LN7-Multivariate opt..

advertisement

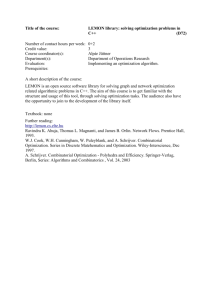

LN #7 OPTIMIZATION OF OBJECTIVE FUNCTIONS WITH MORE THAN ONE CHOICE VARIABLES 1. The Differential Version of Optimization Conditions With an objective function with one choice variable, 𝑦 = 𝑓(𝑥), the optimization conditions involved the first and second derivative of the function. The so-called first order condition (FOC) is: 𝑑𝑦 = 𝑓 ′ (𝑥) = 0 𝑑𝑥 To determine whether the stationary point found via the first derivative is a maximum or a minimum, the second-order-condition (SOC) provided that, 𝑑2 𝑦 = 𝑓 ′′ (𝑥) < 0 for a maximum 𝑑𝑥 2 𝑑2 𝑦 = 𝑓 ′′ (𝑥) > 0 for a minimum 𝑑𝑥 2 Now, given the function 𝑦 = 𝑓(𝑥), the differential approach to optimization, the FOC requires that in differential 𝑑𝑦 = 𝑓′(𝑥)𝑑𝑥 = 0 Since with the derivative the 𝐹𝑂𝐶 required 𝑓 ′ (𝑥) = 0, then, given 𝑑𝑥 ≠ 0, 𝑑𝑦 = 0. Similarly, for the 𝑆𝑂𝐶, 𝑑 2 𝑦 = 𝑓 ′′ (𝑥)𝑑𝑥 2 < 0 for a maximum 𝑑 2 𝑦 = 𝑓 ′′ (𝑥)𝑑𝑥 2 > 0 for a minimum 2. Extreme Values of a Function of Two Variables Consider the function 𝑧 = 𝑓(𝑥, 𝑦). First find the total differential of this function. 𝑑𝑧 = 𝑓𝑥 𝑑𝑥 + 𝑓𝑦 𝑑𝑦 The 𝐹𝑂𝐶 provides that 𝑑𝑧 = 0 for arbitrary values of 𝑑𝑥 and 𝑑𝑦, not both zero. For this to hold, 𝑓𝑥 = 𝑓𝑦 = 0 To establish the 𝑆𝑂𝐶 first we must find the second order total differential. 2.1. Second-Order Total Differential To obtain the second-order total differential of 𝑧 = 𝑓(𝑥, 𝑦), first consider the second order partial derivatives, 𝑓𝑥𝑥 ≡ 𝜕 (𝑓 ) 𝜕𝑥 𝑥 𝑓𝑦𝑦 ≡ 𝜕 (𝑓 ) 𝜕𝑦 𝑦 𝑓𝑥𝑦 ≡ 𝜕2 (𝑓 ) 𝜕𝑥𝜕𝑦 𝑦 𝑓𝑥𝑦 ≡ 𝜕2 (𝑓 ) 𝜕𝑦𝜕𝑥 𝑥 Now we can find the second-order total differential, 𝑑2𝑧 = 𝜕 𝜕 (𝑑𝑧)𝑑𝑥 + (𝑑𝑧)𝑑𝑦 𝜕𝑥 𝜕𝑦 LN 7—Multivariate Optimization Page 1 of 15 Substituting for 𝑑𝑧, we have 𝑑2𝑧 = 𝜕 𝜕 (𝑓𝑥 𝑑𝑥 + 𝑓𝑦 𝑑𝑦)𝑑𝑥 + (𝑓 𝑑𝑥 + 𝑓𝑦 𝑑𝑦)𝑑𝑦 𝜕𝑥 𝜕𝑦 𝑥 𝑑 2 𝑧 = (𝑓𝑥𝑥 𝑑𝑥 + 𝑓𝑥𝑦 𝑑𝑦)𝑑𝑥 + (𝑓𝑦𝑥 𝑑𝑥 + 𝑓𝑦𝑦 𝑑𝑦)𝑑𝑦 𝑑 2 𝑧 = 𝑓𝑥𝑥 𝑑𝑥 2 + 𝑓𝑥𝑦 𝑑𝑦𝑑𝑥 + 𝑓𝑦𝑥 𝑑𝑥𝑑𝑦 + 𝑓𝑦𝑦 𝑑𝑦 2 Since 𝑓𝑥𝑦 𝑑𝑥𝑑𝑦 = 𝑓𝑦𝑥 𝑑𝑦𝑑𝑥, then, 𝑑 2 𝑧 = 𝑓𝑥𝑥 𝑑𝑥 2 + 2𝑓𝑥𝑦 𝑑𝑥𝑑𝑦 + 𝑓𝑦𝑦 𝑑𝑦 2 Example Find 𝑑𝑧 and 𝑑 2 𝑧 of the function 𝑧 = 𝑥 3 + 5𝑥𝑦 − 𝑦 2 𝑑𝑧 = 𝑓𝑥 𝑑𝑥 + 𝑓𝑦 𝑑𝑦 𝑓𝑥 = 𝜕𝑧 = 3𝑥 2 + 5𝑦 𝜕𝑥 𝑓𝑦 = 𝜕𝑧 = 5𝑥 − 2𝑦 𝜕𝑦 𝑑𝑧 = (3𝑥 2 + 5𝑦)𝑑𝑥 + (5𝑥 − 2𝑦)𝑑𝑦 𝑑 2 𝑧 = 𝑓𝑥𝑥 𝑑𝑥 2 + 2𝑓𝑥𝑦 𝑑𝑥𝑑𝑦 + 𝑓𝑦𝑦 𝑑𝑦 2 𝑓𝑥𝑥 = 𝜕 (𝑓 ) = 6𝑥 𝜕𝑥 𝑥 𝑓𝑦𝑦 = 𝜕 (𝑓 ) = −2 𝜕𝑦 𝑦 𝑓𝑥𝑦 = 𝜕 (𝑓 ) = 5 𝜕𝑥 𝑦 𝑓𝑦𝑥 = 𝜕 (𝑓 ) = 5 𝜕𝑦 𝑥 𝑑 2 𝑧 = 6𝑥𝑑𝑥 2 + 2(5)𝑑𝑥𝑑𝑦 − 2𝑑𝑦 2 𝑑 2 𝑧 = 6𝑥𝑑𝑥 2 + 10𝑑𝑥𝑓𝑦 − 2𝑑𝑦 2 Calculate 𝑑𝑧 and 𝑑 2 𝑧 at the point 𝑥 = 1 and 𝑦 = 2. 