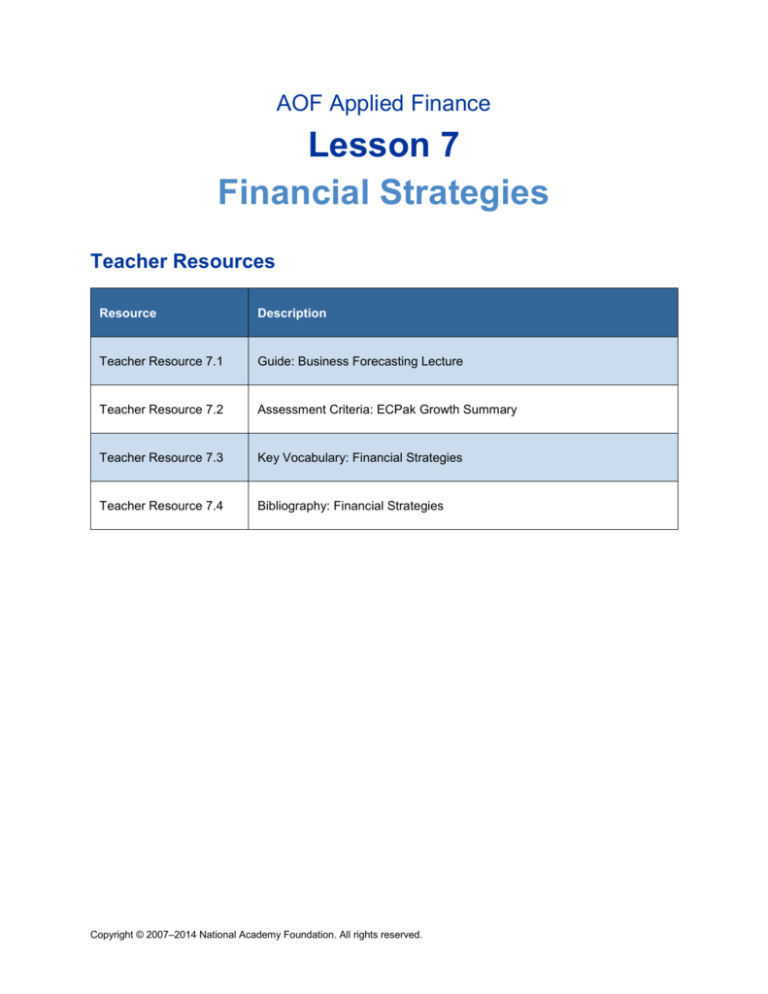

AOF Applied Finance

Lesson 7

Financial Strategies

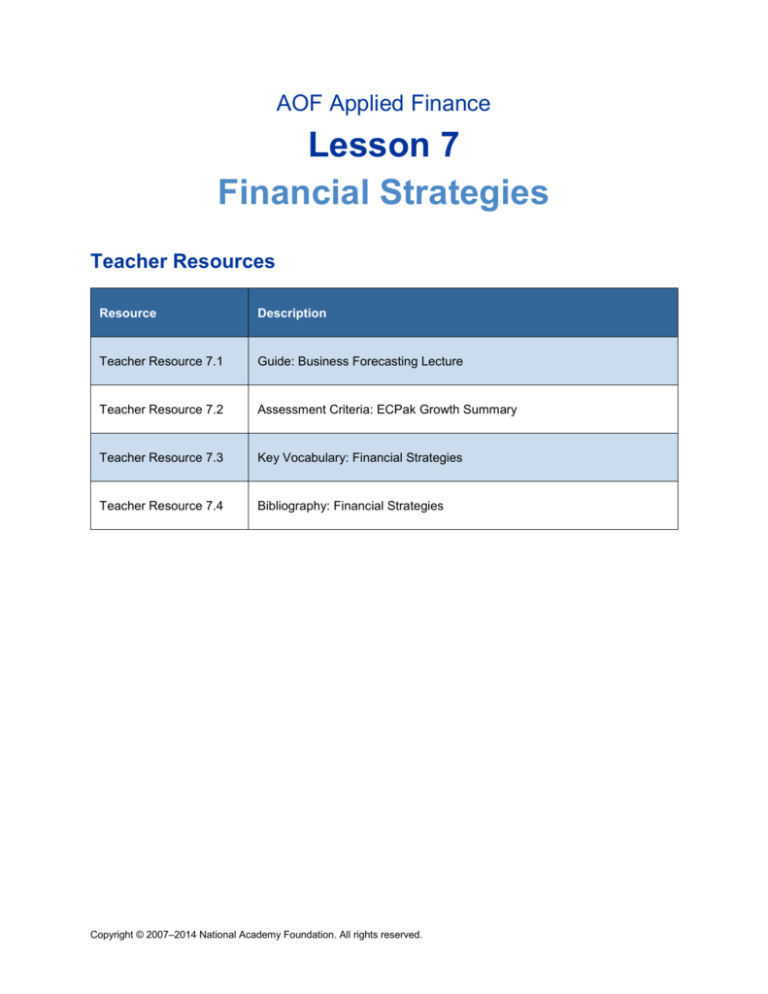

Teacher Resources

Resource

Description

Teacher Resource 7.1

Guide: Business Forecasting Lecture

Teacher Resource 7.2

Assessment Criteria: ECPak Growth Summary

Teacher Resource 7.3

Key Vocabulary: Financial Strategies

Teacher Resource 7.4

Bibliography: Financial Strategies

Copyright © 2007–2014 National Academy Foundation. All rights reserved.

