Title: Local Content Study, Sierra Leone

advertisement

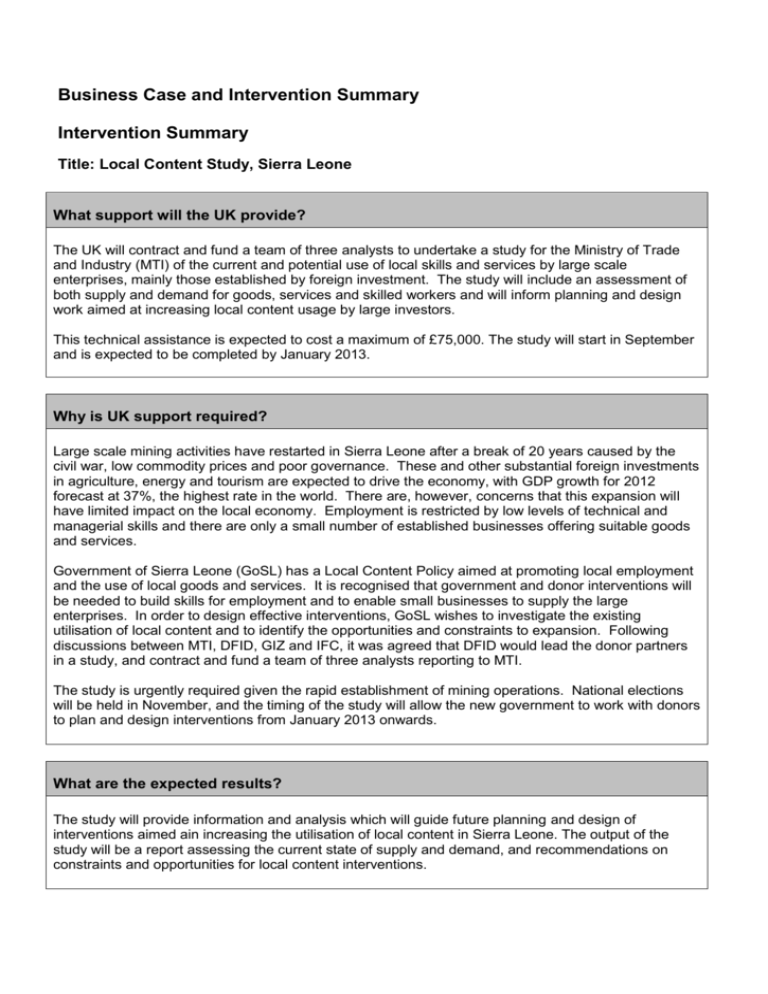

Business Case and Intervention Summary Intervention Summary Title: Local Content Study, Sierra Leone What support will the UK provide? The UK will contract and fund a team of three analysts to undertake a study for the Ministry of Trade and Industry (MTI) of the current and potential use of local skills and services by large scale enterprises, mainly those established by foreign investment. The study will include an assessment of both supply and demand for goods, services and skilled workers and will inform planning and design work aimed at increasing local content usage by large investors. This technical assistance is expected to cost a maximum of £75,000. The study will start in September and is expected to be completed by January 2013. Why is UK support required? Large scale mining activities have restarted in Sierra Leone after a break of 20 years caused by the civil war, low commodity prices and poor governance. These and other substantial foreign investments in agriculture, energy and tourism are expected to drive the economy, with GDP growth for 2012 forecast at 37%, the highest rate in the world. There are, however, concerns that this expansion will have limited impact on the local economy. Employment is restricted by low levels of technical and managerial skills and there are only a small number of established businesses offering suitable goods and services. Government of Sierra Leone (GoSL) has a Local Content Policy aimed at promoting local employment and the use of local goods and services. It is recognised that government and donor interventions will be needed to build skills for employment and to enable small businesses to supply the large enterprises. In order to design effective interventions, GoSL wishes to investigate the existing utilisation of local content and to identify the opportunities and constraints to expansion. Following discussions between MTI, DFID, GIZ and IFC, it was agreed that DFID would lead the donor partners in a study, and contract and fund a team of three analysts reporting to MTI. The study is urgently required given the rapid establishment of mining operations. National elections will be held in November, and the timing of the study will allow the new government to work with donors to plan and design interventions from January 2013 onwards. What are the expected results? The study will provide information and analysis which will guide future planning and design of interventions aimed ain increasing the utilisation of local content in Sierra Leone. The output of the study will be a report assessing the current state of supply and demand, and recommendations on constraints and opportunities for local content interventions. Business Case Strategic Case A. Context and need for a DFID intervention Large scale mining activities have restarted in Sierra Leone after a break of 20 years caused by the civil war, low commodity prices and poor governance. These and other substantial foreign investments in agriculture, energy and tourism are expected to drive rapid growth in the economy, with GDP forecast to rise by 37% in 2012, the highest growth rate in the world. There are, however, concerns that this expansion will have limited impact on the local economy. Employment is restricted by low levels of technical and managerial skills and there are only a small number of established businesses offering suitable goods and services. The Government of Sierra Leone (GoSL) has a Local Content Policy aimed at promoting local employment and the use of local goods and services. It is recognised that GoSL and donor interventions will be needed to build skills for employment and to enable small businesses to supply the large enterprises. In order to design effective interventions, GoSL wishes to assess the existing utilisation of local content and to identify the opportunities and constraints to expansion. Current information is poor, both on the supply and the demand sides. The Ministry of Trade and Industry (MTI) collects and publishes national production figures for certain items (e.g. beer, cement, paint) but these are substantially based on returns from large manufacturing units and the range and quantity of local production by small businesses is known only anecdotally. The supply requirements of the mining companies are also unknown, and there has been no analysis of their procurement policies and systems. Some data on skills and employment are available, but these are not sufficient to inform detailed planning. MTI, DFID, GIZ and IFC have jointly drafted and agreed terms of reference for a study aimed at providing a detailed view of the current status and potential for local content. MTI does not have funds in the 2012 budget for the study and has requested support from donors. IFC