Eagle Valley Land Trust

advertisement

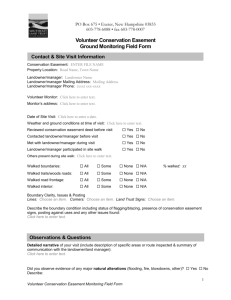

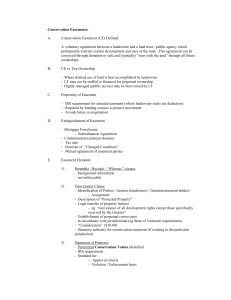

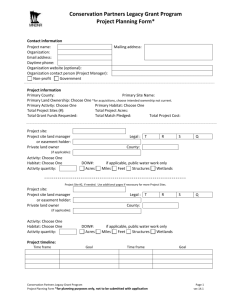

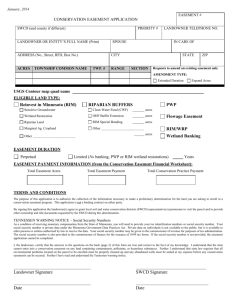

LANDOWNER STEPS TO COMPLETING AN EASEMENT Land conservation transactions are required to meet a number of legal and tax code requirement that must be taken and documented prior to closing. They also may involve “hidden” costs that can surprise property owners as well as add costs to a project. The purpose of this document is to assist the property owner in understanding the steps that must be completed to conserve property and additional costs that are his/her responsibility. CONSERVATION VALUES For the Eagle Valley Land Trust to participate in a land conservation transaction, a property must meet one or more criteria established by the Internal Revenue Service. These include lands that are valued as scenic open space, lands with historic value, lands with wildlife value, lands with water and/or riparian value and lands with educational value. For the donation of an easement to be tax-deductible, the project must meet the requirements of IRC 170(h) and accompanying Treasury Department regulations, Colorado Revised Statues, and/or any other federal or state requirements. The Land Trust reviews each transaction for consistency with these requirements. CONSERVATION EASEMENT/ LEGAL FEES The Eagle Valley Land Trust has developed a model easement that is available on its website (EVLT.ORG). This model is a good starting point for the property owner and Trust to begin drafting a conservation easement. Once there is agreement on the general terms of the easement in an initial draft format, the Land Trust will refer the document to its legal counsel to review and finalize on behalf of the Trust. We recommend that property owners similarly retain an attorney to develop and/or review the easement before the document is signed and recorded. The Eagle Valley Land Trust works with a number of attorneys specializing in land transactions and can provide a list of names. The costs for legal services are the property owner’s responsibility. The Trust will submit to the owner a detailed invoice of its legal costs, which typically range from $4,000 to $10,000 (depending on the size and complexity of the easement), reimbursement of which is a voluntary tax-deductible contribution to the Trust. RECORDING CHARGES Conservation easement deeds are subject to a Transfer Fee, payable to the Eagle Valley Land Trust and Recording Fees, payable to Eagle County. TITLE COMMITMENT The Land Trust will need a recent copy of a Title Commitment that, at minimum, provides a legal description of the property, identifies any mortgages or liens on the property, and reports on the status of mineral rights. MINERAL/REMOTENESS LETTER If the Title Commitment reveals that the owner does not own 100% of the mineral rights on or under the property, the IRS requires that a “mineral remoteness” letter be prepared that indicates that the probability of extraction or removal of minerals from the property by surface mining by a third party is “so remote as to be negligible”. This report needs to be prepared by a professional, certified geologist. MORTGAGE SUBORDINATION If the property is mortgaged, the owner will need to obtain a mortgage subordination agreement from the mortgage holder. This agreement protects the easement in the event of foreclosure. There may be a fee for preparing, executing, and recording such an agreement. TITLE INSURANCE Title Insurance is required at the time of closing. SURVEY A survey is required. The cost of the survey is dependent upon such factors as acreage, survey method, and property terrain. The property owner should request that the surveyor provide an estimate before the work begins and a statement of how the fees will be charged and what additional costs might be involved. ENVIRONMENTAL ASSESSMENT It may be necessary to complete an Environmental Assessment of the property to determine the probability that the property has been contaminated with toxic waste or hazardous materials. This report is required in connection with limiting certain liabilities and needs to be prepared