𝑑𝑧 = 13𝑑𝑥 + 𝑑𝑦 𝑑 2 𝑧 = 6𝑑𝑥 2 + 10𝑑𝑥𝑑𝑦 − 2𝑑𝑦 2 2.2. Second-Order Condition The same 𝑆𝑂𝐶 applies to the function 𝑧 = 𝑓(𝑥, 𝑦) as to 𝑦 = 𝑓(𝑥). The 𝑆𝑂𝐶 for a maximum: minimum: 𝑑2𝑧 < 0 𝑑2𝑧 > 0 For operational convenience, the 𝑆𝑂𝐶 via differentials can be translated into the 𝑆𝑂𝐶 via derivatives. Note that, LN 7—Multivariate Optimization Page 2 of 15 𝑑2𝑧 < 0 iff 𝑓𝑥𝑥 < 0; 𝑓𝑦𝑦 < 0; and 2 𝑓𝑥𝑥 𝑓𝑦𝑦 > 𝑓𝑥𝑦 𝑑2𝑧 > 0 iff 𝑓𝑥𝑥 > 0; 𝑓𝑦𝑦 > 0; and 2 𝑓𝑥𝑥 𝑓𝑦𝑦 > 𝑓𝑥𝑦 Example Find the extreme value(s) of 𝑧 = 8𝑥 3 + 2𝑥𝑦 − 3𝑥 2 + 𝑦 2 + 1 𝑓𝑥 = 24𝑥 2 + 2𝑦 − 6𝑥 = 0 𝑓𝑦 = 2𝑥 + 2𝑦 = 0 From 𝑓𝑦 = 0, we have 𝑦 = −𝑥. Substituting for y in 𝑓𝑥 = 24𝑥 2 + 2𝑦 − 6𝑥 = 0, 24𝑥 2 − 8𝑥 = 0 𝑥1 = 0 1 𝑥2 = 𝑦1 = 0 1 𝑦2 = − 3 3 For 𝑆𝑂𝐶: 𝑓𝑥𝑥 = 48𝑥 − 6 (𝑓𝑥𝑥 )𝑥1=0,𝑦1=0 = −6 < 0 𝑓𝑦𝑦 = 2 (𝑓𝑦𝑦 )𝑥 =0,𝑦 1 1 =0 =2>0 2 Note that since 𝑓𝑥𝑥 and 𝑓𝑦𝑦 have the opposite signs, and thus 𝑓𝑥𝑥 𝑓𝑦𝑦 < 𝑓𝑥𝑦 , the 𝑆𝑂𝐶 for neither the maximum nor the minimum is satisfied. The point (𝑥1 = 0, 𝑦1 = 0) is associated with a “saddle point”. Now, for 𝑓𝑥𝑥 = 48𝑥 − 6 𝑓𝑦𝑦 = 2 (𝑓𝑥𝑥 )𝑥2=1⁄3,𝑦2=−1⁄3 = 10 > 0 (𝑓𝑦𝑦 )𝑥 2 =1⁄3,𝑦2 =−1⁄3 =2>0 2 𝑓𝑥𝑥 𝑓𝑦𝑦 = 20 > 𝑓𝑥𝑦 = 22 = 4 The 𝑆𝑂𝐶 for the minimum is satisfied. Plugging the values for 𝑥2 and 𝑦2 , we have, 1 3 1 1 1 2 1 2 23 𝑧 = 8 ( ) + 2 ( ) (− ) − 3 ( ) + (− ) + 1 = 3 3 3 3 3 27 Example Find the extreme value(s) of 𝑓𝑥 = 1 − 𝑒 𝑥 = 0 𝑥=0 𝑓𝑦 = 2𝑒 − 2𝑒 2𝑦 = 0 𝑦 = 1/2 𝑧 = 𝑥 + 2𝑒𝑦 − 𝑒 𝑥 − 𝑒 2𝑦 (𝑓𝑥𝑥 )𝑥=0,𝑦=1⁄2 = −1 < 0 (𝑓𝑦𝑦 ) = −4𝑒 < 0 𝑥=0,𝑦=1⁄2 𝑓𝑥𝑦 = 0 2 Note that 𝑓𝑥𝑥 𝑓𝑦𝑦 = 4𝑒 > 𝑓𝑥𝑦 = 0. Thus, the SOC for a maximum is satisfied. Plugging in for 𝑥 = 0 and 𝑦 = 1⁄2 in 𝑧 = 𝑥 + 2𝑒𝑦 − 𝑒 𝑥 − 𝑒 2𝑦 , 𝑧 = 0 + 𝑒 − 1 − 𝑒 = −1 LN 7—Multivariate Optimization Page 3 of 15 the point (𝑥, 𝑦, 𝑧) = (0, 1⁄2 , −1) is a maximum point. 2.3. Quadratic Forms and Second-Order Conditions The expression, 𝑑 2 𝑧 = 𝑓𝑥𝑥 𝑑𝑥 2 + 2𝑓𝑥𝑦 𝑑𝑥𝑑𝑦 + 𝑓𝑦𝑦 𝑑𝑦 2 is an example of a quadratic form. A quadratic form is a special case of a polynomial with the following general feature, 𝑎𝑥 2 + 𝑏𝑥𝑦 + 𝑐𝑦 2 Each term in this polynomial has a uniform degree, where the sum of exponents of the variables is equal to 2. Thus, this polynomial of a second degree is called a quadratic form of two variables. The expression above for 𝑑 2 𝑧 is a quadratic form where 𝑑𝑥 and 𝑑𝑦 are counted as the variables, and the partial derivatives are the coefficients. Using the features of a quadratic form, we can develop a simple procedure to determine the “sign definiteness” of 𝑑 2 𝑧. 2.4. Determinant Test for Sign Definiteness Consider the following general quadratic functional form, 𝑧 = 𝑎𝑥 2 + 2𝑏𝑥𝑦 + 𝑐𝑦 2 This quadratic form can be written in the matrix format as 𝑧 = [𝑥 𝑦] [𝑎 𝑏 𝑧 = [𝑎𝑥 + 𝑏𝑦 𝑏 𝑥 ][ ] 𝑐 𝑦 𝑥 𝑏𝑥 + 𝑐𝑦] [𝑦] 𝑧 = 𝑎𝑥 2 + 2𝑏𝑥𝑦 + 𝑐𝑦 2 𝑎 𝑏 |, denoted by|𝐷|, is called the discriminant of the 𝑏 𝑐 quadratic form. The discriminant provides us with the clue to determine the sign-definiteness of z. But