Flood Insurance - The Association of State Floodplain Managers

National Flood Policy—ASFPM 2015 Recommendations

G.

Flood Insurance

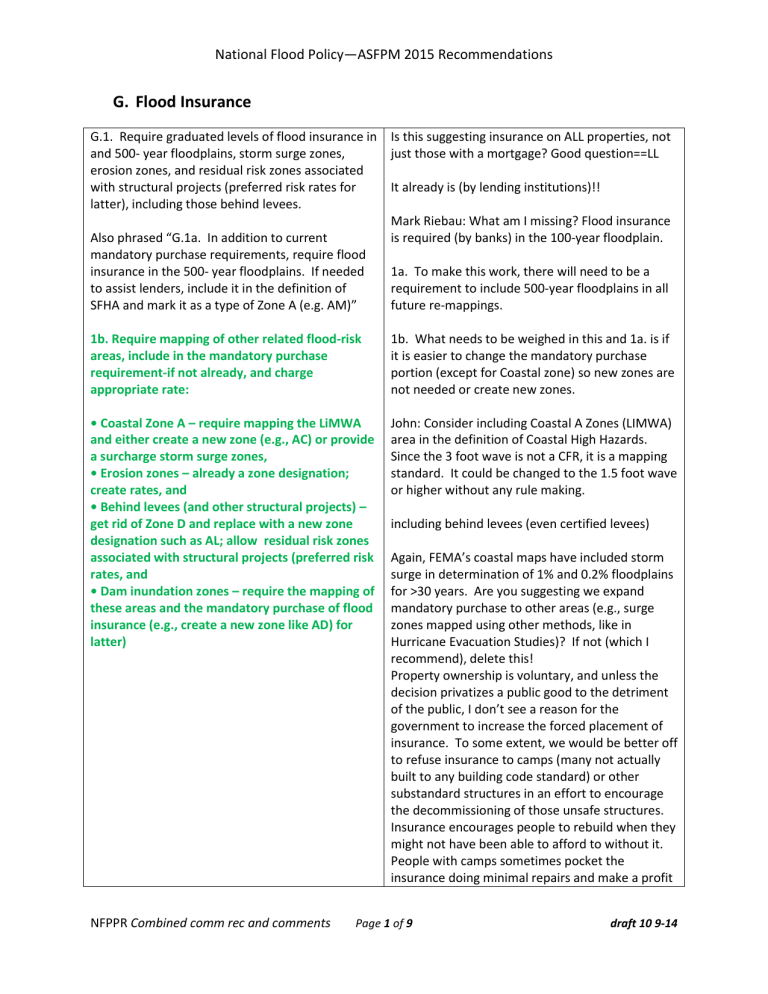

G.1. Require graduated levels of flood insurance in and 500- year floodplains, storm surge zones, erosion zones, and residual risk zones associated with structural projects (preferred risk rates for latter), including those behind levees.

Also phrased “G.1a. In addition to current mandatory purchase requirements, require flood insurance in the 500- year floodplains. If needed to assist lenders, include it in the definition of

SFHA and mark it as a type of Zone A (e.g. AM)”

1b. Require mapping of other related flood-risk areas, include in the mandatory purchase requirement-if not already, and charge appropriate rate:

• Coastal Zone A – require mapping the LiMWA and either create a new zone (e.g., AC) or provide a surcharge storm surge zones,

• Erosion zones – already a zone designation; create rates, and

• Behind levees (and other structural projects) – get rid of Zone D and replace with a new zone designation such as AL; allow residual risk zones associated with structural projects (preferred risk rates, and

• Dam inundation zones – require the mapping of these areas and the mandatory purchase of flood insurance (e.g., create a new zone like AD) for latter)

Is this suggesting insurance on ALL properties, not just those with a mortgage? Good question==LL

It already is (by lending institutions)!!

Mark Riebau: What am I missing? Flood insurance is required (by banks) in the 100-year floodplain.

