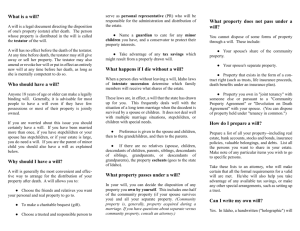

Wills & Estates

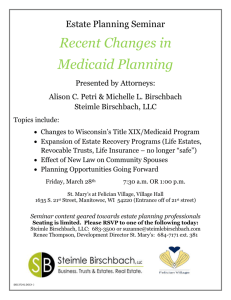

advertisement