first, the determinant |𝑎| = 𝑎 is called the first leading principal minor of the discriminant |𝐷|, and the 𝑎 𝑏 determinant | | is the second leading principal minor. Thus, in a quadratic function with two 𝑏 𝑐 independent variables, there are two leading principal minors. The sign of these principal minors will allow us to determine if z is positive definite, or negative definite: The determinant of the 2 × 2 coefficient matrix | 𝑧 is positive definite iff |𝑎| = 𝑎 > 0 and | 𝑎 𝑏 𝑏 | = 𝑎𝑐 − 𝑏 2 > 0, 𝑐 or 𝑎𝑐 > 𝑏 2 𝑧 is negative definite iff |𝑎| = 𝑎 < 0 and | 𝑎 𝑏 𝑏 | = 𝑎𝑐 − 𝑏 2 > 0, 𝑐 or 𝑎𝑐 > 𝑏 2 Substituting for the variables and coefficients from the expression for 𝑑 2 𝑧, we have, 𝑑 2 𝑧 = 𝑓𝑥𝑥 𝑑𝑥 2 + 2𝑓𝑥𝑦 𝑑𝑥𝑑𝑦 + 𝑓𝑦𝑦 𝑑𝑦 2 LN 7—Multivariate Optimization Page 4 of 15 𝑑 2 𝑧 = [𝑑𝑥 𝑓𝑥𝑥 𝑑𝑦] [ 𝑓𝑥𝑦 𝑓𝑥𝑦 𝑑𝑥 ][ ] 𝑓𝑦𝑦 𝑑𝑦 Thus, 𝑑 2 𝑦 is positive definite: |𝑓𝑥𝑥 | = 𝑓𝑥𝑥 > 0 and | 𝑓𝑥𝑥 𝑓𝑥𝑦 𝑓𝑥𝑦 2 | = 𝑓𝑥𝑥 𝑓𝑦𝑦 − 𝑓𝑥𝑦 > 0, or 𝑓𝑦𝑦 2 𝑓𝑥𝑥 𝑓𝑦𝑦 > 𝑓𝑥𝑦 𝑑 2 𝑦 is negative definite: |𝑓𝑥𝑥 | = 𝑓𝑥𝑥 < 0 and | 𝑓𝑥𝑥 𝑓𝑥𝑦 𝑓𝑥𝑦 2 | = 𝑓𝑥𝑥 𝑓𝑦𝑦 − 𝑓𝑥𝑦 > 0, or 𝑓𝑦𝑦 2 𝑓𝑥𝑥 𝑓𝑦𝑦 > 𝑓𝑥𝑦 Note that the discriminant | Hessian determinant. |𝐻| = | 𝑓𝑥𝑥 𝑓𝑥𝑦 𝑓𝑥𝑥 𝑓𝑥𝑦 𝑓𝑥𝑦 | with the second-order partial derivatives as its elements is called the 𝑓𝑦𝑦 𝑓𝑥𝑦 | 𝑓𝑦𝑦 2.5. Second-Order Conditions for Functions with More than Two Variables. Consider the general function 𝑦 = 𝑓(𝑥1 , 𝑥2 , 𝑥3 ). The total differential of the function is, 𝑑𝑦 = 𝑓1 𝑑𝑥1 + 𝑓2 𝑑𝑥2 + 𝑓3 𝑑𝑥3 The first-order condition for extremum is 𝑓1 = 𝑓2 = 𝑓3 = 0 The second order total differential is, 𝜕 (𝑓 𝑑𝑥 + 𝑓2 𝑑𝑥2 + 𝑓3 𝑑𝑥3 )𝑑𝑥1 𝜕𝑥1 1 1 𝜕 (𝑓 𝑑𝑥 + 𝑓2 𝑑𝑥2 + 𝑓3 𝑑𝑥3 )𝑑𝑥2 𝑑 2 𝑦 = 𝑑(𝑑𝑦) = + 𝜕𝑥2 1 1 𝜕 (𝑓 𝑑𝑥 + 𝑓2 𝑑𝑥2 + 𝑓3 𝑑𝑥3 )𝑑𝑥3 𝑑 2 𝑦 = 𝑑(𝑑𝑦) = + 𝜕𝑥3 1 1 𝑑 2 𝑦 = 𝑑(𝑑𝑦) = 𝑑 2 𝑦 = 𝑑(𝑑𝑦) = 𝑓11 𝑑𝑥12 + 𝑓12 𝑑𝑥1 𝑑𝑥2 + 𝑓13 𝑑𝑥1 𝑑𝑥3 𝑑 2 𝑦 = 𝑑(𝑑𝑦) = +𝑓21 𝑑𝑥1 𝑑𝑥2 + 𝑓22 𝑑𝑥22 + 𝑓23 𝑑𝑥2 𝑑𝑥3 𝑑 2 𝑦 = 𝑑(𝑑𝑦) = +𝑓31 𝑑𝑥1 𝑑𝑥3 + 𝑓32 𝑑𝑥2 𝑑𝑥3 + 𝑓33 𝑑𝑥32 The Hessian determinant is, 𝑓11 |𝐻| = |𝑓21 𝑓31 𝑓12 𝑓22 𝑓32 𝑓13 𝑓23 | 𝑓33 Denoting the leading principal minors by |𝐻1 | = 𝑓11 |𝐻2 | = | LN 7—Multivariate Optimization 𝑓11 𝑓21 𝑓12 | 𝑓22 𝑓11 |𝐻3 | = |𝐻| = |𝑓21 𝑓31 𝑓12 𝑓22 𝑓32 𝑓13 𝑓23 | 𝑓33 Page 5 of 15 The SOC, then, are: 𝑑 2 𝑧 is positive definite: |𝐻1 | > 0 |𝐻2 | > 0 |𝐻3 | > 0 𝑑 2 𝑧 is negative definite: |𝐻1 | < 0 |𝐻2 | > 0 |𝐻3 | < 0 Example Find the extreme values of 𝑦 = 2𝑥12 + 𝑥1 𝑥2 + 4𝑥22 + 𝑥1 𝑥3 + 𝑥32 + 2 𝑓1 = 4𝑥1 + 𝑥2 + 𝑥3 = 0 𝑓2 = 𝑥1 + 8𝑥2 + 𝑥3 = 0 𝑓3 = 𝑥1 + 𝑥2 + 2𝑥3 = 0 The solution for this system of linear equations is 𝑥1 = 𝑥2 = 𝑥3 = 0, which provides for 𝑦 = 2 as the extremum y value. Next we must determine if this extremum is a maximum or a minimum. The Hessian determinant of this function is: 4 |𝐻| = |1 1 1 8 0 1 0| 2 and the leading principle minors are: |𝐻1 | = 4 > 0 |𝐻2 | = | 4 1 1 | = 31 > 0 8 4 |𝐻| = |1 1 1 8 0 1 0| = 54 > 0 2 This indicates that 𝑑 2 𝑦 is positive definite and, hence the extremum is a minimum. 