Economics with Accounting - BSc

advertisement

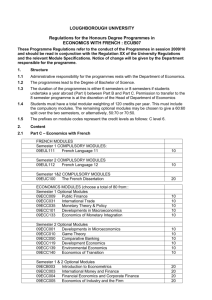

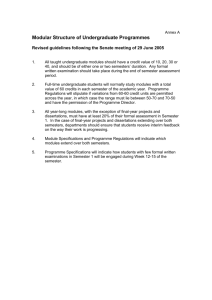

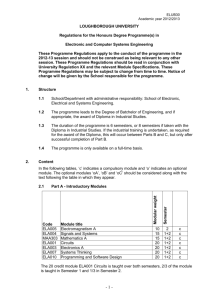

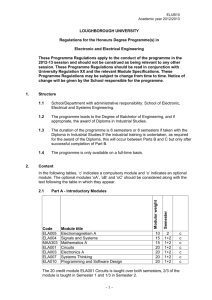

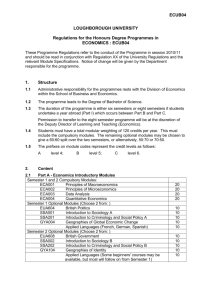

ECUB05 LOUGHBOROUGH UNIVERSITY Regulations for the Honours Degree Programmes in ECONOMICS WITH ACCOUNTING: ECUB05 These Programme Regulations apply to the conduct of the programme in the 2011-12 session and should be read in conjunction with University Regulation XX and the relevant Module Specifications. These programme regulations may be subject to change from time to time. Notice of change will be given by the School responsible for the programme. 1. Structure 1.1 Administrative responsibility for the programme rests with the School of Business and Economics. 1.2 The programme leads to the Degree of Bachelor of Science. 1.3 The duration of the programme is either 6 semesters or 8 semesters if students undertake a year abroad (Part I) which occurs between Part B and Part C. Permission to transfer to the 8 semester programme will be at the discretion of the Deputy Director of Learning and Teaching (Economics). 1.4 Students must have a total modular weighting of 120 credits per year. This must include the compulsory modules. The remaining optional modules may be chosen to give a 60:60 split over the two semesters, or alternatively, 50:70 or 70:50. 1.5 The prefixes on module codes represent the credit levels as follows: A level 4; B level 5; C level 6. 2. Content 2.1 Part A – Economics with Accounting Introductory Modules Semester 1 and 2 COMPULSORY MODULES: BSA017 Financial Accounting Fundamentals ECA001 Principles of Macroeconomics ECA002 Principles of Microeconomics ECA003 Data Analysis ECA004 Quantitative Economics Semester 1 COMPULSORY MODULES BSA025 Introduction to law Semester 2 COMPULSARY MODULES BSA018 Introduction to Management Accounting 2.2 Part B – Economics with Accounting Semester 1 and 2 COMPULSORY MODULES: BSB005 Management Accounting A ECB001 Intermediate Macroeconomics ECB002 Intermediate Microeconomics ECB004 Introduction to Finance ECB015 Economics of the Financial System 20 20 20 20 20 10 10 20 20 20 20 20 ECUB05 Semester 1 COMPULSORY MODULES: BSB007 Intermediate Financial Accounting Semester 2 COMPULSORY MODULES: BSB015 Company Law 10 10 2.3 Part I : Optional Year Abroad (8 semester programme only) During the Year Abroad students will undertake a programme of study as specified by the School of Business and Economics. 2.4 Part C – Economics with Accounting COMPULSORY MODULES Semester 1 and 2 BSC005 Advanced Financial Accounting BSC010 Management Accounting and Control Semester 1 ECC004 Financial Econometrics and Asset Pricing Semester 2 ECC005 Economics of Industry and the Firm ECC141 Corporate Finance and Derivatives OPTIONAL MODULES – Choose one Semester 1 and 2 ECC011 Introduction to Econometrics Semester 1 ECC003 International Money and Finance ECC009 Public Finance ECC031 International Trade ECC035 Monetary Theory and Policy ECC101 Developments in Macroeconomics 3. 3.1 20 20 20 20 20 20 20 20 20 20 20 Assessment Criteria for Progression a) Part A In order to progress from Part A to Part B candidates must accumulate 100 credits and obtain a minimum of 30% in remaining modules. b) Part B In order to progress from Part B to Part C candidates must accumulate at least 200 credits including at least 100 from degree level modules taken in Part B and obtain a minimum of 30% in remaining modules. c) Part C Candidates will be required to obtain 100 credits at 40% or above, plus a minimum mark of 20% in any remaining modules, in accordance with Regulation XX(26). Students registering onto the programme from 2010 onwards will be required to obtain 100 credits at 40% or above, plus a minimum mark of 30% in the remaining modules. ECUB05 3.2 Criteria for Degree Award Candidates will be eligible for the appropriate undergraduate award when they have accumulated the following minimum credits. Degree of Bachelor (Honours Degree) 300 credits, not less than 100 of which shall have accrued from degree level modules taken in Part C, in not less than 6 semesters. The criteria for completion of Part C and the award of the degree are set out in Regulation XX. 3.3 Relative Weighting of Parts of the Programme for the purpose of Final Degree Classification Candidates' final degree classification will be determined on the basis of performance in degree level Module Assessments in Parts B and C in accordance with the scheme set out in Regulation XX. The average percentage marks for each Part will be combined in the ratio Part B 30% : Part C 70% to determine the final Programme Mark. A Diploma in Professional Studies will be awarded to students who have satisfactorily completed the programme of study required for Part I. 4. Reassessment Candidates must accumulate at least 60 credits in a Part of a Programme in order to be eligible for reassessment in the relevant Part during the University’s Special Assessment Period. Provision will be made in accordance with Regulation XX for candidates who have the right of reassessment in any Part of the programme to undergo re-assessment in the University's Special Assessment Period. Final year students will be eligible to enter to the University’s Special Assessment Period providing they have accumulated at least 60 credits in Part C as above. If a student registers to resit a module, they will be required to resit all failed components of that module (ie if their coursework mark was less then 40% they must resit the coursework and if their exam mark was less than 40% they must resit the exam). If a student resits the coursework element of a module and there was more than 1 coursework assignment for that module, then the student would be required to resit all coursework assignments in which they achieved a mark below 40%. Marks for elements of a module not being re-sat will be carried forward. 5. Accreditation for Economics with Accountancy In order to retain exemptions from foundation-level professional courses (under the requirements of the professional bodies) following graduation, candidates must achieve a minimum mark of 40% overall and 35% in each assessed component in core modules as defined by the various professional bodies for accreditation purposes. The core modules are those in accounting, law and finance. Updated March 2011