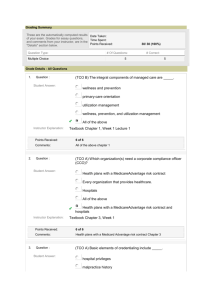

Grading Summary

advertisement

Grading Summary These are the automatically computed results Date Taken: of your exam. Grades for essay questions, Time Spent: and comments from your instructor, are in the Points Received: "Details" section below. Question Type: 182 / 190 # Of Questions: # Correct: Multiple Choice 6 5 Essay 6 N/A Grade Details - All Questions 1. Question : Student Answer: (TCO 1) The type of budget that is updated on a regular basis is known as a ________________ continuous budget. revised budget. updated budget. flexible budget. Instructor Explanation: Points Received: Chapter 1, Page 8 5 of 5 Comments: 2. Question : Student Answer: (TCO 2) The quantitative forecasting method that uses actual sales from recent time periods to predict future sales assuming that the closest time period is a more accurate predictor of future sales is: Moving average model Weighted moving average model Closest moving average model Exponential smoothing model Instructor Explanation: Points Received: Chapter 15, Page 236 5 of 5 Comments: 3. Question : Student Answer: (TCO 3) The regression statistic that measures how many standard errors the coefficient is from zero is the ________________ correlation coefficient. coefficient of determination. standard error of the estimate. t-statistic. Instructor Explanation: Points Received: Chapter 16, Page 247 5 of 5 Comments: 4. Question : Student Answer: (TCO 4) Capital expenditures are incurred for all of the following reasons except: As preventive maintenance To counteract competition Decreased production Improvement in product quality Instructor Explanation: Points Received: Chapter 13, Page 201 5 of 5 Comments: 5. Question : Student Answer: (TCO 5) Which of the following is not true when ranking proposals using zero-base budgeting? Due to changing circumstances, a low-priority item may later become a high-priority item. Decision packages are ranked in order of increasing benefit. Divisional and departmental managers submit initial recommendations, with top management making the final ranking. Nonfunded packages should also be ranked. Instructor Explanation: Points Received: Chapter 21, Page 324 5 of 5 Comments: 6. Question : Student Answer: (TCO 6) Which of the following ignores the time value of money? Internal rate of return Profitability index Net present value Payback period Instructor Explanation: Points Received: Chapter 20, Page 296 5 of 5 Comments: 7. Question : Student Answer: Instructor Explanation: (TCO 1) There are several approaches that may be used to develop the budget. Managers typically prefer an approach known as participative budgeting. Discuss this form of budgeting and identify its advantages and disadvantages. Participative budgeting or sometimes knows as the bottom up budgeting is a budgeting system where all members from top to down in an organization is being given an opportunity of applying their own budgets. This type of budgets are being prepared with the input of subordinate managers as well. The advantages of this type of budgeting is that it motivates the employees because they are now being considered to prepare the budgets on their own and achieve the targets rather than imposing on them. Moreover it helps to give much better results in an organization as each and every member is equally involve in setting budgets and implementing them. Finally it helps to improve the quality of forecasts. The disadvantages of participative budgeting is that setting and designing these budgets are very time consuming and cannot be suitable when the managers needs to make quick decisions.Moreover the biggest disadvantage might be a problem of budgetary slack. There are likely chances that budgets might be overstated to achieve better results but this can lead to a problem of budgetary slack which arises with a difference of true estimated budget and the overstated budget. Participative budgeting is a bottom-up approach to budgeting where departmental managers provide input for their budget. The benefit of this approach is that managers typically have more experience and knowledge regarding the daily operations of their department, which allows them to create a more realistic budget. In addition, managers who participate in the budget process are more motivated to achieve budget goals, and there is usually greater support for