there are a variety of other investment opportunities. This section will provide an overview of alternative investments. The first part of this section will focus on debt securities such as bonds. Following that, we will examine derivative securities. Derivatives, such as options and futures, are financial instruments that get their value from other assets. Valuation of derivatives can be quite mathematical and so we will only get an introduction in this class. For those intending to go into a career in investments I strongly recommend that you take FIN 436 - Futures and Options: Theory and Strategy, which examines derivatives in more detail. There are other ways to invest besides using financial instruments. Probably the most common alternate investment would be in Real Estate. We will only discuss real estate in the context of broader financial strategy; however, if you are interested in real estate I would recommend the trio of FIN 338 - Real Estate Principles, FIN 433 - Real Estate Finance, and Fin 439 - Real Estate Valuation along with the real estate option of the business administration major. We will also look at investing internationally. The theory behind the investment strategy remains the same, but new kinds of uncertainties, such as currency risk, are now faced by the investor. For those interested in this area, the department offers a course that covers international aspects of corporate finance and investment: FIN 430 - International Financial Management. Outcome: At the end of this section you should have a basic understanding of how bonds and derivatives work (without knowing all the mathematical details) and how alternative investments fit into investment planning. Course Schedule (schedule is tentative and subject to revision) Class Topic Chapter 8/25 8/27 9/1 9/3 9/8 9/10 9/15 9/17 9/22 9/24 9/29 10/1 10/6 10/8 10/13 10/15 10/20 10/22 10/27 10/29 11/3 11/5 11/10 11/12 11/17 11/19 11/24 11/26 12/1 12/3 12/8 Overview Securities Mutual Funds Securities Markets Buying and Selling More on Mutual Funds Margin and Selling Short Asset Allocation Application Exam Risk and Return Portfolio Theory Portfolio Selection Visitor! Asset Pricing Models Asset Pricing Models Efficient Markets Inefficient Markets Security Market Analysis Exam Stock Market History Stock Valuation Valuing Google Market Analysis Sector Analysis Security Analysis Financial Statements 2 Thanksgiving Bonds Derivatives Other Chap 1 Chap 2 Chap 3 Chap 4 Chap 5 Assignments (date assigned) Problem set chap 2 Problem set chap 3,4 Problem set chap 4,5 Chap 6 Chap 7 Chap 8 Problem set chap 6 Chap 9 Problem set chap 9 Chap 12 Chap 11 Chap 10 Chap 13 Chap 14 Chap 15 Chap 10 Chap 14 Chap 16 Chap 18 Problem set chap 7,8