AGENT-BASED MODELING OF THE SOFTWARE INDUSTRY

STRUCTURE IN JAPAN: PRELIMINARY CONSIDERATION OF

INFLUENCE OF OFFSHORING IN CHINA

Dr. Yasuo Kadono*, Tokyo University of Technology, Japan

kadono@media.teu.ac.jp, *corresponding author

ABSTRACT

This study aims at the preliminary assessment of the future software industry structure in

Japan from the viewpoint of the influence of offshoring in China based on surveys on

software engineering capabilities of Japanese IT vendors with the Japanese Ministry of

Economy, Trade and Industry. Through the agent-based simulation model mainly focusing on

customer’s price preference and communication quality with customers, Japanese vendors

can possibly lose their share of the market if Japanese customers prefer the lower prices

offered by offshore vendors. The results suggest that Japanese vendors should improve their

communication skill to realize the customer’s requirements for the quality of enterprise

software while avoiding the cost competition with the Chinese vendors and considering the

customer’s price preference. Otherwise, some Japanese vendors within the current multilayered software industry culture will not survive in the drastically changing Japanese market.

Keywords: software industry, agent-based modeling, innovation

INTRODUCTION

The information service industry in Japan is a 10.5 trillion yen market, which includes 7.6

trillion yen in software development and programming. In 2009, orders for software totaled

6.4 trillion yen and accounted for 60.3% of the entire information service industry, while the

market for software products was only 1.2 trillion yen (Ministry of Economy, Trade and

Industry, Japan, 2010).

However, software vendors in Japan are facing drastic changes in their business environment

due to technology innovations and new entrants from emerging countries, such as China,

India, and others, despite domestic Japanese software industry has been showing low growth.

Also, the issues in the IT industry in Japan, such as the multilayer subcontractors and the

business model depending on custom-made applications for domestic market orientation,

have been pointed out over times (Cusumano, M., 2004; Kadono, Y., 2007). The multilayer

subcontractors industry structure implies the posibility of the growth accelleration of software

development offshoring in China and other countries.

In fact, the offshore software development market has experienced high growth: 63.6 billion

yen in 2005, 103.5 billion yen in 2007 and an expected 199.5 billion yen in 2010. In 2007,

36.8% of Japanese software development firms developed software offshore to reduce costs

and to complement Japan’s 80% deficit of domestic human resources. In 2005, the offshore

development in China was 53 billion yen, accounting for 83.5% of the entire offshore

development for Japan (Kondo, 2009; Ministry of General Affairs, Japan, 2007).

Compared to Japan’s 10.5 trillion yen market, the information service industry in China is

still lower at 9.3 trillion yen, but has been growing by more than 20% annually since 2002.

The export of software from China was 3.6 billion dollars (approximately 396 billion yen) in

2005 and has been growing by over 30% annually since 2002 (Kondo, 2009; Ministry of

General Affairs, Japan, 2007). Therefore, new entrants from China entering into the Japan

market are becoming a threat to Japanese domestic software vendors (Porter, 1980).

OBJECTIVES AND METHOD

The focus of this study is an assessment of the market shares in Japan of Japanese and

Chinese software vendors and the conditions for sustaining the competitive advantage of

Japanese vendors in the similar situations to the current software industry in Japan based on a

survey on software engineering excellence (SEE) in 2005, 2006 and 2007 with the Japanese

Ministry of Economy, Trade and Industry. In the survey, we collected data of software

engineering and competitive environment from 233 IT vendors in Japan totally (Kadono et al.

2006). The assessment is conducted through an agent-based simulation that is an extension of

the Sugarscape model (Epstein and Axtell, 1996; Kadono et al., 2002; Yamakage, 2007)

under the condition that the price preference of Japanese software customers is changing.

In this paper, we assume Japanese and Chinese vendors to be agents and set parameters such

as communication levels, service levels, switching cost and price preferences. Also, we

assume that Japanese vendor can outsource projects only to another Japanese vendor under

certain conditions.

