TIIM2011-Tseng

advertisement

GREEN SUPPLY CHAIN MANAGEMENT WITH LINGISTIC

PREFERENCES AND INCOMPLEE INFORMATION

Ming-Lang Tseng, Ru-Jen Lin and Anthony SF Chiu

Graduate School of Business & Management, Lung Hwa University of Science and Technology, Taiwan

Department of Industrial Engineering, De La Salle University, Manila

E-mail: tsengminglang@gmail.com

ABSTRACT

As firms move toward environmental sustainability, management must extend

managements efforts to improve environmental practices across the supply chain. The

selection of a suitable green supplier according to green supply chain management criteria

(GSCM) is essential for the sustainable development of manufacturing firms. The objective of

this study was to select an optimal alternative in the presence of incomplete information and

linguistic preferences using multiple GSCM criteria. The goal of GSCM is to reduce a firm’s

pollution and other environmental impacts. In the proposed method, the weights of GSCM

criteria and alternatives are described using linguistic preferences that can be resolved with

fuzzy set theory. Subsequently, the rank of each alternative was calculated from incomplete

information by applying a grey degree. Moreover, a case study was used to resolve the

proposed method, and the results and managerial implications of the analysis are discussed in

detail.

Keywords: grey degree, fuzzy set theory, firm’s green supply chain management

INTRODUCTION

In recent years, environmental management has evolved to include boundary-spanning

activities in the supply chain, and both upstream and downstream activities are included in

green supply chain management (GSCM) (Sarkis, 1998; Lee et al., 2009). A limited

understanding of GSCM has hindered the development of a widely accepted framework that

characterizes and categorizes a firm’s environmental activities. The European Union has

established a variety of environmental policies, including RoHS (the restricted use of

hazardous substances in electrical and electronic equipment) and WEEE (waste electronics

and electrical equipment) Directives. These directives ban manufacturers, sellers, distributors

and recyclers of electrical and electronic equipment from launching new equipment that

contains hazardous materials on the market (Tseng, 2009a; Tseng 2010a). While WEEE

directives are aimed at the life cycle of the product, RoHS is targeted at the product design

stage. Although environmental regulations and mandatory programs have been implemented,

pressure to protect the environment also comes from other external stakeholders.

Currently, a wide variety of studies on GSCM can be found in the literature (Zhu et al.,

2008; Srivastava, 2007). Srivastava (2007) defined GSCM as a combination of environmental

and supply chain management (SCM) activities, including product design, material selection,

manufacturing processes, final product delivery and end-of-life product management.

Moreover, through GSCM, firms can select from a wide variety of suppliers and leverage

resources throughout the firm to eliminate the environmental impacts of supply chain

activities. Firms typically expect their suppliers to go beyond environmental compliance and

develop efficient, green product designs. In addition, suppliers are expected to assess the life

cycle of a product. Nevertheless, the firm’s suppliers must satisfy GSCM criteria under the

constraint of incomplete information and subjective human preferences (uncertainty);

however, this phenomenon has not been thoroughly examined.

GSCM philosophy focuses on how firms utilize the supplier’s processes and technologies,

as well as the supplier’s ability to integrate environmental concerns and enhance the firm’s

competitive advantage (Vachon and Klassen, 2008). However, to study and advance the body

of knowledge related to GSCM, identification of appropriate measures is necessary. To

effectively and empirically advance the theory, greater attention must be focused on

employing multi-criteria evaluations, assessing the validity of criteria and modifying

unacceptable criteria through extensive literature reviews (Tseng et al., 2009b; Lee et al.,

2009). Hence, in this study, a number of different criteria that can be used to evaluate GSCM

practices were integrated, and a literature review on supply chain and environmental

management was performed. Firms can benefit from the development of reliable and valid

criteria, and the practitioner can apply these criteria as benchmarks to attain continuous

improvement. One objective of the present study was to assist firms in understanding the

criteria and implementation. However, the uncertainties and incomplete information are often

encountered in the implementation process. In the process of GSCM, the selection of green

supplier is always encountered, the multi-criteria decision making (MCDM) tools are always

proposed to be applied in the process (Tseng et al., 2008).

In real systems, MCDM is often based on subjective preferences or incomplete

information. Grey theory is superior for the theoretical analysis of systems with imprecise and

incomplete information within a system of evaluation (Tseng 2010b). Moreover, the

evaluation system having incomplete information is so called grey system and the triangular

fuzzy numbers in grey system represents a set of numbers with less complete information, the

system is always represented as lack of information. Hence, the grey possible degree is to

evaluate the incomplete information. The principles of the available theories and modeling

schemes for the prediction and diagnosis of an uncertain situation are summarized, and the

practical applications of theories and linguistic preferences are reviewed. People often employ

natural language to express thoughts and subjective perceptions; however, the meaning of

words in natural languages is often vague. Although the meaning of a specific word may be

well defined, when that word is used to define a set, the boundaries of the set can become

uncertain. Hence, the proposed method uses fuzzy set theory to appropriately express the

determination of human judgment in GSCM criteria. The second contribution of this study is

the development of a hybrid approach for the establishment of GSCM criteria for the selection

of an optimal alternative.

In an effort to determine the uncertainty in the proposed model, GSCM criteria were

integrated and an optimal alternative was selected. This paper contributes to GSCM literature

by developing valid and reliable criteria based on information obtained from GSCM literature

and experts in the field. Moreover, this study developed an approach based on grey theory for

the determination of linguistic preferences. In section 2 of this paper, a literature review of

GSCM practices is provided. In addition, the methodology used to develop GSCM criteria

was validated and is presented in Section 3. Section 4 presents the results of this study, and

the implications of the results are discussed in section 5. The paper is concluded in section 6

by summarizing the results, implications, limitations and potential topics of future research.