by a qualified consultant. APPRAISAL In general, for a conservation easement to be tax-deductible, the easement must comply with 170(h) of the Internal Revenue Code and associated sections of the Colorado Revised Statutes. If the property owners wish to claim the deduction, then IRS regulations require that the landowner retain the appraiser to prepare a qualified appraisal to determine the value of the easement in order for the conveyance of the easement to qualify as a charitable contribution. The Land Trust will provide a list of qualified appraisers experienced with conservation easement appraisals and recognized by Great Outdoors Colorado (GOCO). If the property owner chooses not to use the services of a GOCO-recognized appraiser, the Trust requires a review of the appraisal conducted by a GOCO-recognized appraiser. The property owner is responsible for costs of the appraisal. Should the property owner select an appraiser not on the suggested list of appraisers, the landowner will also be responsible for the costs of a review appraisal. BASELINE/PRESENT CONDITONS REPORT A baseline is a comprehensive report of the condition of the property and it’s identified conservation values at the time the easement is finalized. This document, which must be completed prior to closing, is generally prepared by a biologist or other qualified professional. The report should include, at minimum, and inventory and report of the values that support the conservation of the property, the characteristics, current use and status of improvements on the property, and supporting maps and photographs that are identified by exact GPS-identified photopoints. The report serves two purposes: (1) it is a requirement of the IRS to document the condition of the property at the time of the conveyance of the easement and (2) it is the benchmark against which any violations of the terms of the easement are measured. The cost, which is the owner’s responsibility, generally ranges from $2,800 to $5,000 depending on the size and complexity of the property. FORM 8283 If the owner is claiming a federal tax deduction, it will be necessary to file a form 8283 signed by the appraiser, the owner and the Trust. STAFF FEES Staff costs for providing professional services and coordinating the project are $10,000 per project for donated easements and $15,000 for purchased easements. STEWARDSHIP AND LEGAL DEFENSE CONTRIBUTIONS When the Eagle Valley Land Trust accepts a conservation easement from a landowner, it takes on a perpetual obligation to uphold the terms of the easement. To meet this obligation, the Land Trust Board of Directors maintains both a Stewardship Fund and a Legal Defense Fund. This policy also supports IRS regulations which state that the easement holder “must have the resources to enforce the restrictions" of the easements. It is the Trust's expectation that the landowner make a one-time, voluntary, tax-deductible contribution to these funds. The Land Trust will provide the landowner with guidelines for the contribution based on the reserved rights and long-term likelihood of violation. OTHER FEES Some landowners with complex estate and income tax considerations may feel it is necessary to seek additional professional advice. This is a personal decision and is dependent upon each property owner’s particular situation. METHODS OF PAYMENT AND DEDUCTIBILITY PAYMENTS and DEDUCTIBILITY The Eagle Valley Land Trust is open to arranging acceptable terms to cover the costs of services provided. Some options include cash payments, timed payments, donations of land for resale (for appropriate uses acceptable to the donor), and use of proceeds from Colorado Income Tax Credit. All costs above, if incurred in conjunction with a charitable donation of land or conservation restrictions, are deductible for income tax purposes. THE EAGLE VALLEY LAND TRUST STAFF AND/OR BOARD MEMBERS MAKE NO REPRESENTATIONS OR ASSURANCES ON LEGAL MATTERS, FINANCIAL MATTERS INCLUDING TAX ADVICE, AND/OR MATTERS OF REAL ESTATE. WE ENCOURAGE PROPERTY OWNERS TO OBTAIN INDEPENDENT PROFESSIONAL ADVICE. THE EAGLE VALLEY LAND TRUST WILL NOT KNOWINGLY PARTICIPATE IN A PROJECT WHERE IT HAS SIGNIFICANT CONCERNS ABOUT THE TAX DEDUCTION.