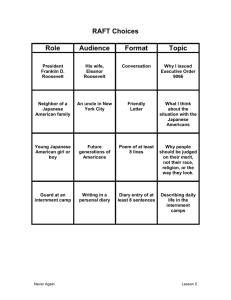

Then, we model the following two scenarios considering the above situations:

- customers prefer the communication level and the price level simultaneously, and

- customers prefer the price level over the communication level, which directly influences

the quality of the software.

SIMULATION MODEL

Agents and parameters

In this paper we assume the agents are Japanese vendors, Chinese vendors, and customers.

The following parameters are set based on the current situations of the Japanese enterprise

software service industry (Kadono, Tsubaki, Tsuruho, 2006; Kadono, 2007; Kadono, Tsubaki,

Tsuruho, 2009; Kadono, Imanishi, 2011).

-

Japanese and Chinese vendors

Number of vendors: Japanese vendors are in the majority in the current Japanese

market.

Improvement of communication level: Chinese vendors have increasingly improved

their communication levels to meet the requirements of Japanese customers.

Improvement of price level: Japanese and Chinese vendors reduce their prices to meet

the requirements of Japanese customers.

Switching cost: Chinese vendors need to pay more initial cost for new customers.

Outsourcing scope of Japanese vendors: Japanese vendor can outsource their projects

only to another Japanese vendor, although Chinese vendors cannot outsource their

projects to the other vendors.

-

Customers

Number of customers: sufficient software customers exist in the current Japanese

market.

Desirable communication level: Japanese customers take into account the

communication level of Japanese vendors.

Preference of low price: Japanese customers also take into account the price.

Algorithm

In this agent-based simulation, the agents of Japanese and Chinese vendors and customers are

distributed randomly on a 50x50 matrix, as shown in Figure 1. The mobile direction of each

vendor agent is randomly set. Each vendor agent moves one cell per time step based on the

following algorithm until either the Japanese or the Chinese vendors monopolize the market

or until the time reaches the certain limit steps.

Step 1: A vendor agent moves by one cell randomly.

Step 2: The vendor successfully makes a contract if encountering a customer whose

requirements of communication level and price meet the vendor’s offering.

Step 3: If the Japanese vendor make a contract, it can outsource the project to another

Japanese vendor within accessible distance from the Japanese prime contractor.

Step 4: The vendor improves its communication level depending on the parameter of

improvement of the communication level. Also, the vendor reduces the price depending on

the parameter of improvement of the price level if the vendor cannot get the customer to

agree to a contract.

Step 5: The market share is updated depending on the contracts completed by the Japanese

and Chinese vendors.