1a. To make this work, there will need to be a requirement to include 500-year floodplains in all future re-mappings.

1b. What needs to be weighed in this and 1a. is if it is easier to change the mandatory purchase portion (except for Coastal zone) so new zones are not needed or create new zones.

John: Consider including Coastal A Zones (LIMWA) area in the definition of Coastal High Hazards.

Since the 3 foot wave is not a CFR, it is a mapping standard. It could be changed to the 1.5 foot wave or higher without any rule making. including behind levees (even certified levees)

Again, FEMA’s coastal maps have included storm surge in determination of 1% and 0.2% floodplains for >30 years. Are you suggesting we expand mandatory purchase to other areas (e.g., surge zones mapped using other methods, like in

Hurricane Evacuation Studies)? If not (which I recommend), delete this!

Property ownership is voluntary, and unless the decision privatizes a public good to the detriment of the public, I don’t see a reason for the government to increase the forced placement of insurance. To some extent, we would be better off to refuse insurance to camps (many not actually built to any building code standard) or other substandard structures in an effort to encourage the decommissioning of those unsafe structures.

Insurance encourages people to rebuild when they might not have been able to afford to without it.

People with camps sometimes pocket the insurance doing minimal repairs and make a profit

NFPPR Combined comm rec and comments Page 1 of 9 draft 10 9-14

National Flood Policy—ASFPM 2015 Recommendations

G.2. Discontinue practice of waiving the flood insurance requirement after issuance of LOMRs and LOMR-Fs; apply risk-based rates F.5, K.15, T.8

Also phrased “Have mandatory flood insurance requirement apply after issuance of LOMR-Fs and do not allow basements to be added to properties receiving LOMR-Fs; however, allow preferred risk rates. Also, have it apply to LOMAs on properties which had been required to carry flood insurance other than LOMA-OAS related to new map changes.”

G.3.a. Ensure the movement to actuarial rates over time continues for all pre-FIRM buildings, including at rates described in Biggert-Waters and allowed for in HFIAA. b. After the second claim on a pre-FIRM building, it must go on the 25% path to actuarial rates path at renewal.

G.4. Gradually eliminate grandfathered rates by having a surcharge of 50 percentage after the first claim and then charging actuarial rates at renewal after the second claim is paid on the insurance proceeds. There is no limit to the number of times people can flood and get claims paid, and no connection between these claims numbers or values and the flood insurance premium. Requiring all structures to get flood insurance will get in revenue, but also increase payments and eliminate the incentives to mitigate that risk or pay off mortgages to eliminate the burden on the NFIP. FEMA must then stand firm and not pay disaster funding to people who were not insured encouraging rebuilding in place.

FEMA has the rating option called “Conversion” where they can convert the SFHA-rated policy to a

PRP to the last policy effective date and refund the different. They should evaluate doing that automatically when the LOMA/LOMR-F is issued and then after they get the notice that they can drop coverage from the lender, they can make the decision then. FEMA should also evaluate not allowing basements to be built for buildings obtaining a LOMR-F. also put in sect F

LOMRs are actually an interpretation that the structure is not really in the SFHA and FEMA has this process to account for the maps being created on a macro scale, yet when you get more detailed information on a specific property, it is shown to not be in the floodplain. Insurance should be waived since no longer in floodplain.

Recommendation to delete completely.

We should promote the need for all pre-FIRM buildings to eventually get to full-risk rates.

Buss: Full actuarial flood insurance rates must be reached for all properties sooner rather than later.

Rating needs to be simplified here, so like the two claim rule for PRP eligibility, we should keep it to 2 as well. There should be no threshold as that may encourage some fudging of numbers and again makes it more difficult. The other option is 25%

NFPPR Combined comm rec and comments Page 2 of 9 draft 10 9-14

National Flood Policy—ASFPM 2015 Recommendations

G.5. Movement of insurance rates toward actuarial must be balanced with increased tools, assistance and funding for mitigation to help homeowners and small businesses with affordability of insurance. This could include means tested vouchers to pay off low cost mitigation loans, credit for mitigation or others means, but must be done carefully to ensure it does not increase the moral hazard.

