List of Tables

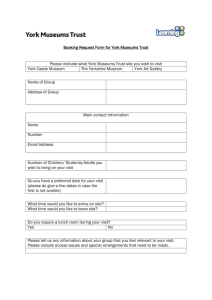

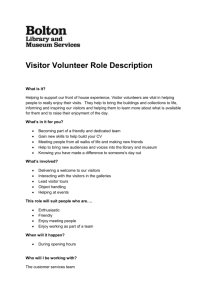

advertisement