AOF Applied Finance

Lesson 7 Financial Strategies

Teacher Resource 7.1

Guide: Business Forecasting Lecture

1. Definition and purpose

a. The process of making extrapolations about the future based on past data is known as

forecasting.

b. Forecasting is used by businesses so that they can make forward-thinking decisions in

the present and develop strategic plans for the future.

2. Pros and cons of forecasting

a. Pros

i. Forecasting can inform decision-making.

ii. Quality of data is vital to quality of forecasting.

iii. Forecasting enables businesses to plan resource allocation.

b. Cons

i. It is impossible to predict the future with any certainty, so predictions must be

recognized as fallible.

ii. The past is not a guide to the future. Numerical trends can be helpful but are not

always definitive.

iii. Qualitative influences—human factors, peer pressure, and so forth—reduce the

reliability of business forecasting.

iv. Changes in business objectives can make forecasts superfluous.

v. External factors—major world events, acts of nature, and so on—cannot be

predicted with any certainty.

3. Methods

a. Quantitative

i. Quantitative methods are used when statistical data are available.

ii. Quantitative analysis involves tracking “moving averages” and looking for

trends, cyclical variations, seasonal variations, and so forth.

iii. Quantitative analysis involves extrapolation: taking data from the past and

projecting it into the future.

b. Qualitative

i. Qualitative methods assess opinion.

ii. Consumer panels, focus groups, and in-house judgments are common methods

of gathering data for qualitative analysis.

Adapted from biz/ed website. Available at

http://www.bized.co.uk/educators/16-19/business/strategy/presentation/forecasting_map.htm

Copyright © 2007–2014 National Academy Foundation. All rights reserved.

AOF Applied Finance

Lesson 7 Financial Strategies

Teacher Resource 7.2

Assessment Criteria: ECPak Growth Summary

Student Name:______________________________________________________________

Date:_______________________________________________________________________

Using the following criteria, assess whether the student met each one.

Met

Partially

Met

Didn’t

Meet

The summary includes an accurate overview of the

historical data presented.

□

□

□

The summary includes an accurate overview of what the

survey data claims.

□

□

□

The summary clearly explains what sort of growth in

profits ECPak should expect. The reasoning is supported

with specific examples from the data.

□

□

□

The concluding statement includes a realistic prediction of

where ECPak is headed in the next three to five years.

□

□

□

The summary is neat, legible, and presentable and uses

proper spelling, grammar, and punctuation.

□

□

□

Additional Comments:

_____________________________________________________________________________

_____________________________________________________________________________

_____________________________________________________________________________

_____________________________________________________________________________

Copyright © 2007–2014 National Academy Foundation. All rights reserved.

AOF Applied Finance

Lesson 7 Financial Strategies

Teacher Resource 7.3

Key Vocabulary: Financial Strategies

Term

Definition

budgeting

Establishing a planned level of revenue and spending for a given time

period.

cash budget

A planned level of cash income and spending for a given time period.

external factors

Opportunities, risks, and threats that are outside of an organization’s

control. Political, environmental, technological, and social factors are all

considered external factors.

extrapolation

To estimate for the future based on current data.

forecasting

The process of making extrapolations about the future based on past

data.

irregular expenses

Expenses that are not paid regularly each month. Also referred to as

unexpected expenses.

manage

The process of allocating a firm’s resources to maximize value.

measure

The process of assessing a firm’s resources and value.

operating budget

A projection of income and expenses based on a forecasted sales

revenue for a given time period.

qualitative analysis

An analysis based on subjective judgment that is not quantifiable, such

as management expertise, labor relations, and so forth.

quantitative analysis

A mathematical analysis based on understanding the reasoning of a

given event or behavior.

resource allocation

The process of allocating money to a specific project, business unit, or

cause. A way to assign the available resource in a very specific and

economic way.

Copyright © 2007–2014 National Academy Foundation. All rights reserved.

AOF Applied Finance

Lesson 7 Financial Strategies

Teacher Resource 7.4

Bibliography: Financial Strategies

The following sources were used in the preparation of this lesson and may be useful for your reference or

as classroom resources. We check and update the URLs annually to ensure that they continue to be

useful.

Print

Besley, Scott and Eugene Brigham. Principles of Finance. Mason, OH: Thomson South-Western, 2006.

Online

“Financial Services - Budgets & Reporting: Terms & Definitions.” Duke University,

www.finsvc.duke.edu/budget/budterm.html (accessed August 31, 2013).

“How to set a budget and stick to it.” BetterMoneyHabits.com,

http://www.bettermoneyhabits.com/en/videos/set-budget-stick-to-it.html?cat=savingbudgeting&incomplete#fbid=2TVMA7wHaPB (accessed November 21, 2013).

Copyright © 2007–2014 National Academy Foundation. All rights reserved.