DOCX file of Introduction to Social Impact Bonds (0.22 MB )

advertisement

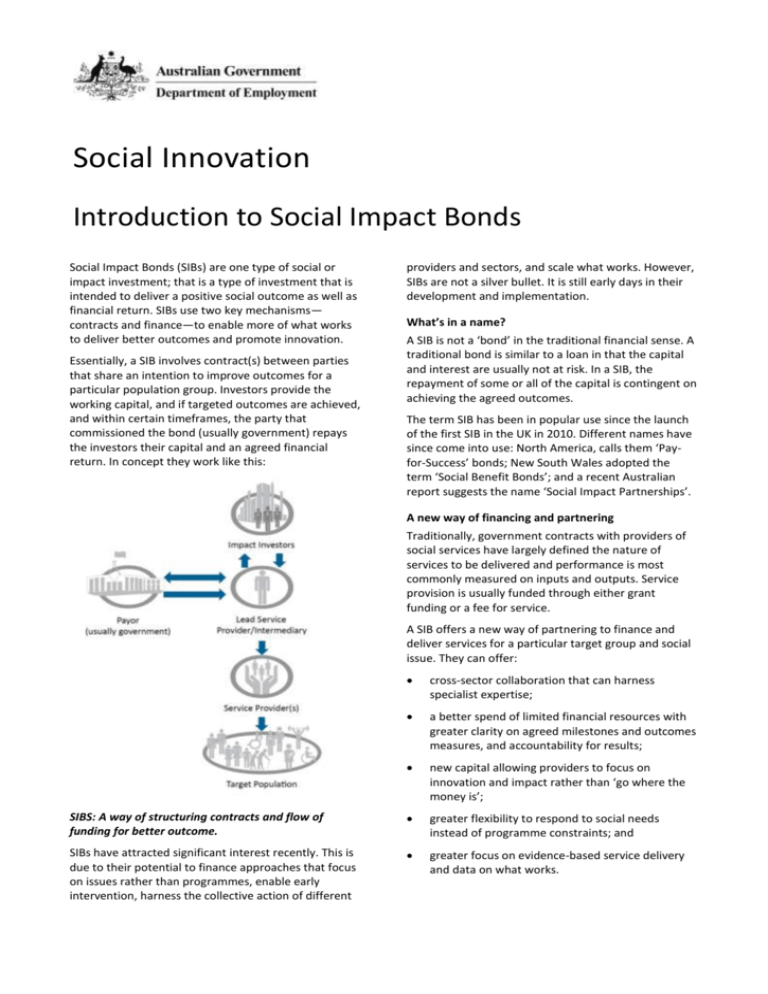

Social Innovation Introduction to Social Impact Bonds Social Impact Bonds (SIBs) are one type of social or impact investment; that is a type of investment that is intended to deliver a positive social outcome as well as financial return. SIBs use two key mechanisms— contracts and finance—to enable more of what works to deliver better outcomes and promote innovation. Essentially, a SIB involves contract(s) between parties that share an intention to improve outcomes for a particular population group. Investors provide the working capital, and if targeted outcomes are achieved, and within certain timeframes, the party that commissioned the bond (usually government) repays the investors their capital and an agreed financial return. In concept they work like this: providers and sectors, and scale what works. However, SIBs are not a silver bullet. It is still early days in their development and implementation. What’s in a name? A SIB is not a ‘bond’ in the traditional financial sense. A traditional bond is similar to a loan in that the capital and interest are usually not at risk. In a SIB, the repayment of some or all of the capital is contingent on achieving the agreed outcomes. The term SIB has been in popular use since the launch of the first SIB in the UK in 2010. Different names have since come into use: North America, calls them ‘Payfor-Success’ bonds; New South Wales adopted the term ‘Social Benefit Bonds’; and a recent Australian report suggests the name ‘Social Impact Partnerships’. A new way of financing and partnering Traditionally, government contracts with providers of social services have largely defined the nature of services to be delivered and performance is most commonly measured on inputs and outputs. Service provision is usually funded through either grant funding or a fee for service. A SIB offers a new way of partnering to finance and deliver services for a particular target group and social issue. They can offer: cross-sector collaboration that can harness specialist expertise; a better spend of limited financial resources with greater clarity on agreed milestones and outcomes measures, and accountability for results; new capital allowing providers to focus on innovation and impact rather than ‘go where the money is’; SIBS: A way of structuring contracts and flow of funding for better outcome. greater flexibility to respond to social needs instead of programme constraints; and SIBs have attracted significant interest recently. This is due to their potential to finance approaches that focus on issues rather than programmes, enable early intervention, harness the collective action of different greater focus on evidence-based service delivery and data on what works. A new way of contracting At a minimum, a feasible SIB proposition requires: 1. a clear focus on the social issue and target group for the initiative; 2. measureable outcomes and available baseline data; and 3. a party (usually government) willing to commission and pay on the ‘bond’, interested and qualified service provider(s) and investors prepared to finance the work on the terms offered. There can be benefits for all parties. Governments utilise expertise and knowledge from the community about what works to improve people’s lives, at lower risk to the tax