PROPOSED GSCM CRITERIA

Contributions from industry and academia, along with the results of an extensive

literature review, were used to establish 16 criteria of an optimal supplier (Li et al., 2006;

Tseng et al., 2009b). Selection of appropriate suppliers in GSCM requires battery of

evaluation criteria, which include such information as customer focus, competitive priority,

green purchasing, information technology, and top management support of a firm. Srivastava

(2007) described GSCM as combining environmental thinking and supply chain management

and defines it as including product design, material sourcing and selection, manufacturing

processes, delivery of the final product to the consumer, and end-of-life management of the

product after its useful life. A firm must have outstanding competitive priority in order to

perform well management in production, such as producing high quality products with

excellent logistics arrangement. The competitive priority is closely related to top management

support that requires strategic purchasing. As such, the present study will view GSCM a

complex, interactive process of many different resources with multidimensional,

interdependent criteria (Sarkis, 1998; 2003).

To ensure that the profitability of the supplier (C2) is an important part of the firm’s

practices, GSCM has become critical in establishing value-added content (Kathuria, 2000;

Johnston et al., 2004; Yao et al., 2007). Moreover, the reliability of delivery (C1), defined as

the ability to meet delivery schedules or promises, and the ability to react quickly to customer

orders, is critical to improving the firm’s customer service. The product conformance quality

(C5), defined as the ability of the firm to satisfy the customer needs, is critical to the firm’s

success (Chase et al., 2001). Tan et al. (1998) explored the relationship between supplier

management, customer relations and organizational performance, and used purchasing,

quality, customer relations and relationship supplier closeness (C3) to evaluate the suitability

of a supplier selection model. Sarkis (1998) categorized environmentally conscious business

practices into five major components including green design (green design (C8)), life cycle

analysis, the total quality of environmental management and compliance with environmental

standards such as ISO 14000 (C11).

Researchers have included internal green production (C12), clean production (C14) and

the quality of internal service (C7) as GSCM criteria, and the supplier’s purchasing

perspective has also been addressed.. Carr and Smeltzer (1999) documented how firms with

strategic purchasing plans foster long-term, cooperative relationships, and achieve greater

responsiveness to the needs of their suppliers. Zhu and Geng (2001) studied Chinese firms

and examined their methods of environmental development in business practices such as

green purchasing (C9). Among the supplier selection models currently in use,

environmentally preferable bidding and life cycle assessment (C10), which assesses the

impacts of green purchasing and their financial consequences through the entire product

life-cycle, are the most popular. However, supplier flexibility (C6) is a complex and

multi-dimensional capability that requires firm-wide effort to increase the firm’s

responsiveness, reduce waste and limit the firm’s environmental impact (Dreyer and

Gronhaug, 2004). Chen, et al. (2006) identified many quantitative and qualitative factors such

as quality, price and flexibility, and concluded that delivery performance must be considered

in the determination of the optimal supplier. Humphreys et al. (2003) identified environmental

criteria that influence a firm’s management support services (C13) and developed

knowledge-based environmental management system requirements (C16) to integrate the

environmental criteria and support the supplier selection process.

GSCM capabilities are ‘‘complex bundles of individual skills, assets and accumulated

knowledge exercised through production processes, that enable firms to co-ordinate activities

and make use of their resources’’ (Olavarrieta and Ellinger, 1997). Moreover, GSCM is

essential to the competitive advantage of a firm. GSCM involves the flow of finances,

logistics, and information, as well as the ability to integrate relationships and green

technology (C4), and to reduce the use of hazardous products in the production process (C15).

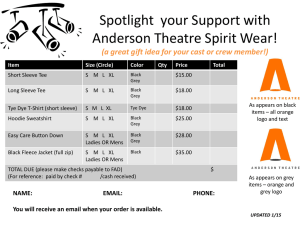

Figure 1 presents the hierarchical structure of the framework used to evaluate a firm’s GSCM.

The framework consists of a MCDM analysis based on fuzzy set theory and grey degree, and

can be used to select optimal suppliers (Chen and Tzeng, 2004; Zhang et al., 2005; Li et al.,

2007). Moreover, fuzzy set theory was used to eliminate the linguistic preferences of

subjective judgment (Zadeh, 1965; Tseng et al., 2008; Tseng, 2010a). The proposed

framework is based on the following criteria: (C1) reliability of delivery; (C2) profitability of

the supplier; (C3) relationship to the supplier; (C4) green technology capabilities; (C5)

conformance quality; (C6) flexibility of the supplier; (C7) service quality; (C8) green

purchasing capabilities; (C9) life cycle assessment; (C10) green design; (C11) green

certifications; (C12) internal green production plans; (C13) management support; (C14) green

production; (C15) the reduction of hazardous materials in the production process; (C16)

environmental management systems.

Firm’s GSCM

C1

C2

Alternative 1

C3

C4

2

………..

3

C15

C16

4

Figure 1. Hierarchical structure

METHOD

Researchers describe GSCM as a strategic, decision-making perspective used to improve

the performance of a firm. This study focused on GSCM criteria and their relevant

associations, as described below. The definitions of fuzzy set theory, grey theory and the

procedures of the proposed approach are also briefly discussed.