3. Economic Applications 3.1. Profit Maximization of a Multiproduct Firm 3.1.1. A Two-Product Perfectly Competitive Firm Here we start with the case of a two-product firm operating in a perfectly competitive market structure. In a perfectly competitive market structure the firm is a price taker; prices of the two products are treated as exogenous variables. The profit function is, 𝜋 = 𝜋(𝑄1 , 𝑄2 ) To obtain the first-order conditions, take the total differential of the profit function, 𝑑𝜋 = 𝜋1 𝑑𝑄1 + 𝜋2 𝑑𝑄2 where, 𝜋1 ≡ 𝜕𝜋 𝜕𝜋 and 𝜋2 ≡ 𝜕𝑄1 𝜕𝑄2 To maximize profits, 𝜕𝜋 𝜕𝜋 = 0 and =0 𝜕𝑄1 𝜕𝑄2 LN 7—Multivariate Optimization Page 6 of 15 The obtain the second-order conditions for profit maximization, 𝑑2𝜋 = 𝜕 𝜕 (𝑑𝜋)𝑑𝑄1 + (𝑑𝜋)𝑑𝑄2 𝜕𝑄1 𝜕𝑄2 𝑑2𝜋 = 𝜕 𝜕 (𝜋 𝑑𝑄 + 𝜋2 𝑄2 )𝑑𝑄1 + (𝜋 𝑑𝑄 + 𝜋2 𝑄2 )𝑑𝑄2 𝜕𝑄1 1 1 𝜕𝑄2 1 1 𝑑 2 𝜋 = 𝜋11 𝑑𝑄12 + 2𝜋12 𝑑𝑄1 𝑑𝑄2 + 𝜋22 𝑑𝑄22 To assure that the profit is maximized, the Hessian matrix 𝜋11 |𝐻| = |𝜋 21 𝜋12 𝜋22 | < 0 𝜋11 which requires, |𝐻1 | = 𝜋11 < 0 and |𝐻2 | = |𝐻| = |𝜋 21 𝜋12 𝜋22 | > 0. Now consider a perfectly competitive firm’s total revenue and cost functions as given below. 𝑅 = 𝑃1 𝑄1 + 𝑃2 𝑄2 𝐶 = 2𝑄12 + 𝑄1 𝑄2 + 2𝑄22 The firm’s profit function is, 𝜋 = 𝑅 − 𝐶 = 𝑃1 𝑄1 + 𝑃2 𝑄2 − 2𝑄12 − 𝑄1 𝑄2 − 2𝑄22 The first-order conditions: 𝜕𝜋 = 𝑃1 − 4𝑄1 − 𝑄2 = 0 𝜕𝑄1 𝜕𝜋 = 𝑃2 − 4𝑄2 − 𝑄1 = 0 𝜕𝑄2 provide the two simultaneous equations, 4𝑄1 + 𝑄2 = 𝑃1 𝑄1 + 4𝑄2 = 𝑃2 the solutions for which can be obtained by, 4 [ 1 𝑃 1 𝑄1 ] [ ] = [ 1] 𝑃2 4 𝑄2 Now, let 𝑃1 = 12 and 𝑃2 = 18. 4 [ 1 1 𝑄1 12 ][ ] = [ ] 4 𝑄2 18 which provides for the profit maximizing quantities, 𝑄1 = 2 and 𝑄2 = 4. LN 7—Multivariate Optimization Page 7 of 15 Checking for the second order conditions, 𝜋11 = −4, 𝜋12 = −1, 𝜋22 = −4 𝜋11 |𝐻| = |𝜋 21 𝜋12 −4 𝜋22 | = |−1 −1 | −4 where |𝐻1 | = 𝜋11 = −4 < 0, and |𝐻2 | = |𝐻| = 16 − 1 = 15 > 0 Thus, the Hessian determinant is negative definite and the optimal solutions for 𝑄1 and 𝑄2 are the maximum. 3.1.2. A Two-Product Monopoly Now consider a monopoly producing two related products each with its own demand function. Since the products are related, then a change in the price one will also affect the demand for the other. 𝑄1 = 40 − 2𝑃1 + 𝑃2 𝑄2 = 15 + 2𝑃1 − 𝑃2 The monopoly’s profit function is, 𝜋 =𝑅−𝐶 where. 