G.6. Create more stratification in insurance rates to reflect the variety in risk within flood zones; this must be linked to providing tools to insurance agents to simply how they can correctly rate a policy. The current NFIP approach that results in rates for some shallow flooded structure to be the same is deeper flooded structures does not encourage mitigation or development in lower risk areas.

G.7.a. Apply mandatory purchase requirement to all non-federally regulated or insured mortgages b. Require all lenders to pay the flood loss up to the replacement cost of the home if in an SFHA and there is no flood insurance policy. Also no IA will be paid for what a flood insurance policy would have covered. increase starting the second claim.

No disagreement or changes on this one.

AS ORIGINALLY WRITTEN, COMMENTS MIXED AND

CONFUSED MITIGATION WITH SUBSIDIZES

PREMIUMS

While there was agreement, there is concern on how this overly complicates an already complicated program. To provide more stratification would that require additional data from the maps/study that is not there or if there, is not available to agents?

The highlighted part does not make sense.

Bruce: Doesn’t having BFE/BFD and LFE accomplish some of what is being suggested? I’d suggest deleting this.

In areas with an effective Risk MAP product so there are depth and probability grids?

While I am in total agreement with this, can we please Map the Nation first??

To ensure that such a policy does not result in an infrastructure that is even more difficult to administer than current flood zone ratings, much thought must be given on how to achieve such a graduate approach to insurance rating, including the consideration of a community-wide policy or other radically different approach to flood insurance.

This would be something for congress to address since it is an instance of a non-regulated business required to enforce.

Love the thought, but this will never fly – that is why we have IA now – it is politically correct; delete last part of statement

NFPPR Combined comm rec and comments Page 3 of 9 draft 10 9-14

National Flood Policy—ASFPM 2015 Recommendations

G.8. Ensure compliance with NFIP mandatory purchase requirements; at every-year anniversary of mortgage, and upon transfer; ensure penalties are applied for violations.

G.9. Revise NFIP regulations to make zone changes effective immediately, without regard to lender notification or changes in status of mortgage

G.10. Map any structure outside the SFHA for which two or more damage claims are paid as a

SHFA structure so that insurance is required

(mandatory) and NFIP regulations apply; Also see

A.5

Also phrased “Require flood insurance on any structure outside the SFHA for which two or more damage claims or federal disaster assistance have been paid due to flooding unless it is mitigated.”

G.11a. Implement law that allows FEMA Director to impose use of ICC when beneficial to NFIP Fund

G.11. b-Provide enough funding to elevate and/or buyout ALL properties where people are WANTING to mitigate to comply with increasing flood insurance premiums as a result of Grimm Waters.

No benefit cost ratio analysis would be required.

No elevation would be allowed higher than 15 feet.

Do this instead of consider any other avenues to reduce the cost of flood insurance such as, has been discussed, vouchers for low income people to pay the flood insurance. –L Buss

Lenders are to be doing this now (besides maybe the annual check); so what can we offer differently? Lenders are apparently not doing it, since big policy drop 3 years after disaster-LL

Not sure what this means, as when a new FIRM goes effective, so does the insurance requirement.

Are we suggesting getting rid of the 45-day letter cycle?

Bruce: I’d suggest deleting this. Not sure where this came from--LL

This could be politically untenable; the issue of notification of policy holders may make this difficult to achieve smoothly.

After the second loss, it will go to Standard Zone X rates which in many instances are around the cost equivalent to Zone AE at BFE.

For structures (residential or non-residential) disaster assistance should only be available once.

If the building is flooded a second time, and it isn’t insured, too bad.