has indicated an interest in providing support for the interventions but not the study and GIZ is unable to fund the whole study this year. Given the need to act quickly before long term arrangements are fixed by the mining companies, DFID has agreed to lead the donor partners in the study, and to contract and fund a team of three analysts – one international who will act as the team leader, and two national – reporting to MTI. B. Impact and Outcome that we expect to achieve Impact: The utilisation of local goods and services and the employment of local skilled workers increase significantly by 2018. Outcome: The planning and design of GoSL and donor interventions aimed at increasing local content is better informed, resulting in more targeted and effective programmes. Appraisal Case A. What are the feasible options that address the need set out in the Strategic case? There are three potential options for this local content study: 1. The counterfactual - that DFID SL does not respond positively to the GoSL’s request for technical assistance for the local content study. 2. DFID SL does the study in house. 3. DFID SL hires a service provider. B. Assessing the strength of the evidence base for each feasible option In the table below the quality of evidence for each option is rated as either Strong, Medium or Limited Option 1 2 3 Evidence rating Medium Strong Medium What is the likely impact (positive and negative) on climate change and environment for each feasible option? Categorise as A, high potential risk / opportunity; B, medium / manageable potential risk / opportunity; C, low / no risk / opportunity; or D, core contribution to a multilateral organisation. Option Climate change and environment risks Climate change and environment and impacts, Category (A, B, C, D) opportunities, Category (A, B, C, D) B B B B B B 1 2 3 Climate change and environment offer both risks and opportunities for this intervention. The GoSL is already taking measures to ensure that environmental regulations, monitoring and enforcement mechanisms are in line with international good practices. However, there is a lack of a good scientific basis on which to predict the impacts of climate change on Sierra Leone. The UNDP Climate Change Country Profile suggests that the potential impact of climate change on Sierra Leone is likely to be felt through changes in rainfall patterns and the durations of the wet/dry seasons, with impacts on agriculture and freshwater resources, and through increased risks of flooding, salinisation and damage to marine habitat as a result of rising sea levels 1. The National Adaptation Plan for Action (NAPA) for Sierra Leone recommends programmes that are compatible with the needs of poverty reduction and development. These typically focus on needs relating to soil management, irrigation and seed selection. Option 1, in which DFID does not respond to the GoSL request, leaves open the risk that there will be no or inadequate planning of interventions addressing the need to promote local content utilisation. The consequence could be higher levels of imports and overseas recruitment, increasing air and seas travel and freight. Conversely, a well informed and analysed design process could promote local green businesses as suppliers to the large mining ventures, decreasing CO2 emissions in production and transportation. However, neither doing nor not doing the study will ensure these outcomes, so the assessment is category B in all cases. 1 UNDP Climate Change Country Profiles http://country-profiles.geog.ox.ac.uk C. What are the costs and benefits of each feasible option? The implications of each option are set out in the text below. Table 1 gives a likely ranking to the options in terms on the cost, benefits (based on the likely quality of the work) and risk associated with each of the option. This would indicate that Option 3 is likely to be the best option overall. Table 1 Lowest to highest option cost Highest to lowest benefits Lowest to highest risk Guide Scoring Option 1 1 3 3 7 Option 2 2 2 2 6 Option 3 3 1 1 5 The reasoning behind the above rankings is set out in the text below. 1. The counterfactual - that DFID SL does not respond positively to the GoSL’s request for technical assistance for the local content study If DFID SL decided not to provide technical assistance for the study, then no study would be undertaken, at least during 2012. GoSL cannot fund it, IFC wish to fund later intervention work instead, and GIZ would only fund the skills and employment section. This would either lead to a serious delay in planning interventions or, more likely, to interventions being designed based on partial information. The consequences of delays and poor planning are worse outcomes downstream, with lower utilisation of local content in the longer term and a missed opportunity to promote green and sustainable businesses as suppliers. The upfront financial costs to DFID of this approach would be zero. The benefits would also be zero as there would be no positive outcome. All other options should yield positive net present values. 