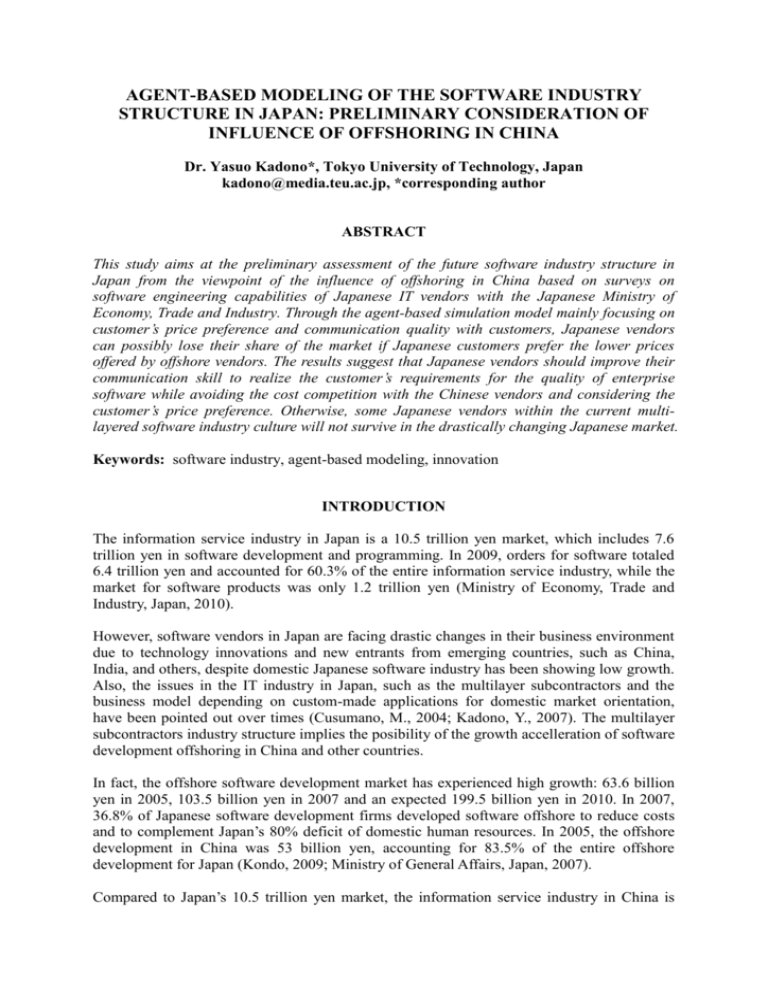

Figure 1: Market in the agent-based modeling

Japanese vendors (read circles), Chinese vendors (blue circles), and customers

(yellow circles) on the market (50x50 matrix).

Simulation conditions and parameters

We assume the following two conditions regarding the communication levels and the prices

of software development:

1. Customers seek the communication level and the price simultaneously, i.e.,

A customer contracts with a vendor if the communication level of the vendor >= the

communication level the customer requires + the switching cost, and if the price level of

the vendor >= the price level the customer requires + the switching cost.

2. Customers prefer the price level to the communication level, i.e.,

A customer contracts with a vendor if the price level of the vendor >= the price level the

customer requires + (the communication level the customer requires – the communication

level of the vendor) * (2 – the price preference of the customer) + the switching cost. The

price preference of the customer is defined as more than 0.1 and less than 0.9.