the budget. A disadvantage of participative budgeting is that it can often be timeconsuming and costly. In addition, if budgets are used as a means of performance evaluation, it may encourage budgetary slack, where managers underestimate sales and overestimate costs to create budget values that are easier to obtain. Points Received: 20 of 20 Comments: 8. Question : Student Answer: (TCO 2) There are a variety of forecasting techniques that a company may use. Identify and discuss the three main quantitative approaches used for time series forecasting models. The three main quantitative approaches used for time series forecasting models are 1) Moving average 2) Exponential Smoothing 3)Weighted moving average Moving average is one of the quantitative approach which are being used to emphasize the direction of the trend forecast and to smooth out the volume and price fluctuation.They are generally being used to measure the momentum in any given data. Exponential smoothing is another quantitative approach which is used to produce a smoothed time series. This method gives more accurate results as compared to moving average because recent observations are given relatively more weight in forecasting than the older observations. Weighted moving average is the approach which average the price series or any given data in order to smooth the data series thereby helping to give more accurate forecasts. This type of approach is being used in markets where there are frequent ups and downs and it helps data to smooth. Instructor Explanation: Points Received: The moving average model uses actual sales from recent time periods to predict future sales, assuming that each time period has an equal influence on the prediction of futures sales. The weighted moving average model also uses actual sales from recent time periods to predict future sales, but it assumes that the closest time period is a more accurate predictor of future sales than previous time periods. The exponential smoothing model uses a smoothing constant called alpha as an adjustment when determining the forecast. We assign a value to alpha based on our assumption of the relationship between sales in one period and sales in the next period. A higher value is assigned to alpha when we believe that current sales are more predictive of future sales, and a lower value is assigned to alpha when we believe that a smoothed forecast is more predictive of future sales. 20 of 20 Comments: 9. Question : (TCO 2) The Federal Election Commission maintains data showing the voting age population, the number of registered voters, and the turnout for federal elections. The following table shows the national voter turnout as a percentage of the voting age population from 1972 to 1996 (The Wall Street Journal Almanac; 1998): Year 1972 1974 1976 1978 1980 1982 1984 Voter Turnout % Turnout Year 55 1986 38 1988 54 1990 37 1992 53 1994 40 1996 53 % Turnout 36 50 37 55 39 49 Part (a) Use exponential smoothing to forecast this time series. Consider smoothing constants of a = 0.1 and 0.2. What is the forecast of the percentage of turnout in 1998? Part (b) Use the mean absolute deviation (MAD) to determine which smoothing constant provides the best forecast of voter turnout. Student Answer: Year %Turnout a = 0.1 MAD_1 a = 0.2 MAD_2 1972 55 55 0.0 55 0.0 1974 38 55.0 17.0 55.0 17.0 1976 54 53.3 0.7 51.6 2.4 1978 37 53.4 16.4 52.1 15.1 1980 53 51.7 1.3 49.1 3.9 1982 40 51.9 11.9 49.9 9.9 1984 53 50.7 2.3 47.9 5.1 1986 36 50.9 14.9 48.9 12.9 1988 50 49.4 0.6 46.3 3.7 1990 37 49.5 12.5 47.1 10.1 1992 55 48.2 6.8 45.0 10.0 1994 39 48.9 9.9 47.0 8.0 1996 49 47.9 1.1 45.4 3.6 1997 48.0 48.0 0.0 46.1 1.9 1998 48.0 48.0 46.5 46.5 MAD 9.6 10.0 Part a) when a = 0.1, the forecast of the percenge of turnout in 1998 is 48%. when a = 0.1, the forecast of the percenge of turnout in 1998 is 46.5%. Part (b) Use the mean absolute deviation (MAD) to determine which smoothing constant provides the best forecast of voter turnout when a = 0.1, the MAD is 9.6. when a = 0.1, the MAD is 10. So, a = 0.1 provides the best forecast of voter turnout. Calculations done in excel Instructor Explanation: Part (a) Using an excel spreadsheet, the forecasted percentage of voter turnout in 1998 is 48.02% using a smoothing constant of 0.1 and 46.14% using a smoothing constant of 0.2. Part (b) Using an excel spreadsheet, the MAD for a smoothing