Requirements of the Financial Management Act 1994

advertisement

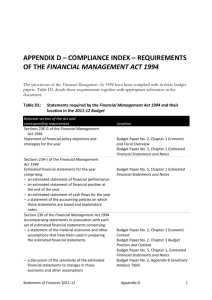

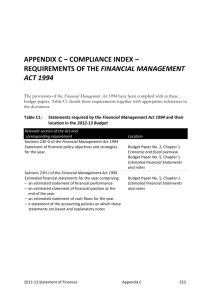

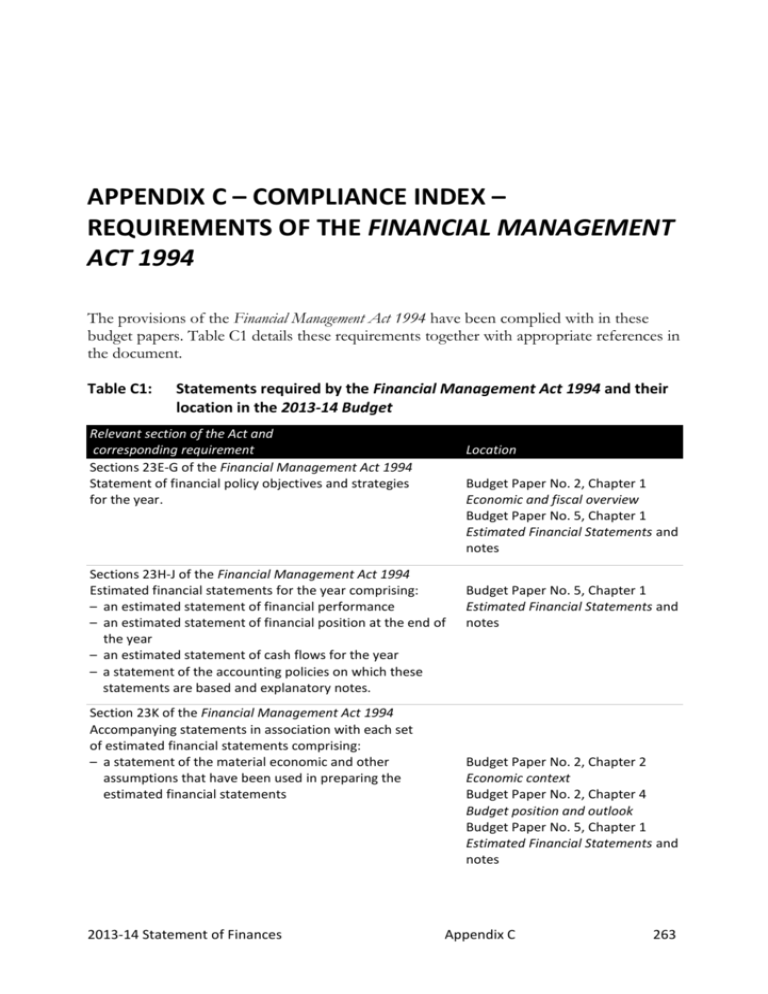

APPENDIX C – COMPLIANCE INDEX – REQUIREMENTS OF THE FINANCIAL MANAGEMENT ACT 1994 The provisions of the Financial Management Act 1994 have been complied with in these budget papers. Table C1 details these requirements together with appropriate references in the document. Table C1: Statements required by the Financial Management Act 1994 and their location in the 2013-14 Budget Relevant section of the Act and corresponding requirement Sections 23E-G of the Financial Management Act 1994 Statement of financial policy objectives and strategies for the year. Location Budget Paper No. 2, Chapter 1 Economic and fiscal overview Budget Paper No. 5, Chapter 1 Estimated Financial Statements and notes Sections 23H-J of the Financial Management Act 1994 Estimated financial statements for the year comprising: – an estimated statement of financial performance – an estimated statement of financial position at the end of the year – an estimated statement of cash flows for the year – a statement of the accounting policies on which these statements are based and explanatory notes. Section 23K of the Financial Management Act 1994 Accompanying statements in association with each set of estimated financial statements comprising: – a statement of the material economic and other assumptions that have been used in preparing the estimated financial statements 2013-14 Statement of Finances Budget Paper No. 5, Chapter 1 Estimated Financial Statements and notes Budget Paper No. 2, Chapter 2 Economic context Budget Paper No. 2, Chapter 4 Budget position and outlook Budget Paper No. 5, Chapter 1 Estimated Financial Statements and notes Appendix C 263 Table C1: Statements required by the Financial Management Act 1994 and their location in the 2013-14 Budget (continued) Relevant section of the Act and corresponding requirement – a discussion of the sensitivity of the estimated financial statements to changes in those economic and other assumptions – an overview of the estimated tax expenditures for the financial years covered by the estimated financial statements – a statement of risks that may have a material effect on the estimated financial statements. Section 26(1) of the Financial Management Act 1994 A quarterly financial report for each quarter of each financial year. Section 40 of the Financial Management Act 1994 A statement of information under departmental headings setting out: – a description of the goods and services to be produced or provided by each department during the period to which the statement related, together with comparative information for the preceding financial year – a description of the amount available or to be available to each department during the period to which the statement relates, whether appropriated by the Parliament for that purpose or otherwise received or to be received by the department, together with comparative figures for the preceding financial year – the estimated amount of the receipts and receivables of each department during the period to which the statement relates, together with comparative figures for the preceding financial year. Section 16B of the Audit Act 1994 The Auditor-General reviews and reports on the estimated financial statements to ensure they are consistent with accounting convention and that the methodologies and assumptions used are reasonable. 264 Appendix C Location Budget Paper No. 2, Appendix A Sensitivity analysis table Budget Paper No. 5, Chapter 5 Tax expenditures and concessions Budget Paper No. 2, Chapter 2 Economic context Budget Paper No. 2, Chapter 4 Budget position and outlook Budget Paper No. 5, Chapter 6 Contingent assets and contingent liabilities Budget Paper No. 5, Appendix B Revised 2012-13 Budget outcome incorporating the financial report for the March quarter 2013 Budget Paper No. 3, Chapter 2 Departmental performance statements Budget Paper No. 5, Chapter 3 Departmental financial statements Budget Paper No. 3, Chapter 2 Departmental performance statements Budget Paper No. 5, Chapter 1 Estimated Financial Statements and notes 2013-14 Statement of Finances