payer. return safely to their families. Social Ventures Australia (the intermediary) is marketing the bond to impact investors with a targeted financial return of 10% to 12% per annum (capped at 15%) over seven years dependent upon rates of restoration of children to their families. See below for more information on the approach, terms and structures. There is still a lot to learn SIBs have the potential to bring significant new capital and efficiencies to social service delivery when the interests of key partners are aligned. There are a number of potential challenges to be understood and worked through, including: lack of track record—there are only a handful of SIBs in operation so available ‘lessons learned’ may not be sufficient to guide design and implementation in different contexts; investor appetite is yet to be fully tested at this early stage of the market; although the NSW experience will provide valuable insights; In some situations, other parties may be required to facilitate delivery and ensure veracity for the process and outcomes. Most commonly, there is a focus on an intermediary to coordinate service provision and/or engage the investment community, or an independent evaluator to verify outcomes. reliance on appropriate, accurate measurement of social outcomes. The ability to attribute these outcomes to the SIB funded initiatives may be difficult in some situations; SIBs are not suitable for all social issues, populations or service providers; and Where have SIBs been used? this approach takes time to develop and deploy— SIBs may involve complex, multi-party negotiations and collaboration to bring to fruition, and may involve different types of costs. Service providers have greater flexibility and creativity in how they work and deliver programmes. Investors can invest in issues they care about, and drive improvements in service delivery and greater accountability for results. The first and most developed example is the One*Service - Peterborough Social Impact Bond (UK). The Ministry of Justice UK (the payor) contracted with Social Finance Ltd (the intermediary) to reduce the reoffending behaviour of 3 000 prisoners leaving Peterborough Prison over a six-year period (the target population). Social Finance Ltd then raised the investment. The Ministry of Justice, in combination with Big Lottery Fund, will pay Social Finance Ltd outcome payments if re-offending is reduced by 7.5% or more. The amount increases if re-offending drops even further. New South Wales is the first Australian jurisdiction to undertake a SIB pilot. The UnitingCare Newpin Social Benefit Bond (NSW) is the first to market there. The New South Wales Government (the payor) has partnered with UnitingCare Burnside (the service provider) to implement a $7 million Social Benefit Bond that will fund the New Parent and Infant Network (Newpin) program. The Newpin program works intensively with struggling families to keep them safely together and assist children in out-of-home care to Further reading Peterborough Social Impact Bond (UK) <http://www.socialfinance.org.uk/sites/default/files/S F_Peterborough_SIB.pdf> UnitingCare Newpin Social Benefit Bond (NSW) <http://www.socialventures.com.au/socialfinance/newpin-social-benefit-bond> Goldman Sachs ‘Pay for Success’ (USA) <http://www.goldmansachs.com/what-wedo/investing-and-lending/urban-investments/casestudies/social-impact-bonds.html>