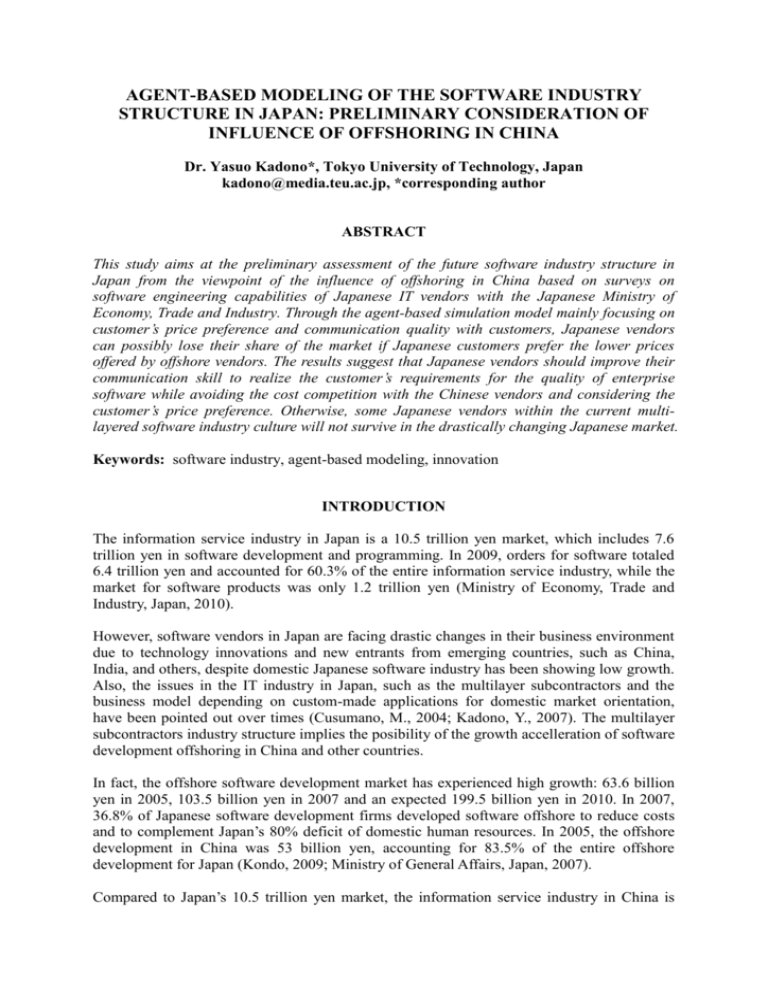

In terms of the simulation parameters of the Japanese and Chinese vendors, based on the

current industry situations, we assume the number of agents, communication level, price level,

switching cost, price reduction and communication level improvement are as shown in Table

1. Also, we assume the number of customers is 100 and the preference of price is 0.8. And,

the outsourcing scope of Japanese vendors is 3, while the outsourcing scope of Chinese

vendors is not applicable (NA).

Table 1: Basic parameters.

Japanese vendor

Chinese vendor

Number of vendors

90

10

Communication level

10

7

Price level

7

10

Switching cost

0.1

0.2

Price reduction (%)

0.02

0.04

Communication level

0.005

0.005

improvement (%)

Number of potential

customers

Customer's preference

of price

Outsourcing scope

100

100

0.8

0.8

3

NA

RESULTS

First, we investigated the following two cases using basic parameters in Table1.

Case 1: the simulation with condition 1 (customers seek the communication level and the

price simultaneously). The results are shown in Figure 2.

Case 2: the simulation with conditions 1 and 2 (customers prefer the price level over the

communication level). The results are shown in Figure 3.

In Figures 2 and 3, the horizontal axis indicates one-tenth of the number of simulation steps

and the vertical axis indicates the share of the market by the Japanese and the Chinese

software vendors.

In Case 1, the Japanese vendors keep a more competitive situation than do the Chinese

vendors until the end.

In Case 2, the share of the Chinese vendors remains 7% until the 1,650th step, begins to

increase at the 1,650th step and the 2,100th step, then overcomes the Japanese vendors, and

finally dominates the market. This means that Japanese vendors possibly lose their market

share if the Japanese customers increasingly prefer the lower price.

These results suggest that Japanese vendors should improve their communication skill to

realize the customer’s requirements while avoiding the cost competition with the Chinese

vendors considering customer’s price preference. Otherwise, some Japanese vendors will not

survive in the Japanese market.

Figure 2: Result of Case 1 with parameters in Table 1.

Vertical axis: share of market of Japanese vendors (red line) and Chinese vendors (blue line).

Horizontal axis: simulation steps*1/10.

Figure 3: Result of Case 2 with parameters in Table 1.

Second, we performed the preliminary analyses in Case 2 with different parameters from

those in Table 1, such as the number of Chinese vendors, the Japanese price level, scope of

outsourcing from Japanese vendors to Japanese vendors.

For example, even if the number of Chinese vendors is 2 and the number of Japanese

vendors is 100, Chinese vendors result in overcoming the Japanese vendors if Japanese price

level is 5 (Figure 4). On the other hand, if Japanese vendors improve their price level up to 8,

Japanese market reject one Chinese vendor and Japanese vendors dominate the market

(APPENDIX: Figure 5).

Figure 4: Result of Case 2 with parameters: Chinese vendor = 2 and Japanese price level = 5.

Another case is shown in Figure 6 (APPENDIX), where both of Japanese and Chinese price

levels are 8 and the Japanese outsourcing scope is 9. In the case we can observe that Chinese

vendors are revitalized after decreasing its share of market until around the 100th step.

Furthermore, we can observe several phenomena with various combinations of vendor’s

parameters in Table 1, such as number of vendors, communication level, improvement of

communication level, price level, improvement of price level, switching cost, outsourcing

scope not only for Japanese vendors but also for Chinese vendors. Regarding the parameters

of customers, we can further consider the number of customers, desirable communication

level of customers, preference of price, and other parameters.

