SWF-Guidance-Updated-April-2014

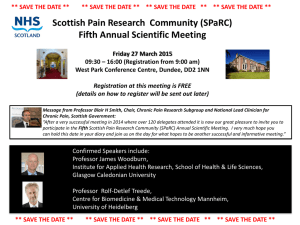

advertisement