here - Dundee and Angus Chamber of Commerce

advertisement

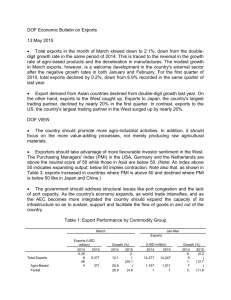

Local Economic Report Dundee & Angus Chamber of Commerce Table of Contents Table of Contents ...........................................................................................................2 1.0 Chamber Level Data ................................................................................................ 3 1.1 Number of Businesses per Chamber Area ...........................................................3 1.2 New Business Start-Ups .......................................................................................3 1.3 Unemployment ....................................................................................................4 1.3.1 Dundee City ...................................................................................................4 1.3.2 Angus.............................................................................................................4 1.4 Non-Domestic Rates Relief Statistics for Small Businesses .................................4 2.0 Data from UK ...........................................................................................................5 2.1 Interest Rates .......................................................................................................5 2.2 Inflation ................................................................................................................5 3.0 Data for Scotland .....................................................................................................6 3.1 Current GDP growth.............................................................................................6 3.1.1 Trends ...........................................................................................................7 3.2 Unemployment Figures........................................................................................7 3.3 Scottish Manufactured Exports ...........................................................................8 3.3.1 Quarterly Growth ..........................................................................................8 3.3.2 Rolling Annual ............................................................................................... 9 3.4 Overall Exports ...................................................................................................10 3.4.1 International Exports ..................................................................................10 3.4.2 Exports by sector.........................................................................................10 3.4.3 Regional Exports .........................................................................................11 3.4.4 Exports by Country......................................................................................11 3.4.5 Exports by Company Size ............................................................................12 3.5 Quarterly Business Survey Highlights ................................................................ 13 2 1.0 Chamber Level Data 1.1 Number of Businesses per Chamber Area Number of Businesses in 2014 for the local council areas relevant to Dundee & Angus Chamber of Commerce has been calculated as displayed in below table: Local Authority Total Number of Businesses 0- 49 50- 249 250+ Employees Employees Employees Dundee City 3,610 3,035 180 390 Angus 4,025 3,760 100 165 1.2 New Business Start-Ups Please note that below the number of new start-ups businesses are that of local council areas relevant to Dundee & Angus Chamber of Commerce: Local Authority Q1/2014 Q2/2014 Q3/2014 Q4/2014 Y/E 2014 Q1/2015 Dundee City 74 84 76 57 291 90 Angus 68 70 68 65 271 74 3 1.3 Unemployment Please note that below unemployment figures are that of local council areas relevant to Dundee & Angus Chamber of Commerce. 1.3.1 Dundee City From those economically active, 6,100 were reported as being unemployed between Apr 14Mar 15, a decrease of 0.6% (200) from the 12 months previous, giving an 8.6% rate of unemployment. From this, the unemployment rate for economically active males is 13.3% (5,100), a decrease of 1.5% (100) from the 12 months previous. Additionally, the unemployment rate among economically active females fell by 0.6% (200) to 3.8% (1,300). 1.3.2 Angus From those economically active, 2,900 were reported as being unemployed between Apr 14Mar 15, unchanged from the 12 months previous, giving a 5.2% rate of unemployment. From this, the unemployment rate for economically active males is 6.2% (1,800), a decrease of 0.1% from the 12 months previous. Additionally, the unemployment rate among economically active females fell by 1.3% (400) to 5.6% (1,500). 1.4 Non-Domestic Rates Relief Statistics for Small Businesses Statistics on the Small Business Bonus Scheme (SBBS), which provides non-domestic rates relief (business rates discounts) to small businesses in Scotland in 2014. Investment Council Areas Number of recipients Total Relief (£million) Dundee City 2,275 4.7 Angus 2,361 3.7 4 2.0 Data from UK 2.1 Interest Rates Recent interest rate figures published on 06 August 2015, indicate that The Bank of England’s Monetary Policy Committee voted to maintain Bank Rate at 0.5%. Similarly, the Committee also voted to maintain the stock purchase assets financed by the issuance of central bank reserves at £375 billion. The last change to be made regarding the size of this was in July 2012 when there was a rise of £50 billion to £375 billion. 