CLIMATE AND CLEAN AIR COALITION TO REDUCE SHORT

advertisement

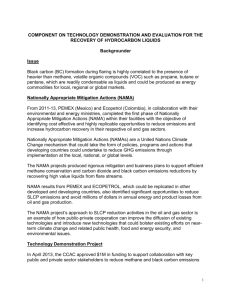

CLIMATE AND CLEAN AIR COALITION TO REDUCE SHORT-LIVED CLIMATE POLLUTANTS CCAC Initiative and Component Process: development, review, approval, funding, implementation and monitoring/evaluation CCAC INITIATIVE-COMPONENT PROGRAMME OF WORK TEMPLATE This template should be used to submit initiative and component proposals for consideration by the CCAC in accordance with the CCAC initiative and component process document. A separate template should be completed for each proposal for initiative or components. Once completed, this template should be submitted by relevant Lead Partners to the CCAC Secretariat at the following address: ccac_secretariat@unep.org The review process extend over a maximum period 35 days, including: 2-3 days for the Secretariat to review comprehensiveness of the proposal template; a minimum of 14 days for Partners and Steering Committee to provide comments; a maximum of 5 days for the Secretariat to compile received comments and send it to the Partners; and a maximum 14 days for the Steering Committee to provide a recommendation on the proposal after reception of the compilation of comments. The Working Group and High Level Assembly are responsible for approving proposals for initiatives and its related components. The Partners must be informed thirty days before a meeting takes place. The Steering Committee has the authority to approve components under an existing initiative unless there is a meeting of the Working Group or High Level Assembly within thirty days or the component changes the scope of the initiative. All State Partners are given a fourteen day notice to objectto the approval of a component by the Steering Committee. Note to applicant: The initiative and its related components must be consistent with UN regulations, rules and procedures applicable to UNEP, any other rules and regulations established by the decision of the Coalition that are not inconsistent with such regulations, rules and procedures and the terms of any relevant donor agreement and in consultation with Lead Partners of initiatives. 1 PART I: SUMMARY (Maximum 2 pages) DATE: October 5, 2012 TITLE OF INITIATIVE: Scaling-up Financing for SLCP Mitigation through Knowledge, Innovation and Strategic Partnerships APPLICANT NAME: APPLICANT CONTACT INFORMATION: LIST OF LEAD PARTNER(S): UNEP Finance Initiative and the World Bank LEAD PARTNER(S) CONTACT INFORMATION: Mr. Remco Fischer Tel: +41 229178685 Email: remco.fischer@unep.org Mr. Philippe Ambrosi Tel: +1 (202) 473-1231 Email: pambrosi@worldbank.org LIST OF IMPLEMENTERS: TARGETED COUNTRIES/REGIONS: Global (World) START DATE: November 2012 END DATE: November 2014 PRIMARY OBJECTIVES: The primary objective of this Initiative is to centralize and share the knowledge, build the understanding, structure the agenda, involve the key stakeholders, and forge the strategic partnerships needed, to pave the way for implementation of a larger scale, longer-term, action-based, public-private, and global effort to up-scale private and public financing for real SLCP emissions reductions; in specific countries, sectors and industries; and in support of CCAC’s sector/technology-focused Initiatives. As such, the Initiative subject to this Proposal is the first, necessary, and preparatory phase of a longerterm, action-oriented effort by CCAC on scaling-up private and public financing forSLCP mitigation. The link between this first phase and subsequent phases is the CCAC Action Roadmap on Finance. The CCAC Action Roadmap on Finance is the ultimate deliverable of this first phase and will provide the starting point and conceptual framework for the subsequent, implementation-oriented phases of CCAC’s overall effort to mobilize SLCP mitigation finance. EXPECTED RESULTS: The ultimate deliverable of this Initiative is the CCAC Action Roadmap on Finance, an informed, actionoriented roadmap that will detail what the CCAC – alongside key strategic partners in the public and private sectors – should do in subsequent phases to mobilise finance for SLCP mitigation at the required pace and scale; in specific sectors, industries and countries; and in support of CCAC’s sector/technologyfocused Initiatives. The CCAC Action Roadmap on Financewill be informed by the activities and results of this Initiative which will include: 2 The set-up of multi-stakeholder expert groups such as the CCAC Task Force on Finance, the Methane Finance Study Group, as well as the Expert Group on Existing Mechanisms. The formulation of CCAC recommendations, by each of these groups, on their respective mandates and areas of expertise. The organization of corresponding expert group workshops, including preparatory analytical work to identify and catalogue best practice and address knowledge gaps. The organization of educational meetings and platforms (webinars, briefings) aimed at sharing the knowledge gained from experts with CCAC members and stakeholders. The involvement of, and engagement with, critical stakeholders, particularly from the private sector (lenders, investors, polluters, technology providers, and their corresponding collective bodies such as associations), at CEO level. This engagement will explore, conceptualize and prepare, strategic and action-oriented alliances which could: formulate concrete emission reduction, financing and technology deployment commitments at CEO-level; organize aggressive media campaigns highlighting the leadership taken; kick-start collaborative shareholder engagement campaigns, by institutional investors, vis-à-vis listed polluter companies; as well as communications and media campaigns on commercially viable SLCP mitigation opportunities. As such – and in addition to the CCAC Action Roadmap on Finance – this Initiative will facilitate the emergence of a large community of practice (governments and public agencies, financial institutions, institutional investors, polluters, technology providers, development partners, and NGOs), through new strategic partnerships and public-private alliances at CEO-level, to leverage expertise, sparkle innovation, formulate action plans, and, as such, pave the way for implementation. ONE PARAGRAPH STATEMENT OF WORK: UNEP Finance Initiative and the World Bank will team up for this Initiative to combine their unique and complementary profiles, skills, experience and networks in the areas of green finance. The aim is to configure, inform, and formulate a global agenda on mobilising financing at scale for SLCP mitigation, as well as a CCAC Action Roadmap on Finance to guide large scale implementation on the ground. The Initiative is structured around four Components that map the economics of SLCP mitigation projects, and provide an initial and logical way of structuring an agenda for unlocking private finance: i)lifting barriers to, and promoting, commercially viable and financeable SLCP reduction projects; ii) facilitating greater uptake of existing mechanisms for SLCP mitigation financing; iii) monetizing the non-climate benefits of SLCP mitigation to mobilize new resources; the fourth component looks at the issues raised in the three prior Components but with a special focus on methane. This is to ensure that the Finance Initiative is setup to effectively coordinate, synergize and engage with, as well as capitalize on, the many other methane initiatives/projects within and outside of CCAC. As such the three first Components are closely linked to, and will inform the fourth Component, and vice versa. PART II: PROPOSAL (Maximum 20 pages) 1. OBJECTIVE (Describe in one sentence the main objective that the proposed initiative or component of agreed initiative seeks to achieve, including the hoped-for magnitude of SLCP emissions reduction.) The primary objective of this Initiative is to centralize and share the knowledge, build the understanding, structure the agenda, involve the key stakeholders, and forge the strategic partnerships needed, to pave the way for implementation of a larger scale, longer-term, action-based, public-private, and global effort to 3 up-scale private and public financing for real SLCP emissions reductions; in specific countries, sectors and industries; and in support of CCAC’s sector/technology-focused Initiatives. 