CONCLUSIONS AND DISCUSSION

This study constructed a simplified agent-based simulation model to preliminary estimate the

tradeoff between the communication skill and the price of Japanese and Chinese software

vendors. Based on the results of the agent-based simulation, Japanese vendors could lose

their share of the market if the Japanese customers increasingly prefer the lower price.

Consequently, to survive intense global competition, Japanese vendors must enhance their

communication skill to improve their software outcome and simultaneously enhance the cost

competition with Chinese vendors.

In this paper, our focus was assessing the influence of future offshore development on the

Japanese enterprise software service industry, particularly in relation to Chinese software

vendors. However, the software vendors in Japan are facing drastic changes in their business

environment due to technology innovations and new participants from emerging countries,

including China, into the low-growth Japanese domestic software industry. In order for the

software industry in Japan to meet these challenges, an important step is also to evaluate the

significance of the software engineering capabilities for achieving medium- and long-term

success.

Therefore, we designed surveys on software engineering excellence (Barney, 2007; Bollen,

1989; Carnegie Mellon University; Fujimoto, 2003; Matsumoto, 2005; Ministry of Economy,

Trade and Industry, Japan, 2010) and administered them in 2005, 2006 and 2007 with the

Ministry of Economy, Trade and Industry, Japan (METI) (Kadono et al. 2006). By surveying

the previous papers on the types of Japanese software vendors (Kadono et al. 2009), we

found that the software maker-turned-vendors tend to significantly expand business with

well-resourced R&D, while the user-turned-vendors seem to depend heavily on the demand

of the parent companies. Therefore, some of user-turned-vendors are thought to gain

inimitable capabilities. In contrast, many of the independent vendors serve as non-principal

contractors that supply people without specific strengths as temporary staffing in a multilayer industry structure. However, some of the independent vendors with inimitable assets are

thought to be the role models of software vendors in Japan. Based on these results, for future

study, we suggest considering the relationship between the types of Japanese software

vendors and the key factors to the success of offshore software development.

Also, in order to model the current and future structures of the software industry in Japan, we

developed another agent-based simulation model that was an extension of the Sugarscape

model (Epstein and Axtell, 1996; Kadono et al., 2002; Yamakage, 2007). The model

consisted of software vendors with variations in their scale, innovation adoption and

outsourcing ratio. In the model, we assumed that the market would follow the innovation

cycle of technology for mainframe computers, client servers, Web applications, cloud

computing services, and so on, and that the larger software vendors would tend to invest more

in the technology innovation and outsource more jobs to the smaller software vendors in a

multi-layer industry structure (Kadono, Terano, Ohkuma, 2010).

For the investigation, we set the following three scenarios. In each scenario, we continue to

pursue the conditions and parameters of availability through the agent-based simulation

model.

- Survival by size and skill: the big software vendors grow increasingly due to their

resourceful staffs and skills based on the scale merit and the scope merit, whereas the

small/medium-sized software vendors do not survive without catching up with the rapid

technology innovation. As a result, the software industry structure in Japan will consist

of a smaller number of players with clear characterizations of their scale or special skills.

- Reciprocal relationships: all types of the current players survive by outsourcing the jobs

from the big (medium-sized) software vendors to the medium-sized (small) software

vendors in the current multi-layer software industry structure. Particularly, the small

software vendors will not survive without outsourcing from the big (medium-sized)

vendors.

- Reverse phenomena: some medium-sized technology-oriented vendors outpace big

software vendors who tend not to invest as much in technology innovation.

Based on the above scenarios, we suggested that future studies be conducted on the

following: interactive behaviors among software vendors, e.g., a project-based alliance and a

merger and acquisition (M&A); influences of offshore developments and new participants on

the Japanese software industry.

Finally, to expand this paper, we would integrate findings in the above papers regarding the

types of Japanese software vendors and the Japanese software industry structure into this

paper, and assess the future Japanese software industry structure in relation to China, India,

the U.S. and the rest of the world.