2. DFID SL does the study in house The study requires at least four weeks of highly specialised expertise from an international analysis, in addition to eight weeks research and analysis on the ground. A desk review and discussion with the DFID Head of Profession for Private Sector Development (PSD), revealed no candidates with the appropriate skills who could undertake the study during the required period prior to December 2012. A modified study, addressing some but not all of the key issues, may be possible, although the timing remains doubtful and would still require contracting local analysts to conduct research on the ground. This option scores higher that option 1 and is retained as a fall-back position in the event that it is impossible to recruit an appropriate external international analyst. The costs associated with this option would be the PSD adviser’s time in DFID SL plus the opportunity costs associated with diverted attention. There would also be costs for the time spent on administration for the two local analyst posts. These costs would be high, given the other pressing work that could not be done. 3. DFID SL hires a service provider Initial checks suggest that experts will be available through a central DFID Professional Evidence and Applied Knowledge Services (PEAKS) provider or companies specialising in private sector analysis. The number and quality of experts is reasonable so it is a likely that at least one will have the necessary skills and experience in a similar country setting. There is therefore less risk with this option, in comparison to option 2, to high quality work being produced to time and to the satisfaction of GoSL. Another risk is that high calibre international analysts will not be available in the time-frame required, but potential service providers have been contacted early to reduce this risk. The cost of this option will be the staff time of DFID staff to oversee the work as well as the service provider’s professional fees and expenses. Whilst the unit costs are likely to be higher than option 2, the work should be completed in a shorter timeframe and the opportunity costs would be limited to management time. The benefits will be that this work will be completed to a high standard and by the required time, both of which are at risk in option 2. This final outcome is better designed interventions leading to higher local content utilisation by 2018. The other benefit is that service provider would oversee the administration for the two local analysts, reducing time spent by DFID on project management. D. What measures can be used to assess Value for Money for the intervention? We have estimated the number of days required to complete the task for each service provider as well as the fee rates charged. DFID SL are planning the project carefully to ensure the international analyst works from their home country whenever possible to minimise expense costs, as well as negotiating a competitive fee to ensure the best value for money possible. DFID SL has produced a logframe for this work, and progress will be regularly reviewed against the logframe to ensure that this work is continuing to represent good value for money. E. Summary Value for Money Statement for the preferred option Option 3 represents the best value for money of all the options and is most likely to deliver the best long term outcomes from Sierra Leone. Fees for the international analyst will be benchmarked against the costs agreed under the PEAKS arrangement, and a combination of cost and quality will be used to determine the best value service provider under this option. Commercial Case Direct procurement A. Clearly state the procurement/commercial requirements for intervention The service provider will be contracted directly by DFID Sierra Leone, under a fees and expenses local contract. The service provider will be responsible for contracting both the international analyst and two local analysts. B. and C. How does the intervention design use competition to drive commercial advantage for DFID? How do we expect the market place will respond to this opportunity? DFID Sierra Leone will approach a number of service providers to request expressions of interest and CVs. This will include DFID’s economic and private sector PEAKS provider, which specialises in locating potential service providers with particular experience and expertise. There is likely to be a reasonable level of interest in this work, taking into consideration the particular expertise and availability required. All interested service providers will then be assessed again set criteria to select the best value