2.2 Inflation Figures published by the Office for National Statistics (ONS) on 18 August 2015 indicated that the UK inflation rate, as measured by the Consumer Price Index (CPI), rose to 0.1% in the year to July, up from 0.0% in June 2015. This slight increase in inflation is mainly due to price movements in clothing and footwear sector, with a smaller fall in prices on the month, compared with a year ago. This rise was partially offset by falling prices for food and beverages. CPIH, which is the measure of household inflation, including the costs faced by owner occupiers’ grew by 0.4% in the year to July 2015, an increase from 0.3% in June 2015. Source: Office for National Statistics 5 3.0 Data for Scotland 3.1 Current GDP growth Recent GDP figures for Scotland indicate that the Scottish GDP grew by 0.6%, during the first quarter of 2015. Output in the services sector expanded by 0.5%, while growth of 0.7% was experienced in the Production sector, and the Construction sector grew by 2.1%. Drawing comparisons to results from the previous year, overall, GDP has grown by approximately 2.8% in the first quarter of 2015 in comparison to the first quarter in 2014. Source: Scottish Government The Services Sector growth, which accounts for 74.6% of the Scottish economy, expanded by 0.5% in Q1 2015. Within the Services sector, there was a contraction in Transport, Storage & Communication (-0.3%). This was more than offset by growth of Government & Other Services (+1.1%), and Distribution, Hotels & Catering (+0.6%). Output of Business Services & Finance was broadly flat over the quarter. The Production sector grew by 0.7% in 2015 Q1. Contraction in Mining & Quarrying (-0.4%) was more than offset by expansions in Manufacturing (+0.2%), Electricity & Gas Supply (+4.6%) and Water Supply & Waste Management (+0.8%). The Manufacturing sector experienced contractions in Food, Beverages & Tobacco (-1.7%), Basic Metals, Metal Products & Machinery (-4.7%) and Computer, Electrical & Optical Products (-7.9%), this was more than offset by expansions in Other Manufacturing & Repair 6 (+2.1%), Refined Petroleum, Chemical & Pharmaceutical Production (+13.6%) and Transport Equipment (+3.4%). The Construction sector grew by 2.1% in Q1 2015. 3.1.1 Trends Source: Scottish Government 3.2 Unemployment Figures National unemployment figures for Scotland indicate that in the months Apr 15- Jun 15 the number of economically active people unemployed in Scotland was 155,000, indicating a decrease in unemployment of 13,000. This figure represents an unemployment rate of 5.6% in Scotland- same as the UK rate of 5.6% unemployment. Additionally, the number of economically active males unemployed fell by 6,000 to 89,000, resulting in an unemployment rate of 6.3% among males in Scotland- 0.5% higher than the UK unemployment rate of 5.8%. Unemployment among economically active females decreased by 6,000 to 67,000, giving an unemployment rate among economically active females in Scotland of 4.9%. This rate is 0.6% lower than the UK unemployment rate of 5.5%. Recent figures also indicate that from Apr 15- Jun 15, the number of people economically inactive in Scotland rose by 25,000 to 731,000, giving a rate of 21.4% in Scotland- 0.7% lower than the UK rate of 22.1%. 7 3.3 Scottish Manufactured Exports Figures published for Scotland regarding the Index of Manufactured Exports (IME) indicates that the volume of international exports rose by 2.1% in real terms during the first quarter of 2015. A comparison of latest four quarters figures and previous four quarters shows a rise of 2.7% in the volume of manufactured exports to overseas markets. Source: Scottish Government 3.3.1 Quarterly Growth The rise of 2.1% in real terms for the Scottish Index of Manufactured in Q1 2015 from the previous three quarters can be largely attributed to the quarterly growth of Food & Drink sector, the Refined Petroleum, Chemical & Pharmaceutical Products sector, and Non-Metallic, Other Manufacturing & Repair Products – three of the largest exporting industries within IME, when combined account for around two thirds of international manufactured exports from Scotland. The Food & Drink sector experienced an increase of 5.5% in the volume of exports. This expansion in the latest quarterly was largely driven by a rise of 6.1% in Drink exports. Food exports remained unchanged at 0.0% in Q1 2015. Exports of Refined Petroleum, Chemical & Pharmaceutical Products sector rose by of 0.6% from the previous quarter. Exports of Non-Metallic, Other Manufacturing & Repair Products increased 5.4% over the latest quarter. 8 Additionally, Engineering & Allied Industries exports decreased by 0.3%, this can be attributed to contractions in Electrical & Instrument Engineering (-2.8%) and Transport Equipment (0.4%). Conversely, there was growth in Mechanical Engineering (+2.0%). There were a number of real-term contractions in smaller sectors, including Metals & Fabricated Metal Products (-1.4%), Wood, Paper & Printing (-5.2%), and Textiles, Clothing & Leather (-6.4%). 3.3.2 Rolling Annual By comparing the most recent four quarters to previous four quarters, there were contractions in Wood, Paper & Printing (-2.6%) and Textiles, Clothing & Leather (-2.8%). Annual growth was positive in all other sectors including Food & Drink (+1.4%), Engineering & Allied Industries (+3.6%), Refined Petroleum, Chemical & Pharmaceutical Products (+4.9%), Non-Metallic, Other Manufacturing & Repair Products (+3.5%), and Metals & Fabricated Metal Products (+3.8%). 3.3.3 Trends Source: Scottish Government 9 3.4 Overall Exports Data for Exports in Scotland has been taken from ‘Scotland’s Global Connections Survey’ published on the 26th of January 2015, the only export survey covering all sectors of the Scottish economy. Figures are given in nominal terms and are therefore not adjusted for inflation. 