3.1 Fuzzy set theory

Fuzzy set theory (Zadeh, 1965) is a mathematical theory designed to model the fuzziness

of cognitive processes. It is essentially a generalization of set theory, where the classes lack

sharp boundaries. The membership function A (x) of a fuzzy set operates over the range of

real numbers on the interval of [0, 1].

An expert’s uncertain judgment can be represented by a fuzzy number. A TFN is a fuzzy

number with a membership function that is defined by three real numbers (a, b, c), where a, b,

and c are real numbers and a b c . This membership function is illustrated in Fig. 2 and

described mathematically below.

In the proposed method, the linguistic preferences used to derive the priorities of the

alternatives and the grey numbers used to establish the selection criteria were uncertain. The

triangular fuzzy membership function employed in the proposed model is presented as

follows (Lin et al., 2007).

~

Definition 1. A TFN N was defined as a triplet (a, b, c), and the membership function

A (x) was defined as:

0

xa

( x a) /(b a) a x b

( x)

(c x) /(c b) b x c

0

cx

(1)

A (x)

1

a

b

c

X

Figure 2. A TFN A= (a, b, c)

Therefore, a, b, and c represent the lower, mean and upper bounds of the TFN. The

membership function represents the degree to which any element (x) in domain X belongs to

fuzzy number A.

3.2 Grey theory

Grey theory is a mathematical theory derived from the grey set and is an effective

method used to resolve uncertainties in discrete data (Deng 1989). In this study, the basic

definitions of grey systems, sets and numbers were applied(Tseng, 2008).

Definition 2. A grey system contains incomplete information and is represented by a set of

TFNs. In the proposed model, X is the universal set, and G of X is a grey set defined by

G (x) and G (x) .

G ( x) : x [0,1]

G ( x) : x [0,1]

(2)

G ( x) G ( x), x X , X R, G ( x) and G (x) are the upper and lower membership

functions of G after defuzzification, respectively. When G (x) = G (x) , G becomes a fuzzy

set. Thus, grey theory considers fuzzy conditions and can handle fuzzy situations.

Definition 3. TFNs can be defined as a set of numbers within a grey system. For example, the

rating of criteria and alternatives in this study are described by TFNs. The numerical interval

contains uncertain information, and the TFNs are defined as G, (G G ). The lower

and upper limit of G can be estimated, and G is defined as a lower limit TFNs.

G [G, )

G (, G ]

(3)

Definition 4. The lower and upper limits of G can be estimated, and G was defined as an

interval TFNs.

G [G, G ]

(4)

A set of TFNs is an operation based on sets of intervals rather than real numbers. In this

study, the exact range of the corresponding operation was located on the interval

G [G1 , G1 ] and G [G 2 , G2 ] . Only the proofs of addition and subtraction were

employed.

G1 G2 [G1 G 2 , G1 G2 ]

G1 G2 [G1 G 2 , G1 G2 ]

(5)

Definition 5. The length of TFNs G was defined as:

L ( G ) = [G G ]

(6)

Definition 6. For the two set of TFNs G1 [G1 , G1 ] and G2 [G 2 , G2 ] , the possible

degree of G1 G2 was expressed as:

P G1 G2

max( 0, L * max( 0, G1 G2 ))

L*

(7)

where L* L(G1 ) L(G2 ) . The positive relationship between G1 and G2 was

determined as follows:

1. If G1 G2 and G1 G2 , that G1 G2 , then P G1 G2 = 0.5

2. If G2 G1 , that G2 G1 , then P G1 G2 = 1

3. If G2 G1 and G1 G2 , that G2 G1 , then P G1 G2 = 0

4. If G1 and G2 overlap, and P G1 G2 > 0.5, then G2 G1 . If

P G1 G2 < 0.5, then G2 G1 .

3.3 Proposed approach

In this study, fuzzy set theory and grey possible degree were applied to the evaluation of

GSCM criteria. The objective of the study was to evaluate the application of fuzzy grey

degree to the determination of GSCM criteria. To rank the suitability of the alternatives, grey

theory was applied. In the proposed model, A = {A1, A2, …. Am} is a discrete set of m

possible alternatives, and C = {C1, C2,….Cn}is a set of n criteria and

w {w1 ,w2 ,........,wn } is the vector of criteria weights. The weights and ratings of the

alternatives were numbers located on the aforementioned interval scale. The procedures used

to determine the optimal supplier are summarized as follows:

Step1. The fuzzy set theory was applied to determine the linguistic preferences of the

proposed model. To this end, linguistic variables were defined for several levels of preference

(Table 1). The TFNs used to represent the preferences are depicted in Fig. 2.

Table 1. Two linguistic variables for criteria and alternatives (importance and performance

level)

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1.0

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1.0

(Criteria)

TFNs G

(Alternative)

TFNs w

VL

L

M

H

(0.00, 0.00, 0.20)

(0.20, 0.30, 0.40)

(0.40, 0.50, 0.60)

(0.60, 0.70, 0.80)

VP

P

F

G

(0.00, 0.00, 0.30)

(0.20, 0.30, 0.40)

(0.35, 0.50, 0.65)

(0.60, 0.70, 0.80)

VH

(0.80, 1.00, 1.00)

VG

(0.75, 1.00, 1.00)

A fuzzy weighted sum performance matrix (P) was derived for the criteria by

multiplying the fuzzy weight vector by the decision matrix.

a1

p ...

an

, b1

...

, bn

,c1

...

, cn

(8)

where n represents the number of criteria.

