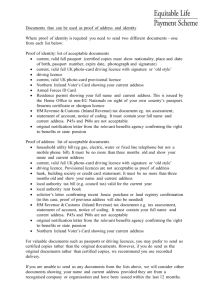

DOCX - 275.71 KB - Department of the Environment

advertisement