constant of 0.1 is 7.11 and the MAD for a smoothing constant of 0.2 is 7.69. Therefore, the smoothing constant of 0.1 provides the best forecast of voter turnout. Points Received: 25 of 30 Comments: 10. Question : (TCO 3) Use the table “Food and Beverage Sales for Paul’s Pizzeria” to answer the questions below. Food and Beverage Sales for Paul’s Pizzeria Restaurant Month January February March April May June July August September October November December ($000s) First Year 55 53 53 63 64 54 33 35 25 30 35 54 Second Year 60 54 56 44 44 34 36 37 28 30 38 52 Part (a) Calculate the regression line and forecast sales for March of Year 3. Part (b) Calculate the seasonal forecast of sales for March of Year 3. Part (c) Which forecast do you think is most accurate and why? Student Answer: Instructor Explanation: Part a) y = -0.7117x + 53.355 R² = 0.1742 34 non seasonally adjusted Part b) 40 seasonally adjusted Part c) 40 is the more accurate forecast All calculations are done in excel Part (a) Using an excel spreadsheet, the regression line is y = 53.36 – .71x. Based on this regression line, the sales forecast for March of Year 3 is $34.14 (in thousands). Part (b) Using an excel spreadsheet, the seasonal forecast of sales for March of Year 3 is $40.06 (in thousands). Part (c) Responses will vary. Students should discuss whether they believe there is a trend in the data. Points Received: 30 of 30 Comments: 11. Question : (TCO 6) Jackson Company is considering two capital investment proposals. Estimates regarding each project are provided below: Initial Investment Annual Net Income Annual Cash Inflow Salvage Value Estimated Useful Life Project Nuts $175,000 $30,000 $70,000 $0 3 years Project Bolts $100,000 52,000 $45,000 $0 3 years The company requires a 9% rate of return on all new investments. Part (a) Calculate the payback period for each project. Part (b) Calculate the net present value for each project. Part (c) Which project should Jackson Company accept and why? Student Answer: Instructor Explanation: Project Nuts a)Payback period = Initial investment / net annual cash inflows = 175000 / 70000 = 2.5 years b)Net present value = -175000 + (70000x0.9174) + (70000 x 0.8417) + ( 70000 x 0.7722) = $2191 Project bolts a)Payback period = 100000 / 45000 = 2.22 years b) Net present value = -100000 + (45000 x 0.9174) + (45000x0.8417) + (45000x0.7722) = $13909 From the above results it can be interpreted that Project Bolts should be accepted as it is giving higher net present value and moreover the payback period is also good as the initial investment is being covered more quickly. Part (a) Project Nuts payback period = $175,000 ÷ $70,000 = 2.50 years Project Bolts payback period = $100,000 ÷ $45,000 = 2.22 years Part (b) Project Nuts NPV = ($70,000 x 2.5313) - $175,000 = $2,191 Project Bolts NPV = ($45,000 x 2.5313) - $100,000 = $13,909 Part (c) – Because Project Bolts has a lower payback period and greater net present value than Project Nuts, Jackson Company should accept this project. Points Received: Comments: 30 of 30 12. Question : (TCO 6) Top Growth Farms, a farming cooperative, is considering purchasing a tractor for $468,000. The machine has a 10-year life and an estimated salvage value of $32,000. Top Growth uses straight-line depreciation. Top Growth estimates that the annual cash flow will be $78,000. The required rate of return is 9%. Part (a) Calculate the payback period. Part (b) Calculate the net present value. Part (c) Calculate the accounting rate of return. Student Answer: Instructor Explanation: Part a) Payback period = Initial investment / net cash inflows = 468000 / 78000 = 6 Years Part b) Net present value = -468000 + (78000x5.99525) + (110000x0.42241) = $ 46095 Ans Part c) Accounting rate of return = Average accounting profit / initial investment = 34400/468000 x 100 = 7.35% Part (a) Payback period: $468,000 ÷ $78,000 = 6 years Part (b) Net present value: Present value of cash flows = $78,000 x 6.4177 = $500,581 Present value of salvage value = $320,000 x .4224 = $13,517 Net Present value = $500,581 + $13,517 - $468,000 = $46,098 Part (c) Accounting rate of return: Average investment = ($468,000 + $32,000) ÷ 2 = $250,000 Annual depreciation = ($468,000 - $32,000) ÷ 10 = $43,600 Annual net income = $78,000 - $43,600 = $34,400 Accounting rate of return = $34,400 ÷ $250,000 = 13.76% Points Received: Comments: 27 of 30