ACKNOWLEDGEMENTS

The author gratefully acknowledges the valuable suggestions and support of the Ministry of

Economy, Trade and Industry (METI), and Software Engineering Center, InformationTechnology Promotion Agency, Japan (SEC/IPA), Japan Information Technology Services

Industry Association (JISA), Kozo Keikaku Engineering (KKE), Takashi Kanno at Tokyo

University of Technology, and Management Science Institute (MSI). This research is

partially supported by the grants-in-aid for scientific research of Japan Society for the

Promotion of Science (B: 20310090).

REFERENCES

1. Jay B. Barney (2007), Gaining and Sustaining Competitive Advantage, Pearson Prentice

Hall.

2. Bollen,K.(1989), Structural Equation with Latent Variables, Wisely-Interscience

Publication.

3. Carnegie Mellon University. Software Engineering Institute, retrieved from

http://www.sei.cmu.edu/cmmi/.

4. Cusumano, M. (2004). The Business of Software, Free Press.

5. Epstein, J. and Axtell, R. (1996). Growing Artificial Societies: Social Science from the

Bottom Up, Brookings Institution Press, The MIT Press.

6. Fujimoto, T. (2003). Nouryoku Kouchiku Kyousou, Chuohkouronshinsya (in Japanese).

7. Kadono, Y., Terano, T. (2002). “How Information Technology Creates Business Value

in the past and in the Current Electronic Commerce (EC) Era,” in Shu-Heng Chen and

Paul Wang Eds. Computational Intelligence in Economics and Finance, Springer-Verlag,

pp. 449-466

8. Y. Kadono, and Y. Imanishi (2011). “A STUDY ON THE OFFSHORE SOFTWARE

DEVELOPMENT OF JAPANESE AND CHINESE VENDORS THROUGH AGENTBASED SIMULATION,” Proceedings of Japan China Conference of Information

Systems.

9. Kadono, Y., Tsubaki H., Tsuruho S.(2006). “A Study on the Reality and Economy of

Software Development in Japan,” The sixth Asia Pacific Industrial Engineering

Management Systems Conference, Bangkok, Thailand:1425-1433.

10. Kadono, Y. (2007). The Issues on IT Industry in Japan, Nikkei Net. Retrieved from

http://it.nikkei.co.jp/business/news/index.aspx?n=MMITac000017122007

11. Y. Kadono, H. Tsubaki, and S. Tsuruho. (2009). “A STUDY ON CHARACTERISTICS

OF SOFTWARE VENDORS IN JAPAN FROM ENVIRONMENTAL THREATS AND

RESOURCE-BASED VIEW,” Proceedings of Pacific Asia Conference on Information

Systems, Indian School of Business, Hyderabad, India.

12. Yasuo Kadono, Takao Terano and Yuya Ohkuma. (2010). “Assessing the Current and

Future Structures of Software Industries in Japan through Agent-based Simulation”,

proceedings of International Conference on Social Science Simulation, Arizona State

University.

13. Shinichi Kondo (2009). ”Present status and issues on offshore development in China and

future directions” Machinery Economics Research, No.40 (in Japanese).

14. Matsumoto, Y. (2005). Application of SWEBOK to Software Development, Ohmsha (in

Japanese).

15. Ministry of Economy, Trade and Industry, Japan. (2010). Report on Software Industry in

Japan.

16. Ministry of General Affairs, Japan (2007). “Study on evolution of offshore development

and its influences”.

17. M. Porter (1980), “Competitive Strategy”, Free Press.

18. S. Yamakage (2007). “Guidance of Designing Artificial Society”, Hayama publishing,

pp.148-163 (in Japanese).

APENDIX

Figure 5: Result of Case 2 with parameters: Chinese vendor = 1 and Japanese price level = 8.

Figure 6: Result of Case 2 with parameters: Japanese and Chinese price level = 8. Japanese

outsourcing scope = 9.