Step 2. Defuzzification. Defuzzification was conducted according to the method of Pan

(2008); thus, TFN were used to transform the total weighted performance matrices into

interval performance matrices, providing αa and αc for each criterion:

a1 b1

p ... ....

an b n

, c1

...

, cn

(9)

where n is the number of criteria.

a (b a) a

c c ( c b)

(10)

The last step of the defuzzification process was to convert interval matrices into crisp

values by applying the Lambda function, which represents the attitude of the evaluator.

Evaluators with optimistic, moderate and pessimistic attitudes take on maximum, intermediate

or minimum Lambda values on the interval [0, 1], respectively:

W 1j

W 2

Wj j

.....

k

W j

W j c (1 ) b

(11)

where W j are crisp values corresponding to Lambda, λ=0.5,

and were normalized to

comparable scales.

Step 3. TFNs were used to obtain a rating of each criterion. The value of each rating was

obtained from the following expression:

wj

1

w1j w2j ....... wkj

K

(12)

where wkj ( j 1,2,..........n) are the weights of the Kth expert and can be described by

k

the TFNs wkj [w j , w j ] .

k

Gij

1

Gij1 Gij2 ....... Gijk

K

(13)

where Gijk (i 1,2,.....m; j 1,2,..........n) are the weights of the Kth expert and can be

k

described by the TFNs G kj [G j , G j ] .

k

Each expert group contains K experts. The criteria weights, wj, were obtained from the

following procedure:

Step 4. Establish the grey decision matrix

G 11

G 21

D ..

..

G m1

G 12

G 22

..

..

G m2

..

..

..

..

..

..

..

..

..

..

G1n

G2 n

..

..

Gmn

where Gij are based on TFNs.

Step 5. Establish the normalized grey decision matrix

(14)

G*11

*

G 21

D* ..

..

G*m1

G*12

G*22

..

..

G *m 2

..

..

..

..

..

G1*n

G2*n

..

..

*

Gmn

..

..

..

..

..

(15)

G ij G ij

For a benefit criteria, Gij* was expressed as Gij* max

, max ,

G j

G j

G

max

j

G min

G min

j

was expressed as G

, j ,

G ij G ij

max 1i m G ij . For other criteria, G

*

ij

*

ij

G min

min 1i m Gij . Normalization was conducted to preserve the property that the range of

j

normalized TFNs was located on the interval [0, 1]

Step 6. By considering the importance of each criterion, the weighted normalized grey

decision matrix was established as:

V

V

D* ..

..

V

11

21

m1

V 12

V 22

..

..

V m2

..

..

..

..

..

V1n

V2 n

..

..

Vmn

..

..

..

..

..

(16)

where Vij Gij* w j

Step 7. The ideal alternative was established as the reference alternative. Thus, for m possible

alternative sets, A = {A1, A2 ,…., Am}, the ideal referential alternative

Amax G1max ,G2max ,................ Gnmax , was obtained from the following expression:

Amax

max V , max V , max V , max V , ............. max V , max V

1im

i1

1im

i1

1im

i2

1im

i2

1im

in

1im

in

(17)

Step 8. The grey degree between compared alternatives (A = {A1, A2, …. Am}) and the ideal

alternative (Amax) was calculated, and the alternatives were ranked according to suitability. As

P Ai Amax

decreased, the rank of Ai increased.

P Ai Amax

1 n

p Vij G max

j

n j 1

(18)

RESULTS

To illustrate the utility of the proposed evaluation method, the model was applied to an

actual firm. In the case study, the firm continues to improve its manufacturing processes and

faces the challenges of environmental management and SCM. To deal with the requirements

of supplier selection, the firm must implement GSCM criteria from relevant environmental

regulations. To this end, the firm created an expert team consisting of four professors, two

vice presidents and four management professionals with extensive experience.

4.1 Case information

Due to the prosperity of the electronic consumer products and network market, a plant

was built in Taiwan to produce IC substrates and IC packing fields, to meet consumer

demands in 2010. Currently, the firm is the largest professional printed circuit board (PCB)

and original equipment manufacturer (OEM) in Taiwan and is the fifth ranked producer in the

world. To offer the best services, the firm is continuing to develop next generation technology,

enhance their competitiveness and satisfy customer demands. Moreover, due to the rapid

replacement rate of electronic products, the firm continues to develop green products and new

green technologies to comply with customer requirements. For the firm to sustain in a

competitive market, proper GSCM is essential.

The chief executive officer wants to understand the role of GSCM, especially in the

green market. Therefore, to develop the firm’s GSCM criteria, this assessment was presented

to the expert group. By complying with the requirement outlined in RoHS and WEEE

directives, the firm benefited from this evaluation by acquiring purchasing orders from the

USA and the European Union. In the case study, the firm’s four green suppliers were analyzed.

The expert group identified an analytical and systematic method of evaluating the

management procedures of the suppliers. To select the optimal supplier, the experts should

adopt an evaluation method from the proposed criteria. The analysis outlined in this paper

would provide recommendations to the firm and would be useful for efficient and effective

GSCM implementation.

4.2 Empirical result

In this study, the eight proposed steps were followed to analyze the data provided by the

experts. The analysis was based on four alternatives Ai = (i =1, 2, 3, 4) and 16 criteria Cj (j =

1, 2, 3,….,16), as shown in Fig. 1. According to Eq. (8), the weights of the criteria were

obtained from the group of experts and are shown in Table 2. The weights of the four

suppliers were obtained from Eq. (9), and the results are shown in Table 3.