Comment received: since this would then be a non-mapped flood zone, notice must be provided to any potential buyer. Typically, the buyer would consult the FIRM.

A reverse LOMR?

We need to be careful to not create a policy where the insured purchases a policy for a minimal amount just to get the $30K ICC. It then no longer becomes an insurance policy but a cheap grant subsidy program.

This doesn’t make sense. ICC is available for any structure that meets the program criteria. Suggest striking.

Allow ICC to be used when a building in substantially improved. Why not elevate the prior to the flood. Cost should be lower and more resilient community.

NFPPR Combined comm rec and comments Page 4 of 9 draft 10 9-14

National Flood Policy—ASFPM 2015 Recommendations

G.12. Promulgate insurance rules to financially neutralize repetitive loss properties through actuarial rates, deductibles, or by actuarial rates if mitigation is not done after any offer; incentives can be a part of this effort

G.13. Set up a procedure by which the NFIP compliance of a structure is automatically verified after a claim is paid for substantial damage or even a second or third claim, this should be used for eligibility in CRS and NFIP? (CAV)

G.14. Continually Evaluate CRS to ensure that activities that merit rate reductions are reducing losses

G.15. (a) Establish clear and rigorous audit procedures for CRS communities compliance, and do this on a set schedule, especially post-disaster, but also for auditing on a regular basis. CRS compliance is essential and must carry penalties for non-compliance. All policyholders pay for CRS credits whether in CRS community or not, at a cost of over $200 million per year. And, where FEMA undermines CRS communities by approving inappropriate LOMRs, assess penalties against the

FEMA staff.

G.15 (b). Require EC’s for all new floodplain permits for structures and require that the community keep copies and make available publicly, even if they are not a CRS community.

G.15 (c). Examine potential for community based insurance, multi-year policies purchased by and for the community at-large and based on actual risk as outlined in provisions with HFIAA.

G.15 (d). FEMA disaster program could offer or work with the reinsurance industry to offer communities insurance for their infrastructure and disaster assistance in general. It should be required of all communities and could be subject to the CRS discount. It would cover roads, bridges, waterlines, sewer, stormwater, power, telecommunication, treatment plants, debris removal, - basically everything now covered by PA.

This is nice, but it needs meat/direction to give to

FEMA

There was a concern on tying in CAVs and eligibility due to timing. In general, claim data should be made available for all FPAs as they are reported in FEMA’s Quick Claims. This should also be made available to the NFIP SC

Nice, but can we give better direction to this one?

How? How often? Independent TF or contractor? a. This is already being done, as they lose their credit if they aren’t doing what they say they are doing. They have to yearly report and have a CAV every 3-5 years. A bigger issue is when FEMA HQ approves inappropriate LOMCs which undermines

CRS communities. I hear many reports of CRS communities non-compliant for years-LL a. But who is going to pay for this? Non compliant community I assume--LL b. The challenge is how to police this and what happens if they don’t? b. Increase education on reading and understanding ECs for local officials. c. And when the community goes belly up because they can’t pay the claims after a catastrophic event, what then? d. This does not belong under NFIP Flood

Insurance. It should be moved somewhere else.? d. Never pass political muster – but a nice thought just the same! This is not a political document-LL

Recommendation to delete G.15. a and d completely (from Bruce).

Encouraging PA re-insurance useful. Used in other nations-LL

NFPPR Combined comm rec and comments Page 5 of 9 draft 10 9-14

National Flood Policy—ASFPM 2015 Recommendations

G.16. Continue marketing campaigns for both purchase and renewal of flood insurance policies; target marketing to homeowners without mortgages and in areas of low penetration. Work much more closely with WYOs, state and national insurance associations, FEMA Regions, CERC

Contractor, B&SA field reps, NFP Training

Contractor, NFIP SCs, and local communities where targeting is occurring so they may leverage what is being done where.

