tangible landowner

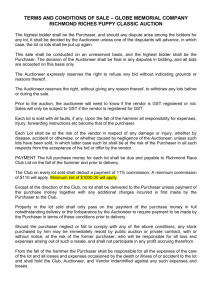

advertisement