Table 2. Criterion important weights

wj

Cj

D1

D2

….

D 10

C1

(0.00, 0.00, 0.20)

(0.60, 0.70, 0.80)

….

(0.40, 0.50, 0.60)

0.35

0.60

C2

(0.40, 0.50, 0.60)

(0.40, 0.50, 0.60)

….

(0.60, 0.70, 0.80)

0.50

C3

(0.40, 0.50, 0.60)

(0.60, 0.70, 0.80)

….

(0.40, 0.50, 0.60)

C4

(0.60, 0.70, 0.80)

(0.60, 0.70, 0.80)

….

C5

(0.60, 0.70, 0.80)

(0.80, 1.00, 1.00)

C6

(0.60, 0.70, 0.80)

C7

Weights

Ranking

0.90

0.617

12

0.60

0.90

0.667

9

0.40

0.60

0.90

0.633

11

(0.60, 0.70, 0.80)

0.60

0.65

0.80

0.683

8

….

(0.60, 0.70, 0.80)

0.50

0.80

0.90

0.733

6

(0.00, 0.00, 0.20)

….

(0.80, 1.00, 1.00)

0.40

0.65

0.80

0.617

12

(0.80, 1.00, 1.00)

(0.80, 1.00, 1.00)

….

(0.80, 1.00, 1.00)

0.65

0.80

0.90

0.783

3

C8

(0.80, 1.00, 1.00)

(0.40, 0.50, 0.60)

….

(0.00, 0.00, 0.20)

0.50

0.60

0.70

0.600

13

C9

(0.40, 0.50, 0.60)

(0.80, 1.00, 1.00)

….

(0.60, 0.70, 0.80)

0.53

0.60

0.80

0.643

10

C10

(0.80, 1.00, 1.00)

(0.60, 0.70, 0.80)

….

(0.60, 0.70, 0.80)

0.50

0.80

0.90

0.733

6

C11

(0.40, 0.50, 0.60)

(0.80, 1.00, 1.00)

….

(0.80, 1.00, 1.00)

0.60

0.60

0.70

0.633

11

C12

(0.60, 0.70, 0.80)

(0.60, 0.70, 0.80)

….

(0.60, 0.70, 0.80)

0.70

0.75

0.85

0.767

4

C13

(0.40, 0.50, 0.60)

(0.40, 0.50, 0.60)

….

(0.40, 0.50, 0.60)

0.60

0.70

0.80

0.700

7

C14

(0.60, 0.70, 0.80)

(0.60, 0.70, 0.80)

….

(0.60, 0.70, 0.80)

0.70

0.80

0.90

0.800

2

C15

(0.60, 0.70, 0.80)

(0.40, 0.50, 0.60)

….

(0.40, 0.50, 0.60)

0.80

0.80

0.90

0.833

1

C16

(0.40, 0.50, 0.60)

(0.60, 0.70, 0.80)

….

(0.60, 0.70, 0.80)

0.70

0.70

0.85

0.750

5

Table 3. Four alternative performance weights under firm’s GSCM criteria

G ij

Cj

Ai

D1

D2

….

D10

C1

A1

(0.20, 0.30, 0.40)

(0.35, 0.50, 0.65)

….

(0.35, 0.50, 0.65)

0.55

0.65

0. 75

A2

(0.35, 0.50, 0.65)

(0.35, 0.50, 0.65)

….

(0.20, 0.30, 0.40)

0.65

0.85

0.90

A3

(0.60, 0.70, 0.80)

(0.20, 0.30, 0.40)

….

(0.60, 0.70, 0.80)

0.45

0.60

0.75

A4

(0.75, 1.00, 1.00)

(0.35, 0.50, 0.65)

….

(0.35, 0.50, 0.65)

0.75

0.85

0.95

A1

(0.60, 0.70, 0.80)

(0.20, 0.30, 0.40)

….

(0.35, 0.50, 0.65)

0.65

0.85

0.90

A2

(0.20, 0.30, 0.40)

(0.60, 0.70, 0.80)

….

(0.20, 0.30, 0.40)

0.70

0.75

0.85

A3

(0.75, 1.00, 1.00)

(0.20, 0.30, 0.40)

….

(0.35, 0.50, 0.65)

0.65

0.85

0.95

A4

(0.75, 1.00, 1.00)

(0.20, 0.30, 0.40)

….

(0.75, 1.00, 1.00)

0.35

0.65

0.80

A1

(0.75, 1.00, 1.00)

(0.35, 0.50, 0.65)

….

(0.35, 0.50, 0.65)

0.65

0.85

0.95

A2

(0.35, 0.50, 0.65)

(0.75, 1.00, 1.00)

….

(0.35, 0.50, 0.65)

0.45

0.65

0.75

A3

(0.35, 0.50, 0.65)

(0.35, 0.50, 0.65)

….

(0.35, 0.50, 0.65)

0.65

0.85

0.95

A4

(0.75, 1.00, 1.00)

(0.35, 0.50, 0.65)

….

(0.35, 0.50, 0.65)

0.45

0.85

0.95

C2

C3

C4

C5

C16

A1

(0.75, 1.00, 1.00)

(0.20, 0.30, 0.40)

….

(0.60, 0.70, 0.80)

0.40

0.60

0.75

A2

(0.20, 0.30, 0.40)

(0.35, 0.50, 0.65)

….

(0.60, 0.70, 0.80)

0.45

0.65

0.75

A3

(0.75, 1.00, 1.00)

(0.35, 0.50, 0.65)

….