𝑅 = 𝑃1 𝑄1 + 𝑃2 𝑄2 and 𝐶 = 𝑄12 + 𝑄1 𝑄2 + 𝑄22 Unlike the case of a perfectly competitive firm, now the prices are no longer treated as exogenous variables. The price of each product depends on the volume of output. Thus, we need to express price as a function of quantity to determine the firm’s revenue function. Rewriting the above demand functions as −2𝑃1 + 𝑃2 = 𝑄1 − 40 −2𝑃1 − 𝑃2 = 𝑄2 − 15 Writing the two equations above in the matrix format and using Cramer’s rule we can solve for 𝑃1 and 𝑃2 . 𝑄 − 40 1 𝑃1 ][ ] = [ 1 ] 𝑄2 − 15 −1 𝑃2 −2 [ 1 𝑄1 − 40 1 | 𝑄2 − 15 −1 𝑃1 = = 55 − 𝑄1 − 𝑄2 −2 1 | | 1 −1 | −2 𝑄1 − 40 | 1 𝑄2 − 15 𝑃1 = = 70 − 𝑄1 − 2𝑄2 −2 1 | | 1 −1 | Thus, LN 7—Multivariate Optimization Page 8 of 15 𝑅 = (55 − 𝑄1 − 𝑄2 )𝑄1 + (70 − 𝑄1 − 2𝑄2 )𝑄2 𝑅 = 55𝑄1 + 70𝑄2 − 2𝑄1 𝑄2 − 𝑄12 − 2𝑄22 The profit function then becomes, 𝜋 = 55𝑄1 + 70𝑄2 − 2𝑄1 𝑄2 − 𝑄12 − 2𝑄22 − (𝑄12 + 𝑄1 𝑄2 + 𝑄22 ) 𝜋 = 55𝑄1 + 70𝑄2 − 3𝑄1 𝑄2 − 2𝑄12 − 3𝑄22 The first order conditions for profit maximization provide: 𝜕𝜋 = 55 − 4𝑄1 − 3𝑄2 = 0 𝜕𝑄1 𝜕𝜋 = 70 − 3𝑄1 − 6𝑄2 = 0 𝜕𝑄2 4𝑄1 + 3𝑄2 = 55 3𝑄1 + 6𝑄2 = 70 4 [ 3 [ 3 𝑄1 55 ][ ] = [ ] 6 𝑄2 70 8 𝑄1 ] = [ 72 ] 𝑄2 3 Substituting the quantity values into the price equations above we have, 2 1 𝑃1 = 55 − 8 − 73 = 393 2 2 𝑃1 = 70 − 8 − 2 (73) = 463 𝜋 = 55𝑄1 + 70𝑄2 − 3𝑄1 𝑄2 − 2𝑄12 − 3𝑄22 2 2 2 2 1 𝜋 = 55(8) + 70 (73) − 3(8) (73) − 2(8)2 − 3 (73) = 4883 The Hessian determinant for the second order condition is 𝜋11 |𝐻| = |𝜋 Since 21 𝜋12 −4 𝜋22 | = |−3 −3 | −6 |𝐻1 | = 𝜋11 = −4 < 0 −4 |𝐻2 | = |𝐻| = | −3 −3 | = 24 − 9 = 15 > 0 −6 Thus, 𝜋 = 48813 is the maximum profit. 3.2. Price-Discriminating Monopoly The ability to price discriminate arises when a monopoly can segregate the market for a given product according to the price elasticity of demand in each segment of the market, and is able to prevent arbitrage among the buyers of that product. LN 7—Multivariate Optimization Page 9 of 15 Consider a single-product monopoly with three segregated markets. The firm can sell the same product in each market segment at a different price, starting with a higher price where demand is relatively inelastic and lowering the price in the other market segments with a higher price elasticity of demand. The firm’s total revenue therefore consists of three distinct components, each corresponding to a different market segment: 𝑅 = 𝑅1 (𝑄1 ) + 𝑅2 (𝑄2 ) + 𝑅3 (𝑄3 ) The single-product firm’s cost function is simply, 𝐶 = 𝐶(𝑄) where 𝑄 = 𝑄1 + 𝑄2 + 𝑄3 The profit function is then expressed as, 𝜋 = 𝑅1 (𝑄1 ) + 𝑅2 (𝑄2 ) + 𝑅3 (𝑄3 ) − 𝐶(𝑄) To obtain the first order conditions, take the total differential of the profit function. 