2. a) b) c) d) CONTEXT (Describe relevant context in the following terms) Scope of the problem: Relevant policies and institutional arrangements: Key stakeholders: Additional information, if necessary: Current actions to mitigate SLCPs are not sufficient to address the challenge that SLCPs represent. One of the obstacles to the acceleration and up-scaling of SLCP mitigation is the lack of financing. Financing represents key challenges to all types of SLCP mitigation efforts, across types of SLCPs and economic activities, but these challenges differ. Currently, the landscape of options to finance SLCP mitigation features the following characteristics: Multiple means of financing SLCP mitigation already exist. For instance, the capture and utilization of landfill methane can be financed by raising carbon finance under the Clean Development Mechanism (CDM). The mitigation of all such SLCPs recognized under the UNFCCC and Kyoto Protocol (methane and HFCs in particular) is, in principle, financeable through international carbon markets. Some types of SLCP reduction projects are commercially viable and hence commercially financeable by the private sector today. However, neither the existence of international carbon markets nor the fact that many projects are commercially attractive, is currently translating into high-enough levels of financial flows for SLCP mitigation. There is a wide range of SLCP reduction efforts – across SLCP types and economic sectors - in terms of project types, project scales, project economics, and relevant stakeholders. Correspondingly, a wide array of financing sources (existing vs. new; public vs. private; corporate vs. third-party; SLCP polluters vs. the beneficiaries of SLCP reductions; national vs. international; multilateral vs. bilateral), stakeholders in the economy and channels for finance, needs to be addressed and considered by the Coalition. Finance sources, channels and actors in the private sector need to play a key role in SLCP mitigation. It is known from UNEP’s analysis on investing in greenhouse gas (GHG) emission reductions that the bulk of the financing required can be mobilized from sources in the private sector, through public incentives and sanctions as well as finance instruments or other forms of public intervention. In light of fiscal constraints in most countries, the Coalition should therefore emphasize the mobilization of private sector financing for reductions of SLCP emissions. Multiple, in principle ‘monetizable’, benefits: SLCPs are different from other greenhouse gases (GHGs) because, in addition to contributing to global warming, they have adverse effects on local climate, human health and agricultural productivity. The Coalition should, therefore, dedicate special attention to how the near term, ‘non- climate’ benefits of SLCP reductions could be used to create sustainable, performance-based revenue streams for SLCP reduction projects. The mitigation of SLCP is a relatively new and fragmented field, with a number of incipient or on-going initiatives targeting each some component of the challenge (e.g., specific mitigation 4 opportunity, specific sector or geography, specific financing instrument). To mobilize financing at scale and accelerate SLCP mitigation investment, there is a need to maximize synergies among such initiatives for faster knowledge exchange and innovation and for larger momentum and commitment on the ground. 3. DESCRIPTION o New Initiative (For a new initiative proposal, describe the initiative as well as the components of the initiative): o New Component(s) (For a new component proposal,describe the component and how it relates to the overall existing initiative): o For each component described, provide the following information: Name of component: Objective: Deliverable (name deliverable and provide brief description): List implementers (if consultant, provide name of institution responsible for hiring the consultant): Timeline, including delivery date(s) for deliverable(s): This Initiative for scaling up financing for SLCP mitigation is structured around four Components that represent the first steps of a broader and longer-term initiative aimed at SLCP mitigation. As this is still a relatively new and fragmented field, this Initiative will explore areas where there is already some experience and momentum that it can help crystalize to accelerate SLCP mitigation. The four Components concentrate their efforts on the comparative advantages of the two lead institutions to propose concrete solutions for scaling up financing for SLCP mitigation and promote their implementation by working closely with governments, financing institutions and other potential implementers through existing initiatives (both under the CCAC and other fora). Financing SLCP mitigation encompasses a wide range of pollutants, of emission sources, of public and private stakeholders, of sectors, and of solutions that include the application of a wide set of technologies and of policy and financing instruments. It is therefore critical that links are created between the crosscutting CCAC Finance Initiative and the sector-focused Initiatives of CCAC (see below for examples of how the Finance Initiative would aim to do that). However, finance also a ‘generic’ issue, and while exploring financing solutions for SLCP mitigation projects of all types two generic types of variables will particularly be considered: (i) project economics, and (ii) the general mandates and roles of public and private actors, including public policy and regulation. For instance, there may be (unexpected) parallels, and similarities, between the challenges to financing SLCP mitigation through the recovery and utilization of vented associated gas, in the oil and gas sector, and the challenges to financing SLCP mitigation through recovery and utilization of landfill methane at the municipal level. The reason is that project economics in each case may be similar, as well as the natural roles of private and public actors in achieving emissions reductions. As an analogy: financing GHG mitigation more broadly encompasses a similarly wide set of GHGs, emission sources, sectors, technologies, etc. Still, innovative and generic financing solutions (such as the CDM, or cap-and-trade schemes at the national level) have mobilized private finance for emission reduction project categories as diverse as renewable energy; energy efficiency; industrial gases; transport and reforestation. Against this background, this Initiative is structured around four Components that map the economics of SLCP mitigation projects, and provide an initial and logical way of structuring an agenda for unlocking private finance: 5 Component 1: lifting barriers to, and promoting, commercially viable and financeable SLCP reduction projects (or reaping the so-called “low-hanging” fruits of SLCP mitigation for quick and effective impact); Component 2: facilitating greater uptake of existing mechanisms for SLCP mitigation financing (including both mechanisms associated with the climate benefits of SLCP mitigation as well as the broader menu of public finance mechanism for green investment); Component 3: monetizing the non-climate benefits of SLCP mitigation to mobilize new resources; The fourth component looks at the issues raised in the three prior Components but with a special focus on methane. This is to ensure that the Finance Initiative is set-up to effectively coordinate, collaborate, engage with, and capitalize on, the many other methane initiatives/projects within and outside of CCAC. As such the three first Components are closely linked to, and will inform the fourth Component, and vice versa. UNEP-FI and the World Bank will team up for this Initiative to combine their unique and complementary profiles, skills, experience and networks1 in the areas of green finance and investment to propose ways and channels to mobilize private sector flows for scaled-up SLCP mitigation. Most importantly, the four Components of this Initiative will aim to forge strategic, high-level