(0.20, 0.30, 0.40)

0.50

0.65

0.70

A4

(0.20, 0.30, 0.40)

(0.75, 1.00, 1.00)

….

(0.60, 0.70, 0.80)

0.35

0.55

0.65

A1

(0.75, 1.00, 1.00)

(0.20, 0.30, 0.40)

….

(0.60, 0.70, 0.80)

0.65

0.85

0.95

A2

(0.60, 0.70, 0.80)

(0.60, 0.70, 0.80)

….

(0.20, 0.30, 0.40)

0.45

0.75

0.75

A3

(0.20, 0.30, 0.40)

(0.75, 1.00, 1.00)

….

(0.75, 1.00, 1.00)

0.65

0.85

0.85

A4

(0.60, 0.70, 0.80)

(0.35, 0.50, 0.65)

….

(0.35, 0.50, 0.65)

0.45

0.75

0.85

…

…

…

…

…

…

…

….

…

…

…

…

…

…

…

….

…

…

…

…

…

…

…

….

…

…

…

…

…

…

…

….

A1

(0.75, 1.00, 1.00)

(0.60, 0.70, 0.80)

….

(0.20, 0.30, 0.40)

0.55

0.85

0.95

A2

(0.60, 0.70, 0.80)

(0.20, 0.30, 0.40)

….

(0.35, 0.50, 0.65)

0.50

0.70

0.85

A3

(0.35, 0.50, 0.65)

(0.35, 0.50, 0.65)

….

(0.60, 0.70, 0.80)

0.55

0.65

0.85

A4

(0.20, 0.30, 0.40)

(0.35, 0.50, 0.65)

….

(0.60, 0.70, 0.80)

0.45

0.65

0.75

Step1. In step 1, the expert’s opinions on linguistic preferences of performance measures

were collected and transformed according to the TFN membership functions provided in

Table 1. The six definitions used to apply the following computational steps are denoted in

Eqs. (1) - (6)

Step 2. 16 criteria and four alternatives were measured in the TFN. The defuzzification

process employed Eqs. (9) - (10). The TFN was applied to transform the total weighted

performance matrices into interval performance matrices, providing αa and αc .Using Eq. (11),

W j was transformed into crisp values corresponding to Lambda values on comparable scales.

Step 3. Using Eq. (12) and (13), TFNs for the ratings were calculated to obtain the criteria

rating value, and the results are presented in Table 2 ( w j) and 3 ( G ij). w j was

defuzzified into the weights and ratings of each criteria.

Step 4. In step 4, the grey decision matrix of alternatives was established according to Eq.

(14).

Step 5. The grey decision matrix was normalized according to Eq. (15), and the resulting grey

normalized decision table is shown in Table 4.

Step 6. According to Eq. (16), the weighted normalized grey decision matrix was obtained,

and the results are shown in Table 5.

Step 7. The ideal alternative, Amax (the reference alternative), was calculated according to Eq.

(17), and values of [0.614, 1.000], [0.574, 0.971], [0.547, 0.936], [0.486, 0.864] were

obtained.

Table 4. Grey normalized decision matrix

C1

C2

C3

C4

C5

C6

C7

C8

C9

A1

0.735

0.898

0.825

1.000

0.818

0.780

0.962

0.825

0.825

1.000

1.000

1.000

0.825

1.000

0.825

1.000

0.780

0.962

A2

0.769

0.932

0.788

0.964

0.818

0.742

0.924

0.715

0.715

0.891

0.891

1.000

0.752

0.927

0.715

0.891

0.742

0.924

A3

0.735

0.898

0.825

1.000

0.742

0.780

0.962

0.825

0.825

1.000

1.000

0.924

0.825

1.000

0.788

0.964

0.780

0.962

A4

0.837

1.000

0.752

0.927

0.780

0.818

1.000

0.752

0.752

0.927

0.927

0.962

0.752

0.927

0.752

0.927

0.818

1.000

C10

C11

C12

C13

C14

C15

C16

A1

0.735

0.898

0.825

1.000

0.625

0.818

0.962

0.825

0.825

1.000

1.000

0.737

0.825

1.000

A2

0.769

0.932

0.788

0.964

0.818

0.742

0.924

0.715

0.715

0.891

0.891

1.000

0.752

0.927

A3

0.735

0.898

0.825

1.000

0.742

0.780

0.962

0.752

0.825

1.000

1.000

0.924

0.805

1.000

A4

0.837

1.000

0.752

0.927

0.780

0.818

1.000

0.745

0.752

0.925

0.826

0.962

0.752

0.927

Table 5. Grey weighted normalized decision matrix

C1

C2

C3

C4

C5

C6

C7

C8

C9

A1

0.593

0.879

0.636

0.943

0.607

0.907

0.544

0.836

0.636

0.943

0.607

0.907

0.546

0.838

0.657

0.965

0.755

0.962

A2

0.620

0.912

0.552

0.840

0.580

0.874

0.544

0.836

0.580

0.874

0.526

0.808

0.520

0.805

0.655

0.831

0.654

0.924

A3

0.593

0.879

0.636

0.943

0.607

0.907

0.493

0.772

0.636

0.943

0.580

0.874

0.546

0.838

0.745

0.855

0.585

0.962

A4

0.675

0.979

0.580

0.874

0.553

0.841

0.518

0.804

0.580

0.874

0.553

0.841

0.573

0.871

0.652

0.755

0.836

0.952

C10

C11

C12

C13

C14

C15

C16

A1

0.735

0.898

0.825

0.950

0.685

0.818

0.655

0.825

0.825

0.921

0.758

0.855

0.796

0.862

A2

0.769

0.932

0.788

0.964

0.755

0.835

0.458

0.685

0.715

0.891

0.831

0.956

0.752

0.927

A3

0.735

0.898

0.825

0.965

0.589

0.742

0.752

0.825

0.825

0.911

0.756

0.924

0.825

0.965

A4

0.837

0.925

0.752

0.927

0.652

0.780

0.555

0.752

0.752

0.927

0.852

0.962

0.752

0.927

Step 8. The grey degree of the four alternatives, (A1, A2, A3, A4), was calculated from Eq.