𝜋 = 𝜋(𝑄1 , 𝑄2 , 𝑄3 ) 𝑑𝜋 = 𝜕𝜋 𝜕𝜋 𝜕𝜋 𝑑𝑄1 + 𝑑𝑄2 + 𝑑𝑄 𝜕𝑄1 𝜕𝑄2 𝜕𝑄3 3 𝜕𝑅1 𝑑𝐶 𝜕𝑄 𝜕𝑅2 𝑑𝐶 𝜕𝑄 𝜕𝑅3 𝑑𝐶 𝜕𝑄 𝑑𝜋 = ( − ) 𝑑𝑄1 + ( − ) 𝑑𝑄2 + ( − ) 𝑑𝑄3 𝜕𝑄1 𝑑𝑄 𝜕𝑄1 𝜕𝑄2 𝑑𝑄 𝜕𝑄2 𝜕𝑄3 𝑑𝑄 𝜕𝑄1 Regarding the term 𝜕𝑄 ⁄𝑑𝑄𝑖 in the above total differential, note that the partial derivative implies that the total output changes due to a change in market segment 𝑖 holding the quantities in other market segments constant. 𝑄 = 𝑄1 + 𝑄2 + 𝑄3 𝜕𝑄 = 1, 𝜕𝑄1 𝜕𝑄 = 1, 𝜕𝑄2 𝜕𝑄 =1 𝜕𝑄2 The first-order condition then becomes 𝜕𝜋 𝜕𝑅1 𝑑𝐶 ≡ 𝜋1 = − =0 𝜕𝑄1 𝜕𝑄1 𝑑𝑄 𝑀𝑅1 = 𝑀𝐶 𝜕𝜋 𝜕𝑅2 𝑑𝐶 ≡ 𝜋2 = − =0 𝜕𝑄2 𝜕𝑄2 𝑑𝑄 𝑀𝑅2 = 𝑀𝐶 𝜕𝜋 𝜕𝑅3 𝑑𝐶 ≡ 𝜋3 = − =0 𝜕𝑄3 𝜕𝑄3 𝑑𝑄 𝑀𝑅3 = 𝑀𝐶 Therefore, the first-order condition for profit maximization through price discrimination requires, 𝑀𝑅1 = 𝑀𝑅1 = 𝑀𝑅1 = 𝑀𝐶 This means that the level of output in each market segment should be determined such that the marginal revenue in each is equal to the marginal cost of total output. Now back to price discrimination. At the beginning of this discussion it was stated that, “The firm can sell the same product in each market segment at a different price, starting with a higher price where demand is LN 7—Multivariate Optimization Page 10 of 15 relatively inelastic, and lowering the price in the other market segments with a higher price elasticity of demand.” Recall from “LN3—Differentials” that we derived the relationship between marginal revenue, price, and the price elasticity of demand as follows: 𝑀𝑅 = (1 − 1 )𝑃 |ε| Using this relationship, the first-order condition can be written as, (1 − 1 1 1 ) 𝑃 = (1 − ) 𝑃 = (1 − )𝑃 |ε1 | 1 |ε2 | 2 |ε3 | 3 Assume the following relationship exists between the coefficients of elasticity in the three market segments: |ε1 | < |ε2 | < |ε3 | Thus, to maintain the first-order-condition requirements, 𝑃1 > 𝑃2 > 𝑃3 For example, let |ε1 | = 1.2 (1 − |ε2 | = 1.4 |ε3 | = 1.6 𝑀𝐶 = $2.00 1 1 1 ) 𝑃1 = (1 − ) 𝑃2 = (1 − ) 𝑃 = $2.00 1.2 1.4 1.6 3 Then, to maintain the equality, (𝑃1 , 𝑃2 , 𝑃3 ) = ($12, $7, $5.33) For the second-order condition, find the Hessian determinant. Once again, keeping in mind that 𝜕𝑄 ⁄𝑑𝑄𝑖 = 1, 𝜕2𝜋 𝜕 2 𝑅1 𝑑 2 𝐶 𝜕𝑄 − = 𝑅1′′ (𝑄1 ) − 𝐶′′(𝑄) 2 ≡ 𝜋11 = 𝜕𝑄1 𝜕𝑄12 𝑑𝑄2 𝜕𝑄1 𝜕2𝜋 𝜕 2 𝑅2 𝑑 2 𝐶 𝜕𝑄 ≡ 𝜋 = − = 𝑅2′′ (𝑄2 ) − 𝐶′′(𝑄) 22 𝜕𝑄22 𝜕𝑄22 𝑑𝑄2 𝜕𝑄2 𝜕2𝜋 𝜕 2 𝑅3 𝑑 2 𝐶 𝜕𝑄 ≡ 𝜋 = − = 𝑅3′′ (𝑄3 ) − 𝐶′′(𝑄) 33 𝜕𝑄32 𝜕𝑄32 𝑑𝑄2 𝜕𝑄3 Also note, 𝜕2𝜋 𝜕 2 𝑅1 𝑑 2 𝐶 𝜕𝑄 𝑑2 𝐶 ≡ 𝜋12 = − = − = −𝐶′′(𝑄) 𝜕𝑄1 𝜕𝑄2 𝜕𝑄1 𝜕𝑄2 𝑑𝑄2 𝜕𝑄2 𝑑𝑄2 Since the market segments are segregated, 𝑅1 = 𝑅1 (𝑄1 ). Therefore, LN 7—Multivariate Optimization Page 11 of 15 𝜕 2 𝑅1 =0 𝜕𝑄1 𝜕𝑄2 Applying the same argument to all market segments, then 𝜋12 = 𝜋13 = 𝜋23 The Hessian determinant is then 𝑅1′′ − 𝐶′′ |𝐻| = | −𝐶′′ −𝐶′′ −𝐶′′ 𝑅2′′ − 