G.17. FEMA should significantly expand the agent training provided by NFIP Training Contractor, both the number of courses and topics (i.e., legislation changes, ICC, mitigation options, nonreg products like depth grids, Changes Since Last

FIRM, as well as in-person classroom instruction courses. This should also support agent training that incorporate floodplain management, flood mapping familiarity, and mitigation, and to require at least 3 hours of continuing education for license renewal by end of 2015 for those states that don’t already require it.

G.18. Use outreach, monitoring, and other measures to enforce the NFIP requirement to identify and insure state- owned and locallyowned floodprone structures, with required pay back to the federal treasury and NFIP for noncompliance

Bruce, suggest we need to include this, since too often states get coverage no matter which list they are on—discuss with CB--LL

G.19. Improve working relationship among floodplain managers and insurance industry, with

FEMA and the professional organizations assisting in fostering this relationship

G.20 Modify the NFIP to require mapping and management of and to provide erosion/mudslide coverage only where those hazards are mapped and appropriately regulated, possibly via a

Bruce: If the building has not received federal disaster assistance or does not have a federallybacked loan, they can just self-insure it, correct?

So, don’t know if this makes sense to have. So, I suggest deleting it.

John Ivey: 44CFR Part 75.1 talks about states that are self-insured. It list FL, GA, IA, KY, MA, NJ, NY,

NC, OR, PA, SC, TN, and VT. As self-insured states.

The others are supposed to carry policies as I understand it.

All agree; but this needs to be flushed out more with some examples.

Work with states/Chapters to require yearly/biennial CECs for agents selling flood insurance policies.

Should this be moved to 1b?

NFPPR Combined comm rec and comments Page 6 of 9 draft 10 9-14

National Flood Policy—ASFPM 2015 Recommendations surcharge

Also phrased “G.20 Modify the NFIP to require mapping and management of riverine or coastal erosion, mudslide, alluvial fans, ice jams, etc., and to provide insurance coverage only where those hazards are mapped and appropriately regulated, possibly via a surcharge. This should be established in order to incentivize the mapping and regulation of these hazards.”

G. 21 Establish a surcharge for flood insurance on buildings in floodways

G.22 Establish higher rates for structures in high velocity or erosion prone riverine areas.

Rating does not currently consider velocity, erosion or duration, so some way of accounting for added risk is needed-LL

G.23(a) Review the existing policy base, and continually perform Quality Assurance, to ensure structures are shown to be within the appropriate community to prevent policy holders from receiving an inappropriate CRS discount. See

A.26.(a) and (b)

G.23(b) FEMA must issue LOMRs to reflect community boundary changes due to annexations within 60 days of receipt of revised corporate limits.

G.24. Establish a requirement that by 2020 all owners of insured structures must obtain Elevation

Certificates and place on file with local governments and with FEMA. FEMA, working with local governments, provides incentives to implement. Provide CRS credits for communities who do this for all floodprone structures; also allow use of other cost share funding for this

G.25. Ensure actual cost of flood insurance is communicated clearly and directly to all policy holders each year with their policy renewal, regardless of discounts or subsidies

This phrasing gets to the point-LL

Will grandfathering be applied/allowed

Substantially overlaps with G6.

Are these not accounted for already in the maps?

If not, how will this information get to the insurance agent for rating? This needs to be identified before it is made a recommendation.

Overlaps with G6 and G21

Who is this recommendation to; community?

FEMA HQ/Contractor? This is such a minor issue, it should not be part of a big policy paper. Maybe a comment in passing but not a key rec.—perhaps intro discussion of use of data—or penalty

John: I agree it is a minor issue. I am sure it happens, just like using a participating county’s

CID in the jurisdiction of a non-participating community.

Recommendation to delete this completely- Bruce.

See G.15b.

As written, this is a financially burdensome requirement on the homeowner and FPA. There is no need for them in NSFHA and why force someone to get it when they don’t need it.