alliances between key public and private stakeholders at CEO level (the CCAC; national governments; national industry associations; national banking, insurance and investment associations; ‘polluter’ companies; banks; institutional investors such as pension funds; technology providers; infrastructure developers and project sponsors). These Alliances will aim to formulate concrete emissions-reduction, financing or technology deployment commitments by these different stakeholder groups. Ultimately, the CCAC Action Roadmap on Finance will draw on the knowledge gained as well as the strategic partnerships forged, for the design and initiation of – possibly public-private – SLCP emission reduction programmes on the ground; in selected sectors and countries; and in support of CCAC’s sector/technology-focused Initiatives. Though focus is on private finance, it also relates to the role of public intervention to unlock and leverage private flows through policy incentives and financing instruments (notably to de-risk projects), thus opening a window on experience from the use of, and opportunities for the application of, public financing mechanisms by governments and bi- and multilateral as well as national development partners. Activities under the four components will be implemented through a series of multi-stakeholder workshops, including preparatory analytical work to identify and catalogue best practice and to address knowledge gaps, and subsequent workshop reports. These workshops would address, explore, conceptualize and detail the list of activities above and prepare for their implementation under the abovementioned Roadmap. The implementation of all activities will be steered and overseen by a CCAC ‘Task Force on Finance’ which will convene expert representatives of all relevant stakeholder groups. The CCAC ‘Task Force on Finance’ can be seen as the Steering Committee of the Finance Initiative, and as an advisory body to both CCAC and the CCAC Steering Committee on issues related to the mobilization of private financial resources. 1 Including UNEP FI’s network of members: over 200 financial institutions across banking, insurance and investment, predominantly from the private sector. 6 COMPONENT 1:Solutions for financing and implementing SLCP reduction projects which are, in principle, commercially viableand financeable. This Component looks at zero- and negative-cost options. This includes: Replacing traditional brick kilns with more efficient kilns; Replacing traditional coke ovens with modern recovery ovens ; Clean burning stoves instead of conventional stoves and/or - clean fuel (LPG/biogas) instead of biomass stoves; Household anaerobic digesters;Recovery and utilization of vented associated gas during gas production; etc.) Differentiating between types of SLCP reduction project and taking into account lessons learnt from other agendas with similar difficulties, such as the challenges around financing energy efficiency projects, work under component 1 will include activities such as: The preparation of a CCAC-convened forum of relevant company, bank and investor CEOs, for the formulation of concrete emissions-reduction, financing or technology deployment commitments. This effort could engage with and build from other on-going initiatives in the private sector, such as the Investor Statement and Initiative on ‘Controlling fugitive methane emissions in the oil and gas sector’ which already calls on oil and gas companies to move to, and disclose on, best practice in methane emissions control (more information can be found here: http://www.iigcc.org/__data/assets/pdf_file/0017/15371/Methane-emissionsStatement.pdf). This type of activity would be particularly suitable for zero- and negative cost SLCP mitigation options, but could also be explored across all SLCP mitigation options (see further Pillar 1 Activity Areas below). The conceptualization and start ofcollaboration with institutional investors in an effort of broad ‘shareholder engagement’ vis-à-vis listed, polluter companies in the relevant sectors. Here, Pillar 1 would make use of the ‘Engagement Clearinghouse’ of the UN Principles for Responsible Investment (UNPRI), an initiative of UNEP FI and the UN Global Compact, whichprovides a platform for institutional shareholders to convene and collaboratively exert pressure on investee companies on environmental, social and governance issues (more information on the ‘Engagement Clearinghouse’ can be found here: http://www.unpri.org/collaborations/). This type of activity would be particularly suitable for zero- and negative cost SLCP mitigation options, but could also be explored across all SLCP mitigation options (see further Pillar 1 Activity Areas below). In the first phase, the exploration and promotion of national and regional SLCP-service companies (in analogy to the ‘energy-service-company’ (ESCO) model), either public or private, which would identify, finance and implement negative- and zero-cost SLCP reductions in the economy. In subsequent phases, and under the umbrella of a then formulated ‘CCAC Action Roadmap on Finance’ (see below), this activity area will move to facilitate and pilot such companies in selected countries and sectors. The conceptualization and preparation of a major information, capacity building and mobilization campaign targeted at companies, investors and financial institutions on opportunities to finance SLCP mitigation opportunities (in the case of zero-cost opportunities this could be achieved through a Corporate Social Responsibility angle). This type of activity would be particularly suitable for zero- and negative cost SLCP mitigation options, but could also be explored across all SLCP mitigation options (see further Pillar 1 Activity Areas below). 7 Links to other CCAC Initiatives: This activity area of the CCAC Finance Initiative will be particularly relevant to the following Initiatives: CCAC’s Brick Kilns Initiative where synergies could be seized in efforts to mobilize private finance from local partner banks in the envisaged project demonstration outlines (through CEO commitments by banks in the countries concerned; UNEP FI has active bank networks in Colombia, Mexico, Nigeria, South Africa, Kenya, Brazil, China and Peru). Furthermore, a financial dimension could be added to the capacity building workshops on how private finance can be secured for the replacement of traditional brick kilns with more efficient ones. In the context of CCAC’s Initiative on HFC Alternative Technology and Standards, the above mentioned company, bank and investor CEO forums, as well as approaches of investor collaborative engagement with investee companies (through the ‘Engagement Clearinghouse’), could play strong catalytic roles in the industries concerned. In the context of accelerating methane and black carbon reductions from oil and natural gas production, the above mentioned company, bank and investor CEO forums, as well as approaches of investor collaborative engagement with investee companies through the ‘Engagement Clearinghouse’, could play strong catalytic roles in the sector. This effort could engage with and build from other on-going initiatives in the private sector, such as the Investor Statement and Initiative on ‘Controlling fugitive methane emissions in the oil and gas sector’ which already calls on oil and gas companies to move to, and disclose on, best practice in methane emissions control (more information can be found here: http://www.iigcc.org/__data/assets/pdf_file/0017/15371/Methane-emissions-Statement.pdf). COMPONENT 2:Solutions for facilitating greater uptake of existing mechanisms for SLCP mitigation financing. This component looks at all options for which financial support mechanisms exist, particularly, but not exclusively, via international carbon markets. This includes:Oxidation of ventilation air methane including improvements in ventilation air systems in coal mines; Recovery of pre-mine degasification emissions in coal mines; Feed changes for dairy and non-dairy cattle; Reduced leakage during gas pipeline transmission; Recovery and utilization of vented associated gas during gas production; Farm-scale anaerobic digestion on large farms with liquid manure management; etc. Work under Component 2 will include drawing lessons from experience with offset mechanisms such as the Clean Development Mechanism (CDM) as well as with the financing mechanism under the Montreal Protocol for addressing ozone depleting substances, to conceptualize, design and implement additional incentives and mechanisms to expand project pipelines where relevant for SLCPs and to inform the proposal for new financing mechanisms. This activity area will create a public-private Expert Group on Existing Mechanisms (EGEM) tasked with: Exploring how to boost the effectiveness of the CDM and PoAs in mobilizing funding specifically for SLCP reduction projects. The group would not act on the CDM itself but rather explore and conceptualize additional incentives and mechanisms (including performance-based payments) to expand and accelerate CDM/POA pipelines where relevant to SLCPs. Identify, highlight and socialize existing concepts and mechanisms which monetize the nonclimate benefits of SLCP reduction activities, both at national and international levels. 8 Explore how existing instruments and operations of development banks (multilateral, bilateral, national) that aim to leverage private finance for infrastructure and technology investment in developing countries, can be used more explicitly in the area of SLCP mitigation. As such, this Expert Group will closely follow, and engage in, the discussions –under Component 4 of this Initiative – of the Methane Finance Study Group, ensuring that insights in the methane area are fed into the work on other SLCPs, and vice versa. Links to other CCAC Initiatives: While not limited to methane as an SCLP, this component will specifically include a review of lessons learned from carbon finance projects in the solid waste management sector (either landfill gas or composting), looking at institutional, financing and regulatory barriers that are relevant in the context of SLCP mitigation. This study will be done in close collaboration with the Financing work stream of the Municipal Solid Waste Initiative of the Coalition, thus strengthening partnerships and maximizing synergies among activities supported by the Coalition. COMPONENT 3:Solutions for the monetization of the non-climate benefits of SLCP mitigation, at both local and global levels. This Component looks at positive-cost options with non-climate co-benefits that cannot be monetized as of yet. This includes: All options under 2. if implemented in developed countries; Euro VI/6 standards for heavy duty vehicles; Pellet stoves and boilers replacing current wood burning technologies in industrialized countries; Ban of field burning of agricultural waste; Elimination of high-emitting vehicles; Intermittent aeration of continuously flooded rice paddy fields; etc. Activities under Component 3 will include assessing roles going forward of, as well as possibly commitments for, (particularly corporate) polluters, technology providers, financiers, institutional investors, national policy-makers, sector regulators, as well as the CCAC as an international coalition of countries in this important area. The fundamental notion that underpins this area of activity is that SLCPs, in addition to contributing to global warming, have adverse effects on local climate, human health and agricultural productivity. The resulting co-benefits of SLCP mitigation should be drawn upon, in a finance context, in a similar way to how the climate change mitigation benefits of emission reduction projects are drawn upon under the Kyoto Protocol’s Clean Development Mechanism. Links to other CCAC Initiatives: This activity area of the CCAC Finance Initiative would be particularly relevant to CCAC’s Initiative on Reducing Black Carbon Emissions from Heavy Duty Diesel Vehicles and Engines Initiative, as it could add a financing component to it. For instance, the ‘CCAC Action Roadmap on Finance’ in this activity area could foresee the piloting of schemes, in partner countries, that aimed to monetize the health-benefits of higher fuel sulphur standards. COMPONENT 4:Devising new financing mechanisms to deliver the climate and non-climate cobenefits of SLCP mitigation. Component 4 will consider methane as a test case for devising new financing mechanisms to deliver the climate and non-climate co-benefits of SLCP mitigation.Methane is the second largest cause of climate change after carbon dioxide and reducing a ton of methane has over 70 times the cooling effect of reducing a ton of carbon dioxide over a 20-year time frame. Given low carbon prices 9 prevailing today, there are not any longer strong financial incentives for firms and governments to reduce methane emissions at scale. This leaves a void that can be filled with pay-for-performance mechanisms, potentially containing market elements that could overcome this investment gap with appropriate financial engineering. Drawing on the experience of the members of the Methane Study Group convened by the World Bank, it will assess financing options, with particular attention to performance-based approaches. With an explicit focus on how to achieve mitigation scale-up, Component 4 will review the potential catalytic effect public resources (including through ODA and MDBs’ instruments) can have on leveraging other sources of private finance. There are significant synergies between activities carried out under the different components of this initiative: for instance, insights from work under Component 2 (lessons learned from carbon finance projects in the solid waste management sector) can inform discussions under Component 4 while options examined under Component 3 can benefit from advances in Component 4. The target size of the Study Group is 25 participants. All G8 countries will be invited to participate, as will other countries with a known interest in pay-for-performance and/or strong programs in methane abatement, for example, Australia, China, European Commission, Indonesia, Mexico, Norway and Sweden. Interested CCAC partner countries will be prioritized for invitation to the Study Group. Selected experts from academia, NGOs, and the investor community will be invited including experts involved in the Global Methane Initiative, Methane Blue Ribbon Panel, the Global Methane Group and the Global Gas Flaring Partnership At the first Methane Study Group meeting, participants will agree on objectives and be educated on the topic. Topics to be discussed include 1) methane abatement generally, with an overview of the different type of activities and relevant financing tools available, 2) the World Bank’s experience with carbon finance in methane abatement, and 3) orientation to pay-for-performance instruments, including definitional questions (e.g., Results Based Finance, Pay for Performance, etc.) The second meeting of the Study Group will focus on presenting and discussing the various financing instruments and their positive and negative features. At this second meeting, the Study Group will review the commonalities and differences between financing mitigation of methane and that of other SLCPs and the opportunities for building on methane-focused financing solutions. To that end (and to capitalize on thinking under both Pillars), the second meeting of the Methane Study Group will be held alongside a meeting of the CCAC Task Force on Finance. The World Bank will lead in the drafting of an options paper for circulation and comment. Based on this paper, the World Bank will lead the drafting of a Study Report outlining the recommendations of the Study Group. The Study Report will be discussed and finalized at a third meeting in early 2013. In addition to being shared with Coalition partners, the report will also be forwarded to G8 ministers/leaders under the U.K. presidency. The Report will build on the presentations and discussions during the three meetings. It will provide an overview of financing constraints facing methane abatement projects, review common financing arrangements for these types of projects, and assess what types of innovative approaches, especially pay-for-performance mechanisms (e.g., Put option pay-for-performance mechanism, Public Finance pay-for-performance facility, Carbon Market Top-Up, or a combination of all of the above in a Global Methane Fund). The Study Report will inform the discussion on new, dedicated financing mechanisms for SLCPs by providing concrete inputs for methane financing. The recommendations of the Study Group would feed into both the Climate and Clean Air Coalition’s targeted sectoral work to reduce methane 10 emissions as well as its cross-cutting discussions on financial mechanisms and leveraging private finance for SLCP reductions.Key findings (including concrete options and identification of possible pilots) from work under Component 4 can also provide critical insights on opportunities to leverage ODA and MDB finance. Depending on demand and catalytic resources available, MBDs and bilateral development partners can have a significant role in facilitating the emergence of pay-forperformance schemes (e.g., through piloting) and in putting in place SLCP mitigation programs in their portfolio of development activities. Lessons from the Methane Study Group on opportunities for blending ODA and results-based financing with methane mitigation potential can play here a key role in driving this effort. Links to other CCAC Initiatives: The Methane Finance Study Group plans to inform the discussion on new, dedicated financing mechanisms for SLCPs by providing concrete inputs for methane financing early-on in the CCAC Finance Initiative. The Study Group discussions will build on existing expertise and understanding in the methane abatement field, including the work under two CCAC Initiatives, Mitigating SLCPs from the Municipal Solid Waste Sector and Accelerating Methane and Black Carbon Reductions from Oil and Natural Gas Production. It will also link with related efforts such as the Methane Blue Ribbon Panel, the Global Methane Initiative, the Global Gas Flaring Partnership and others. The recommendations of the Study Group would ideally feed into both the Coalition’s targeted sectoral work to reduce methane emissions as well as cross-cutting discussions on financial mechanisms and leveraging private finance for SLCP reductions. The findings of the Study Group will also be shared widely through existing networks and organizations including the Global Methane Initiative which holds its annual Expo in Vancouver in March of 2013. 4. THEORY OF CHANGE (Explain how the initiative and its related components, or new component of an existing initiative, will contribute to the achievement of SLCP emissions reduction in the following terms) a) Ability to contribute to targeted long-term goals: Both UNEP FI and the World Bank have an extensive track record, proven expertise, and relevant networks in the areas of green finance. The nature and focus of both organisations is, however, complementary: UNEP FI is a public-private partnership with a network of over 200 financial institutions, predominantly from the private sector. Therefore, UNEP FI focuses on facilitating behavioral change on financial markets, as well as on the design of policy frameworks, incentives, sanctions, and public finance mechanisms, which are aimed at mobilizing private debt, equity, and shareholder engagement for, for instance, low-emissions activities. UNEP FI not only has the track record, convening power, and analytical expertise, to build public-private agendas around these issues; furthermore, UNEP FI has shown its ability to effectively engage with private sector decision-makers in the formulation of behavioral principles and corresponding commitments at CEO-level. The ‘Principles for Responsible Investment’ (http://www.unpri.org/), a normative charter for institutional investors now backed by over 1000 investors worldwide, as well as the recently launched ‘Principles for Sustainable Insurance’ (http://www.unepfi.org/psi/), signed by over 30 CEOs from the insurance industry, demonstrate this ability. This means that the Initiative subject to this Proposal is well equipped to convene, through UNEP FI, the high-level, publicprivate, and commitment-based alliances required to achieve the long-term SLCP mitigation targets of CCAC. The World Bank, a multilateral development bank, plays an important role in mobilizing and leveraging resources for green development through policy and institution dialogue, investment on the ground, innovation and readiness. Its recently approved new Environment Strategy (Toward a Green, Clean, and Resilient World for All: A World Bank Group Environment 11 Strategy 2012 – 2022) identifies mobilizing additional resources as an important cross-cutting objective to advance the green, clean, and resilient agenda. In support of this proposed joint Initiative with UNEP-FI for scaling-up financing for SLCP mitigation, the World Bank will leverage (teaming up as relevant with the International Finance Corporation) its extensive capacity and experience in areas such as i) economy-wide support to governments for sustainable development and policy reforms (e.g., energy sector); ii) pioneer of financial innovation for green growth, as evidenced by its catalytic role for the deployment of carbon markets or through innovative use and combination of financing sources and instruments to leverage private finance for low-emissions development; iii) provider of cutting-edge knowledge and support for readiness and capacity-building in the area of green, clean and resilient development (e.g., including to private sector audience, such as through the Climate Technology Program to facilitate the uptake of green technologies by companies in developing countries); iv) convening power and extensive partnerships for green investment and finance (e.g., the recently established Green Growth Action Alliance, geared at mobilizing private finance). b) Ability to complement, scale up and accelerate existing efforts to address SLCP emissions: The mitigation of SLCP is a relatively new and fragmented field, with a number of incipient or on-going initiatives targeting each some component of the challenge (e.g., specific mitigation opportunity, specific sector or geography, specific financing instrument). To mobilize financing at scale and accelerate SLCP mitigation investment, this Initiative will maximize momentum of such initiatives by interacting with them for faster knowledge exchange and innovation and for larger momentum and commitment on the ground (see below for an overview of how the different Components of this Initiative are relevant to, and should interact, with other CCAC Initiatives). Beyond CCAC, this Initiative will engage, and seek to seize synergies with other SLCP-related initiatives, particularly in the private sector and in financial markets, such as the Investor Statement and Initiative on ‘Controlling fugitive methane emissions in the oil and gas sector’ which already calls on oil and gas companies to move to, and disclose on, best practice in methane emissions control (more information can be found here: http://www.iigcc.org/__data/assets/pdf_file/0017/15371/Methane-emissions-Statement.pdf). This Initiative is undertaken by the Institutional Investor Group on Climate Change (IIGCC), the Investor Network on Climate Risk (INCR), and the Investor Group on Climate Change (IGCC), which are all partner networks of UNEP FI already. UNEP FI, by its own public-private nature, and by its potential role as an interface between CCAC, the investment community and financial markets, can particularly seize synergies between the activities of CCAC and its members, on the one hand, and SLCP-related activities in the private sector on the other. Similarly the World Bank is engaged in SLCP-related initiatives, both under the CCAC (e.g., on solid waste management or agriculture) or in other fora (e.g., through work recently commissioned by the G-8 or through the Global Gas Flaring Partnership and others) and will actively broker knowledge and innovation among its extensive networks and partnerships in support of this proposed joint Initiative with UNEP-FI for scaling-up financing for SLCP mitigation. c) Ability to catalyze new actions to address SLCP emissions: Drawing on the complementary expertise, mandate and networks of the Lead Partners (highlighted in a) and maximizing synergies with existing efforts for SLCP mitigation (discussed in b), this Initiative is well-positioned to foster an action-oriented community of practice on SLCP mitigation, at both technical and high levels, is an important feature of this initiative. It ambitions to forge new strategic partnerships and public-private alliances at CEO-level to formulate emission reduction, financing, and technology deployment commitments, including by private sector actors. 12 d) Describe how the participation of the CCAC will improve the chances for success: Mobilising private sector engagement, and financing, will not happen by itself. Market forces alone do not seem to be strong enough yet to unlock private finance and engagement for SLCP mitigation; not even in the case of negative- or zero-cost mitigation options. What is needed is an integrated publicprivate approach to address the problem, whereby public actors help to put in place policy frameworks, regulations, incentives, sanctions, and financing instruments conducive to generating private finance. Alternatively: already by creating a high-level agenda and a public discourse with political weight behind it, can public actors effectively bring an issue like SLCP mitigation to the attention of private sector decision-makers, and facilitate their engagement on the problem. The participation of CCAC, as the most significant public effort on SLCPs at the international level, in this effort to mobilize particularly private finance is, therefore, as essential to its success, as the participation of decision-makers from the investment community, financial markets, and the private sector more broadly. 5. EXPECTED BENEFITS (Describe the expected benefits in terms of the following criteria)[Please note: this critera could be replaced with revised criteria agreed on by the Coalition] This Initiative is about catalyzing change by laying out an action-oriented roadmap and mobilizing committed stakeholders to pave the way for implementation in subsequent phases. Therefore direct benefits from the Initiative are mostly related to awareness raising and capacity building while longerterm benefits (linked to the implementation of the Roadmap in subsequent phases) will likely include all of the below categories. a) b) c) d) e) f) Economic: Technical: Health: Gender: Social: Capacity building: Effective knowledge management (addressing gaps, identifying and cataloguing best practice, raising awareness, and enhancing readiness) is critical to ensure maximum impact for this Initiative. Among its activities features the organization of educational meetings and platforms (webinars, briefings) aimed at sharing the knowledge gained from experts with CCAC members and stakeholders and at catalyzing change. The conduits to do so could include the already extensive capacity building programs of development partners, notably to address readiness gaps and needs for the implementation of the CCAC Action Roadmap on Finance, for instance around financing solutions and potential pilots. g) Awareness raising: Together with building capacity, the proposed Initiative will work towards raising awareness on benefits of, and solutions for, mitigating SLCP both for stakeholders within its community of practice and for a more general audience. This will take several forms including kick-start collaborative shareholder engagement campaigns, by institutional investors, vis-à-vis listed, polluter companies; as well as communications and media campaigns on commercially viable SLCP mitigation opportunities;organize media campaigns highlighting the leadership taken. 13 h) Environment a. Air quality: b. Climate benefits: c. Ecosystem health: d. Natural resources conservation: 6. EXPECTED RESULTS (Describe, in qualitative and quantitative terms to the extent possible, expected results) The ultimate deliverable of this Initiative is the CCAC Action Roadmap on Finance, an informed, actionoriented Roadmap that will detail what the CCAC – alongside key strategic partners in the public and private sectors – should do in subsequent phases to mobilise finance for SLCP mitigation at the required pace and scale; in specific sectors, industries and countries; and in support of CCAC’s sector/technologyfocused Initiatives. The CCAC Action Roadmap on Financewill be informed by the activities and results of this Initiative which will include: The set-up of multi-stakeholder expert groups such as the CCAC Task Force on Finance, the Methane Finance Study Group, as well as the Expert Group on Existing Mechanisms. The formulation of CCAC recommendations, by each of these groups, on their respective mandates and areas of expertise. The organization of corresponding expert group workshops, including preparatory analytical work to identify and catalogue best practice and address knowledge gaps. The organization of educational meetings and platforms (webinars, briefings) aimed at sharing the knowledge gained from experts with CCAC members and stakeholders. The involvement of, and engagement with, critical stakeholders, particularly from the private sector (lenders, investors, polluters, technology providers, and their corresponding collective bodies such as associations), at CEO level. This engagement will, explore, conceptualize and prepare, strategic and action-oriented alliances which could: formulate concrete emission reduction, financing and technology deployment commitments at CEO-level; organize aggressive media campaigns highlighting the leadership taken; kick-start collaborative shareholder engagement campaigns, by institutional investors, vis-à-vis listed, polluter companies; as well as communications and media campaigns on commercially viable SLCP mitigation opportunities. As such – and in addition to the CCAC Action Roadmap on Finance – this Initiative will facilitate the emergence of a large community of practice (governments and public agencies, financial institutions, institutional investors, polluters, technology providers, development partners, and NGOs), through new strategic partnerships and public-private alliances at CEO-level, to leverage expertise, sparkle innovation, formulate action plans and, as such, pave the way for implementation. 7. IMPLEMENTATION (Describe implementation of the initiative and its related components or new component within an existing initiative, according to the following categories): a) List and describe implementers of the components: UNEP-FI, World Bank 14 b) Assistance desired from the Coalition (Specify any non-financial assistance requested from State and Non-state Partners, Science Advisory Panel, and Secretariat): c) Interrelation with other existing efforts (Describe any ongoing and/or planned efforts that the proposed initiative will build upon, link with, and/or scale up): Component 1 could inform stakeholders/help identification/implementation of pilots in relation with the following initiatives: CCAC’s Brick Kilns Initiative where synergies could be seized in efforts to mobilize private finance from local partner banks in the envisaged project demonstration outlines (through CEO commitments by banks in the countries concerned; UNEP FI has active bank networks in Colombia, Mexico, Nigeria, South Africa, Kenya, Brazil, China and Peru). Furthermore, a financial dimension could be added to the capacity building workshops on how private finance can be secured for the replacement of traditional brick kilns with more efficient ones. In the context of CCAC’s Initiative on HFC Alternative Technology and Standards, the above mentioned company, bank and investor CEO forums, as well as approaches of investor collaborative engagement with investee companies (through the ‘Engagement Clearinghouse’), could play strong catalytic roles in the industries concerned. In the context of accelerating methane and black carbon reductions from oil and natural gas production, the above mentioned company, bank and investor CEO forums, as well as approaches of investor collaborative engagement with investee companies through the ‘Engagement Clearinghouse’), could play strong catalytic roles in the sector. This effort could engage with and build from other on-going initiatives in the private sector, such as the Investor Statement and Initiative on ‘Controlling fugitive methane emissions in the oil and gas sector’ which already calls on oil and gas companies to move to, and disclose on, best practice in methane emissions control (more information can be found here: http://www.iigcc.org/__data/assets/pdf_file/0017/15371/Methane-emissions-Statement.pdf). Component 2:While not limited to methane as an SCLP, this component will specifically include a review of lessons learned from carbon finance projects in the solid waste management sector (either landfill gas or composting), looking at institutional, financing and regulatory barriers that are relevant in the context of SLCP mitigation. This study will be done in close collaboration with the Financing work stream of the Municipal Solid Waste Initiative of the Coalition, thus strengthening partnerships and maximizing synergies among activities supported by the Coalition. Component 3:Activites under component 3 would be particularly relevant to CCAC’s Initiative on Reducing Black Carbon Emissions from Heavy Duty Diesel Vehicles and Engines Initiative, as it could add a financing component to it. For instance, the ‘CCAC Action Roadmap on Finance’ in this activity area could foresee the piloting of schemes, in partner countries, that aimed to monetize the health-benefits of higher fuel sulphur standards. Component 4:The Methane Finance Study Group plans to inform the discussion on new, dedicated financing mechanisms for SLCPs by providing concrete inputs for methane financing early-on in the CCAC Finance Initiative. On the margin of one of the Study Group meetings the Lead Partners will organize a wider SLCP mitigation workshop in order to provide cross fertilization between experts and 15 information between methane and other SLCP ideas. The Study Group discussions will build on existing expertise and understanding in the methane abatement field, including the work of the Methane Blue Ribbon Panel, the Global Methane Initiative, the Global Gas Flaring Partnership and others. The recommendations of the Study Group would ideally feed into both the Coalition’s targeted sectoral work to reduce methane emissions as well as cross-cutting discussions on financial mechanisms and leveraging private finance for SLCP reductions. The findings of the Study Group will also be shared widely through existing networks and organizations including the Global Methane Initiative which holds its annual Expo in Vancouver in March of 2013. d) Risks and mitigation: (Describe the main risks and obstacles of the initiative and its components, or new component of an existing initiative, and proposals for overcoming and mitigating these risks. Rate each risk/obstacle “low”, “moderate” or “substantial”): Perceived Risk (rating) Proposed mitigation action Limited engagement of key stakeholders, given novelty of field, perceived costs and risks and low benefits of SLCP mitigation (moderate) At their kick-off meeting, the Task Force on Private Finance and expert groups of each component will identify areas (and related stakeholders) where there is already interest to build on such momentum and ensure maximum impact of efforts under the Initiative Major awareness raising/outreach activities planned such as collaborative shareholder engagement campaigns, high-level Summit, communications and media campaigns on commercially viable SLCP mitigation opportunities, campaigns highlighting the leadership taken Task force and expert groups of each component will also work with Lead Partners and CCAC bodies to maximize convening power and obtain high level participation and commitments Preliminary discussions with private sector representatives in the UNEP FI network have already shown strong interest, and willingness to participate in this Initiative, among member organizations of UNEPFI. Change in some governments’ priorities, with less posterior interest in activities of the Coalition (low) The Coalition is already extending its reach, with broader participation or interest from governments (and other partners). Larger membership should help mitigate the risk of realignment in the environmental priorities of some partner governments Low amount of catalytic public resources (e.g., ODA) available to help implement pilots in subsequent phase (moderate) In a related effort, the World Bank is looking into integrating SLCP mitigation opportunities in its portfolio of development activities at the request of the G8. Key findings from this work (of relevance to bi- and multi-lateral development finance institutions) can provide critical insights on opportunities to leverage MDB finance for SLCP mitigation and mitigate (to a certain extent only) lack of catalytic public resources. 16 e) Sustainability: (Describe the ability to sustain the initiative and its components, or new component of an existing initiative, to scale-up over time, and to replicate in different contexts): This initiative is about catalyzing change by laying out an action-oriented roadmap and mobilizing committed stakeholders to pave the way for future implementation. Depending on future availability of catalytic resources in a second phase of the initiative, a number of pilots could be undertaken contributing to increased private sector financing and broader and more active engagement of stakeholders. f) Outreach and awareness raising: (Outline the outreach and awareness raising activity that will support the achievement of expected benefits and results – noting that a detailed outreach plan should be prepared for major initiatives and components with the following information: outreach objectives, target groups, key messages and communication tactics): Fostering an action-oriented communityof practiceon SLCP mitigation, at both technical and high levels, is an important feature of this proposal. All due efforts will be made to ensure inclusive participation, to benefit from cutting-edge knowledge and experience of a wide range of stakeholders and, to raise the awareness of, and strengthen synergies among, existing initiatives for faster dissemination and implementation. Additional outreach/awareness raising will include: Workshops and/or information-sharing mechanisms and platforms to disseminate findings and inspire change (for instance building on events from particular CCAC initiatives, or leveraging the capacity building programs of development partners); Awareness raising campaigns on benefits of, and solutions for, mitigating SLCP both for stakeholders within its community of practice and for a more general audience. This will take several forms including kick-start collaborative shareholder engagement campaigns, by institutional investors, vis-à-vis listed, polluter companies; as well as communications and media campaigns on commercially viable SLCP mitigation opportunities; organize media campaigns highlighting the leadership taken; High-level engagement – via events and fora – featuring the participation of heads of financial institutions, companies and ministers to formulate commitments and mobilise resources for mainstreaming SLCP considerations in their activities (for instance in Dec. 2013 in the margins of the COP or World Economic Forum Summit in Davos in Feb. 2012). 8. TIMELINE (Provide a detailed timeline for implementation (e.g. with Gantt chart): Components 1-3 Component 4 17 Dec 2012 Kick-off Meeting of the CCAC ‘Finance Task Force’ to detail the composition and objectives of each of the components Kick-off Meeting of the Methane Finance Study Group with the CCAC ‘Private Task Force’ in tandem Jan/Feb 2013 Second meeting of Methane Finance Study Group Feb/Mar 2013 World Bank drafts Methane Finance Options Paper Mar-May 2013 First set of public-private workshops in the order and with the focus agreed on by the CCAC Task Force on Finance, and following the logic provided by the structure of the Components. Final meeting of Methane Finance Study Group Submit Recommendations on Methane Finance Study Report April/May 2013 May - July 2013 Based on the initial set of workshops and the Methane Finance Study Report,the World Bank and UNEP FI draft the CCAC Action Roadmap on Finance, and submit a first draft to the CCAC Task Force on Financeand the CCAC Steering Committee for discussion. July – December 2013 Consultation and socialisation process of the draft CCAC Action Roadmap on Finance with relevant public and private stakeholders (among polluters and technology providers, their associations, etc.), including in the finance sector and the global investment community, within and outside of CCAC. 18 January - April 2014 June 2014 Second and final set of publicprivate workshops in the order and with the focus agreed on by the CCAC Task Force on Finance, and following the logic provided by the structure of the Components. Aim is to validate and agree, with the CCAC Task Force on Finance as well as the CCAC Steering Committee, on a final draft of the CCAC Action Roadmap on Finance. Final draft of the CCAC Action Roadmap on Finance is submitted and presented to CCAC. 9. RESULTS, MONITORING AND EVALUTION (List performance indicators to measure progress, using SMART criteria (specific, measurable, achievable, relevant, and time-bound). Include the following indicators, if relevant: This initiative is about catalyzing change by laying out an action-oriented roadmap and mobilizing committed stakeholders to pave the way for future implementation. Its ultimate deliverable is the CCAC Action Roadmap on Finance, and the main evaluation criteria will be its endorsement by the members of the Coalition. The longer-term success of this Initiative (linked to implementation in subsequent phases) will be measured by the incorporation of its recommendations into other initiatives of the Coalition and its partners, as well as the leading to subsequent phases of development and implementation of the CCAC finance initiative. Therefore, UNEP-FI and the World Bank will seek to monitor the key indicators including the number of domestic policies modified based on the results of the report, and the number of report recommendations translated into action by the Coalition and/or other stakeholders. 10. BUDGET For initiatives: Provide a two-year budget envelope, with any known costs and financing options required for implementing this initiative. To the extent possible, indicate priorities and sequencing of funding components. Add additional rows as necessary. (If long-term budget projections are available, e.g. on a five or ten-year timescale, please provide a short paragraph with this information). For Components: Provide a two-year budget with costs for each component and activity to be undertaken as part of this component, breakdown activity cost by type of expenses (personnel, travel, etc.). Please note, one component may have multiple activities. Indicate priorities and sequencing of funding components. Add additional rows as necessary.(If long-term budget projections are available, e.g. on a five or ten-year timescale, please provide a short paragraph with this information). 19 TO BE MERGED INTO 1 TABLE Components 1-3 Activities CCAC Costs Other Costs - Financing Sources % CCAC Financing Senior supervision by UNEP FI: Concept, agenda-building and organisation of a first set of publicprivate workshops (3), in the order and with the focus agreed on by the CCAC Task Force on Finance, and following the logic provided by the structure of the Components $100,000 $5,000 CCAC / UNEP FI 95% Venue and catering for the first set of public-private workhops $20,000 $0,00 CCAC 100% Concept, design, development and darfting of the CCAC Action Roadmap on Finance $100,000 $5,000 CCAC / UNEP FI 95% Consultation and socialization process of the draft CCAC Action Roadmap on Finance across public and private constituencies and fora: discussion fora, presentations, webinars, online presence $150,000 $5,000 CCAC / UNEP FI 97% 20 Second and final set of publicprivate workshops (3) in the order and with the focus agreed on by the CCAC Task Force on Finance, and following the logic provided by the structure of the Components. Aim is to validate and agree, with the CCAC Task Force on Finance as well as the CCAC Steering Committee, on a final draft of the CCAC Action Roadmap on Finance. $100,000 $5,000 CCAC / UNEP FI 95% Venue and catering for the second set of public-private workshops $20,000 $0,00 CCAC 100% Organisation and holding of 3 meetings of the CCAC Task Force on Finance $25,000 $5,000 CCAC / UNEP FI 83% Travel of developing country participants $75,000 $0,00 CCAC $590,000 $25,000 Total budget 21 CCAC / UNEP FI 96% Component 4 Actions Developing country participants 1x external venue and catering Travel Expenses 2 x WB venue as ‘in-kind’ Staff and consultant travel Contribution Event coordination Report research and publication Contingency Total Budget CCAC Costs $64,500 $9,000 $0 $17,500 $12,000 $79,000 $18,000 $200,000 22 Other Costs $0 $0 $1,000 $0 $0 $0 $0 $1,000 Financing Sources CCAC CCAC World Bank CCAC CCAC CCAC CCAC % CCAC Financing 100% 100% 0% 100% 100% 100% 100% ANNEX 1 COMPILATION OF COMMENTS RECEIVED FROM PARTNERS ON THE DETAILED PROPOSAL Comments from Denmark In general we find the intiative both relevant and focused. It is therefore more as a matter of principle, that we would sugest to change the title of the initiative to : "Analysing options for Scaling-up Financing for SLCP Mitigation through Knowledge, Innovation and Strategic Partnerships" The suggested change reflects that we do not want to create the expectation, that there will be a separate financial structure to be build around the initiative. At this stage a number of partners, such as Denmark, are planning to come forward with a contribution that can get coalition activities up and running. Only a few countries have so far set out their level and priorites for climate finance after 2012 and no decision for longer-term financial contributions to the initiatives have been considered. On that basis, the desciption under "primary objectives" on the first page, should read: "As such, the Initiative subject to this Proposal is the first, necessary, and [analytical] preparatory phase of a [possible] longer-term, action-oriented effort by CCAC on scaling-up private and public financing for SLCP mitigation." Comments from the United Kingdom We are very supportive of research being carried out to identify how finance can be mobilised to tackle short-lived climate pollutants, as this is a worthwhile task. However, many of the issues referenced are generic climate finance issues rather than specific only to SLCPs. While some issues are specific to these gases and sectors, it would be good to see more details as to how this work links in with wider research conducted by others into mobilising climate finance. There is a huge literature already out there on mobilizing climate finance. Therefore there is a real risk of reinventing the wheel here and commissioning further research which will sit on the shelf. This is particularly the case if the CCAC ends up doing generic research into mobilizing climate finance, rather than specifics on a particular policy/technology/ sector. The first 3 components of the proposed work looks rather generic. Even component 4 which is looking at Methane could be considered too broad ¨Methane covers agriculture, extractives and waste among others, with relatively little overlap in issues between sectors. Therefore 3 separate studies would be ideal to do this. It should be noted that the time and budget is available to do this. The proposal still suggests that CO2 mitigation doesn’t carry any co-benefits. While this isn’t necessarily an issue for this work, it could be if they start examining how to redirect existing climate finance flows rather than looking at how to mobilize additional climate finance. On the costs, the actual research again forms a relatively small share of the total costs, with developing country participation, venues, management and stakeholder engagement all representing a significant proportion of costs. While they are all important aspects of the research, it would be useful to emphasise the need to keep a check on the costs of these wider elements. 23