Le Club Francais du Vin Case Report

advertisement

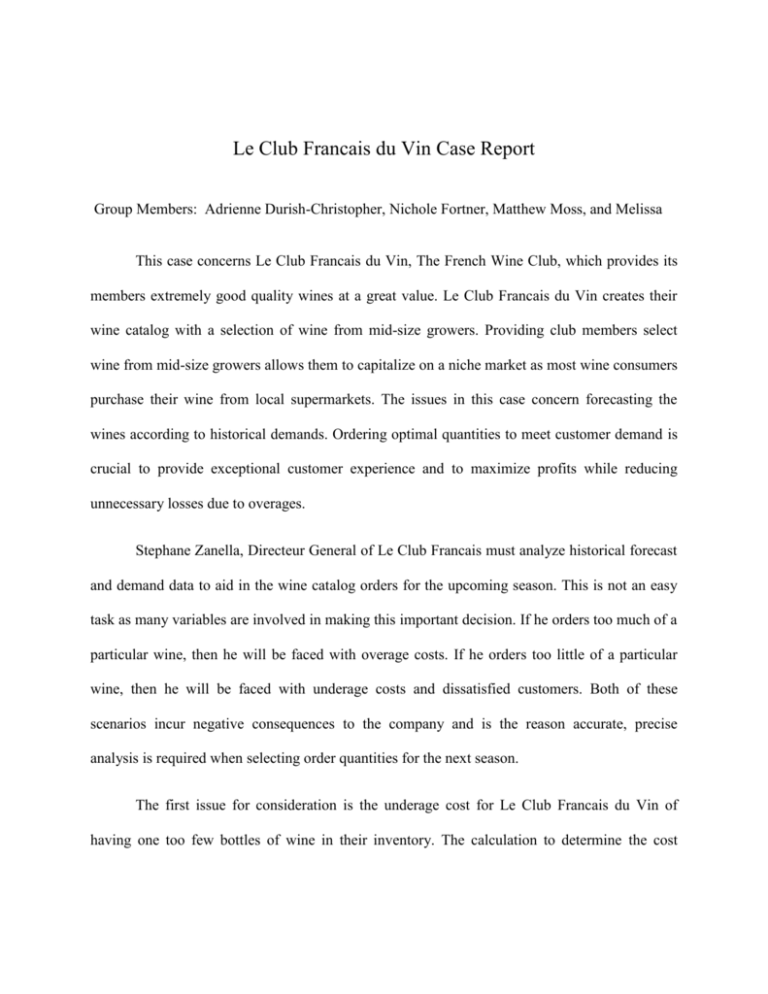

Le Club Francais du Vin Case Report Group Members: Adrienne Durish-Christopher, Nichole Fortner, Matthew Moss, and Melissa This case concerns Le Club Francais du Vin, The French Wine Club, which provides its members extremely good quality wines at a great value. Le Club Francais du Vin creates their wine catalog with a selection of wine from mid-size growers. Providing club members select wine from mid-size growers allows them to capitalize on a niche market as most wine consumers purchase their wine from local supermarkets. The issues in this case concern forecasting the wines according to historical demands. Ordering optimal quantities to meet customer demand is crucial to provide exceptional customer experience and to maximize profits while reducing unnecessary losses due to overages. Stephane Zanella, Directeur General of Le Club Francais must analyze historical forecast and demand data to aid in the wine catalog orders for the upcoming season. This is not an easy task as many variables are involved in making this important decision. If he orders too much of a particular wine, then he will be faced with overage costs. If he orders too little of a particular wine, then he will be faced with underage costs and dissatisfied customers. Both of these scenarios incur negative consequences to the company and is the reason accurate, precise analysis is required when selecting order quantities for the next season. The first issue for consideration is the underage cost for Le Club Francais du Vin of having one too few bottles of wine in their inventory. The calculation to determine the cost underage (Cu) is found by subtracting the cost from the retail price. For example, a bottle of wine with a retail price of 10 euro and cost of 5 euro has a cost underage (Cu) of 5 euro. The second issue for consideration is the overage cost for Le Club Fracais du Vin of having one too many bottles of wine in their inventory. The formula to calculate the cost overage (Co) is found by subtracting the salvage value from the cost per bottle of wine. For example, an overbought bottle of white wine sells at a 40% discount and on average costs the Club .80 euro in indirect and direct warehouse operation costs. A bottle of red wine with a retail price of 10 euro has a cost overage of 5 euro (cost) minus 2 euro (salvage value) equals 3 euro. (The above examples left out the shipping and handling costs for simplification. However, in the case excel models the shipping cost has been added to the cost of each bottle of wine.) The critical value is an important factor when calculating the optimal order quantity. The critical value is determined by dividing the cost underage (Cu) by the sum of the cost underage (Cu) and the cost overage (Co). The critical value is used with the mean and standard deviation to calculate optimal order quantities based on historical forecasts and demands. In the case excel file, the critical value, mean, and standard deviation was used to calculate the optimal order quantity with a historical forecast of 2,000 bottles. The cost underage (Cu) was set at 3 euro and the cost overage (Co) was set at 1 euro. The mean of demand according to historical data was 1653 and the standard deviation of demand was 1886.03. Inputting these values into the Newsvendor model with normally distributed demand calculated a result of 2935.50. Based on this calculation, 2936 bottles of wine should be ordered. The last consideration was to forecast how many bottles of each wine to order for the upcoming season based on the historical data of the previous season. The previous season’s forecast and demand quantities are used to calculate the error value and the A/F ratio. The A/F ratio is used to calculate the mean and standard deviation. These values are then used to calculate the expected actual demand. These calculations provide a good start for forecasting. However, forecasting can be taken a step further by utilizing the excel function, norm.inv(CR,μ,σ), CR = critical value, μ = mean, and σ = standard deviation. All of the above mentioned techniques were utilized to calculate overage and underage costs as well as to forecast optimal ordering quantities. These factors are critical when making business decisions. An error in forecasting demand can be very costly to a company which is evident by reviewing the overage and underage costs. Not only can poor forecasting negatively affect a company by increasing costs, but it is bad for business. Meeting customer demand is a part of providing a superior customer experience which is essential to business growth.