for money option (see section E below). D. What are the key cost elements that affect overall price? How is value added and how will we measure and improve this? The key cost elements are fees and expenses: The daily fee rate for the international analyst will be negotiated to ensure best possible value for money, and benchmarked against the DFID PEAKS provider fees. The daily fee rate for the two local analysts will be negotiated by the service provider on behalf of DFID, with a small administrative fee added to cover the service provider’s administrative costs. Expense limits are set across DFIDSL contracts, as they are benchmarked against local services. Where appropriate, the international analyst will conduct work in their home country in order to reduce expenses costs. E. What is the intended Procurement Process to support contract award? This will be a local contract, meaning that no formal tender process is required. Nonetheless, the PSD Adviser will assess the potential service providers and their proposed international analysts against the criteria set out in the terms of reference. This includes the proposed analyst’s experience in producing similar work, experience working in the region, expertise in conducting local content analysis, and will also take into consideration the cost. This means that potential service providers will be assessed according to both quality and cost to select the best value for money option. The local analysts will be chosen by the successful service provider from a short list of candidates prepared by the MTI. F. How will contract & supplier performance be managed through the life of the intervention? The international analyst will meet regularly with GoSL representatives to discuss emerging conclusions and the final report and keep DFID officials and other donors informed on progress and issues arising in the study. Financial Case A. What are the costs, how are they profiled and how will you ensure accurate forecasting? The expected overall cost is approximately £75,000, allowing for contingencies. The service provider will start the assignment in early September, and expected to finish in January 2013. The contract will have an end date of the end of January, to allow for potential delays caused by the national elections in November. Costs (fees and expenses) will be paid in arrears. The exact forecast schedule will be agreed with the successful service provider, but is likely to be split into two payments, with one payment midway through the contract and the other upon successful delivery of the final study. B. How will it be funded: capital/programme/admin? Programme D. and E. What is the assessment of financial risk and fraud? How will expenditure be monitored, reported, and accounted for? Fee costs will be paid on the basis of service provider days – as agreed in the contract – and expense costs will be paid against receipts. The level of financial risk is therefore extremely low. Expenditure will not be actively monitored by DFID, as all costs must stay within the agreed fees and expenses limits and payment is dependent on project progress. Management Case A. What are the Management Arrangements for implementing the intervention? The international analyst will be responsible for managing the inputs of the two local analysts, and for reporting progress to the MTI and the Private Sector Development Adviser in DFID. For administrative issues, the service provider will report to the DFID programme manager. B. What are the risks and how these will be managed? Data is not available. New research and analytic work with be undertaken by local analysts to fill gaps after an assessment of existing data. This will entail field work and discussions with businesses. Some enterprises have already indicated a willingness to support the study and provide data. Even if some enterprises are uncooperative, it will therefore be possible to build a more complete picture of supply and demand. GoSL is not happy with the final study. The exact scope of the work will be agreed with the MTI at during the international analyst’s first field visit to Sierra Leone. The International analyst will be in regular contact with the MTI and DFID Private Sector Development Adviser, including sharing the draft study. National elections delay the study. The study is not due to finish until the end of December, allowing flexibility if there is disruption associated with the national elections. The contract end date will be set as the end of January, as a contingency measure. C. What conditions apply (for financial aid only)? N/A D. How will progress and results be monitored, measured and evaluated? The international analyst will meet regularly with GoSL representatives and DFID officials, to discuss emerging conclusions and the final study. Lograme Quest No of logframe for this intervention: