Video transcript - Department of Agriculture

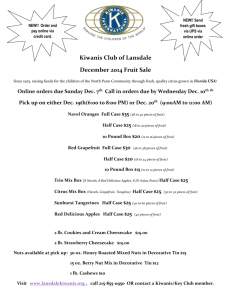

advertisement

33 Menzies Tues 1600 1730 ANDREW HARTY Citrus is Australia's largest fresh fruit export industry. We did, last year, just over 200 million dollars, FOB. The big focus is on North Asia. And you can see the dominance here of Hong Kong, Japan, and China. We'll talk a little bit later about why we still have such a large trade going to Hong Kong and how we're trying to transit some of that into the mainland. So, what progress have we made since we gained access in 2006? Trade was almost nonexistent up until 2010, because of the very difficult protocol that we had to comply with, the pest quarantine protocol. Since then, largely due to research that was funded by industry and the federal government and carried out by state agencies, methods for overcoming some of these problems were developed. And also, one company in particular, Mildura Fruit Company, pioneered putting those practises into place. And since then, the trade has taken off, as you can see. I guess everybody in the world wants a bit of China, and that's really important to realise. We're certainly not alone in our aspirations in that market. The Southeast Asian countries surrounding China are some of the biggest exporters into that country. We actually fall into place number 11, which is actually not that brilliant. I think we could do a whole lot better. And certainly, that's our aspirations with citrus. Now, products in China, primarily Navel oranges at the moment, that's the standard Navel orange. But also, this beautiful red variant called Cara Cara Navel which is really taking off like hotcakes in China. And then Honey Murcott mandarins, which are mostly grown up in Queensland, also much prized in China for their sweet taste. We are looking at alternative products. There's a lemon boom happening in Asia at the moment, mostly centred around all the wonderful things that it can do. I don't know if you can read that there, but it says, it will improve immunity, promote wound healing, detoxification, urine acidity, blood circulation. What more could you wish for? Some of the opportunities we've got, I won't dwell on these, because I think you're all aware of this amazing historical dynamic that's happening over this incredible middle class affluence that's occurring there. There is strong demand for imported fresh product. Fortunately, for us, we've got premiums for that high quality product. And citrus, it originated in China. That is the natural home of the genus and the various species is China, so they've been consuming this fruit for millennia. And it's highly valued there. We also are fortunate that we have, generally for Australian product, but also for our citrus in particular, a very high quality reputation. So some of the challenges that I'll just go through briefly are the competition that we face there, some of the quality issues that we need to constantly stay on top of, external and internal, some of the pricing things and how the exchange rate has affected that, and then this constant task of trying to establish in a very new, quite raw market for us, trading relationships. Competitive advantages, the flavour, as I've already mentioned is something that is strongly appreciated in the trade and acknowledged that we have sweeter fruit than our competitors from South America and South Africa. The external rind appearance of the fruit is very favoured there. We have deeper rind colour. And in the wholesale market, which I'll talk about shortly, that is critically important. The visual appearance of the fruit is absolutely paramount. Food safety is something we're very proud of. I know we all talk about being clean and green, but citrus actually now is the biggest user of the national residue survey programme that is run out of the Department of Agriculture here. So we are actually walking the walk, not just talking. And, of course, being closer to this market than any of our competitors, we can present fruit in a more timely way. And it's a whole lot fresher. It's about half the travel time that it takes from a shipload from Chile or South Africa. South Africa is our biggest competition. This graph shows you, in the red, the South African deliveries last year into southern Chinese ports compared to ours in blue. And you can see that in the middle of our season there, there was a horrible three week period where they sent shipload after shipload in of fruit that they diverted away from one of their traditional markets, Europe, because they had a quarantine problem there. We were actually helping them with that situation, sending our scientists over there, trying to overcome that problem. That's our way of trying to deal with that particular issue. As I said, we've got to be worried about external quality, so things like these light blemishes that we see. The fruit actually has to look fantastic. It is getting a premium price. They want a premium-looking product. Amazingly enough, the rind texture is something that they are very fussy about. The Chinese oranges that you see here on your right are almost glass-like in appearance, very flavourless, low-juice content. Nevertheless, they look, in their eyes, fantastic. Whereas our product, which has brilliant flavour, has got the more slightly pebbled rind. And taste is absolutely the number one thing for us. In just about every outlet that you see in China, disregarding the wholesale market, where it's almost all bought by eye, in every other outlet, there is fruit tasted. And people will repeat purchase on excellent flavour. I'm pleased to say that our three biggest citrus packing houses, including Harry's citrus packing house in Renmark, has now installed Brix grading machinery on their packing lines, which means they can segregate out the sweeter lines of fruit and deliver them to premium markets like China. We have to improve our packaging. We have a challenge of our fruit arriving into very hot, humid conditions in Shanghai or Guangzhou. And coming out of cold storage, the fruit gets levels of condensation around it that are absorbed immediately by the cardboard cartons and they collapse. Some of our competitors, like this pack of French apples here, they're doing a whole lot better job of it. And, in fact, we've got some industry research happening right now up in Queensland, trying to develop stronger, more resilient packaging for that market. A lot of these problems I've told you about are related to the traditional supply chain in China, which is very primitive. If you go to Shanghai, or Guangzhou, or Beijing, or one of these whole import markets, they are just literally big, tin sheds with almost no cool storage or very primitive cool storage. And it's just product that's basically put on the floor and then shifted out through various middlemen to secondary markets or to wet markets. So, delivery is as basic as going out on a motorbike, as you can see there or into the back of a van. What is really interesting to us is the amazing phenomenon that's happening with online fresh produce selling in China. More than any other country in the world, China's absolutely embraced this new way of marketing fresh produce. I think at last count in Shanghai, there were something like 600 companies that are selling online fresh produce. And that's just in that city alone. It is for us interesting because it gives us the ability to communicate directly with the consumer. On the screen here, we can put messages that tell people about the attributes of the fruit. We can tell them, well, it actually might have a little bit of blemish on it. But hey, you can buy that for 75% the cost of something that looks pristine and glass-like. They came from the same tree. They taste the same. This is the kind of messaging we can give out online that you just simply cannot get on the wholesale market or in a supermarket. Quickly, through some of our market access issues, we have developed with the Department of Agriculture last year, a very comprehensive export strategy for all our countries. These are the four main issues that are affecting us. And I'll focus just on one of those, and that is this little beetle called Fullers rose weevil. If we were able to get a status change in the quarantine status of that insect alone, we would save our industry millions and millions of dollars in compliance costs. And we would also literally take a hand brake off the industry and allow many, many more hectares of citrus to be prepared for China. So that's something that's right now on our radar. We've had discussions about the exchange rate. We went through some really, really bad times in citrus exporting in 2011 and 2012. When we were above parity, things were looking very bleak for our industry, I have to say. Things are looking a whole lot rosier now. And I'll give you a practical example of what that actually means to a grower. So if we take a typical premium price for a 18 kilogram carton of oranges, let's say 28 US dollars, and this is a fairly universal price around Asia, the actual return to the farm gate actually increases in a non-linear fashion. It actually goes exponentially as we drop down. So dropping from parity to 0.95 increased the orchard gate return by a AUD1.40. But when we went from 0.85 to 0.80, which is kind of the territory where we are now, that equivalent 0.05 drop gave us a AUD1.90 return. And similarly, when we hopefully go from 0.80 to 0.75 and maybe 0.75 to 0.70, it'll get even better. So the bottom line for our industry is if you've got good quality fruit, and we've got high prices in premium markets like China and a low dollar, this is really, really good times for our industry. I'm sure you've heard about how important it is, the relationship building in China. This is a country that does not have 1,000 years of contract law backing up trade relationships. So we have to base everything on trust. And that's all a very personal experience. Our exporters, of course, have to work on that individually. As a peak industry body, we are working with equivalent associations over there. We have developed a very strong relationship with the China Agricultural Wholesale Markets Association, or CAWA, as they call themselves, which culminated in signing an MoU last year. And we continue to go to their conferences every year. They are important to us because they oversee the 3,000 wholesale markets that are in China. And all our fruit at the moment is going at some point through a wholesale market. So we need good friends on our side, if things ever go wrong or to solve problems in those markets. Also forming relationships with regulators, this is myself and colleagues meeting with the CIQ quarantine inspectors in Shanghai. And actually, I'll say that since the time that the government announced that there was going to be a Free Trade Agreement negotiated with China, our relationship with these people has turned from one that was fairly risky and sour to one that's absolutely open arms, great buddies. We couldn't be the best friends in the world. So just bear in mind the goodwill is being generated by that FTA is really important to us. Through an Austrade grant, over the last two years, we've helped to get our industry Chinaready, and that's teaching them about the protocol. It's also teaching them about the cultural gap and how to do trade and form those relationships. Branding is something we've emphasised. It is a very, very critical thing in China. The brands are everything. If you've got a very strong brand, you will do incredibly well. If you've got a brand where the quality lapses for some reason, you'll be absolutely slaughtered. And it probably would be better not to have a sticker on the fruit. One little thing I illustrated here is that even though our friends from Austrade tell us that the kangaroo has become old fashioned and passé, believe me, there's not a person in China that would not recognise that symbol and immediately say, "Oh, Australia." Yeah, they know exactly where it comes from. Very quickly, pricing, we're helping our industry with voluntary committees to talk about that. And we're developing volume forecasts, both here onshore and also with our competitors. We've got a good thing happening with South Africa. We're doing some promotions through trade fairs. And, I guess, just some challenges that looking ahead, will these austerity measures that you're all aware of that the Chinese government is bringing, will they affect imported fruit sales? Our thinking is not really. We're not in the Gucci product luxury market that is being affected by that. And at the latest CAWA conference that I went to in January, there was just a steady increase predicted for imported fruit. More worrying to us is the fraud crackdown that's happening in China on importers, where they have run afoul of customs declaration. And one of our biggest importers, a company called [INAUDIBLE] has been-- well, one of the principals of that has been in prison. So it's kind of a messy thing that we don't want to get caught up in. And finally, as I mentioned, this grey channel trade out of Hong Kong is something that we are really working hard to try and mesh that in with protocol improvements. We say to the Chinese government, we both want the same thing. We both want to legalise trade, move it away from Hong Kong. You guys can collect the taxes and tariffs that you're missing out on when it goes through Hong Kong. How about we talk about a more sensible protocol, because that will allow our industry to comply with that? Will the demand for imported food decline? I personally think it's going to take decades for the land degradation, the water pollution, all those things to change in China for the local people there to really start to trust their product more than imported product. And lastly, we're just very impressed with what the government has done in negotiating these three Free Trade Agreements in North Asia in such quick time. It's going to be fantastic for us. And, as I said, it's not just about the tariffs. Of course, we will benefit from those. It's also about the goodwill that we've immediately engendered in China, in particular. So, xie xie, thank you very much.