We do need a rec on ECs. At a minimum, CRS credits for community wide ECs--LL

While all agreed, it is very vague. We need to be more specific on what we mean. Seems pretty specific to me.--LL

NFPPR Combined comm rec and comments Page 7 of 9 draft 10 9-14

National Flood Policy—ASFPM 2015 Recommendations

G.26. Require signoff of all claims over 25% or similar threshold by community floodplain administrator as part of claims processing for substantial damage determination and mitigation

G.27. Allow communities direct access to claims data as they are being processed for use in regulatory processes

G.28. Modify Flood Insurance Manual page “Rate

33” XVII. FLOODPROOFED BUILDINGS to eliminate last step requiring policy holders to annually obtain local authority inspection of floodproofing, where licensed engineers have already attested to appropriate design and installation.

“Documentation or certification from the

Authority Having Jurisdiction (AHJ) that it has reviewed and inspected the structure with all floodproofing measures in place and provide evidence of approved final inspection and issuance of certificate of occupancy for the structure.”

G.29. Allow disclosure of flood loss history to current property owners of Repetitive and Severe

Repetitive Loss Properties, now restricted by the

Privacy Act of 1974.

G.28. Require that the substantial damage determination letter needed for ICC claim be signed by a CFM.

G28. Increase ICC. Also, allow purchasing of additional ICC coverage up to $150K.

G29. Provide optional Basement, Additional

Living Expense and Business Interruption at actuarial rates

G30. Direct States to earmark NFIP premium taxes (about 2.5% of premium are paid to states, but the amount varies state-to-state) to mitigate high flood-loss buildings.

This needs to be tied in with G13. All claims data should be made available as the claims are adjusted via Quick Claims reporting procedure

(e.g., go to FTP site and download); one comment was they’d like to see the actual total damages, especially when more than the NFIP limit.

See G26 and G13; these should be tied together.

From Scott Fraser: City doesn’t have appropriate staff nor funding to meet this requirement, nor does City have jurisdiction to enforce provisions of

FIM. Have little sympathy for complaints about lack of local resources---the program is voluntary; locals can take or refuse fed assistance-LL

From Scott Fraser: Finding it difficult to discuss qualifications for mitigation funding with property owner to whom we can’t disclose the loss history.

The challenge is that the total still cannot exceed

$250K or $500K.—rec should address that too-LL

This is a long shot and don’t know if we wish to include it—any other way to get it across?-LL

NFPPR Combined comm rec and comments Page 8 of 9 draft 10 9-14

National Flood Policy—ASFPM 2015 Recommendations

G31. FEMA should release an annual report on

ICC detailing the funds expended and what was accomplished with them.

G32.Detailed tracking and enforcement of required flood insurance on Group Flood

Insurance Policies and flood insurance on SBA

Disaster Loans post-Flooding.

Flood insurance should also be required on these

SBA Disaster Loans that are in NSFHAs.

G33. Explore offering an alternative rating that would negate getting an EC but instead use LiDAR

Perhaps put in the NC option and process to encourage

Currently, there is no tracking nor enforcement of

GFIP certificate holders (or subsequent property owners) that are required to carry coverage after the 3-year GFIP expires. Likewise, in a research study I was involved with in 2006, there was no system at the SBA to track flood insurance on loans, hence no enforcement if they let it drop.

Finally, if a property owner is getting an SBA

Disaster Loan or IA Grant due to flooding, flood insurance should be required no matter what zone. If it flooded once, it will flood again. yes

For example, the insurance agent can click on that structure location on a digital map and be given a

“factor” based on BFE, LiDAR-based elevation of the grade and then rate the building. If the insured doesn’t like the premium, they can get an

EC and go the route of traditional rating.

NC will be doing this in the near future

Ya gotta dream! G34. Provide incentive in DRA for state to

Require flood insurance on all loans in SFHA regardless of flood zone.

NFPPR Combined comm rec and comments Page 9 of 9 draft 10 9-14