𝐶′′ −𝐶′′ −𝐶′′ −𝐶′′ | 𝑅3′′ − 𝐶′′ For profit maximization |𝐻| must be negative definite, which requires |𝐻1 | = 𝑅1′′ − 𝐶 ′′ < 0 |𝐻2 | = | 𝑅1′′ − 𝐶′′ −𝐶′′ −𝐶′′ |>0 𝑅2′′ − 𝐶′′ |𝐻3 | = |𝐻| < 0 The first part of the SOC requires that the slope of the MR function be less than the slope of the MC function at the point of intersection of the two functions. When, at the point of intersection, 𝑀𝑅𝑖 = 𝑀𝐶, the marginal revenue curve slopes downward and the marginal cost curve slopes upward, this condition is satisfied. This is shown in the following graph, where 𝐶 ′ = 3𝑄2 − 36𝑄 + 141 and 𝑅′ = 150 − 10𝑄. The profit maximizing output is 𝑄 = 9. At the point of intersection of 𝑅′ and 𝐶′, the slope of 𝑅′ is 𝑅′′ = −10, and the slope of 𝐶′ is 𝐶 ′′ = 6(9) − 36 = 18. Thus, the first part of the SOC, |𝐻1 | = 𝑅1′′ − 𝐶 ′′ < 0, is satisfied. There are no economic interpretations of |𝐻2 | > 0 and |𝐻3 | = |𝐻| < 0. Consider the following numerical example. A price-discriminating monopoly faces the following demand functions (demand price being a function of quantity) in three market segments. LN 7—Multivariate Optimization Page 12 of 15 𝑃1 = 100 − 0.10𝑄1 𝑃2 = 120 − 0.25𝑄2 𝑃3 = 200 − 0.50𝑄3 The cost function is, 𝐶 = 5𝑄 + 0.25𝑄2 The corresponding marginal revenue functions and the marginal cost function are: 𝑅1′ = 100 − 0.2𝑄1 𝑅2′ = 120 − 0.5𝑄2 𝑅3′ = 200 − 0.6𝑄3 𝐶′ = 5 + 0.5𝑄 = 5 + 0.5(𝑄1 + 𝑄2 + 𝑄3 ) The FOC provides that, 100 − 0.2𝑄1 = 5 + 0.5(𝑄1 + 𝑄2 + 𝑄3 ) 120 − 0.5𝑄2 = 5 + 0.5(𝑄1 + 𝑄2 + 𝑄3 ) 200 − 0.6𝑄3 = 5 + 0.5(𝑄1 + 𝑄2 + 𝑄3 ) which results in the following system of simultaneous equations, 0.7𝑄1 + 0.5𝑄2 + 0.5𝑄3 = 95 0.5𝑄1 + 0.6𝑄2 + 0.5𝑄3 = 115 0.5𝑄1 + 0.5𝑄2 + 1.5𝑄3 = 195 Using the matrix format , 0.7 [0.5 0.5 0.5 1.0 0.5 0.5 𝑄1 95 0.5] [𝑄2 ] = [115] 1.5 𝑄3 195 we obtain the following profit maximizing quantities for each market segment: 𝑄1 = 25 𝑄2 = 50 𝑄3 = 105 For the SOC: 𝑅1′′ − 𝐶′′ |𝐻| = | −𝐶′′ −𝐶′′ −𝐶′′ 𝑅2′′ − 𝐶′′ −𝐶′′ −𝐶′′ −0.7 −𝐶′′ | = |−0.5 −0.5 𝑅3′′ − 𝐶′′ −0.5 −1.0 −0.5 −0.5 −0.5| −1.5 Thus, all parts of the SOC are satisfied: |𝐻1 | = 𝑅1′′ − 𝐶 ′′ = −0.7 < 0 |𝐻2 | = | 𝑅1′′ − 𝐶′′ −𝐶′′ −𝐶′′ −0.7 |=| 𝑅2′′ − 𝐶′′ −0.5 −0.7 |𝐻3 | = |𝐻| = |−0.5 −0.5 −0.5 −1.0 −0.5 LN 7—Multivariate Optimization −0.5 | = 0.45 > 0 −1.5 −0.5 −0.5| = −0.5 < 0 −1.5 Page 13 of 15 Now, given the optimum quantities determined above, the monopolist will charge the following prices in the corresponding market segment. 𝑃1 = 100 − 0.10𝑄1 = 100 − 0.10(25) = 97.5 𝑃2 = 120 − 0.25𝑄2 = 120 − 0.25(50) = 107.5 𝑃3 = 200 − 0.50𝑄3 = 200 − 0.50(105) = 147.5 The elasticity in each market segment at the price-quantity pairs found above are: 𝑑𝑄1 𝑃1 1 97.5 = ( )( ) = 39 𝑑𝑃1 𝑄1 0.1 25 𝑑𝑄2 𝑃2 1 107.5 |𝜀2 | = =( )( ) = 8.6 𝑑𝑃2 𝑄2 0.25 50 𝑑𝑄3 𝑃3 1 147.5 |𝜀3 | = = ( )( ) = 2.81 𝑑𝑃3 𝑄3 0.5 105 |𝜀1 | = 3.3. Input Decisions of a Firm In some cases profit maximization decision of a firm may involve a decision regarding the optimum combination of inputs. Consider the case of two inputs labor (L) capital (K). The firm’s production function is expressed as 𝑄 = 𝑄(𝐿, 𝐾). A special type of production function is the Cobb-Douglas production function, 𝑄 = 𝐿𝛼 𝐾𝛽 where α and β are positive parameters indicating the returns to scale: 𝛼+𝛽 >1 𝛼+𝛽 =1 𝛼+𝛽 <1 Increasing returns to scale. Doubling the size of the inputs, output more than doubles. Constant returns to scale. Doubling the size of the inputs, output doubles. Decreasing returns to scale. Doubling the size of the inputs, output less doubles. Here we assume 𝛼 + 𝛽 < 1, and further we assume a symmetric function where 𝛼 = 𝛽 < 1⁄2. Then the production function becomes, 𝑄 = 𝐿𝛼 𝐾 𝛼 Using P for the price of the product, w for the price of labor, and r for the price of capital, then the firm’s profit function is, 𝜋(𝐿, 𝐾) = 𝑃𝐿𝛼 𝐾 𝛼 − (𝑤𝐿 + 𝑟𝐾) The FOC for profit maximization is 𝜕𝜋 = 𝑃𝛼𝐿𝛼−1 𝐾 𝛼 − 𝑤 = 0 𝜕𝐿 𝜕𝜋 = 𝑃𝛼𝐿𝛼 𝐾 𝛼−1 − 𝑟 = 0 𝜕𝐾 Solving for K from the first equation 𝐾=( 𝑤 1−𝛼 1⁄𝛼 𝐿 ) 𝑃𝛼 and substituting in the second, LN 7—Multivariate Optimization Page 14 of 15 1 𝑃𝛼𝐿𝛼 ( 1 𝑤 1−𝛼 1−𝛼 𝐿 ) =𝑟 𝑃𝛼 1 𝑃𝛼 𝛼 𝛼 𝑤 𝛼−1 2𝛼−1 𝛼 𝛼 𝐿 =𝑟 Solving for L, 2𝛼−1 𝛼 𝐿 = 𝑟 1 𝛼 1 𝛼 𝑃 𝛼 𝑤 1 −𝛼 𝐿 = [𝑟 (𝑃 𝛼 1 𝛼−1 𝛼 1 −𝛼 𝑤 1 = 𝑟 (𝑃−𝛼 𝛼 −𝛼 𝑤 − −𝛼−1 𝛼 )] 𝛼 2𝛼−1 𝛼−1 𝛼 ) 𝛼 1 1 𝛼−1 −𝛼 1 1 𝛼−1 = 𝑟 2𝛼−1 𝑃 −2𝛼−1 𝛼 −2𝛼−1 𝑤 −2𝛼−1 = 𝑟 1−2𝛼 𝑃 1−2𝛼 𝛼 1−2𝛼 𝑤 1−2𝛼 1 𝐿 = (𝑃𝛼𝑤 𝛼−1 𝑟 −𝛼 )1−2𝛼 Similarly, the model being symmetric, 1 𝐾 = (𝑃𝛼𝑤 −𝛼 𝑟 𝛼−1 )1−2𝛼 Thus, given the parameter α, the firm’s demand for labor and capital is a function of P, w, and r. Substituting for L and K in production function 𝑄 = 𝐿𝛼 𝐾 𝛼 , 𝛼 𝛼 𝛼 𝑄 = (𝑃𝛼𝑤 𝛼−1 𝑟 −𝛼 )1−2𝛼 (𝑃𝛼𝑤 −𝛼 𝑟 𝛼−1 )1−2𝛼 = [(𝑃𝛼𝑤 𝛼−1 𝑟 −𝛼 )(𝑃𝛼𝑤 −𝛼 𝑟 𝛼−1 )]1−2𝛼 𝛼 𝑃2 𝛼 2 1−2𝛼 𝑄𝑂 = ( ) 𝑤𝑟 Note that here 𝑄𝑂 represents the optimal or profit maximizing Q. We still need to establish the SOC to see they are satisfied for profit maximization. 𝜋𝐿𝐿 = 𝑃𝛼(𝛼 − 1)𝐿𝛼−2 𝐾 𝛼 𝜋𝐾𝐾 = 𝑃𝛼(𝛼 − 1)𝐿𝛼 𝐾 𝛼−2 𝜋𝐿𝐾 = 𝜋𝐾𝐿 = 𝑃𝛼 2 𝐿𝛼−1 𝐾 𝛼−1 |𝐻| = | 𝑃𝛼(𝛼 − 1)𝐿𝛼−2 𝐾 𝛼 𝑃𝛼 2 𝐿𝛼−1 𝐾 𝛼−1 𝑃𝛼 2 𝐿𝛼−1 𝐾 𝛼−1 | 𝑃𝛼(𝛼 − 1)𝐿𝛼 𝐾 𝛼−2 |𝐻1 | = 𝑃𝛼(𝛼 − 1)𝐿𝛼−2 𝐾 𝛼 < 0 We have assumed 𝛼 < 1⁄2. Let 𝛼 = 0.4, then, |𝐻1 | = 𝑃(0.4)(0.4 − 1)𝐿𝛼−2 𝐾 𝛼 = −0.24𝑃𝐿−1.6 𝐾 0.4 < 0 |𝐻| = 𝑃2 𝛼 2 𝐿2𝛼−2 𝐾 2𝛼−2 (1 − 𝛼) = 0.096𝑃2 𝐿−1.2 𝐾 −1.2 > 0 LN 7—Multivariate Optimization Page 15 of 15