(18), and a ranking of the alternatives was obtained. The grey degrees of the alternatives were

P( A1 Amax ) 0.522, P( A2 Amax ) 0.555, P( A3 Amax ) 0.541, P( A4 Amax ) 0.552. The

smallest value indicates the best alternative; thus, A1 is the optimal supplier. Moreover, the

following trend in suppliers was observed: A1>A3>A4>A2. Hence, to achieve the firm’s

GSCM criteria, supplier A1 is an important alternative.

MAMAGERIAL IMPLICATIONS

The framework can be used to evaluate the impact of various supplier selection activities

and can provide a mechanism of monitoring and establishing evaluation platforms for firms in

the green supply chain. In previous studies, the firm’s GSCM procedures were highly variable;

however, a clear link to the firm’s decision was not observed. Indeed, the analyses presented

in previous studies were based on only a few variables, and single variable models were not

sufficient at explaining GSCM criteria. These results indicate that GSCM is a multi-criteria

concept based on upstream or downstream selection in the supply chain. When evaluating the

impact of a firm’s GSCM activities, the overall enhancement in production and its effect on

the organization must be considered.

By examining the 16 criteria, the proposed framework allows managers and researchers

to better understand the differences in operations, activities and specific management

interventions. The framework allows the firm to control and evaluate management practices

and can describe the firm’s supplier selection dilemmas. For example, in step 8, a value is

placed on the overall importance of the evaluator’s perception to the four alternatives. Here,

the top five criteria and corresponding values were: 1. to reduce the use of hazardous products

in the production process (C15- 0.833); 2. support of management (C14- 0.800); 3. quality of

service (C7- 0.783); 4. the applicability of internal green production plans (C12- 0.767); 5. the

presence of environmental management systems (C16- 0.750). The GSCM criteria were

analyzed by the experts, and the performance of the supplier was determined primarily by the

reduction of hazardous products in the production process and management support.

The results of the case study are similar to those of Yao et al. (2007), who found that

management support and external influences are important determinants. Moreover, perceived

benefits to customers or suppliers, and internal benefits affect the use of

electronically-enabled supply chains. Tseng et al. (2009a) studied sustainable production

indicators, and found that two major criteria contributed to sustainable production, including a

reduction in waste generated by contracted service/material providers and a reduction in the

amount of hazardous waste generated by the supplier. In a broader sense, the framework can

be used as an analytical tool to develop and construct a strategic environmental development

plan and GSCM criteria for the firm. To achieve optimal results, managers should understand

the firm’s GSCM evaluation criteria, including the presence of linguistic preferences and

incomplete information.

This study proved that the manager must be aware that the firm’s GSCM is not just a

black box. Through the proposed framework, managers are able to capture a fairly complete

picture of the firm’s GSCM. In other words, managers may find that the proposed framework

for the assessment of GSCM criteria is a useful method for reviewing and improving strategic

development plans and performance evaluations, which may lead to enhanced productivity

and competitive advantage.

For firms that intend to evaluate suppliers with the proposed criteria, this study offers

several benefits. The main contribution of this study is the hierarchical model presented in Fig.

1. This model provides a structured and logical method of synthesizing judgments that can be

used for the evaluation of appropriate suppliers. The model is a useful guideline that helps

structure a difficult and often emotional decision. The second benefit of this study is the

development of criteria based on a comprehensive review. Moreover, the features of a firm’s

GSCM have been examined and identified.

The model developed in this study provides an overview of a firm’s decision-making

process in the presence of incomplete information. Moreover, firms can better understand the

evaluation criteria of GSCM by applying the proposed model. The methodology outlined in

this study is particularly useful for making decisions based on multiple criteria in the presence

of linguistic preferences and incomplete information. Moreover, the framework can be

customized and used for the selection of suppliers and management activities. To apply the

proposed methodology, the evaluator must remove irrelevant criteria and include criteria that

are applicable to their firm. Thus, a firm’s GSCM can be based on many different types of

criteria and can be modified and refined as necessary.

Furthermore, this study proposed a hybrid MCDM for selecting alternatives in the

presence of uncertainty. However, the evaluator’s judgment is often uncertain, and incomplete

information cannot always be evaluated with exact numbers. An empirical example of green

supplier selection was used to illustrate the application of the proposed criteria in an OEM

firm. The experimental results indicated that the proposed approach is reliable and reasonable,

and an optimal alternative was selected from the four possible choices. The proposed model

can easily and effectively accommodate validated criteria. The proposed model establishes a

foundation for future research and is appropriate for predicting uncertain criteria. To improve

the firm’s performance and provide information that will have the greatest effect on reducing

uncertainty, a firm can apply this model to evaluate and determine the optimal GSCM

supplier.

REFERENCES

1.

Carr, A.S. and Smeltzer, L.R. (1999) The relationship of strategic purchasing to supply

chain management, European journal of purchasing and supply management 5, 43–51.

