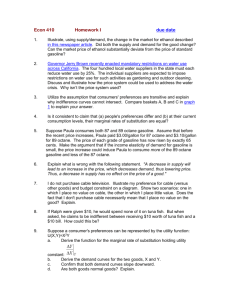

Elasticity, Taxes, and Market Intervention Problem Set

advertisement

HW2 Problem Set 3 More on Elasticities Part 1: Perloff Chapter 2: Q18 , Q20, Q33, Q34, Q35 Part2: Deriving Supply and Demand Equations using Elasticity 1) Suppose that the current price of oil is $60 per barrel and the quantity sold is 90 million barrels per day. The current estimates of the price elasticity of supply and demand are η=1 and ε=-.2 respectively. What will be the effects on the market price and quantity if the U.S. government suddenly decides to purchase an additional 2 million barrels of oil? Assume that the supply and demand curves are linear and the addition consumption of oil by the government results in a parallel shift of the supply curve to the left by 2 million barrels per day. 2) Midcontinent Plastics makes 80 fiberglass truck hoods per day for large truck manufacturers. Each hood sells for $500.00. Midcontinent sells all of its product to the large truck manufacturers. Suppose the own price elasticity of demand for hoods is -0.4 and the price elasticity of supply is 1.5. a. Compute the slope and intercept coefficients for the linear supply and demand equations. b. If the local county government imposed a per unit tax of $25.00 per hood manufactured, what would be the new equilibrium price of hoods to the truck manufacturer? c. Would a per unit tax on hoods change the revenue received by Midcontinent? Problem Set 4 Tax Effects and Price Control Part 1: Perloff Chapter 2: Q36 and Q40. Part2: Effects of a Sales Tax 1) Suppose the market for grass seed can be expressed as: Demand: QD = 100 - 2p Supply: QS = 3p a. At the market equilibrium, calculate the price elasticities of supply and demand. Use these numbers to predict the change in price resulting from a specific tax. b. If government imposes a $5 specific tax to be collected from sellers, what is the price consumers will pay? How much tax revenue is collected? What fraction is paid by sellers? c. If government imposes a 10% ad valorem tax to be collected from sellers, what is the price consumers will pay? How much tax revenue is collected? 2) Suppose that a market has the following supply and demand equations: Demand: QD = 380 - 10p Supply: QS = 80 + 5p If the government imposes a specific tax of τ on suppliers, what will be the price buyers pay and sellers receive, quantity, and government revenue from the tax (as functions of τ). What tax level maximizes the revenue the government collects from the tax? Topic: Quantity Supplied Need Not Equal Quantity Demanded 3) Usury laws place a ceiling on interest rates that lenders such as banks can charge borrowers. The interest rate is the price of a loan. Graph a binding usury law on the market for loans, and describe the effects of the law on the quantity of loans supplied and the quantity of loans demanded. 4) Suppose the market for corn is given by the following equations for supply and demand: QS = 2p − 2 QD = 13 − p where Q is the quantity in millions of bushels per year and p is the price. a. Calculate the equilibrium price and quantity. Sketch the supply and demand curves on a graph indicating the equilibrium. b. If a price floor is imposed at $7 per bushel, will there be a surplus or a shortage? What is the quantity of excess supply or demand that results? Draw a graph to show this. Problem Set 5 Consumer and Producer Surplus 1) Suppose the supply of gasoline on the California market is perfectly elastic at $1/gallon, and that the own price elasticity of demand is –2. Without government intervention, gasoline demand by California drivers is 20 billion gallons/year. Illustrate your answers graphically. a. How large a unit tax is necessary to reduce demand by 30%? What amount of revenue does this tax generate? b. How much surplus do drivers loose as a result of the tax? What part of this loss cannot be made up by redistributing the revenue of the gasoline tax to drivers? c. Suppose the California has 20 million drivers and that all drivers have identical preferences and behavior. A law is passed that restricts individual gasoline consumption to 700 gallons per person and year. What effect does the law have on the gasoline market (hint: how does the law affect the demand for gasoline)? d. How much must drivers be paid in (c) to be made as well off as in the initial nointervention situation? e. Would drivers prefer the law (without compensation) in (c) or the tax with redistribution of the tax revenue in (b), or are they indifferent? Topic: Policies That Create a Wedge Between Supply and Demand 2) The figure below shows the demand and supply curves in the market for milk. Currently the market is in equilibrium. a. If the government imposes a $2 per gallon tax to be collected from sellers, estimate the change in p, Q, and social welfare. b. If the government establishes a $4 per gallon price support, estimate the change in p, Q, and social welfare. c. If the government establishes a $2 per gallon price ceiling to ensure that children are nourished, estimate the change in p, Q, and social welfare.