3.4.1 International Exports In 2013, Scottish international exports (excluding oil and gas) are estimated to be £27.9 billion. This represents an increase of 7.2% amounting to £1.9 billion since 2012. The five largest exporters are listed below: 1. Manufacture of food & beverages (£5 billion) 2. Manufacture of coke, refined petroleum and chemical products (£3.5 billion) 3. Legal, accounting, management, architecture, engineering, technical testing and analysis activities (£1.9 billion) 4. Technical Testing and Analysis (£1.7 billion) 5. Computer, Electronic and Optical (£1.6 billion) 3.4.2 Exports by sector Manufacturing exports experienced an increase of £1.3 billion to approximately £16.8 billion, which amounts to 60.2% of all international exports. Manufactured food and drink exports have risen by 0.2% over the year, an estimated increase of £10 million resulting in a total of £5 billion. Whiskey is the main component of the food and drink manufacturing sector, and contributed £4.2 billion, a decrease of £15 million, which in percentage term is approximately 0.3%. While exports for the manufacture of coke, petroleum and chemical products, experienced a rise of £155 million (4.7%) to £3.5 billion since 2012. Exports from the service sector rose by £590 million to an estimated £9.2 billion, which accounts for 33.1% of all international exports. Within this sector, the legal, accounting, management, architecture, engineering, technical testing and analysis activities is worth an estimated £1.9 billion, remaining the largest international exporting service. Followed by wholesale and retail trade; repair of motor vehicles and motorcycles which was also estimated at £1.4 billion, Financial and Insurance activities (£1.3 billion) and Administration and Support (£1.2 billion). Largest increases in the service sector include: £255 million increase (to £910 million) in Transportation and Storage. £215 million increase (to £1.2 billion) in Admin and Support service activities £155 million rise (to £1.9 billion) Legal Accounting and Business. 10 3.4.3 Regional Exports All exports can be shown to have experienced an increase over the year to 2013 for all regions, with the exception of Central and South America, which decreased by £5 million, and Asia, which experienced a fall of £45 million. Export increased in the following regions: Increased by £1.4 billion to the EU. Rise of £165 million to the rest of the Middle East. £115 million increase to North America. Total international exports by geographic region 2010-2013 Source: Scottish Government 3.4.4 Exports by Country The top export destination is currently the USA, representing 14% of total exports and £3.9 billion. The Netherlands ranked second representing 7.3% of total exports at an estimated £2 billion. Followed by Germany with 7% of total exports (£1.9 billion), and France with £1.8 billion, approximately 6.6% of total exports. The top ten export destinations listen below (£million): 11 4,500 4,000 3,910 3,500 3,000 2,500 2,000 2,040 1,945 1,845 1,500 1,000 1,420 1,110 1,000 920 £ million 870 745 500 0 Source: Scottish Government 3.4.5 Exports by Company Size Research indicates that large companies with 250 employees or over export the most, representing £15.4 billion in exports in 2013, accounting for 55% of all international exports. Yet, an increase of £1.1 billion (17%) can be attributed to medium sized companies. Approximately 30% of international exports are attributed to around 10 businesses, 50% is attributable to around 50 businesses, and 100 businesses account for 60% of international exports, thus making the concentration of international exports skewed. 12 3.5 Quarterly Business Survey Highlights Over the second quarter of this year, the Construction and Manufacturing sectors reported a return to the very strong results recorded during 2014, after a decline in some performance variables such as new contracts and cash-flow last quarter. Results for the Retail & Wholesale and Tourism industries in Q2 were fairly typical compared with seasonal averages, but the Financial & Business Services sector experienced its poorest performing quarter since being introduced into the Indicator in Q1 2014. Overall, these results suggest continued growth of the Scottish economy over Quarter 2 2015. However, given that the Financial & Business Services sector contributes more Gross Value Add (GVA) to the Scottish economy than any other (approximately 28%), and a significant proportion of firms in the sector reported lower capacity utilisation levels, reduced employment and stagnant sales over the quarter, there are reasons to be concerned about the subsequent impact on the Scottish economy of a relatively poor quarter for the industry. The low global market price for Brent crude oil observed since the winter of 2014, was a commonly cited business concern of firms and was a significant business concern for oil and gas service sector companies within the Financial & Business Services. Expectations for next quarter’s sales revenues, employment levels and expenditure on investment are positive among firms in the industry, but at their lowest levels since Q1 2014. The average price of Brent crude oil per barrel has remained at low levels throughout 2015 so far and long term low oil prices represent a challenge not only for the oil & gas sector and the North East of Scotland, but for every business in Scotland that makes up the supply chain of firms in the industry. 13