2.

3.

4.

5.

6.

Chase, R.B.

Aquilano N.J.

and Jacobs, E.R. (2001) Operations Management for

Competitive Advantage (9 ed), McGraw-Hill, Irwin, p. 30.

Chen, C.T., Lin, C.T., and Huang, S.F., (2006) A fuzzy approach for supplier evaluation

and selection in supply chain management, International journal of production

economics 102, 289–301.

Chen, I.J., Paulraj, A. (2004) Towards a theory of supply chain management: the

constructs and measurements, Journal of operations management 22(2), 119-150.

Deng, J.L., (1989) the introduction of grey system. The journal of grey system 1(1),

1-24.

Dreyer, B., Gronhaug, K. (2004) Uncertainty, flexibility, and sustained competitive

advantage, Journal of business research 57, 484–494.

7.

Humphreys, P. K., Wong, Y. K., Chan, F. T. S. (2003). Integrating environmental

criteria into the supplier selection process, Journal of Materials Processing Technology

138, 349–356.

8. Johnston, D.A., McCutcheon, D.M., Stuart, F.I., Kerwood, H. (2004) Effects of supplier

trust on performance of cooperative supplier relationships, Journal of operations

management. 22(1), 23–38.

9. Kathuria R. (2000) Competitive priorities and managerial performance: taxonomy of

small manufacturers, Journal of operation management. 18, 627-641.

10. Lee, A. H.I., Kang, H.Y., Hsu, C.F., Hung, H.C., (2009) A green supplier selection

model for high-tech industry. Expert systems with applications 36 7917–7927.

11. Li, G.D., Yamaguchi, D., Nagai, M., (2007) A grey based decision making approach to

supplier selection problem, Mathematical and computer modelling 46, 573-581.

12. Li, S., B., Ragu-Nathan, Ragu-Nathan, T.S., Rao, S.S. (2006) The impact of supply chain

management practices on competitive advantage and organizational performance, Omega

34(2), 107-124.

13. Lin, F., Ying, H., MacArthur, R.D., Cohn, J.A., Barth-Jones, D., Crane, L.R., (2007)

Decision making in fuzzy discrete event systems, Information Sciences 177, 3749- 3763.

14. Olavarrieta, S., Ellinger, A.E., (1997) Resource-based theory and strategic logistics

research, International journal of physical distribution & logistics management 27 (9/10),

15.

16.

17.

18.

559–587.

Pan, N.F., (2008) Fuzzy AHP approach for selecting the suitable bridge construction

method, Automation in construction 17, 958–965.

Sarkis, J., (1998) Evaluating environmentally conscious business practices, European

journal of operational research 107(1), 159-174

Sarkis, J. (2003). A strategic decision framework for green supply chain management,

Journal of Cleaner Production. 11(4), 397-409

Srivastava, S.K., (2007) Green supply-chain management: a state-of-the-art literature

review, International Journal of Management Review. 9 (1), 53–80.

19. Tan, K.C., Kannan, V.R., Handfield, R.B. (1998) Supply chain management: supplier

performance and firm performance, International journal of purchasing and material

management. 34 (3), 2–9.

20. Tseng, M.L., Lin, Y.H., Chiu, A.S.F., Liao, C.H., (2008) Using FANP approach on

selection of competitive priorities based on cleaner production implementation: a case

study in PCB manufacturer, Taiwan, Clean Technology and Environmental Policy. 10(1),

17-29

21. Tseng, M.L., Divinagracia, L., Divinagracia, R., (2009a) Evaluating firm’s sustainable

production indicators in uncertainty, Computers & Industrial Engineering. 57 ,

1393–1403

22. Tseng, ML., Chiang, J.H., Lan, L.W. (2009b) Selection of optimal supplier in supply

chain management strategy with analytic network process and choquet integral,

Computer & industrial engineering. 57(1), 330-340.

23. Tseng, M.L. (2008) A causal and effect decision-making model of service quality

expectation using grey-fuzzy DEMATEL approach, Expert system with applications.

36(4), 7738-7748

24. Tseng, M.L. (2010a) An assessment of cause and effect decision making model for

firm environmental knowledge management capacities in uncertainty, Environmental

Monitoring and Assessment. 161, 549-564

25. Tseng, M.L. (2010b) Using linguistic preferences and grey relational analysis to evaluate

the environmental knowledge management capacities, Expert systems with applications.

37(1), 70-81

26. Vachon, S., Klassen, R.D. (2008) Environmental management and manufacturing

performance: The role of collaboration in the supply chain, International journal of

production economics. 111, 299-315.

27. Yao, Y., Palmer, J., Dresner, M., (2007) An inter-organizational perspective on the use of

electronically-enabled supply chains, Decision support systems. 43(3), 884-896

28. Zhang, J., Wu, D., Olsen, DL., (2005) The method of grey related analysis to multiple

attribute decision making problems with interval numbers, Mathematical and computer

modeling. 42, 991-998.

29. Zhu Q, Geng, Y. (2001) Integrating environmental issues into supplier selection and

management: a study of large and medium-sized state-owned enterprises in China,

Greener management international journal. 9(3), 27-40.

30. Zhu,Q., Sarkis,J. Cordeiro,J.J., Lai, K.H. (2008) Firm-level correlates of emergent green

supply chain management practices in the Chinese context, Omega. 36, 577-591.

31. Zadeh, L. A. (1965) Fuzzy set, Information and control. 18, 338-353.